Nab reported a 13.6% fall in statutory net profit for 2019, at $4,798 million, compared with $5,702 million last year. Along with ANZ and Westpac, it is the same story of a massive hit from customer remediation (past results inflated by milking customers, and many customers still require remediation), margin compression, not helped by lower cash rates, weak loan growth, and higher mortgage delinquency and provisions. And again they expect 2020 to be a weak year economically speaking. So no growth story here.

Revenue was down 4.2%, although they at pains to point out that excluding customer-related remediation, revenue rose 1.1% mainly reflecting growth in business lending partly offset by lower margins. Of course they dismiss many of the writes-downs as a one-off, and there will be some “putting the trash out” as the new CEO takes up the reigns. $2,092 million for customer remediation all up, is a big number, and not yet final. But do not be misled, the underlying business is under extreme pressure, and competition for the meager loan volumes is intense.

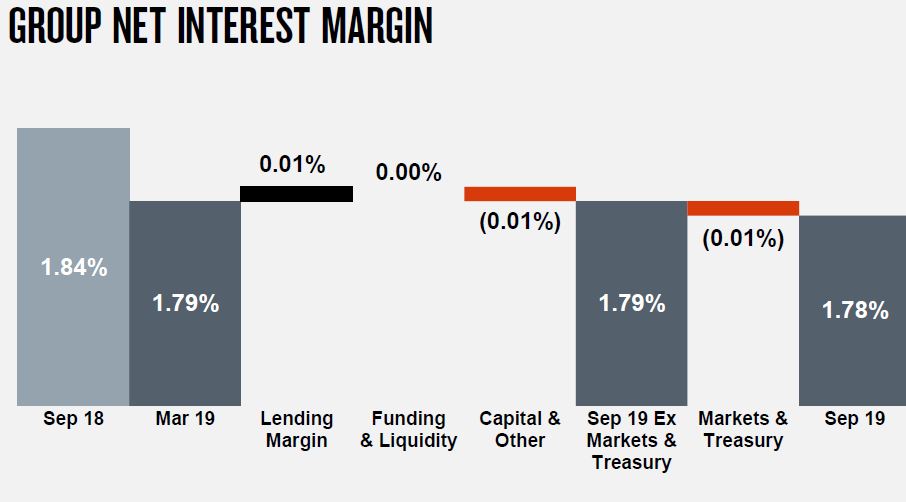

Net Interest Margin (NIM) declined 7 basis points (bps) to 1.78%. Excluding Markets and Treasury and customer-related remediation, NIM declined 4bps with home lending competition an important driver.

Expenses rose 0.2%. Excluding large notable items, expenses were up 0.4% with productivity benefits and lower performance based compensation largely offsetting higher investment and increased spend to strengthen the compliance and control environment.

But the revenue excludes customer-related remediation $1,207m in FY19, $249m in FY18. Expenses excludes: customer-related remediation $364m in FY19, $111m in FY18; capitalised software policy change $494m in FY19; restructuring-related costs $755m in FY18.

In cash earnings terms, they fell by 10.6%, from $5,702 million in 2018 to $5,097 in 2019.

FY19 cash earnings includes charges of $1,100 million after tax for additional customer-related remediation. During FY19 they uplifted customer remediation practices with more than 950 people (including NAB employees and external resources) solely dedicated to remediating customers.

In combination with provisions raised in 2H18 which have not yet been utilised, provisions for customer-related remediation as at 30 September 2019 total $2,092 million. They warn that the final cost of such remediation matters remains uncertain.

Cost savings of $480 million were achieved in FY19 bringing total savings since September 2017 to $800 million.

