Household debt in Australia is around 190%, which is high by any standard, but Norway wins the award for the most indebted households at 224% and this is a structural risk for Norway’s Banks. So its interesting to compare the measures taken there with Australian regulation, which appears to be several years behind the pace….

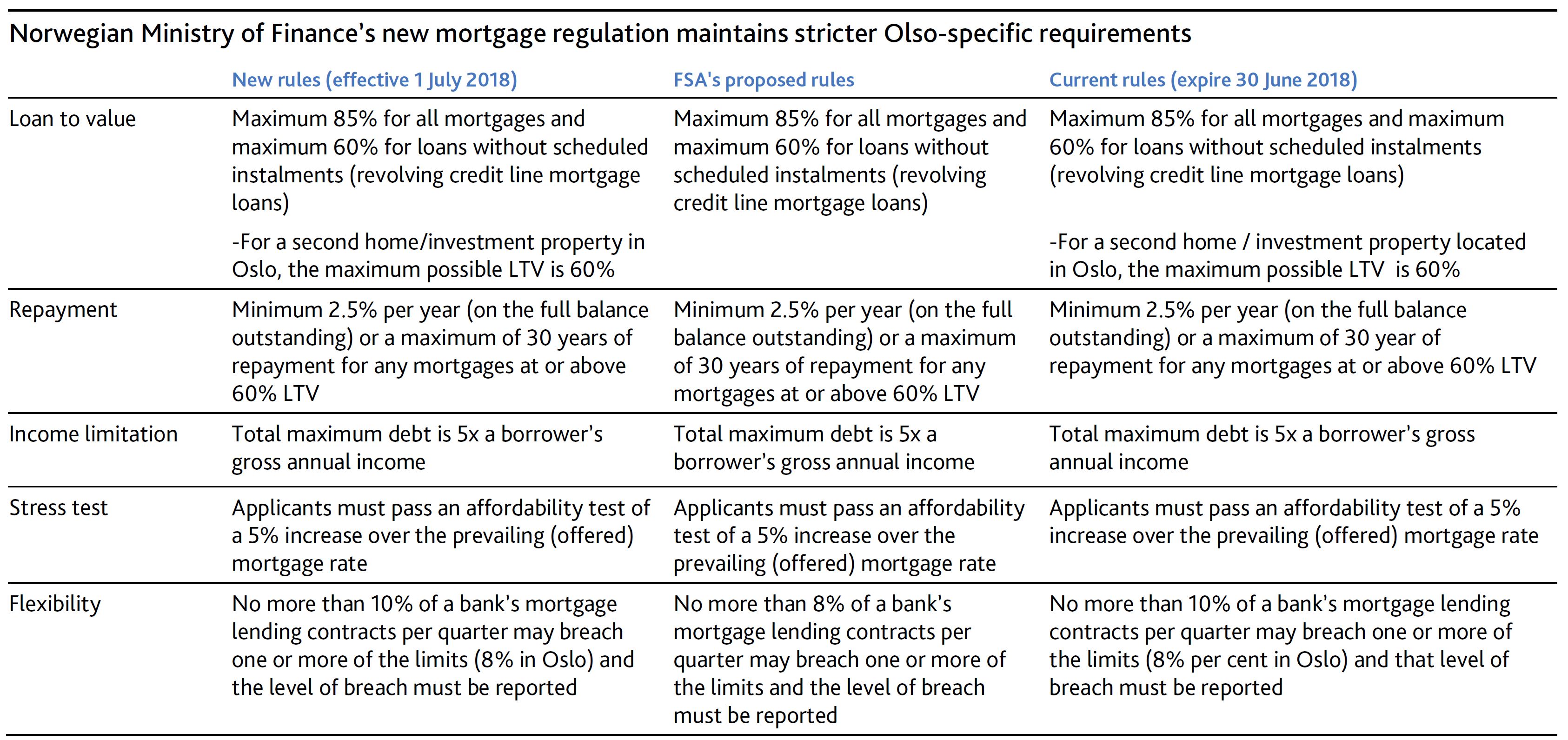

Last Tuesday, the Norwegian Ministry of Finance extended until 31 December 2019 its strict regulations on mortgage underwriting standards, introduced in January 2017 and scheduled to expire on 30 June 2018. In addition, the ministry decided to maintain the stricter Oslo-specific measures regarding loan-to-value (LTV) ratios on secondary homes of 60%, rejecting the Norwegian Financial Services Authority’s (FSA) March 2018 proposal to remove the Oslo-specific measures.

Extending these measures past their scheduled expiration will dampen house price inflation and contain borrower leverage, a structural risk for Norway’s banks, both credit positive says Moody’s.

The proposal maintains the maximum LTV for home equity credit lines at 60%, the 85% LTV cap on mortgages, and the limit on borrowers’ aggregate debt at 5x gross annual income. It caps the portion of mortgages that do not comply with the national applicable LTV ratio limit at 10%. However, the ministry decided against the FSA’s suggestion of eliminating the existing LTV limit of 60% for secondary homes located in Oslo as well as applying nationwide the Oslo-specific cap on the portion of mortgages non-compliant with the LTV ratio of 8% (see exhibit). By maintaining the 8% cap on the portion of non-compliant mortgages only in Oslo and not extending it nationwide, the ministry has reduced the possibility that exceptions to the LTV rule for national lending would become concentrated in Oslo, a credit positive for cover pools that have concentrations in Oslo loans.

Norwegian banks are retail focused, with mortgages accounting for almost 50% of their total lending. The extension of the regulation until December 2019 is a step toward improving mortgage underwriting standards by containing borrower leverage. Household debt reached a record 224% of disposable income in December 2017, far above that of other Nordic countries, and we expect it to remain close to those levels over the next 12-18 months. Substantial household debt remains a structural risk for Norway’s banks. However, a preliminary analysis by Norway’s central bank has shown that the introduction of a maximum debt-to-income ratio requirement in 2017 has resulted in lower debt growth, particularly in municipalities with a high share of highly leveraged homebuyers.

The ministry’s extension of the regulation will also support the quality of mortgage loans in the cover pools of Norwegian covered bonds by suppressing LTV ratios and reducing the risk of cover pool losses as a result of borrower defaults and falling house prices. Requirements on loan amortization also support reduction of LTV ratios in more seasoned loans, although many cover pools continue to have material levels of interest-only loans and flexi loans that have delayed amortisation provisions.

Maintaining Oslo-specific measures in combination with our expectation of interest rate hikes will limit retail credit growth in the Oslo metropolitan area, particularly as it relates to investment properties and highly leveraged individuals. We expect DNB Bank ASA, which has the largest share of Oslo’s retail market, to be most affected by the extension.

During 2018, house prices have grown 4.5% after falling 4.2% in 2017 from a peak in March 2017. However, the extension of stricter underwriting measures along with our expectation of higher interest rates after seven years of cuts and the completed construction of a large number of new dwellings by this fall will likely restrain house price inflation over the next 12-18 months.