Defaults are expected to rise this year amid new data which reveals that almost a million Australians are under mortgage stress.

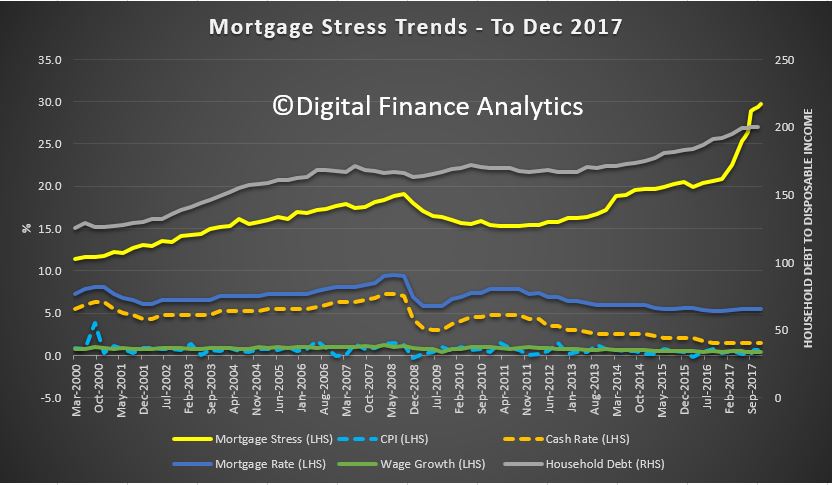

Digital Finance Analytics (DFA) has released its mortgage stress and default analysis for the month of December, revealing that over 921,000 households (29.7 per cent) are under “mortgage stress”, with 24,000 households under “severe mortgage stress”, up by 3,000 from the previous month.

DFA principal Martin North has predicted that more Australians will default on their debts in 2018, with an estimated 54,000 households at risk of 30-day debt defaults in the next 12 months.

“My own view is that we’re going to see default debts rise in 2018,” Mr North told The Adviser. “I can’t see any argument to suggest that it’s going to be different unless income starts to move up in real terms.

“I know that Treasury is forecasting a very positive outlook for wage growth over the next couple of years, [but] I can’t see where that’s coming from at the moment. My own view is that we’re going to see mortgage stress rising and that will actually have a knock-on effect on defaults. So, I’m forecasting defaults will be higher later into the year than they were at the end of last year.”

The data analyst attributed rises in mortgage stress to the “loose” lending standards of previous years.

“Over the last four or five years, lending standards have been a bit too loose,” Mr North said.

“We’ve got a lot of people now who, if they applied for the same mortgage two or three years ago, they wouldn’t now get that mortgage because effectively the affordability criteria has been tightened, the income standards have been tightened, all of the dimensions have been tightened.”

Mr North also urged Australians to keep a budget, and he warned that household accumulation of unsecured debt could further perpetuate mortgage stress.

“There’s an alignment between mortgage stress and rises in other forms of debt,” the principal said.

“What we’re finding is that there’s an accumulation of other debt categories around people with mortgage stress, so it’s part of the problem.”

Despite acknowledging the negative impact that a future rate rise imposed by the Reserve Bank of Australia (RBA) would have on mortgage stress, Mr North believes that the central bank needs to increase its cash rate to ease “systematically structural risk” caused by a high debt ratio.

“The RBA [has] a really tricky situation because we’ve got mortgage lending growing at three times income growth — 6 per cent annual mortgage growth lending and 2 per cent income growth — so, that’s an unsustainable position.

“If they do lift rates, essentially that’s going to put more households under pressure.

“[But] my own view is that the next rate will be up, [and] it won’t be for some months — probably in the second half of 2018 — and I think it’s predicated on what happens to wages.”

Concluding, Mr North said: “I can’t see any logic for driving rates lower, and the challenge is that they should be putting rates higher than they probably will because of the problem with debt overhanging in the system we’ve got at the moment.”