Last Tuesday, Norway’s parliament began debating proposed legislation to implement the Bank Recovery and Resolution Directive (BRRD) and an amended deposit guarantee scheme.

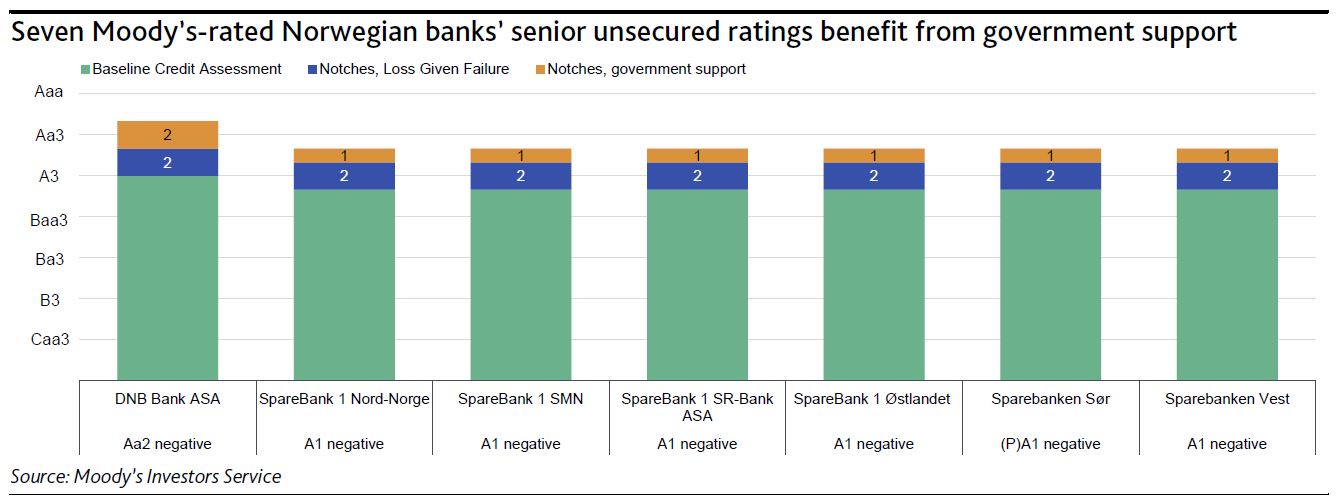

The intention of the BRRD law is to promote financial stability and ensure that losses are borne by a bank’s shareholders and creditors rather thantaxpayers. Although the first reading in parliament concluded with a unanimous vote in favour for the proposal, a second reading (at least three days after the initial reading) is required before the bill can be transposed into Norwegian law. The BRRD law’s enactment, which we expect within the next few weeks, would be credit negative for seven of the 17 Norwegian banks we rate because it would reduce the probability that they would receive government support in case of need.

In line with the European Union’s (EU) BRRD, the proposed legal framework features recovery and resolution plans for banks, early intervention measures and resolution tools including the bail-in of creditors. Additionally, the proposal includes small changes to the current deposit guarantee scheme to align it with that of the EU. However, in contrast to the EU’s deposit guarantee scheme limit of €100,000 per depositor per bank, the Norwegian Ministry of Finance has proposed maintaining its current coverage of NOK2 million (approximately €200,000) per depositor in each bank.

The bail-in tool is a central feature in the BRRD framework, intended to reduce the need for government intervention in failing banks. Consequently, government support is less likely for Norwegian banks since bail-in can be used to recapitalise financial institutions and absorb losses.

We assigned negative outlooks to those banks’ ratings following the submission of the legislative proposal in June 2017 in anticipation of the law’s passage, and the eventual moderation of our government support assumptions, which likely will lead us to remove the one-notch rating uplift incorporated into the banks’ ratings.

We expect Norway’s implementation of BRRD to be followed by a minimum requirement for own funds and liabilities (MREL) for each bank within the next 12 months. Nevertheless, no relevant details have been disclosed yet, although the BRRD proposal includes MREL requirements in line with the EU’s BRRD.

We expect Norwegian banks that will be subject to MREL requirements to gradually change their funding plans by raising non-preferred senior debt instruments in order to be compliant. This likely will provide senior unsecured creditors additional protection against potential losses, which eventually could counterbalance the negative rating effect on banks from revised government support assumptions.