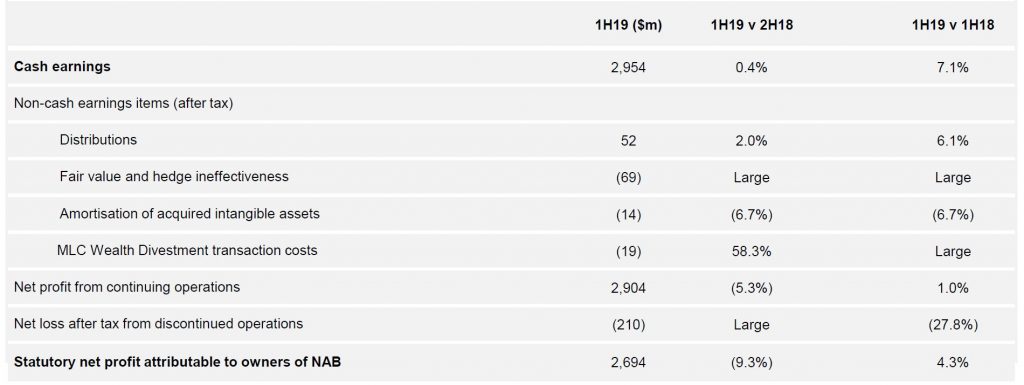

NAB reported their IH2019 results today. The statutory net profit in 1H19 was $2,694 million dollars, which is 9.3% lower compared with the 2H18, but 4.3% higher than 1H18.

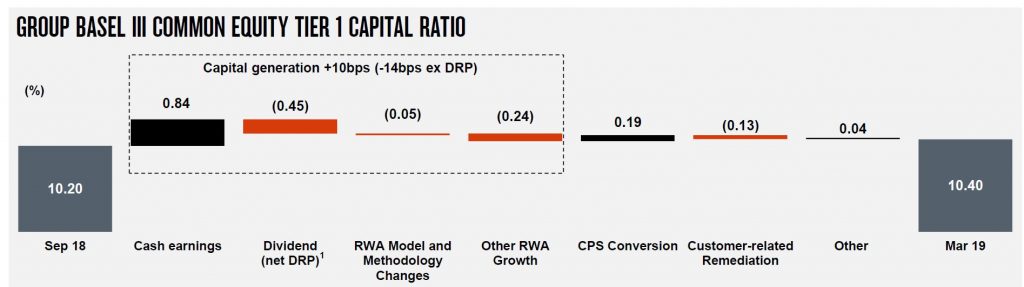

Significantly they dropped the dividend to 83 cents per share, a drop of 16.2% compared with 1H18 – this was more than was anticipated by the market. But this is still an annualised dividend of circa 6.4%, compared with CBA and ANZ who are around 5.7%. This will help NAB build capital.

The cash ROE excluding restructuring and customer remediation was down 60 basis points to 13%, compared to ANZ’s 11.7%.

There were a number of one-offs which impacted the cash earnings, (their preferred measure) of $2,954 million, which is up 0.4% from 2H18, and 7.1% from 1H18.

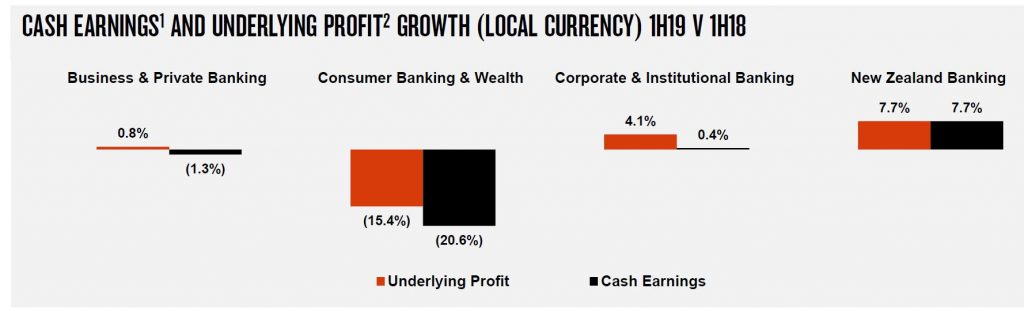

Consumer Banking dropped cash earnings by 20.6%.

