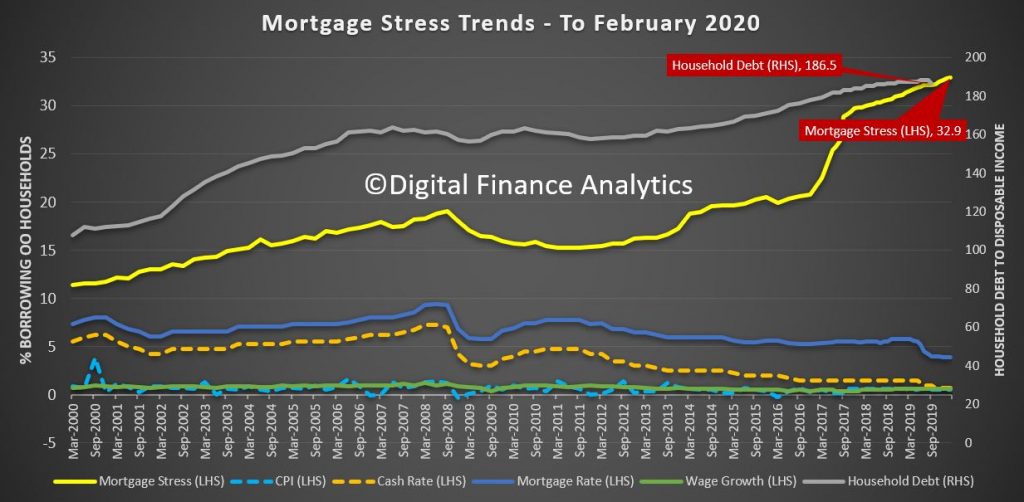

The official story is that lower interest rates are translating to reduced financial stress in the community. The true story, as revealed in the latest edition of our mortgage stress analysis is that more households are up against it, with a record 32.9% of mortgages households wrestling with cash flow issues. This translates to 1.08 million households in stress, and more than 82,000 risking default in the months ahead.

Many households are chasing their tails, in that while mortgage repayments are dropping – for some, rising living costs and flat real incomes are compounding their financial pressures. There was a sharp downturn in take home pay, thanks to bushfires and the virus is beginning to hit businesses, (who in turn are less able to pay and retain staff, especially those on “flexible” contracts).

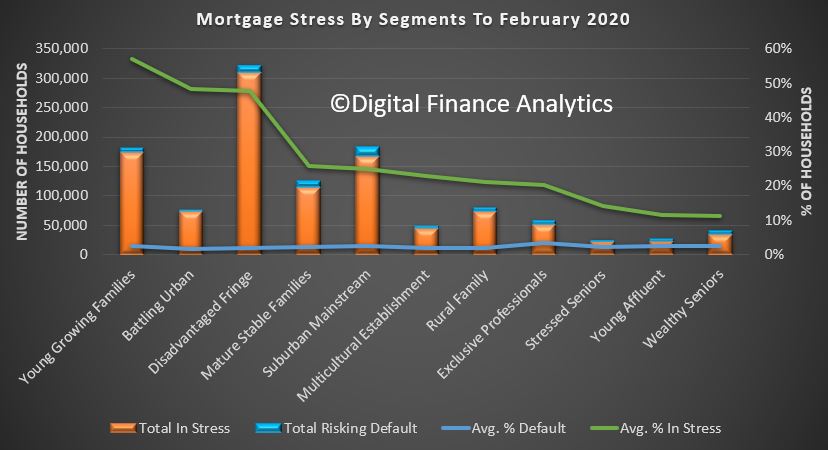

Across our master household segments, the highest proportion of households under pressure are “Young Growing Families”, which includes many recent first time buyers, “Battling Urban” – those older households living in the main urban corridors, and “Disadvantaged Fringe” households, those living in the often new fringe developments are also at the top of the list. That said, stress takes no prisoners, in that even some wealthy households, and more mature families are also under pressure.

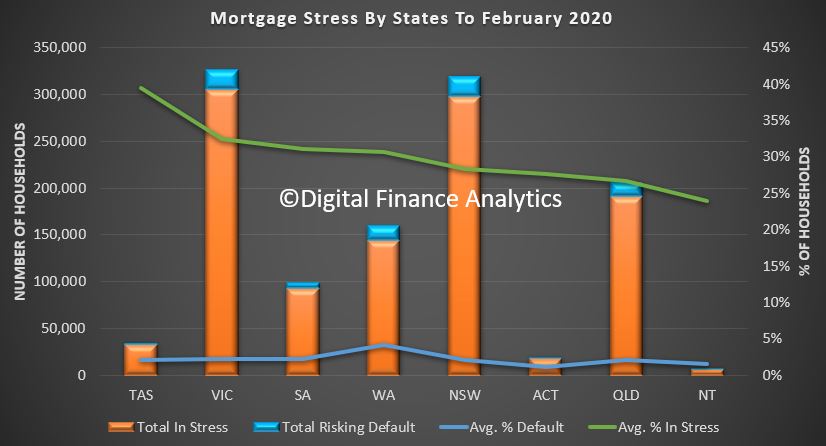

Across the states, the highest proportion of households are in Tasmania, where the recent run up in prices, against high costs and low wages is a nasty cocktail. As yet though defaults remain low here. Western Australia has a significantly higher level of defaults, because the financial pressures have been running for years. The largest counts of stressed households are located in Victoria and New South Wales, with Queensland also seeing a further rise. Defaults are expected to rise again.