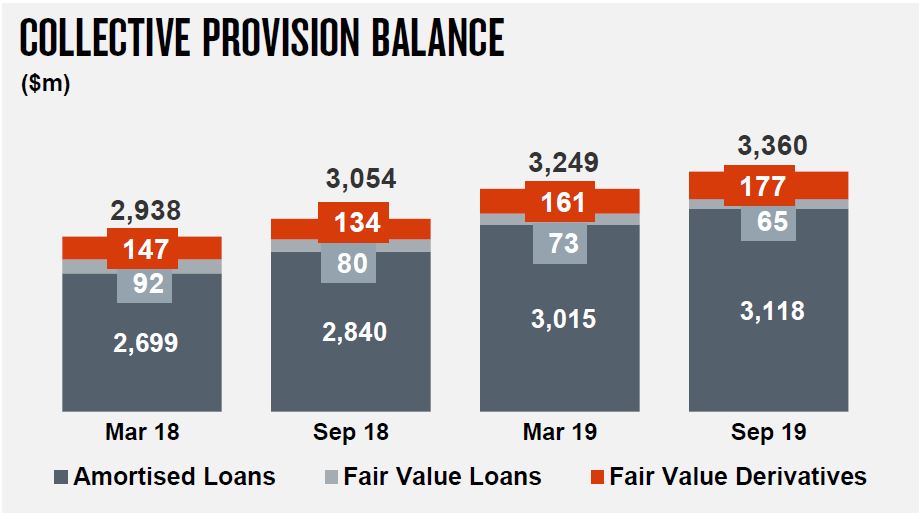

Collective provisions rose to 0.96% of CRWA’s, which equates to $3,360 million.

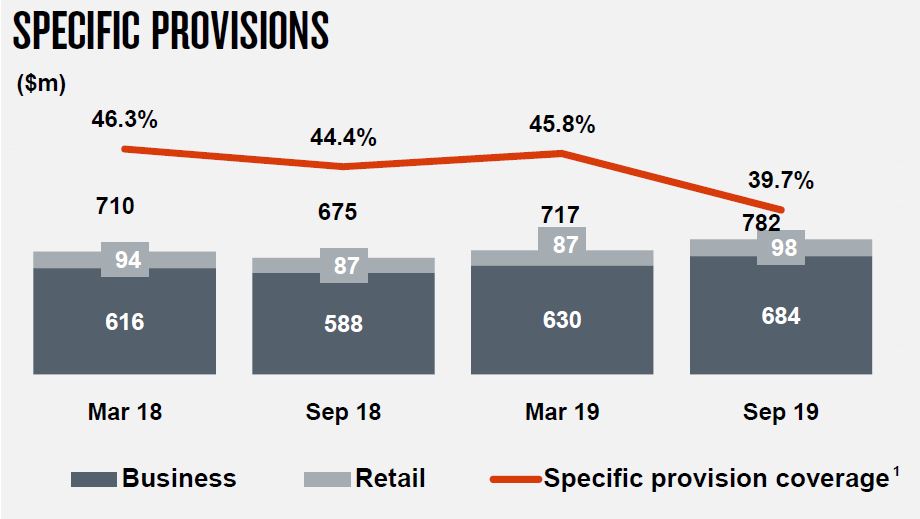

Whereas specific provisions fell to 39.7%, but were also higher.