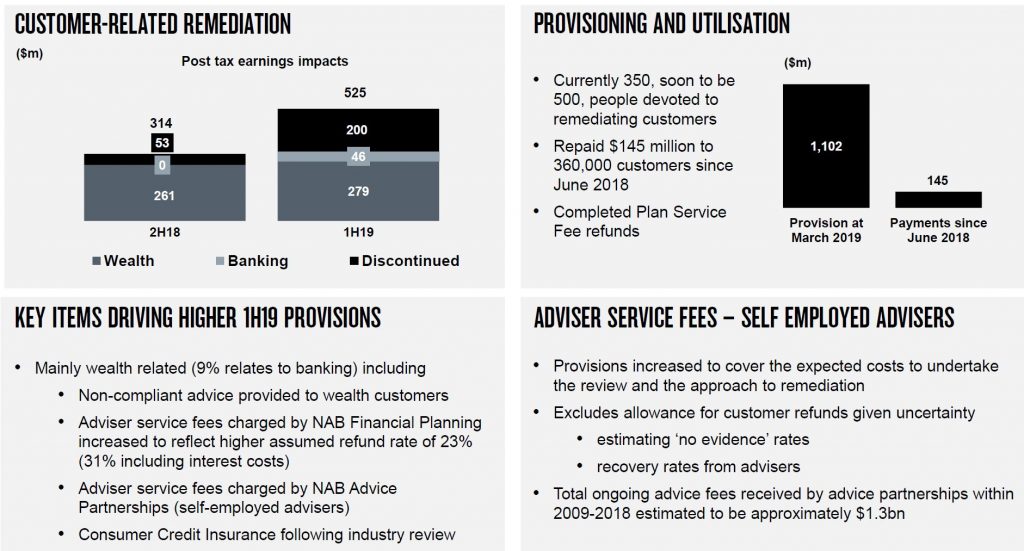

Customer remediation provisions stood at $1,102 million, and they plan to have 500 people devoted to this activity.

