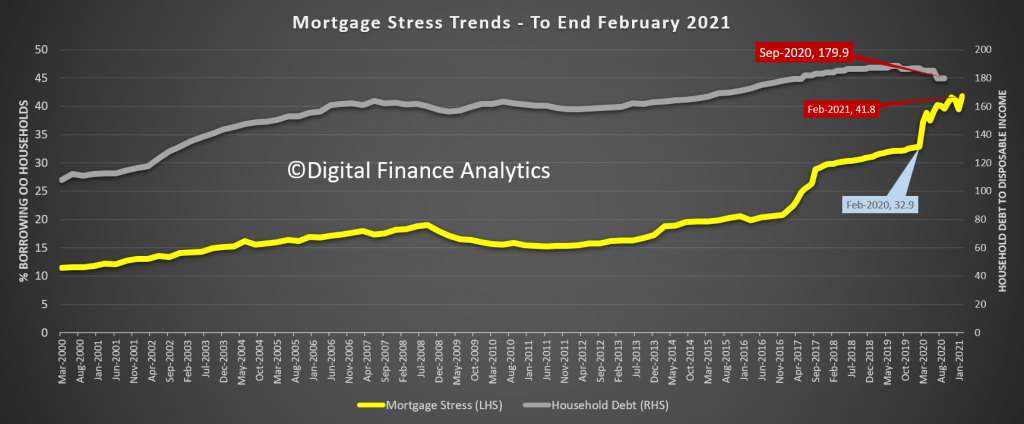

Well, against expectations – based on the main thrust of economic news (and spin), some may find it surprising to learn that our latest household surveys detected a RISE in Mortgage stress in February, based on our 52,000 or 0.5% rolling sample.

Remember that we are measuring free cash flow, and a range of factors have driven the rate higher. First, people are spending harder now, and draining their savings (some built large buffers last year). Second the number of people on principal and interest rate holidays from the banks has fallen as they restart some (any) sort of repayments, (which of course resets the default “timer”, conveniently). Third, more are weaning off JobKeeper, and payment rates on JobSeeker are dropping as the extra support is withdrawn. Finally, some have negotiated new loans, at lower rates, but others are not successful in this, due to credit history, or taking a larger loan. Support ends at the end of March, so expect to see more of this ahead.

And the snap lock-downs had a big impact on some incomes, which are growing only slowly, if at all.

It is worth remembering that some new loans are being made at up to eight times income – this is a very high multiple even in the current low rate environment. And rates may not be as low for as long as many currently expect!

Thus overall mortgage stress rose from around 39% last month to more than 41% this month.