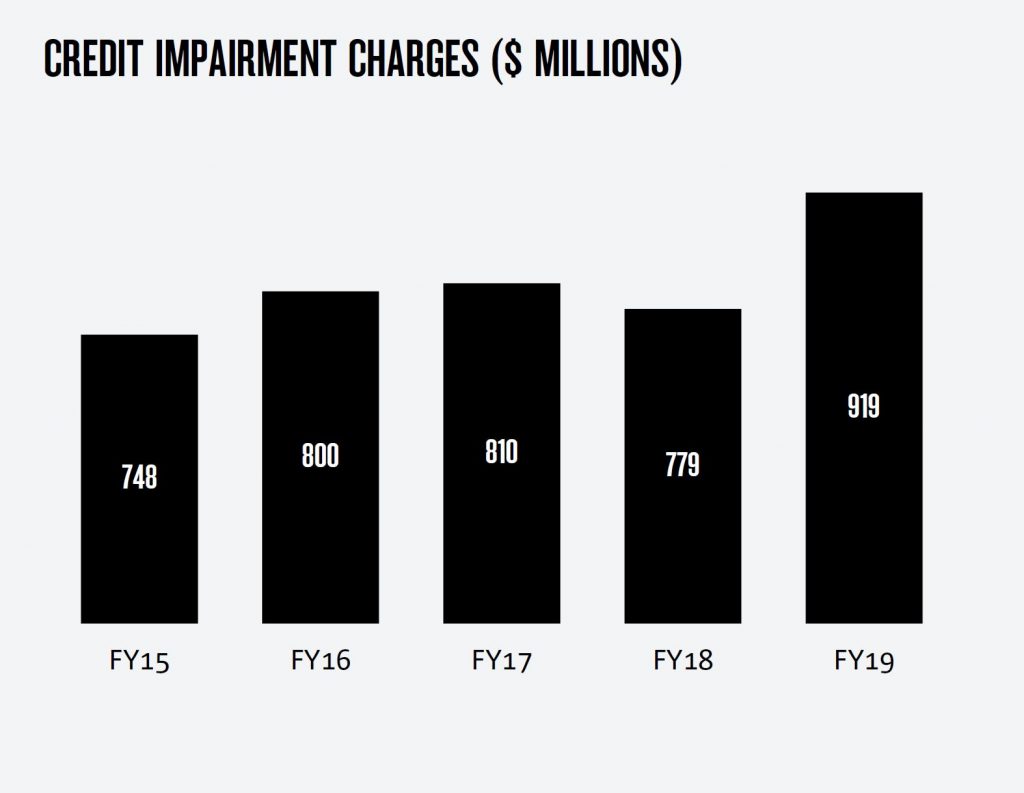

Credit impairment charges increased 18% to $919 million, and as a percentage of gross loans and acceptances rose 2bps to 15bps. FY19 charges include $60 million of additional collective provision forward looking adjustments for targeted sectors experiencing elevated levels of risk.