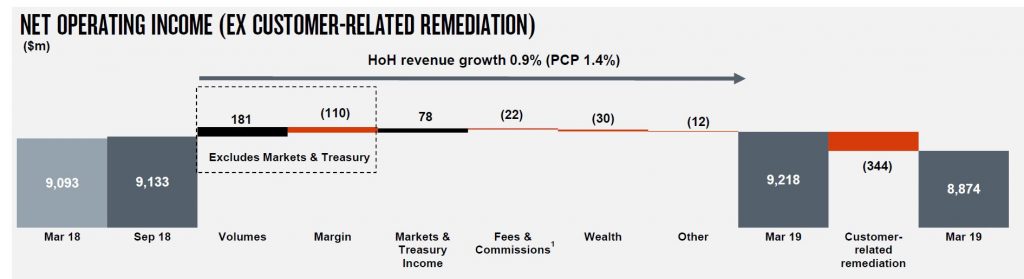

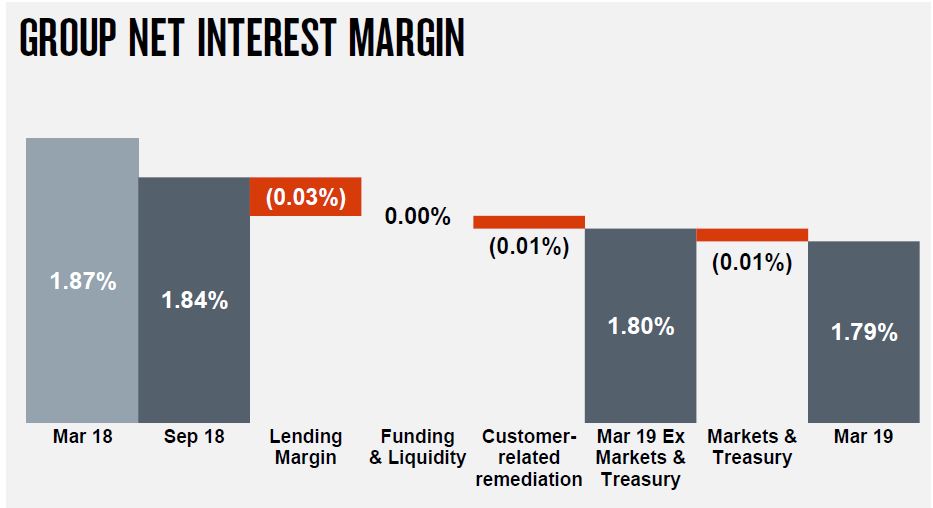

Overall income was higher, thanks to volume, but offset by margin compression of $110 million, a fall in fees and commissions, down $22 million and a customer remediation charge of $334 million, to give a net lower income of $8,874 million.

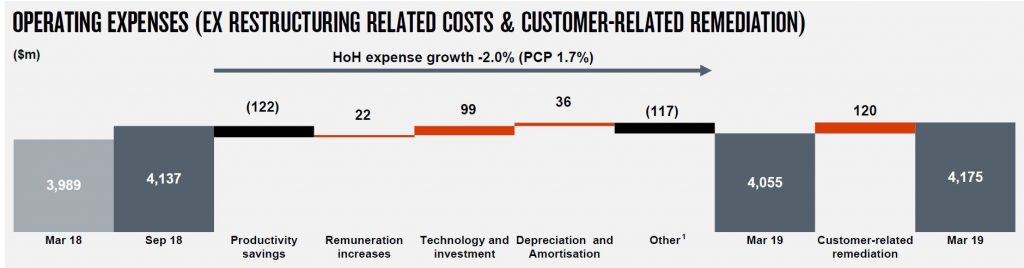

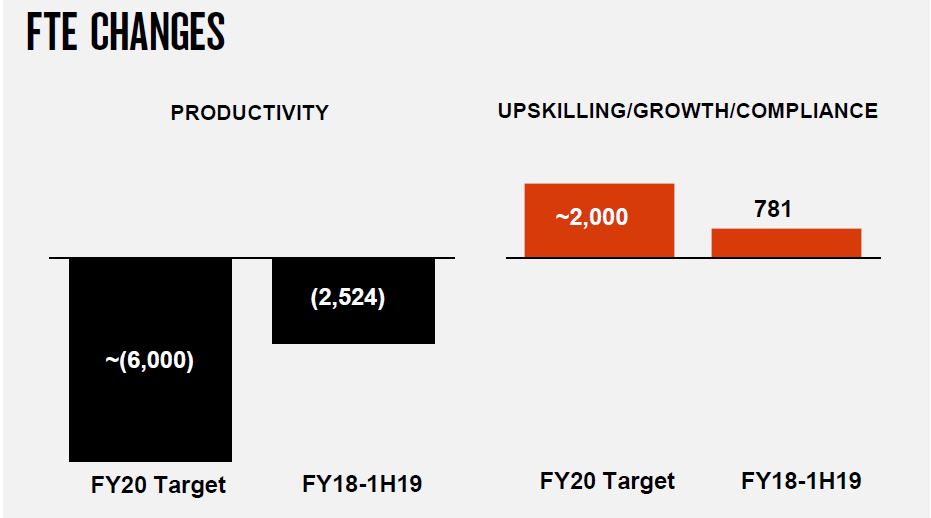

Operating expenses were flat(ish), but total FTE rose from 33,283 in 2H18 to 33,790 in 1H19.

They said that the banks is midway through its 3 year transformation program with additional investment target of $1.5bn, and that cost savings and FTE reduction are broadly on track.

Group net interest margin fell 7 basis points. Of course NAB delayed their Australian mortgage book repricing, and clearly this cost. Corporate and Institutional helped support the result. The subsequent mortgage repricing may help ahead.

