From The Real Estate Conversation

Renters are quickly becoming a growing demographic in Australia, as fresh research reveals the proportion of Australian renters becoming homeowners has nosedived.

In news that will hardly come as a surprise to most millennials, the number of Australian renters eventually becoming homeowners has plummeted over the last 15 years – particularly for those between the ages of 18 and 24.

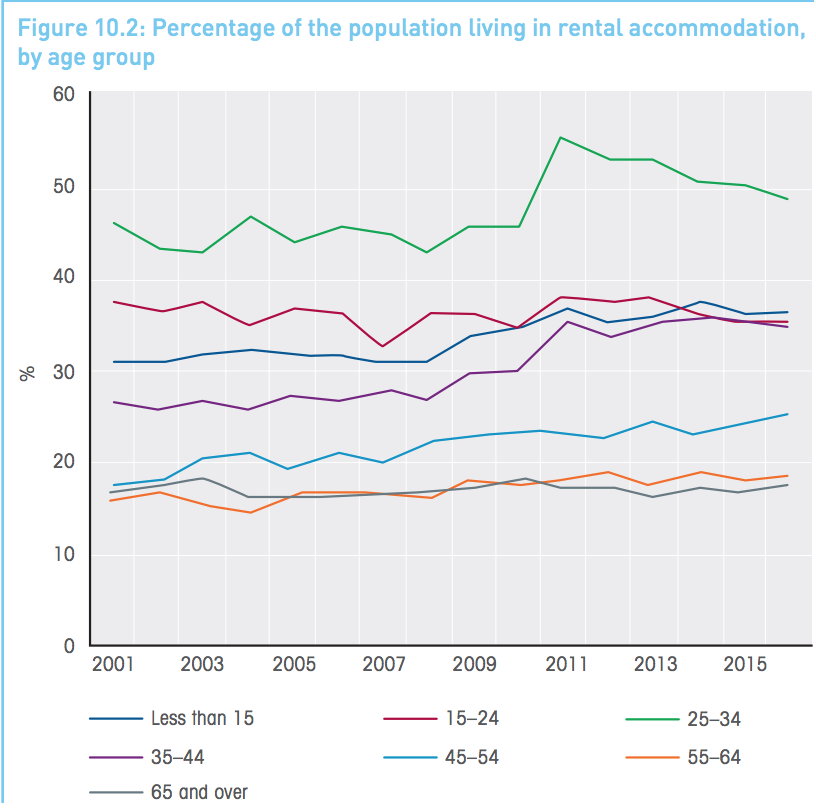

The latest Household, Income and Labour Dynamics in Australia (HILDA) survey found the overall proportion of people living in rental accomodation has increased by 23 per cent since 2001 to 31.3 per cent in 2016.

Undoubtedly as a result of this, the survey correspondingly found people aged between 15 and 24 are choosing to live with their parents longer.

Melbourne Institute deputy director and report co-author Roger Wilkins told WLLIAMS MEDIA the findings from the survey highlights the plight of renters.

“Renters, particularly younger ones, are finding it increasingly harder to achieve home ownership,” Wilkins said.

According to the HILDA survey, renters were far more likely to be under housing or financial stress than homeowners.

Findings from the survey show renting has declined since 2011 for the 25 to 34 age group.

“But this is not because they are more likely to be home owners, however. Rather, as with the trend for the 15 to 24 age group, it reflects the trend towards remaining in the parental home, which is often owner-occupied, until older ages,” the report said.

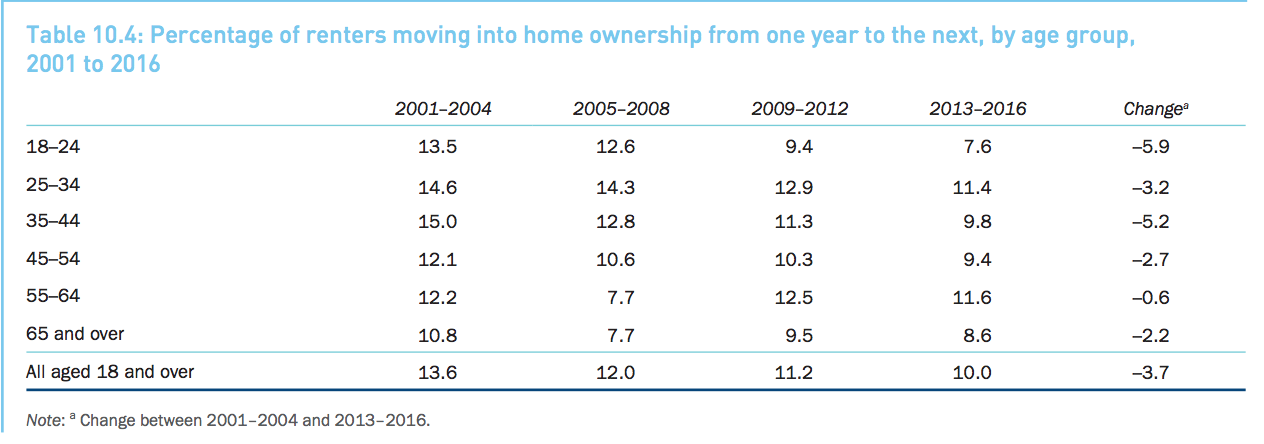

Over the survey period, which began in 2001 and tracks over 17,500 people across 9,500 households, the number of renters aged between 18 and 24 transitioning into home ownership has dropped massively, from 13.5 per cent down to just 7.5 per cent.

The declining rates of home ownership demonstrate the growing evidence of ‘intergenerational inequality’.

“There has been a growth in inequality across the generations, and this is very much tied to home ownership,” Wilkins said.

Despite this, research from Westpac shows more millennials than ever are saving up for their first property.

The data, released earlier this year, shows the highest number of first home buyer loans in March and April 2018, compared to the same period in the previous two years.

Kathryn Carpenter, Westpac’s Head of Savings, told WILLIAMS MEDIA that first home buyers are being diligent with their savings and digging deep to save for a home.

Related reading: Advice for first home buyers after new research shows most are clueless about buying property: ME Bank

“Millennials are often depicted as a generation more focused on life experiences and living in the ‘now’. However, our research shows that many are in fact taking saving for a home deposit seriously and prioritising it above other goals including travel or lifestyle,” Carpenter said.

“It is great to see our millennial customers making the most of their savings plans, and the timing could not be better with the current cooling of the property market.”

The research also revealed the younger end of the millennial spectrum (18-24) are already starting to save for a home.

“Our data shows reaching 25 appears to be a key tipping point for customers moving from thinking about saving for a home, to seriously saving for one”, commented Carpenter.

Dion Tolley, a real estate agent from Place Bulimba, told WILLIAMS MEDIA he has started to see more first home buyers entering the market.

“The investor market has pretty much left in the last year, given the investor squeeze from the banks, and the pressure they are putting on with lending requirements. Also with the changes to stamp duty concession at $499,000, we are definitely seeing more first home buyers entering the market along with those interest rates. As the concession has been extended for 12 months, more first home buyers are moving into the market instead of renting,” Tolley said.

“I think most people are sick of paying off investors mortgages and want to own their own homes.

“Most first home buyers typically purchase between the $350,000 to $499,000 threshold, and will typically go for the two-bedroom, two-bathroom, one car apartments. Established properties are more consistently snapped up than off the plan apartments.

“It has usually taken most of my clients who are first home buyers a couple of years to save up a decent deposit. Their parents will use the equity from their own home to tip them over that 20 per cent threshold to avoid lenders mortgage insurance because that does add on a fair whack to the weekly mortgage repayments,” he said.