New Zealand’s financial system is sound but continues to face risks, Reserve Bank Governor, Graeme Wheeler, said today when releasing the Bank’s November Financial Stability Report.

“Global GDP growth has been subdued, despite extremely accommodative monetary policy in a number of countries. Financial markets have remained volatile due to heightened political uncertainty.

“Dairy prices have recovered in recent months and the average dairy farm is now expected to return to profitability this season. However, indebtedness in the sector has increased as farms have had to borrow to absorb losses over the past two seasons, leaving the sector vulnerable to future shocks. Some farms remain under pressure and problem loans are likely to continue to increase for a time.

“House price inflation in Auckland has softened in recent months but it is uncertain whether this will be sustained. House price to income ratios in the region remain among the highest in the world and prices are continuing to rise rapidly in the rest of the country. There is a significant risk of further upward pressure on house prices so long as the imbalance between housing demand and supply remains.

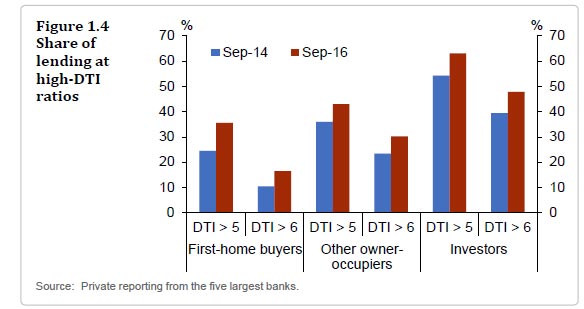

“The Reserve Bank has asked the Minister of Finance to agree to add a Debt to Income (DTI) tool to the Memorandum of Understanding on macro-prudential policy. While the Bank is not proposing use of such a tool at this time, financial stability risks can build up quickly and restrictions on high-DTI lending could be warranted if housing market imbalances were to deteriorate further.”

Deputy Governor, Grant Spencer, said: “New restrictions on lending to property investors with high loan to value ratios (LVRs) came into force on 1 October. These restrictions, along with the earlier LVR restrictions, are increasing the resilience of bank balance sheets to a downturn in the housing market.

“However, the share of bank mortgage lending to customers with high DTI ratios has been increasing and this could increase the rate of loan defaults during a housing downturn.

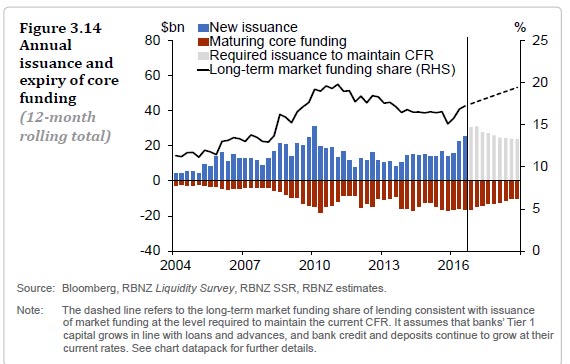

“The banking system has strong capital and funding buffers and profitability remains high. Despite being relatively concentrated, New Zealand’s banking system also appears to be operating efficiently from an international perspective based on metrics such as the cost-to-income ratio and the spread between lending and deposit rates.

“However the banking system’s reliance on offshore wholesale funding is beginning to increase due to a widening gap between credit and deposit growth. Banks could become more susceptible to increased funding costs and reduced access to funding in the event of heightened financial market volatility.

“Damage from the magnitude 7.8 Kaikoura earthquake on 14 November is being assessed. While it is too early to estimate the cost to insurers, the sector is well positioned in terms of catastrophe reinsurance cover and capital buffers.

“The Reserve Bank continues to make progress on a number of regulatory initiatives, including a review of bank capital requirements, amendments to the outsourcing policy for banks and a dashboard approach to quarterly disclosure.”