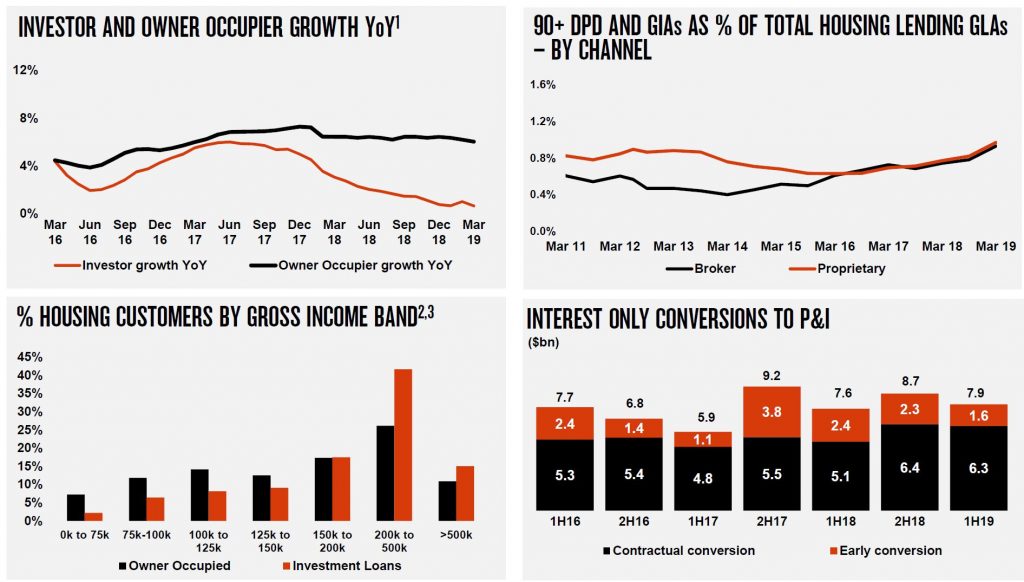

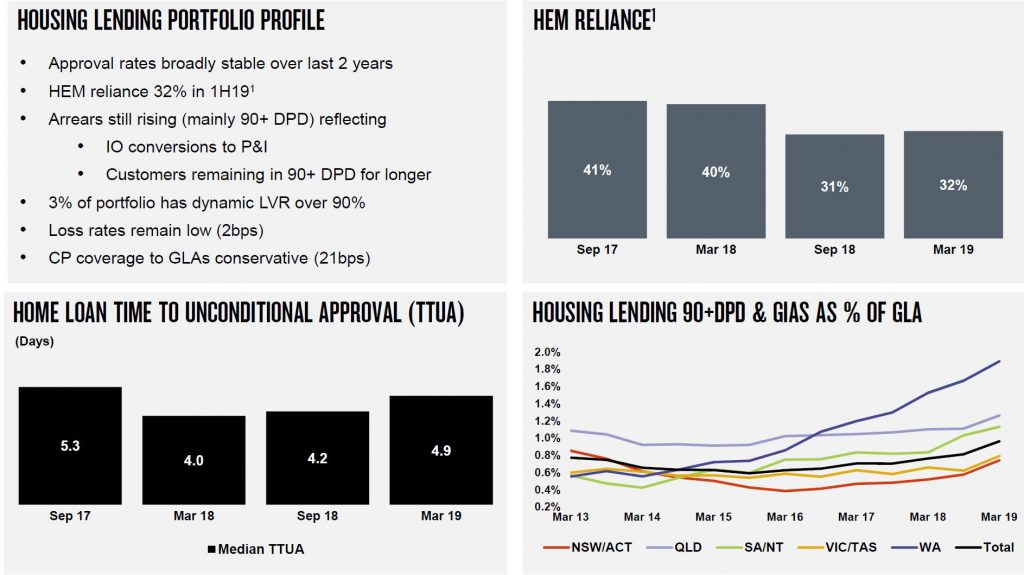

Home lending in Australia shows that approvals rates have remained stable over the past 2 years, and that reliance on HEM has fallen to 32% in March 19, compared with 41% in September 2017.

