The Reserve Bank of NZ released a report today “Vulnerability of new mortgage borrowers prior to the introduction of the LVR speed limit: Insights from the Household Economic Survey.” The paper uses household level data for New Zealand to assess the vulnerability of new mortgage loans to owner-occupiers between 2005 and 2013.

They modelled financial vulnerability, considering:

- Does the household have adequate cash flow to support mortgage borrowing?

- How large is the equity buffer of the household?

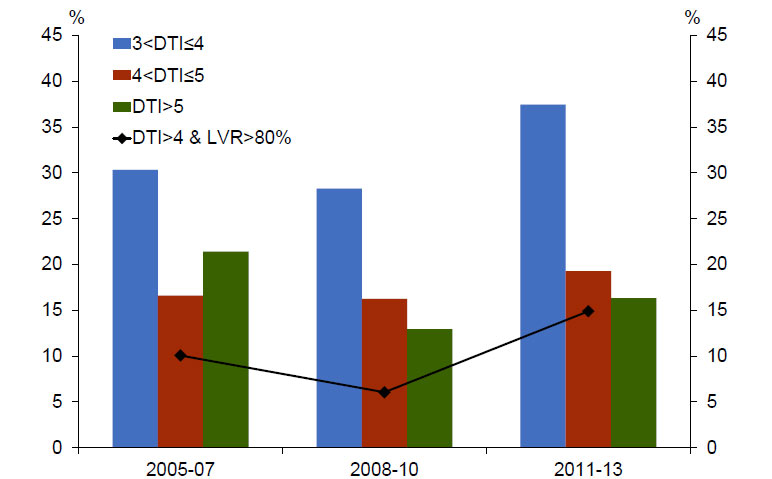

Their analysis suggests a move towards more stretched debt-to-income ratios between the 2008-10 and 2011-13 cohorts.

They highlighted that most banks will lend at much higher DTIs to high income borrowers than low income borrowers. Owner occupiers with an income of greater than $80,000 do account for almost half of high DTI lending in the 2011-13 cohort. However, this is significantly lower than their share of total lending of around 70 percent. By number, such households account for only 30 percent of owner occupiers with a high DTI.19 Subject to the caveat that our sample of high DTI borrowers is relatively small, this suggests that owner-occupiers with a high DTI are more likely to have an income below $80,000 than those with a low DTI (despite banks’ preference to supply high DTI loans to high income households).

They highlighted that most banks will lend at much higher DTIs to high income borrowers than low income borrowers. Owner occupiers with an income of greater than $80,000 do account for almost half of high DTI lending in the 2011-13 cohort. However, this is significantly lower than their share of total lending of around 70 percent. By number, such households account for only 30 percent of owner occupiers with a high DTI.19 Subject to the caveat that our sample of high DTI borrowers is relatively small, this suggests that owner-occupiers with a high DTI are more likely to have an income below $80,000 than those with a low DTI (despite banks’ preference to supply high DTI loans to high income households).

They found an increase in typical DTI multiples compared to earlier years, in addition to the well-known rise in the share of high-LVR lending. The proportion of borrowers with both a high-DTI and a high-LVR also increased sharply and was higher than prior to the GFC. These results are consistent with an increase in the vulnerability within the 2011-13 cohort, although the quantum of lending undertaken and the tail of very high DTI borrowers both remained smaller than prior to the GFC.

Note that an assessment of the vulnerability of other borrower types – including investors and owner occupiers that have not recently bought – is left for future work.

One thought on “NZ Loan To Income Ratios Higher”