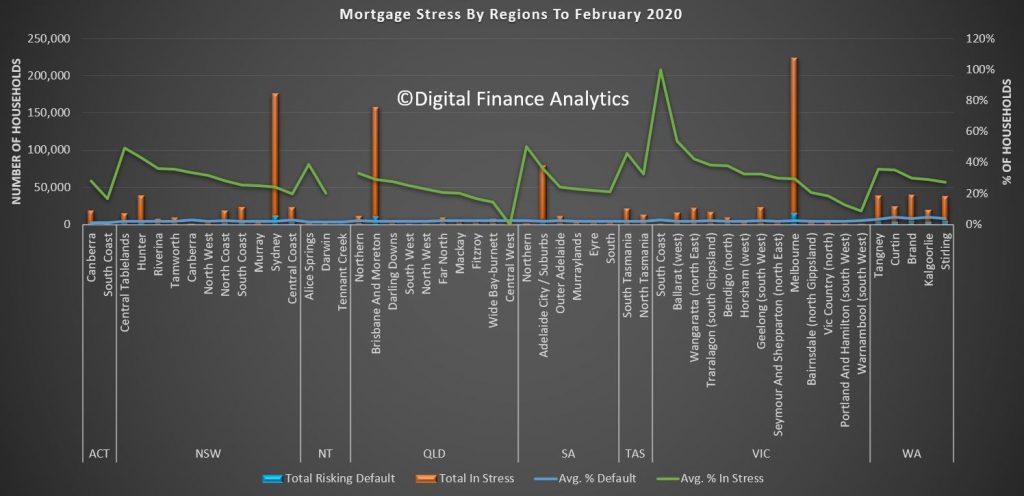

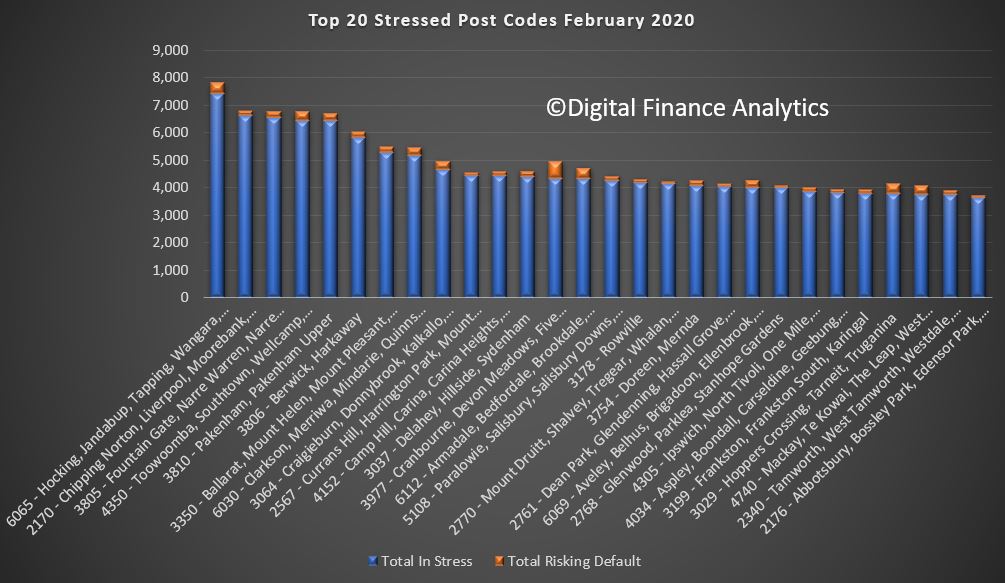

Across the regions, there are considerable variations, with a significant spike in some areas following the recent bushfires.

The top 20 post codes reveals that WA post code 6065 which includes Tapping and Hocking tops the list this month, with more than 7,000 households impacted. Liverpool, 2170, in New South Wales, Narre Warren 3805 in Victoria and Toowoomba 4350 in Queensland are all at the top of the list. The common theme here is significant and recent higher density development, large mortgages and over priced real estate (and supported by insufficient infrastructure).

As always we remind households that maintaining a cash flow record is an essential tool to managing a household budget – there are good tools available on ASIC’s Money Smart Web Site. Less than half of the households surveyed know their financial status. Careful prioritisation, and repaying higher interest debts first often makes the most sense, especially when wages growth will remain sluggish (and before the economic impact of the virus really hits). Finally, refinancing may provide short term relief, but without a change in behaviour this will not be long lasting.

We will update our models again next month.