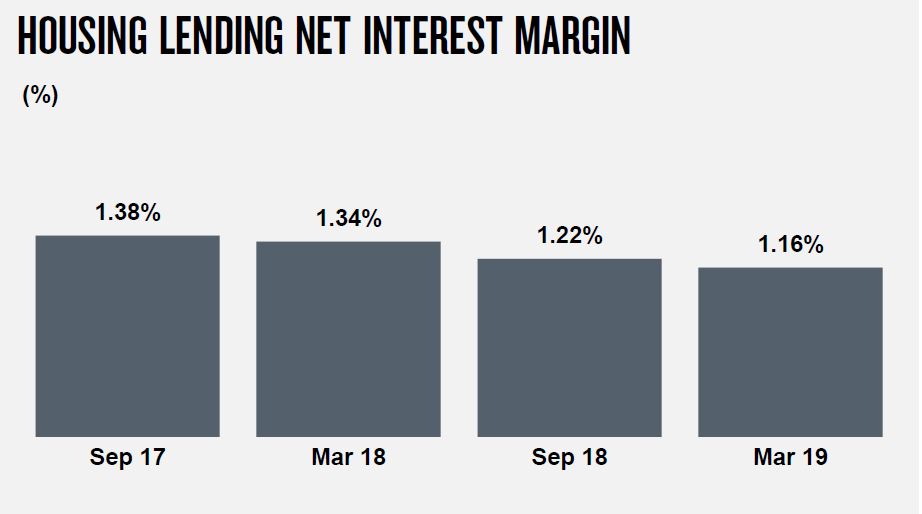

Net interest margin across Australian home loans fell 6 basis points from Sep 18 to Mar 19, and continues the slide from 2017.

Loan growth slowed, especially investor lending, and defaults are similar in both proprietary and broker channels now

They implemented Comprehensive Credit Reporting (CCR) for mortgages in February 2019 (first major bank to reach this milestone).

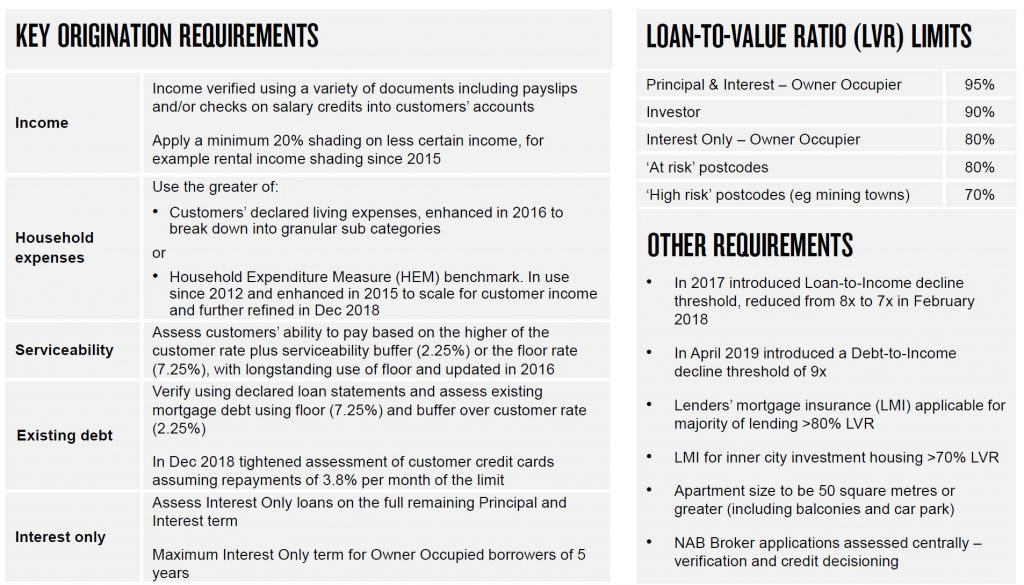

Lending standards have become tighter.

