In a nod to the emerging Fintech SME lending sector, NAB today announced $100,000 unsecured lending for Australian small business owners to grow and expand, backing the strength of their business without the need for security requirements such as property or cash, with a decision is around 10 minutes. As we discussed recently, getting funding for SME ex. security is tough.

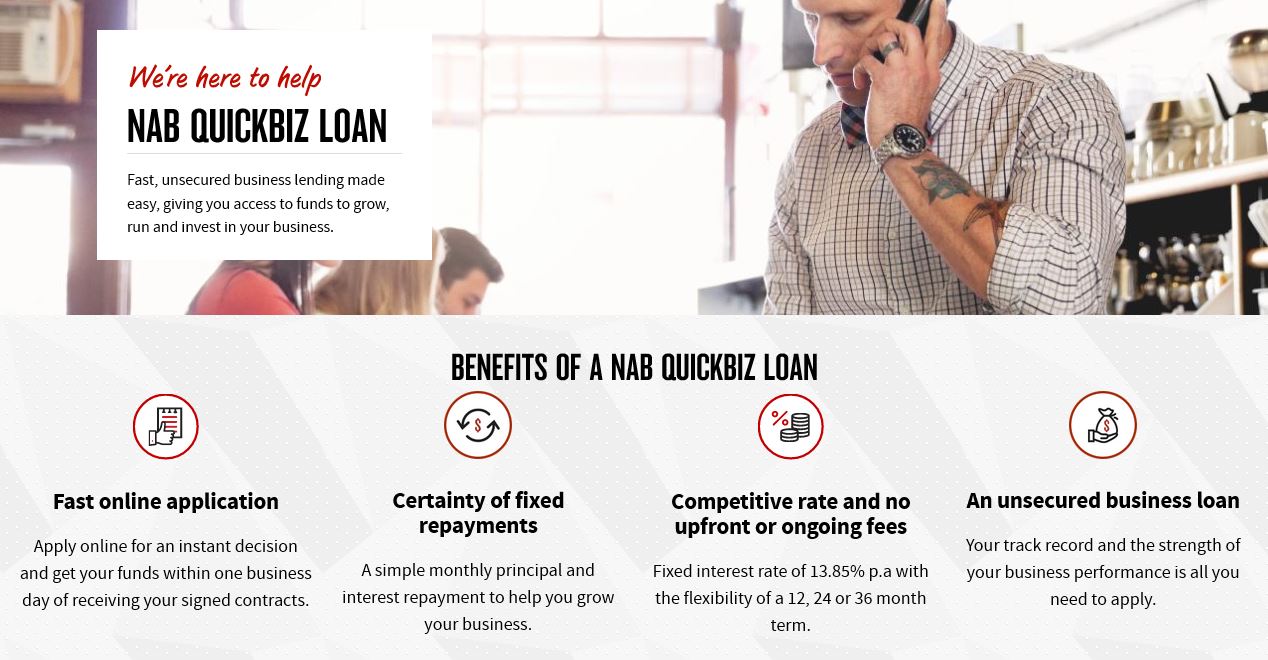

The rates look highly competitive at 13.85% relative to many of the other Fintech alternatives.

Customers apply via a fast and simple digital application process, with conditional credit approval granted in minutes. Once application contracts are signed and returned, cash is delivered within 24 hours.

Executive General Manager Business Direct and Small Business Leigh O’Neill said NAB recognises that fast and easy access to funds is critical for small businesses as they grow.

“There is often a perception that access to credit is difficult without a property or other major asset to secure against. That’s why we’ve responded by placing more emphasis on the strength of the business rather than traditional physical bricks and mortar, and we’re doing this at a fair and competitive price,” Ms O’Neill said.

NAB is the only Australian bank to have developed in-house an unsecured online lending tool without a third party referral involved. QuickBiz first launched in June 2016, initially up to $50,000.

The new $100,000 QuickBiz loan is an extension to NAB’s existing unsecured, self-service digital financing facilities, which includes an overdraft and credit card, all unsecured and capped at $50,000 for eligible customers.

“Six months after a QuickBiz loan application, just under half of our customers grew their business turnover by greater than 10 percent. This confirms we have an important role to play by offering finance to businesses with good prospects- it’s the the kick-start they need.”

“Small businesses are the backbone of the Australian economy. We need all parts of the economy – big business, government and industry – to get behind them to move the country forward.”

NAB’s Unsecured Solutions Fast Facts:

- Unsecured QuickBiz loan, up to $100,000 available for eligible Australian SMEs

- Direct connectivity to Xero or MYOB data, or simple financial upload from any accounting package

- Application and decision in under 10 minutes

- Competitive and transparent annualised interest rate charges, 13.85 % – no hidden surprises

For more information on the entire QuickBiz product suite (loan, overdraft) and Low Rate NAB business cards),