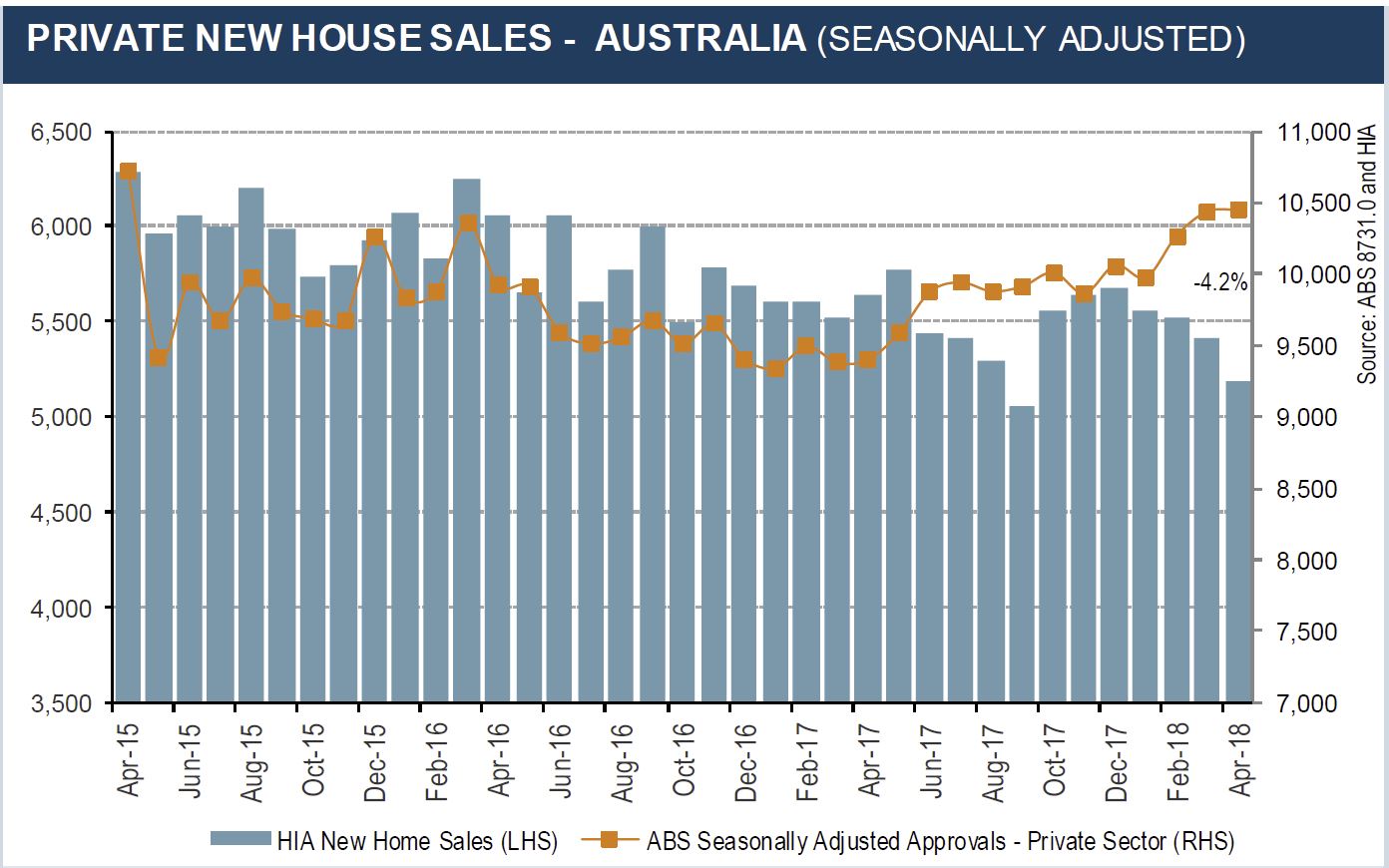

The HIA says new house sales fell in each of Australia’s five largest states during April. Nationally, sales have fallen each month of this year and in April they fell a further 4.2 per cent. New house sales for the year to date are now 3.1 per cent lower, than they were in the same period in 2017.

During April 2018, new house sales declined in all five markets covered by the HIA New Home Sales Report. The largest reduction in house sales occurred in Western Australia (-11.6 per cent) followed by New South Wales (-8.2 per cent), Queensland (-2.9 per cent), South Australia (-1.7 per cent) and Victoria (-0.1 per cent).

New house sales are a leading indicator of new dwelling approvals – and ultimately activity on the ground. New home sales were strong through most of 2017 and the fall back in sales reflects a modest slowdown in demand from both owner occupiers and investors.

There are a number of factors influencing this result. The most recent concern is that access to finance has been constrained as banks exhibit greater caution as house prices fall in key markets. Banks responding to falling house prices by increasing their requirements for collateral is an obvious reaction to the change in house price conditions.

The decline in house prices in Sydney and Melbourne also impacts on the market as more new home purchases are delayed and alternative investments become increasingly attractive.

The second concern is that the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry may lead the banks to be increasingly cautious in lending for residential homes.

Australian banks have significant exposure through loans for the purchase of residential homes and the Royal Commission has highlighted concerns in other aspects of the banking industry. Lending for the purchase of home-ownership is an aspect of the banking industry that is closely monitored by a number of government agencies including the RBA, APRA and departments of treasury. This can be demonstrated through the number of interventions in the residential lending market in recent years.

Indications are that the growth in FHB participation has slowed after strong growth since July 2017. The re-emergence of FHBs is due to enhanced state government supports, the deceleration of dwelling price growth in key markets like Sydney and Melbourne working to make the home purchase more accessible to FHBs. Since January’s 2018 the FHB share has retreated marginally to 17.4 per cent in March. Even so, the number of FHB loans totalled 26,460 during the first three months of 2018, an increase of 28.0 per cent on the same time last year.

This upturn in first home buyer participation has been more than offset by a fall in the value of investor lending. The value of housing loans to investors peaked in August 2017 at $152.7 billion in the preceding 12 months. Since then investor loans have been falling quite steadily to $144.2 billion over the year to March 2018. This represents a reduction of 5.6 per cent on last August’s peak.

These risks need to be balanced against the strong population growth rate, solid employment growth and improving economic activity which is maintaining demand for new homes at elevated levels.