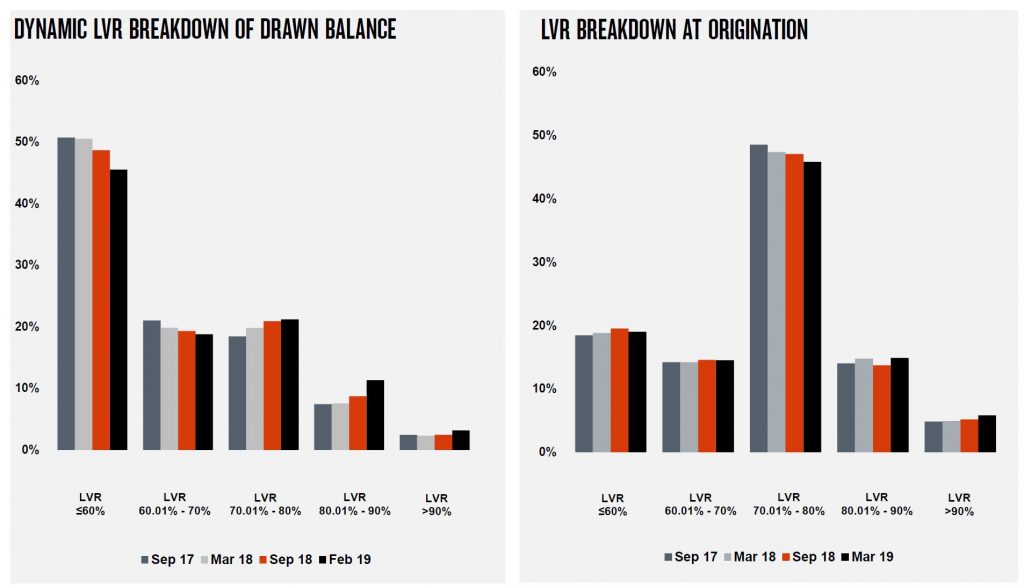

LVR Bands still include loans above 80% (and rising).

Default are rising, with 90 day+ defaults partly attributed to the conversion of interest only loans to P&I. WA has the highest levels, but other states also rose.

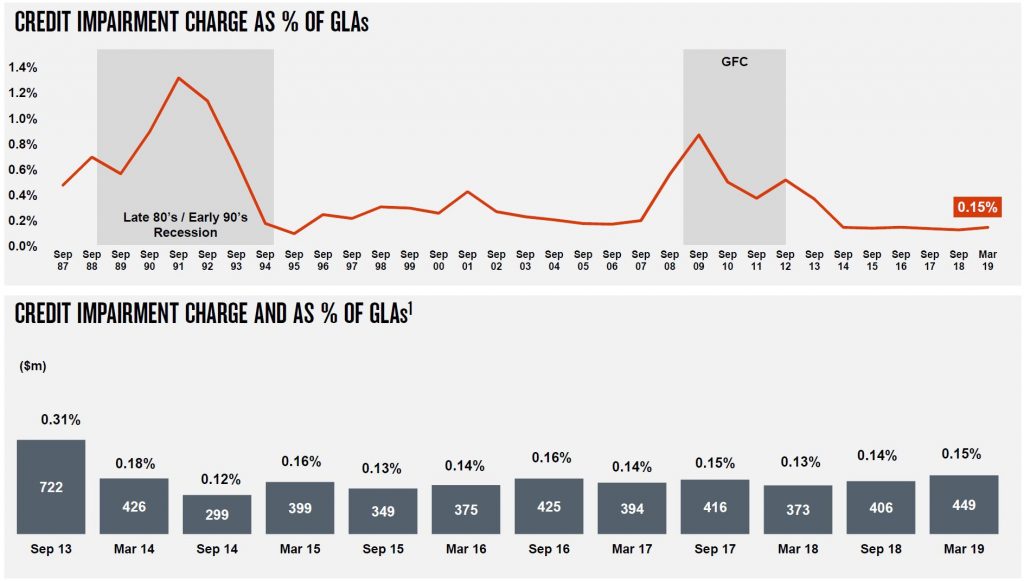

Group credit impairments rose to 0.15% of GLA’s.