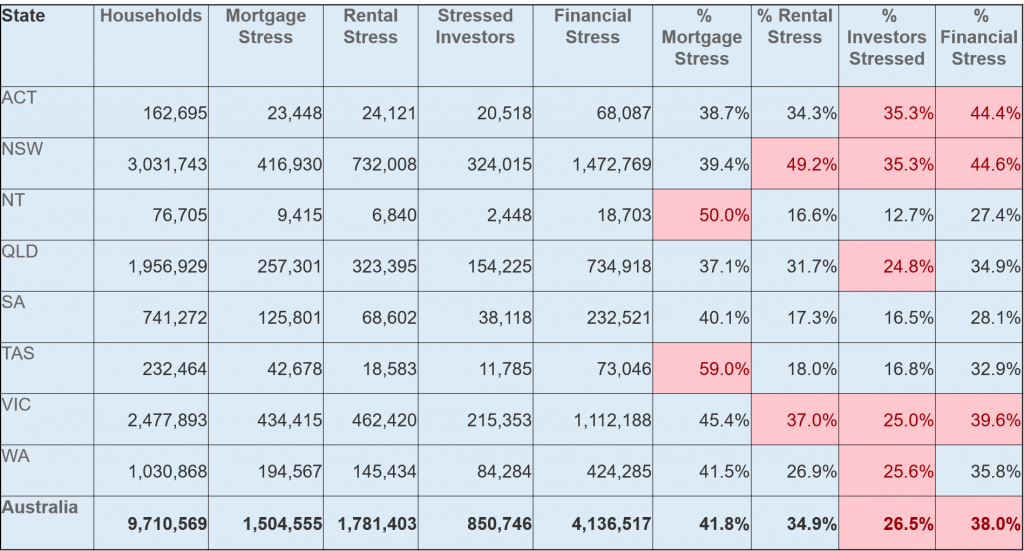

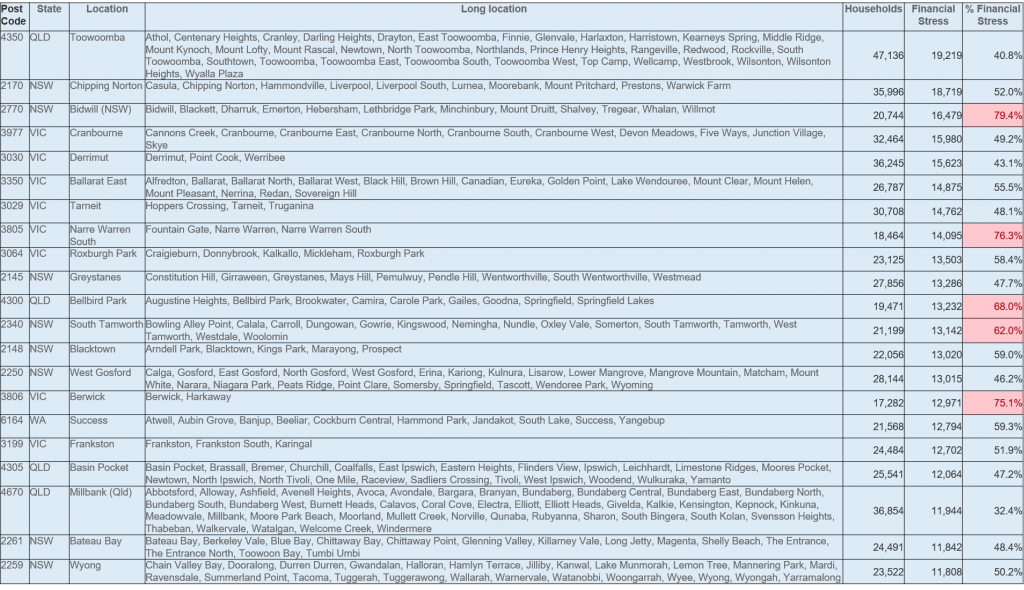

Across the country, more than 1.5 million mortgage holders have cash flow issues, this is 41.8% of borrowers. Tasmania and NT had the highest proportion of households exposed, and Victoria rose to 45.4% in response to the recent lock-down.