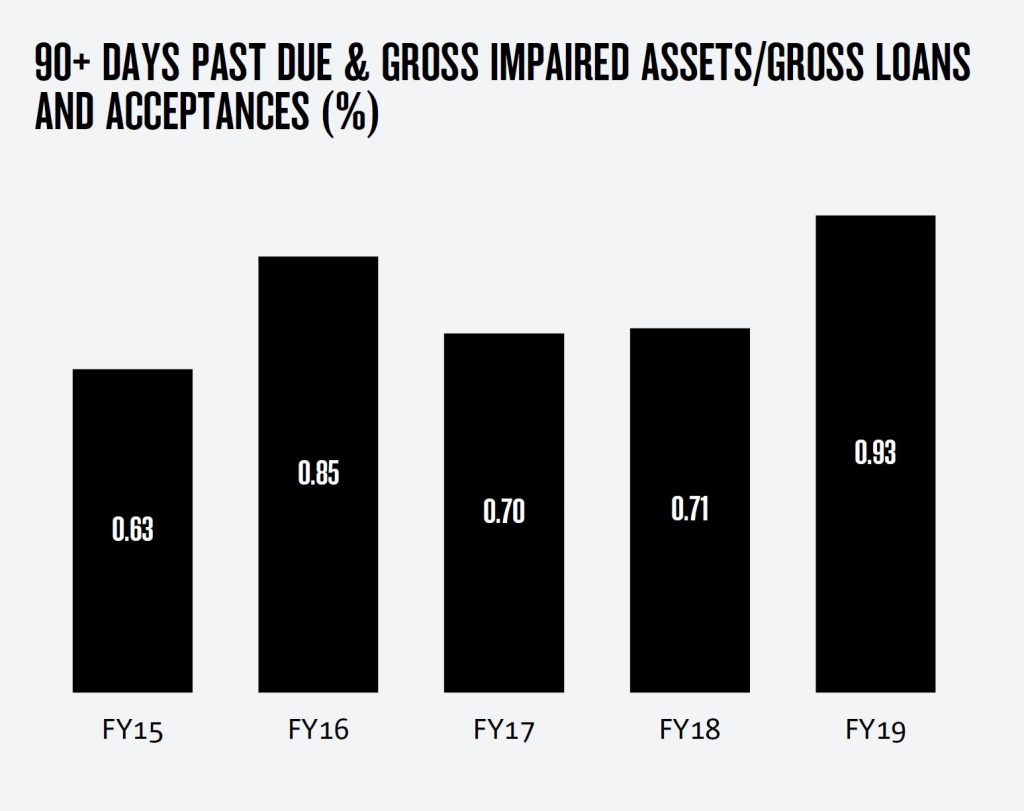

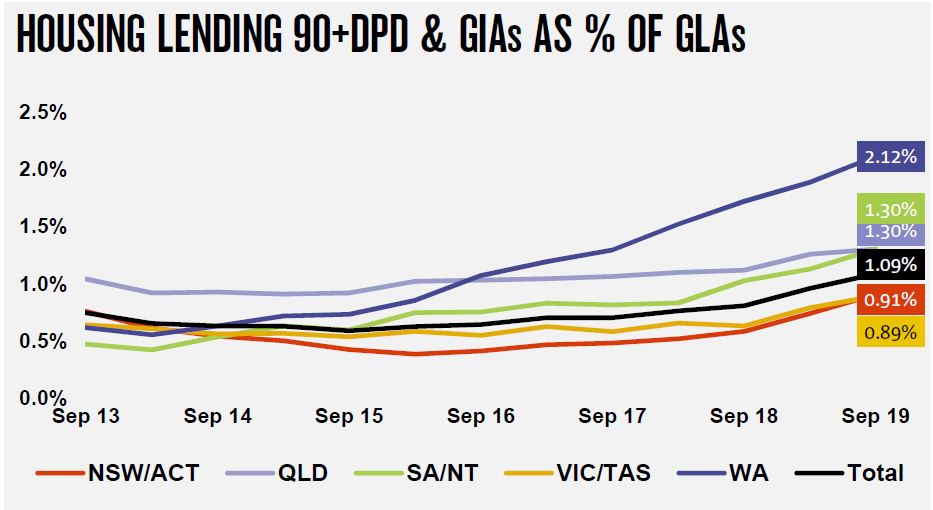

The ratio of 90+ days past due and gross impaired assets to gross loans and acceptances increased 22bps to 0.93%, largely due to rising Australian mortgage delinquencies.

While Australian housing arrears increased further, loss rates for this portfolio is 2bps. Collective provision forward looking adjustments for targeted sectors increased over FY19 and now stand at $641 million. In their scenario testing, they estimate a Peak Net Credit Impairment of $1.8bn in year 2, which equates to 57 basis points, based on an average home price fall of 25.2%

2.4% of mortgages in Australia are above 100% LVR (based on SA3 level CoreLogic data, so not very specific).