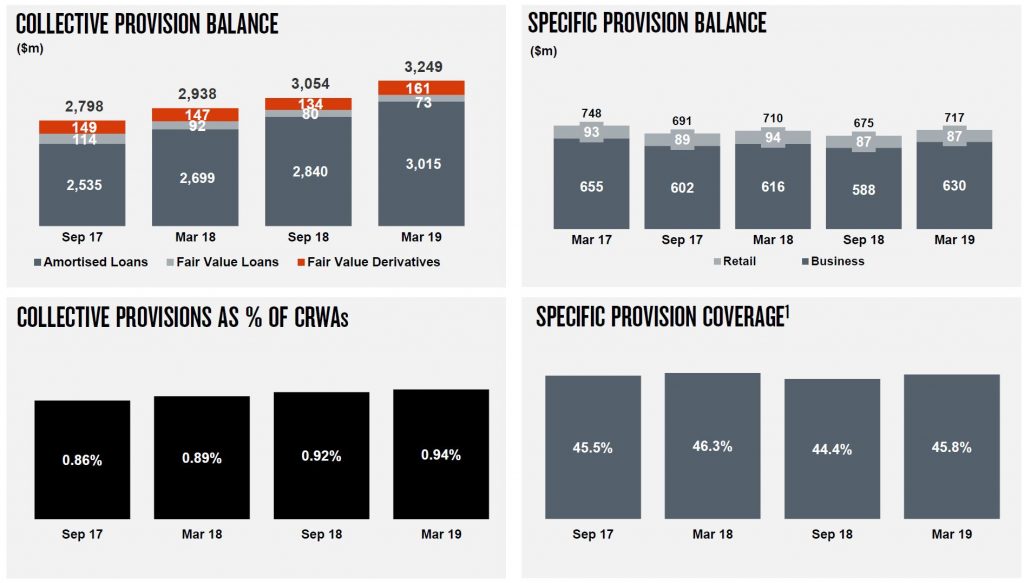

The group provisions are higher, as are the specific provision balances.

The CET1 ratio is 10.40, up from 10.20 in Sep 18, and they say they are on track for “unquestionably strong”.

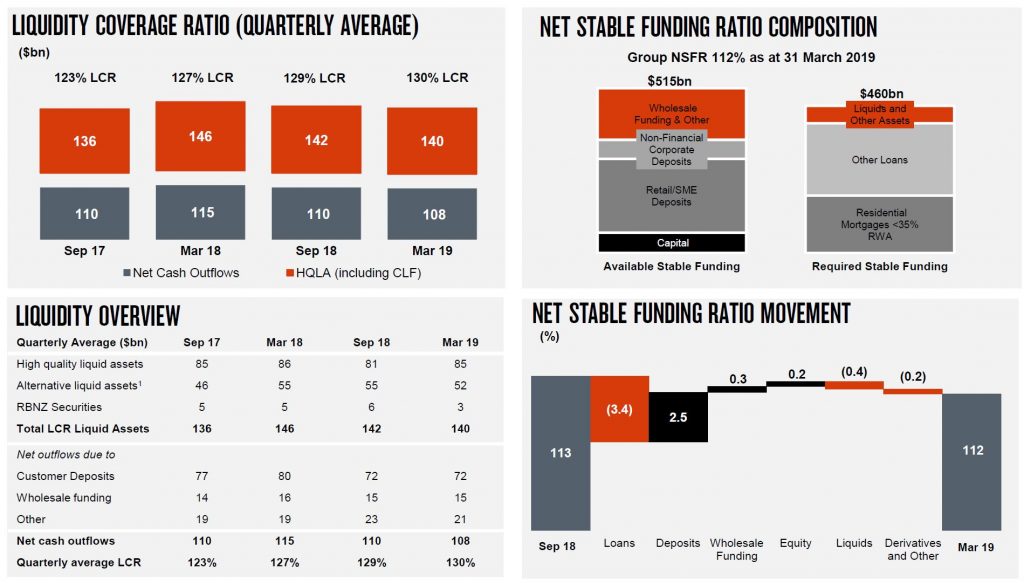

The LCR and NSFR remain strong.

So the underlying franchise still looks in reasonable shape, but the weakening housing sector needs to be watched.