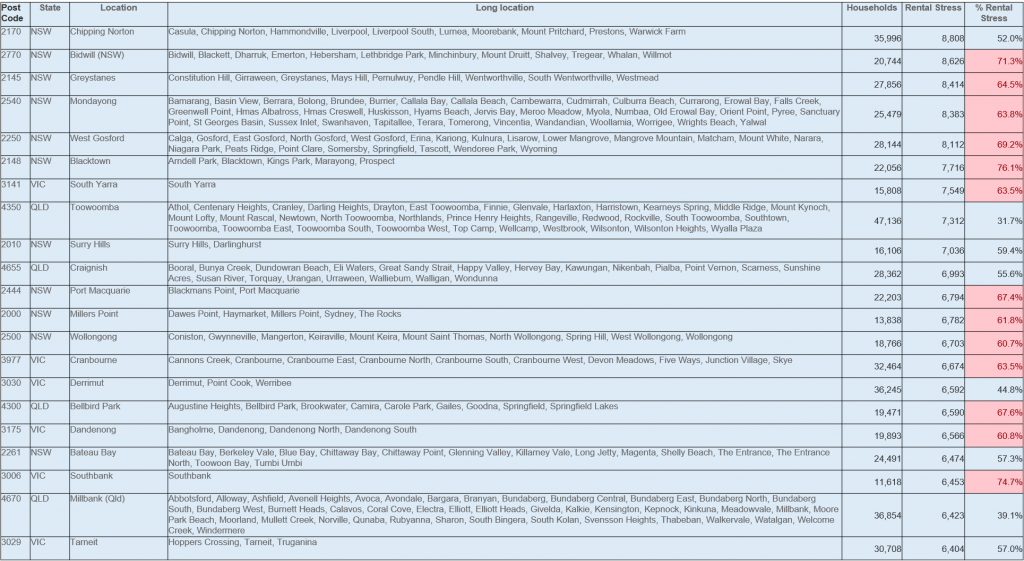

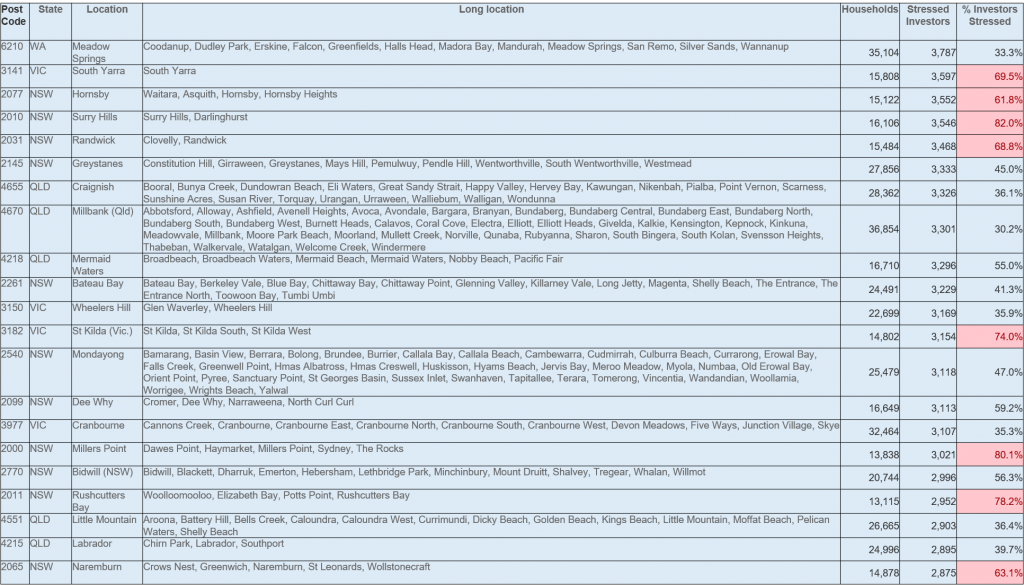

We also measure rental stress, which is 34.9% of renters, investment property stress at 26.5%, and overall aggregate financial stress at 38%. In total around 4 million households are being crunched in some way.

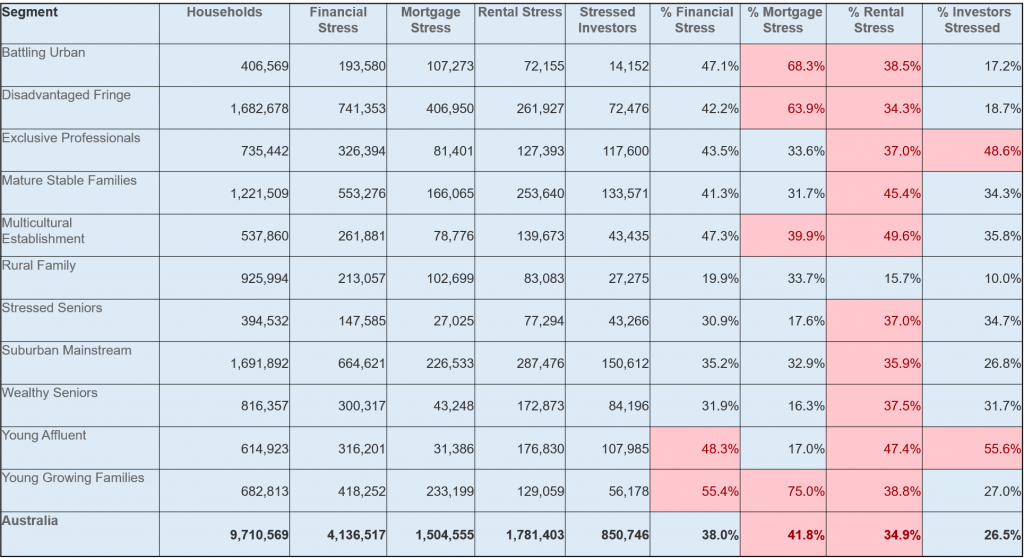

Across the segments, young growing families, and those on the urban fringe are most exposed (this includes many recent first time buyers), while more affluent households are also caught, thanks often to multiple investment properties.

