The IMF published their review of New Zealand, and included a Financial System Stability Assessment. They highlight the imbalances in the housing market, banks’ concentrated exposures to the dairy sector, and their high reliance on wholesale offshore funding are the key macrofinancial vulnerabilities in New Zealand.

The banking sector has significant exposures to real estate and agriculture, is relatively dependent on foreign funding and is dominated by four Australian subsidiaries. A sharp decline in the real estate market, a reversal of the recent recovery in dairy prices, a deterioration in global economic conditions, and a tightening in financial markets would adversely impact the system. The key risks faced by the insurance sector relate to New Zealand’s vulnerability to natural catastrophes.

There was significant commentary on the relationship between Australian and New Zealand banking.

The home-host relationships between Australia and New Zealand are well above international practice, but stronger collaboration would enhance synergies. The RBNZ could take a more proactive role in collaborative supervision. The scope of the Memorandum of Cooperation on Trans-Tasman Bank Distress Management (MOC) could be extended to include insurance companies and FMIs. Moreover, further work on the trans-Tasman framework for assessing systemic importance and discussing possible coordinated responses would support timely and effective decision-making in an actual crisis.

They highlighted the dominance of Australian banking subsidiaries in New Zealand.

The financial sector in New Zealand is dominated by banks, focuses its activities on lending to the domestic private sector, and is characterized by the importance of four Australian subsidiaries. Banks represent about 75 percent of total financial assets. The sector seems well capitalized and liquid, nonperforming assets are low, and profitability has remained broadly stable. Foreign funding accounts for almost 20 percent of banks’ liabilities.

The system is concentrated on four subsidiaries of the largest

Australian banks, whose share in the banking sector’s total assets was 86 percent at end-2016 and represent a significant share of parents’ assets. The systemic importance of these subsidiaries for the parent banks, which are all systemic for the home supervisor as well, makes New Zealand-Australian interdependence unique among other countries with high foreign bank presence.

Australian subsidiaries (including branch assets of dual-registered banks) account for 86 percent of New Zealand banking sector’s assets, compared to 41 percent for Spanish banks in Mexico and 35 percent for the Swedish bank in Finland.

Nonbank financial institutions (NBFI) have more than halved in size since 2007. Nonbank lending institutions (NBLI) are savings institutions (credit unions and building societies), deposit-taking that fund their activities via deposits or debentures issued to the public and non-deposit taking finance companies. Most are domestically-owned.

The vulnerabilities of the New Zealand financial system are largely associated with concentrated exposures to the real estate and agriculture sectors, dependence on wholesale funding, and the similar business models of the four Australian subsidiaries. In particular:

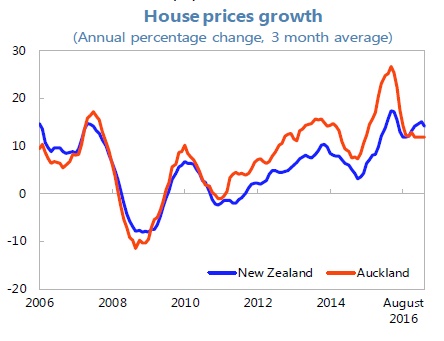

- The banking sector exposure to residential mortgages reached over 50 percent of total claims at end-2015. Low global and domestic interest rates for the last few years are a main driver behind the observed increases in mortgage lending.2 While low interest rates facilitate debt repayments by the existing mortgage borrowers, rising housing prices have elevated the debt-to-income ratios of new house buyers. The rise in real estate prices has been most rapid in Auckland. The property boom has been driven also by increased investor activity.

- The banking sector has a large concentration of loans to the agricultural sector. Agriculture credit exposure, with the dairy industry accounting for more than two-thirds, stood at 15 percent of total exposures in 2015. Low global milk prices have put significant financial pressure on dairy farms, with half of the sector having experienced a second consecutive season of operating losses. However, prices have recently recovered and, according to the most recent forecasts, the effective payout for the dairy industry will increase above the break-even price in the next season. Nonetheless, the already high dairy-farm debt relative to trend income has increased recently, and remains a source of risk. Credit risk concerns in other sectors are limited, with corporate lending growing at around 5 percent in 2016 (compared to 15.6 percent during January 2007–July 2008), and low debt-to income ratios hovering around 16 percent.

- The financial system is highly concentrated on a few Australian-owned players, with similar business models and vulnerabilities. As a result, there is a strong correlation in the financial soundness of the subsidiaries among themselves and with their parents.

