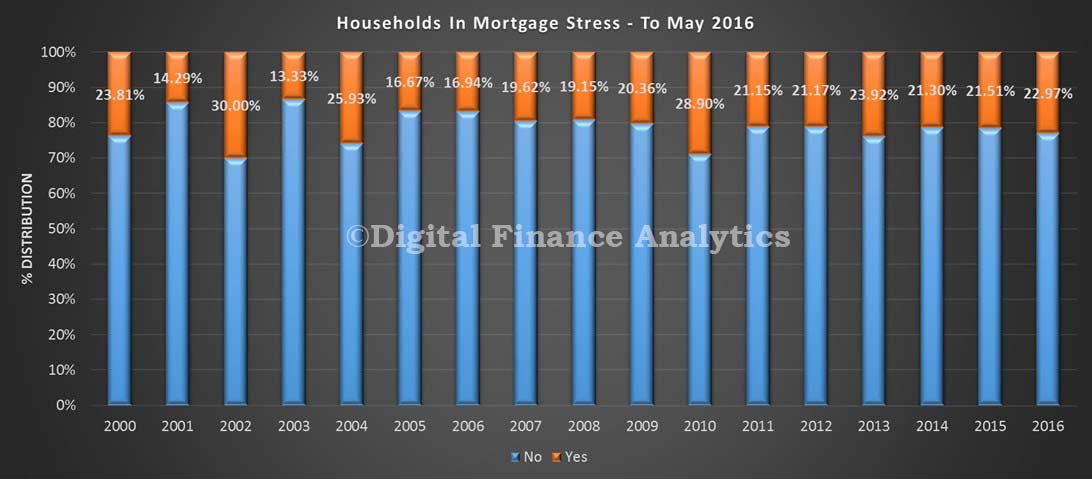

We have run our mortgage stress models, using data from our latest household surveys. At the moment, 21.73% of households are in difficulty (a fall thanks to lower rates from last years), though some locations and segments are above 30%. You can read about how we calculate mortgage stress in the Anatomy of Mortgage Stress.

Households in stress are having to cut back spending, are likely to be putting more on credit cards, will have refinanced to reduce payments, may be in arrears, or are taking to a broker about refinancing. The stress model has been updated with the latest survey data, and recent mortgage repricing. This covers owner occupied loans only. In our experience, stressed households, in a flat income environment do not recover, and grind on into greater difficulty later – also of course they are very exposed should rates rise.

Our first chart shows the proportion of households in stress by age of loan. (Of course most loans are just a few years old, so there are more households in recent years. We still see the impact of high first time buyer volumes in 2010 flowing though to higher stress levels, still.

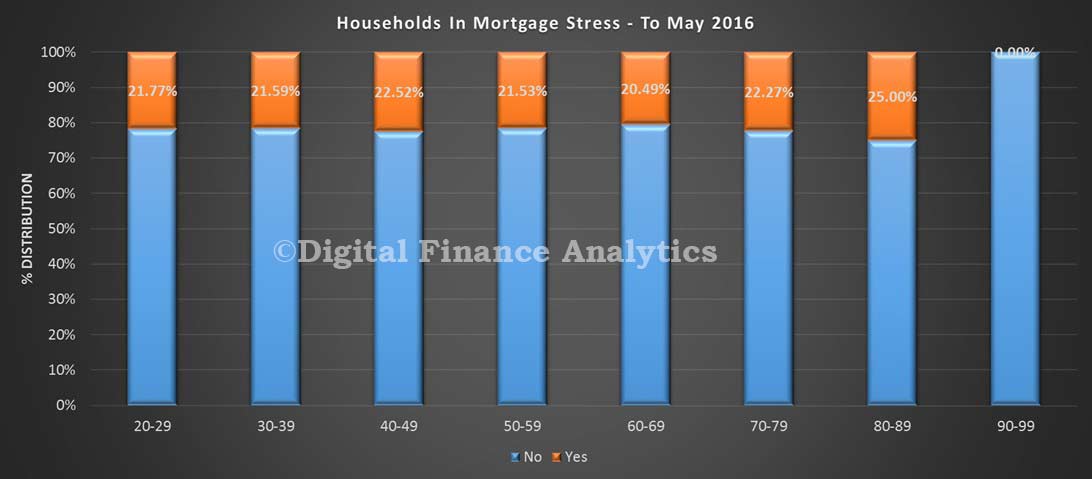

Stress is not just the domain of the young. In fact proportionally, older households with loans are more likely to be stressed – though the numbers with a mortgage are much lower – this is because incomes are squeezed, and households have outstanding mortgages for longer.