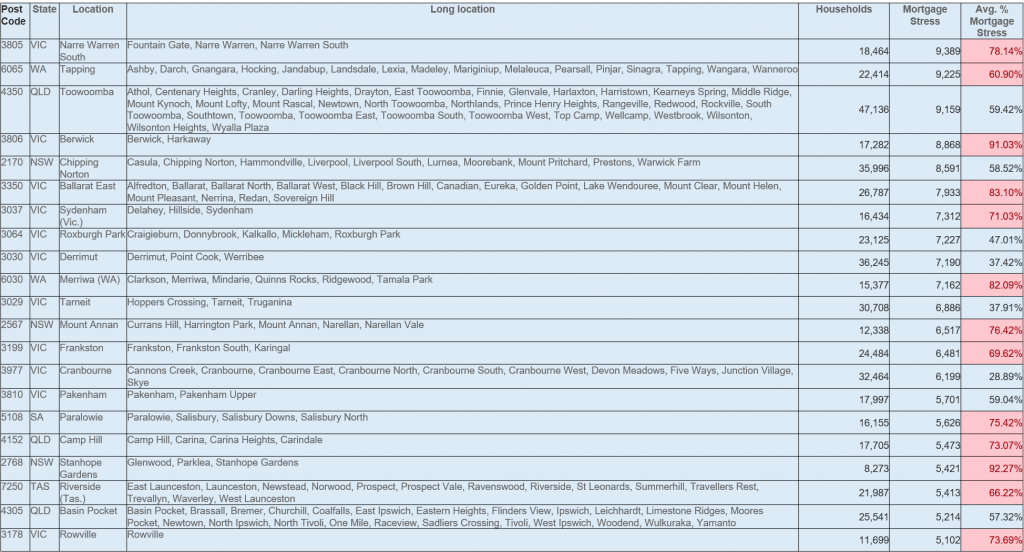

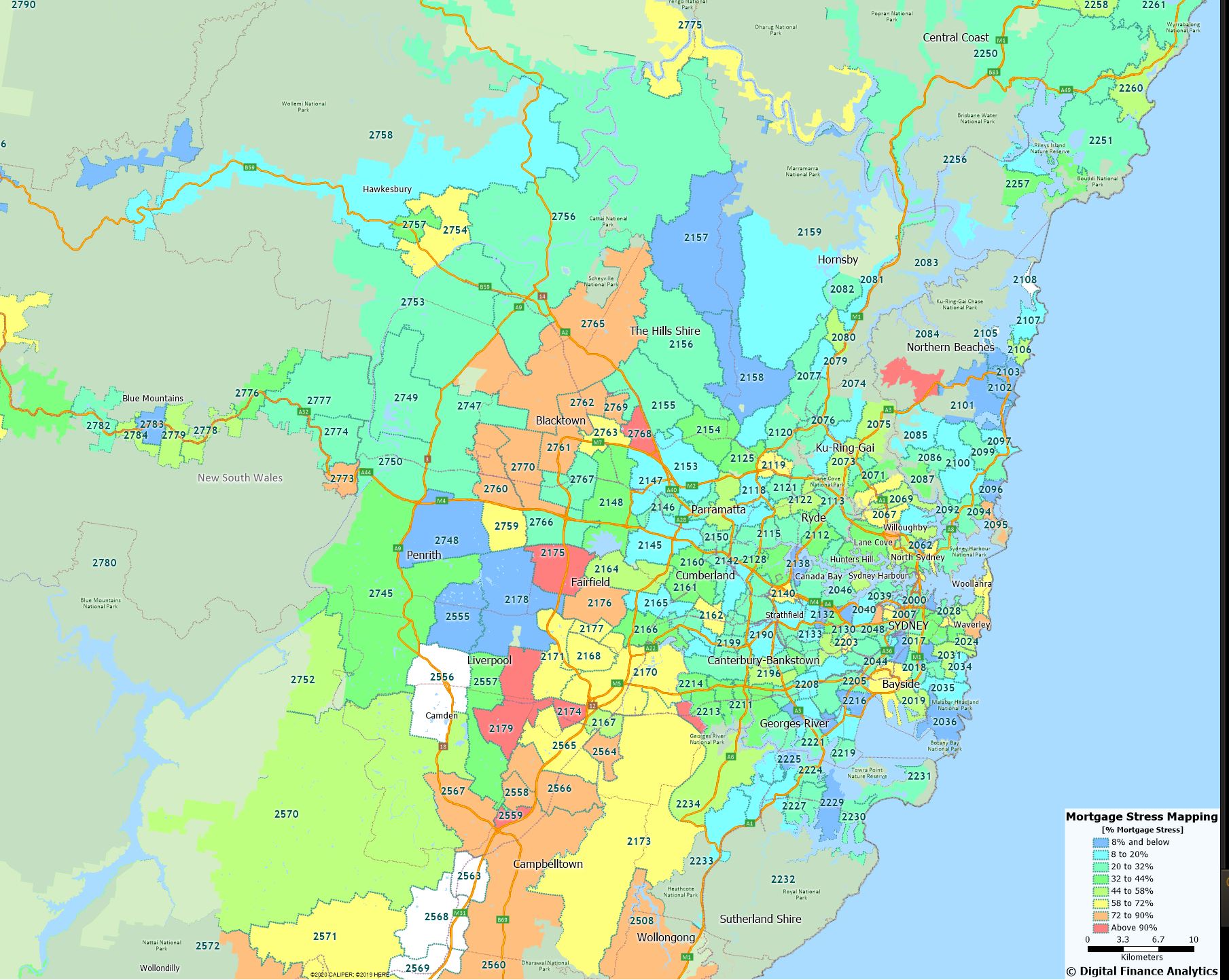

We can identify the top post codes for our four stress types, sorted by the number of households exposed. We see the same post codes appearing in multiple lists. There was a significant rise in the high growth areas around Melbourne, as well as Toowoomba in Queensland, and areas of New South Wales.

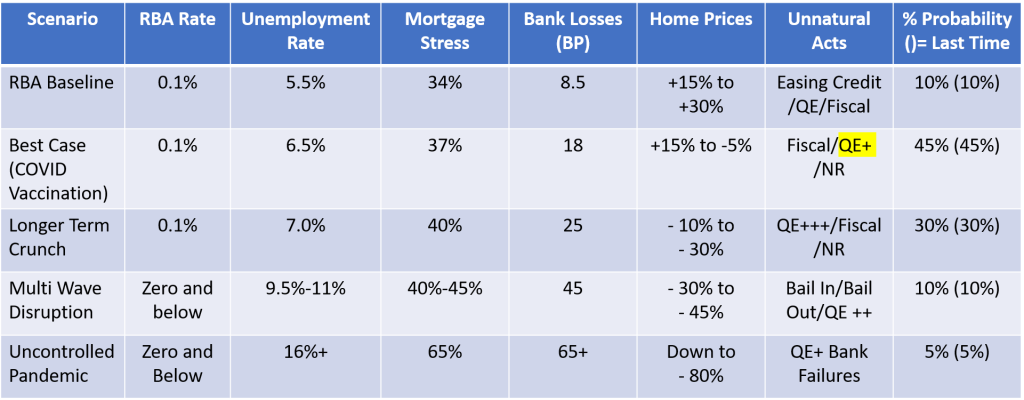

Underlying our modelling are our scenarios, which we have updated with the latest economic data inputs. There is a greater probability of home price rises, especially in some smaller states, and in the house, not high-rise unit segment.

And we discussed this analysis, together with the stress maps which accompany it in our recent live show.

Whilst some are falling over themselves to get into the market, we remain cautious, given the potential rise in stress, mortgage rates, and the tapering of Government support.