- The banking sector depends to some extent on wholesale funding, including foreigncurrency funding sourced from offshore markets, and is exposed to liquidity risk from maturity mismatch. The main liquidity risk has traditionally been a reliance on offshore wholesale funding relative to domestic deposits. Rollover liquidity risk has been mitigated by the introduction of the core funding ratio (CFR) in 2010. However, because over 50 percent of banks’ assets are long term housing financing, the maturity mismatch is still a concern. Banks have also reduced their reliance on non-NZD funding to below 20 percent of total liabilities. While this development mitigates concerns over vulnerability to FX risk and increases the availability of foreign currency swap counterparties, pushing down hedging costs, banks might be vulnerable to risks related to hedging techniques under a stress event. As New Zealand’s banks looking for offshore funding use mostly the primary market, funding liquidity on global markets is relatively more important than market liquidity. Yet, heightened volatility in global financial markets may contribute to a pick-up in wholesale funding spreads.

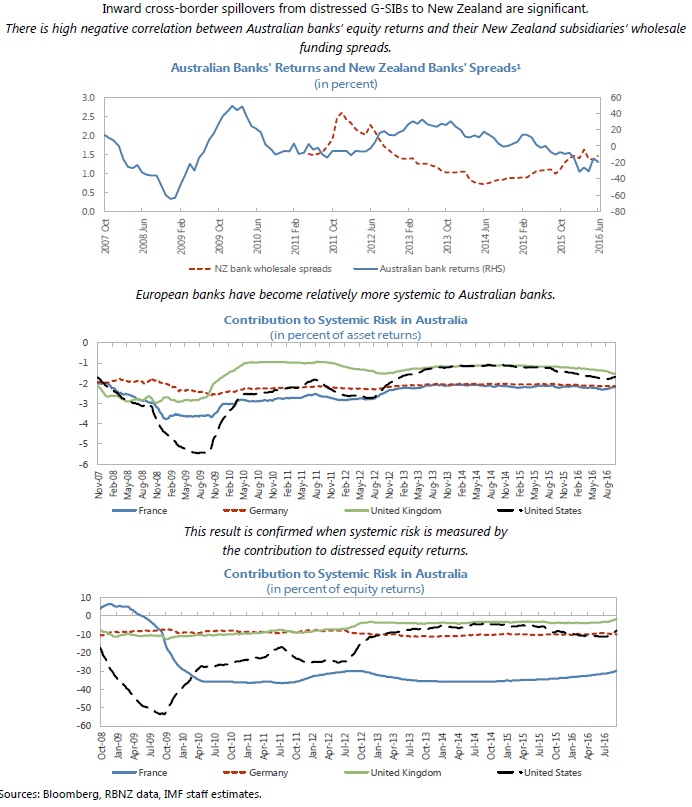

Inward cross-border spillovers from distressed G-SIBs to New Zealand banks are significant. The analysis suggests that Australian banks have become increasingly exposed to European banks. The transmission of distress is more severe to tail equity returns than to market-implied asset returns during stressed times due to fire sales effects and contagion in funding costs. The reverse is true during calm periods suggesting flight-to-quality rebalancing of investors’ portfolios.

They also comment on housing exposures directly, and the current review of debt to income proposals.

They also comment on housing exposures directly, and the current review of debt to income proposals.

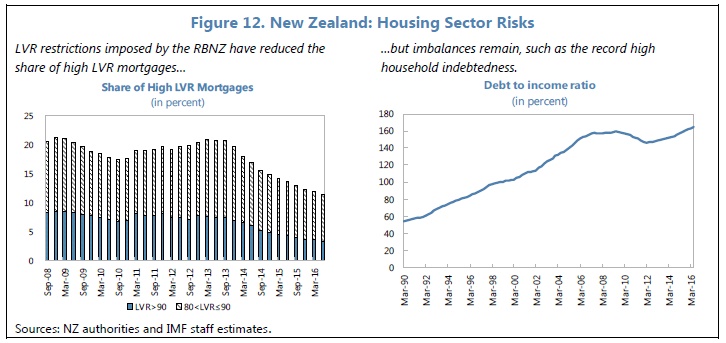

Since housing loans represent more than half of banks’ assets, limits on debt-toincome could usefully become part of the macroprudential toolkit. It is still not possible to assess the full effects of the October 2016 LVR adjustments in the housing market. If the measures do not substantially reduce current risks, as the recent experience with LVR measures seems to suggest, authorities should complement the current measures with Debt-to-Income (DTI) limits. The RBNZ is discussing with the MoF the introduction of DTI limits in the macroprudential toolkit. Caps on DTI (or measures of similar nature such as debt servicing to total income (DSI)) can usefully complement the LVR restrictions and would help addressing remaining risks and targeting more directly risks derived from high household indebtedness. Considering that risks can build up relatively quickly, the expansion of the macroprudential toolkit is an important precautionary measure for the RBNZ to be ready to respond should the need arise. The reliance on multiple tools may also reduce distortions when compared to the use of one conservatively calibrated tool. Firsttime home buyers, for instance, tend to be more affected by LVR restrictions because they do not have the equity gain arising from the increase in house prices, though they tend to be in a relatively better position in terms of servicing debt in relation to investors. In addition, authorities are encouraged to maintain efforts to reduce distortionary tax benefits and facilitate housing supply.

One thought on “New Zealand Banking’s Deadly Australian Embrace”