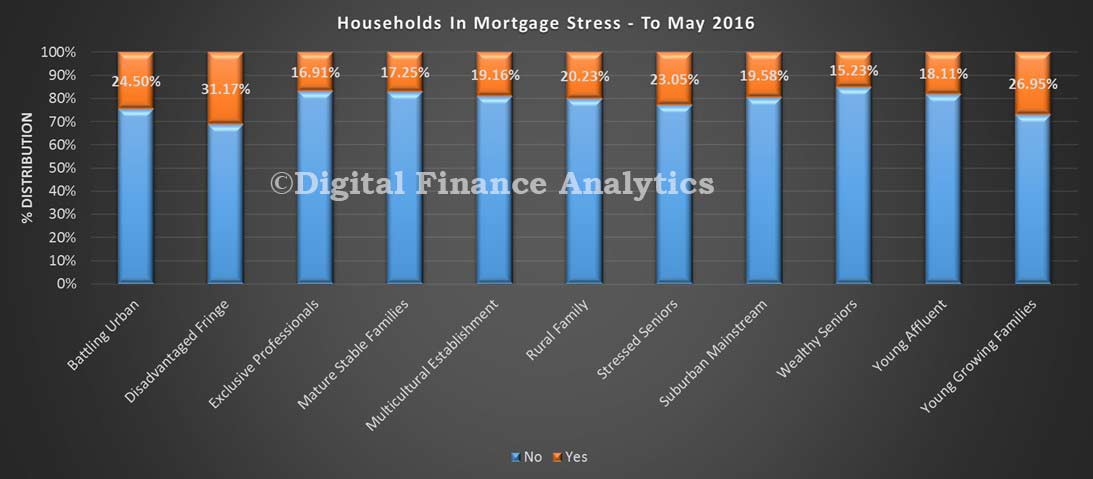

Our master household segmentation shows that younger families, and disadvantaged households are more likely to be in stress. The affluent are least impacted.

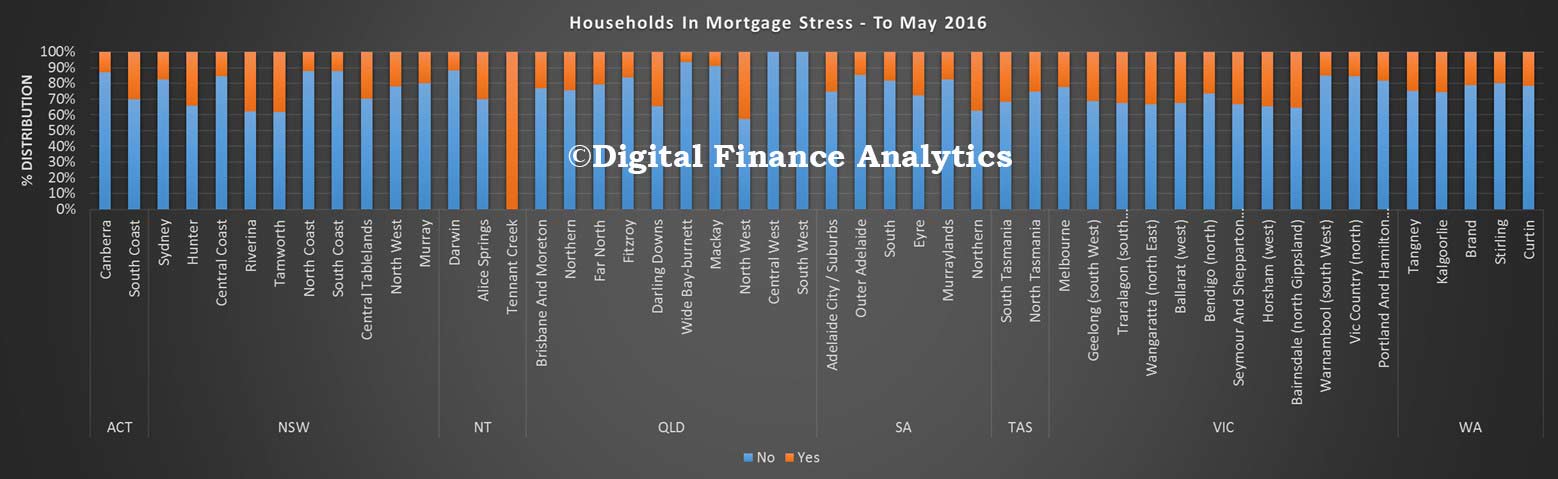

Finally, we have a view by state and region. There are considerable differences across the states and by location. Again, this does not show the relative count by area, but remember half of all loans reside in NSW and VIC.

Overall we conclude that the cash rate cuts and deep discounts on refinanced loans have eased the pain for many households, despite static incomes. This chimes with recent improved household finance confidence levels.

Overall we conclude that the cash rate cuts and deep discounts on refinanced loans have eased the pain for many households, despite static incomes. This chimes with recent improved household finance confidence levels.

Provided rates stay low, or go lower, stress levels will remain contained provided employment rates do not rise. Of course the real killer would be interest rate rises. But we are now not expecting lifts in rates anytime soon.