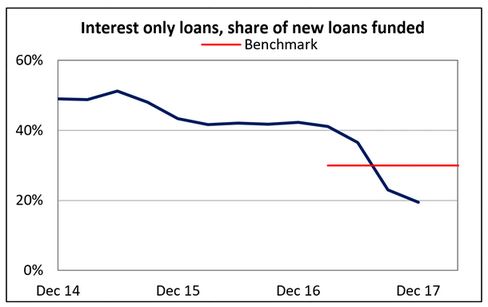

The story so far. Banks were lending up to 40%+ of mortgages with interest only loans, some even more.

The regulator eventually put a 30% cap on these loans and the volume has fallen well below the limit. Some banks almost stopped writing IO loans.

They also repriced their IO book by up to 100 basis points, so creating a windfall profit. This is subject to an ACCC investigation to report soon.

The RBA and APRA both warn of the higher risks on IO loans, especially on investment properties, in a down turn.

APRA has confirmed the “temporary” 30% cap will stay for now, although the 10% growth cap in investment loans is now redundant, thanks to better underwriting standards.

Banks have now started to ramp up their selling of new IO loans, to customers who fit within current underwriting standards and are offering significant discounts. Borrowers will be encouraged to churn to this lower rate.

CBA will cut fixed interest rates for property investors across one-, two-, three-, and four-year terms. The cuts, which range from 0.05 percentage points to 0.5 percentage points, apply to both interest-only investor loans and principal-and-interest investor loans.

CBA is also cutting some of its fixed rates for owner-occupiers, including a reduction on owner-occupied principal-and-interest fixed-rate loans by 0.1% over terms of one to two years, landing at 3.89% for borrowers on package deals.

Key rival Westpac also unveiled a suite of fixed-rate changes on Friday, including some cuts to fixed-rate interest-only mortgages, another area where banks have been forced to apply the brakes. The Sydney-based bank also hiked rates across various fixed terms for owner-occupiers.

Westpac will increase fixed-rate owner-occupied home-loan interest rates by 0.1 percentage points for loans of one-, two-, four-, and five-year terms. Across three-year terms, the bank will leave rates unchanged at 4.19%.

Both banks’ rate changes will only impact customers who are taking out new fixed-rate loans, leaving existing mortgages untouched.

CBA’s aggressive pursuit of property investors comes after it said in its most recent half-year results that its loan book was growing more slowly than allowed by the regulators. Credit growth has slowed across the board and house prices in Sydney and Melbourne have begun to soften.

Major lenders are expected to follow the Commonwealth Bank of Australia’s latest round of interest-only mortgage cuts after losing market share because of massively over-estimating the impact of lending caps on their loan books, despite regulatory fears about rising debt and prices, according to analysts.

“Expect others to follow,” said Steve Mickenbecker, group executive for financial services at Canstar, which monitors rates and charges for financial service products, about the CBA’s recent cuts.

Big four lenders started losing market share to smaller lenders and regulation-lite non-bank financial institutions when they slammed on the brakes to meet Australian Prudential Regulation Authority’s 30 per cent cap on interest-only loans.

CBA’s CEO-elect, Matt Comyn, recently flagged plans to rebuild interest-only market share after over-shooting the regulatory 30 per cent target and ending in the low 20s.

Well under lending caps

The bank’s mortgage growth in the 12 months to December 31 was about 5 per cent, compared with about 6 per cent system growth and more than 11 per cent for non-bank financial institutions (NBFI).

From Mortgage Professional Australia.

Meanwhile, Westpac-owned St George cut its two-year fixed-rate investment property loan marginally by -0.04% to 4.60%, and Aussie Home Loans cut its one-year fixed IQ Basic Investment Loan by -0.25% to 4.24%.

Other smaller lenders, such as ING, Mortgage House, and Virgin Money have also dropped some interest-only rates over the previous month.

… the story continues….