Norway, one of the countries mirroring the Australian mortgage debt bubble (223%) has taken steps to tighten mortgage lending further. This includes a limit of 5x gross annual income and a 5% interest rate buffer.

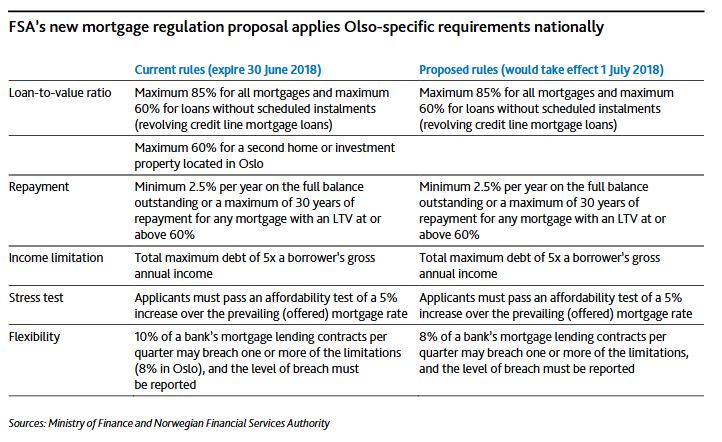

According to Moody’s, last Wednesday, the Norwegian Financial Services Authority (FSA) proposed to the Ministry of Finance a new regulation on requirements for residential loans. The proposed national regulation is based on existing and Oslo-specific policy measures introduced in January 2017 and scheduled to expire 30 June 2018 that cap the portion of a mortgage that does not comply with the national applicable loan-to-value (LTV) ratio limit at 8% from 10% previously. Extending these measures past their scheduled expiration will contain borrower leverage, a structural risk for Norway’s banking sector, and dampen house price inflation, both credit positive.

The proposal maintains the maximum LTV for home equity credit lines at 60%, continues to cap the LTV on mortgages at 85%, and leaves unchanged the limit on borrowers’ aggregate debt at 5x gross annual income. However, the FSA suggests eliminating the existing LTV limit of 60% for secondary homes located in Oslo (see exhibit).

Household debt reached a record 223% of disposable income in June 2017, far above that of other Nordic countries, and we expect it to remain close to current levels over the next 12-18 months. This trend remains a structural risk for Norway’s banking sector.

Although the Ministry of Finance will make the final decision on whether to accept the recommendation and in what form, the proposal is a step to improve mortgage underwriting standards by containing borrower leverage. Norwegian banks are retail focused, with mortgages accounting for almost 50% of their total lending. The proposed expansion of the previously Oslo-specific measures will improve banks’ asset quality and increase mortgage competition in Oslo. Smaller regional banks will be able to compete for mortgages in Oslo with DNB Bank ASA (Aa2/Aa2 negative, a34), which has the largest share of Oslo’s retail market, because they will be able to account for deviations from the suggested LTV limits against their entire loan book rather than the small share of Oslo-originated loans in accordance with current regulation.

House prices in Norway have declined 4.2% since peaking in March 2017. The decline followed the Ministry of Finance’s 2017 implementation of tighter mortgage lending criteria in response to accelerating property price inflation and rising household indebtedness. The restrictions have cut demand for investment properties in large city centres, particularly the Oslo metropolitan area, where house prices have grown fastest in recent years.