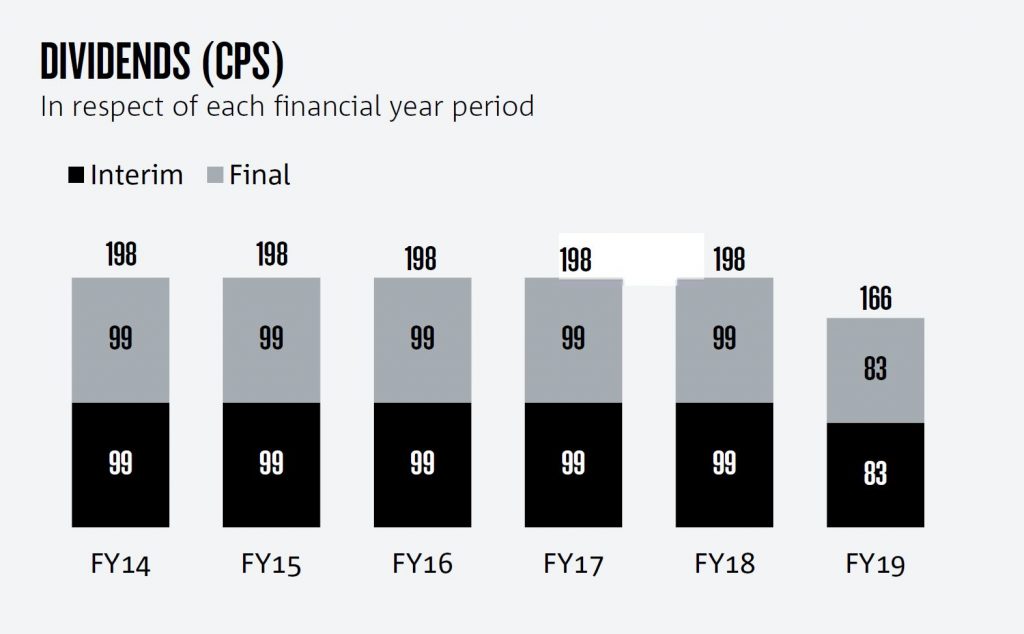

The final fully franked dividend of 83 cents per share (cps) has been held stable with the 2019 interim dividend, bringing the total for FY19 to 166 cps. This represents a 16% reduction compared with FY18.

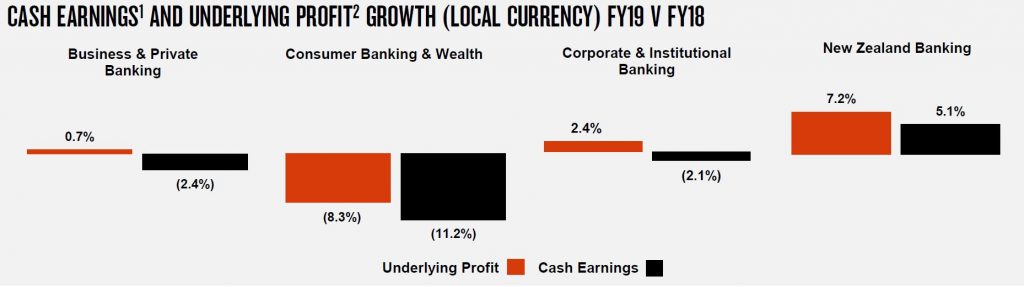

Across the divisions in cash earning terms:

Business & Private Banking $2,840 were down 2.4% on last years, reflecting higher credit impairment, charges and higher investment spend. Revenue increased 1% reflecting good SME business lending growth.

Consumer Banking & Wealth $1,366 were down 11.2% where banking earnings decreased given lower margins with competitive pressures in housing a key driver, combined with increased credit impairment charges.

Wealth earnings also declined reflecting the impact of customer preferences and repricing on margins, and lower average funds under management and administration.

Corporate & Institutional Banking $1,508 down 2.1% reflecting higher credit impairment charges relating to impairment of a small number of larger exposures. Revenue increased 1% despite lower Markets income, with higher lending volumes benefitting from continued focus on growth segments.

New Zealand Banking NZ$1,055m up 5.1% benefitting from

growth in lending, partly offset by increased investment spend and higher credit impairment charges.

