The latest amendments passed into law last week extends the capital raising capabilities of mutuls in Australia, via mutual capital instruments (MCIs), which Moody’s rates as “credit positive”.

However, we are concerned by the extension of “financialisation” into the mutual sector, the potential higher risks it introduces as players compete for returns to investors, and the complexity of the financial markets they have to engage in. This could be a disaster.

Frankly, this just continues the journey away from meat and potato banking and is a further illustration of the myopic views of the regulators, especially APRA.

Rather than extending these additional capital channels, we need banking structural reform to contain the over-risky sector. This is the wrong strategy at the wrong time (especially as the housing sector tanks).

Anyhow, this is what Moody said:

On 4 April, Australia’s parliament passed the Treasury Laws Amendment (Mutual Reforms) Bill 2019, which amends the Corporations Act 2001 to allow mutually owned institutions to issue capital instruments. The development is credit positive for mutuals because it will enhance their ability to support growth, invest in technology innovation and, over time, will also strengthen their competitiveness.

In particular, the amended Act introduces a definition of a “mutual entity;” clarifies that demutualisation rules can only be triggered by an intended demutualisation and not by other acts such as capital raising; and creates mutual capital instruments (MCIs) that are specific to the mutual industry to raise equity capital.

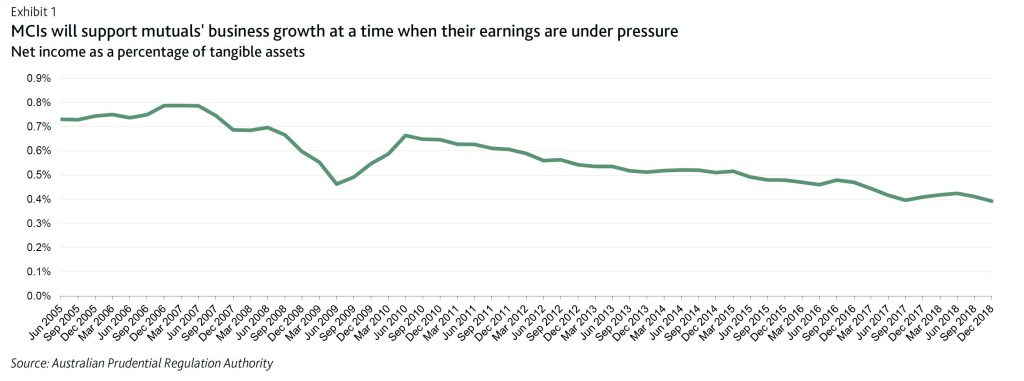

MCIs will provide mutuals with an additional capital channel to respond to growth opportunities, supplementing the retained earnings they have relied on to date. This additional capital channel is particularly important for mutual authorised deposit-taking institutions (mutual ADIs, which include mutual banks, building societies and credit unions) at a time when their profitability is under pressure. Pressure on profitability stems from competition for lower-risk owner-occupier mortgages with principal and interest repayments, the mutuals’ core products. This elevated competition stems from a number of factors including reduced overall loan growth; a reduced demand for investor mortgage loans in the face of potential changes to negative gearing and capital gains taxes; and tightened underwriting criteria at the major commercial banks as a result of public scrutiny during Australia’s Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry.

Additional capital options will also help mutual ADIs build the scale and efficiency they need for technology investment, which is particularly important at a time when banking services are rapidly becoming technology-based. Compared with mutual ADIs, the large commercial banks have more resources to develop or acquire innovative products, digitise processes and integrate new technologies into their business models. Technology-driven financial firms (fintechs) are seeking entry to banking, while the Australian Prudential Regulation Authority (APRA) has established a framework that allows new entrants to begin operating at an earlier stage in their licensing process than previously. These new entrants are currently small and subject to regulatory constraints in taking deposits

and making loans. In most cases they have not yet built up a retail customer base of meaningful size. However, they could grow to challenge incumbents, particularly small-scale ones like the mutual ADIs, over time.

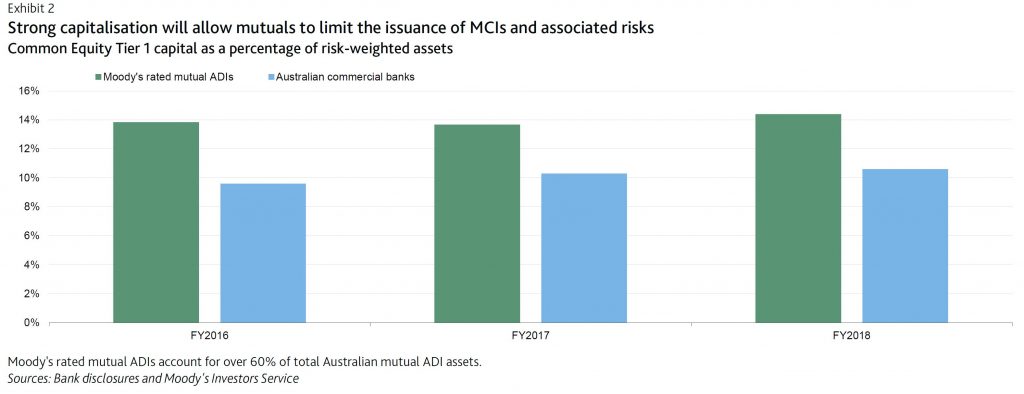

We do not expect mutual ADIs to swiftly ramp up their issuance of MCIs because their already-strong capitalisation and the current low loan growth environment are likely to reduce their need for additional capital. Mutual ADIs’ average Common Equity Tier 1 (CET1) capital ratio is well above that of the major commercial banks, which is itself strong by international standards. Moreover, APRA has set a 25% cap on the inclusion of MCIs in CET1 capital and has also capped the annual distribution of profit to holders of MCIs at 50% of a mutual institution’s net profit after tax for the year in question.

The prospect that the issuance of MCIs will remain limited will reduce the risk that mutual ADIs will significantly increase their risk profiles in an attempt to generate greater dividend returns for MCI holders. Mutuals will need time to amend their constitutions and build market recognition for MCIs. The experience of mutual banking peers in the UK also suggests that the process will be gradual. In the UK, mutuals have been allowed to issue core capital deferred shares, similar to MCIs, under the Building Societies (Core Capital Deferred Shares) Regulations 2013, but few have done so to date. We expect that Australian mutual ADIs that already have a strong investor base in the debt market to be in a better position to issue MCIs.