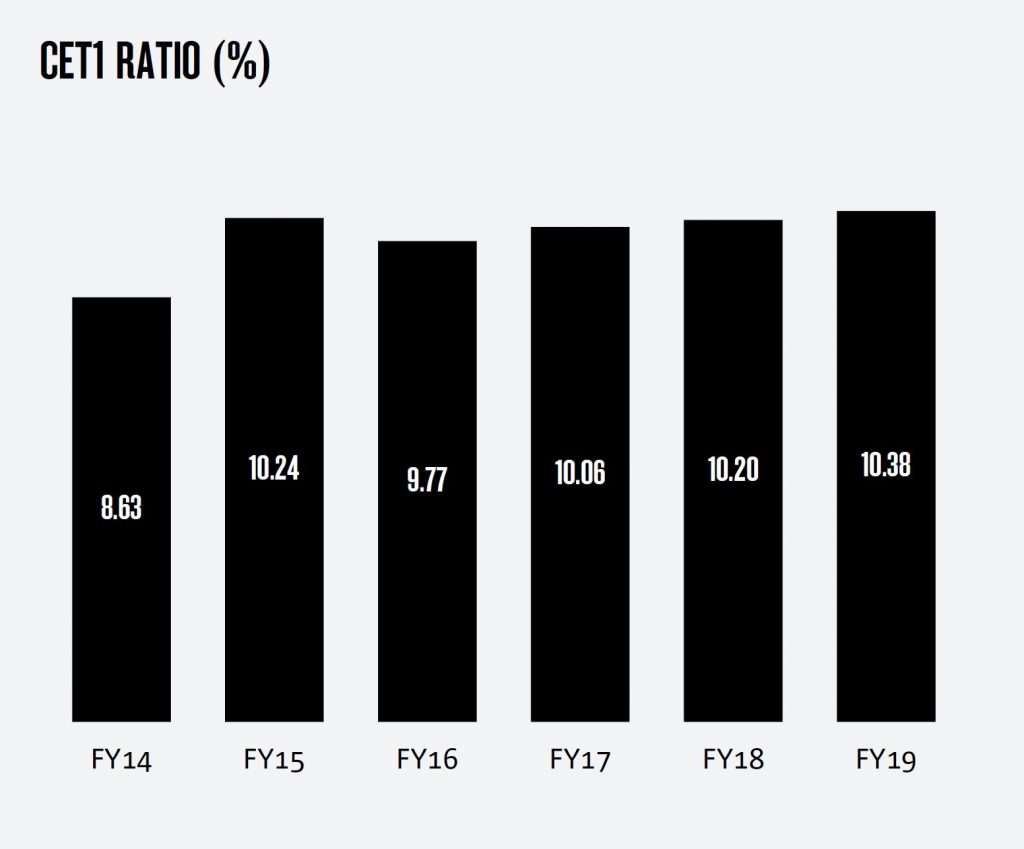

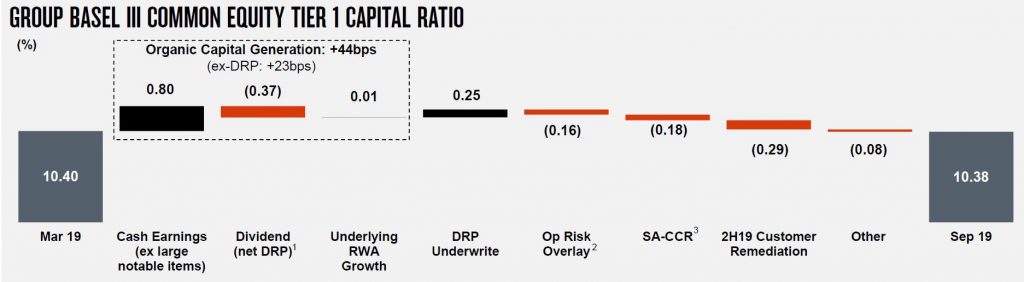

The Group Common Equity Tier 1 (CET1) ratio is 10.38%, up 18bps from September 2018, and includes $1 billion (25bps) of proceeds received in

July from the 1H19 underwritten Dividend Reinvestment Plan and 34bps adverse impact from regulatory changes relating to operating risk and derivative counter party credit risk measurement.

Leverage ratio (APRA basis) of 5.5%

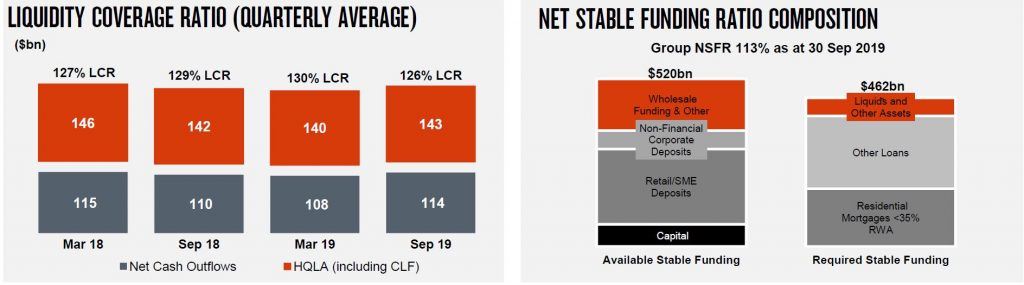

Liquidity coverage ratio (LCR) quarterly average of 126% and Net Stable Funding Ratio (NSFR) of 113%

NAB expects weak credit growth ahead, a GDP result in 202 of around 2% and business confidence also weakened which may dampen business credit growth.

I must say all of the financial planners qualifications and requirements are working well, they’re way above everyone else in stealing money from clients.

Well done government regulators you system is working perfectly.