The NZ Reserve Bank has started a public consultation about what type of financial instruments should qualify as bank capital. They offer a range of potential options from simple to more complex and highlight the trans-Tasman context.

Capital regulations address not only the minimum amount of capital that banks must hold, but also the type of financial instruments that qualify as capital. The consultation that starts today is about the nature of financial instruments that are suitable, rather than the amount of capital.

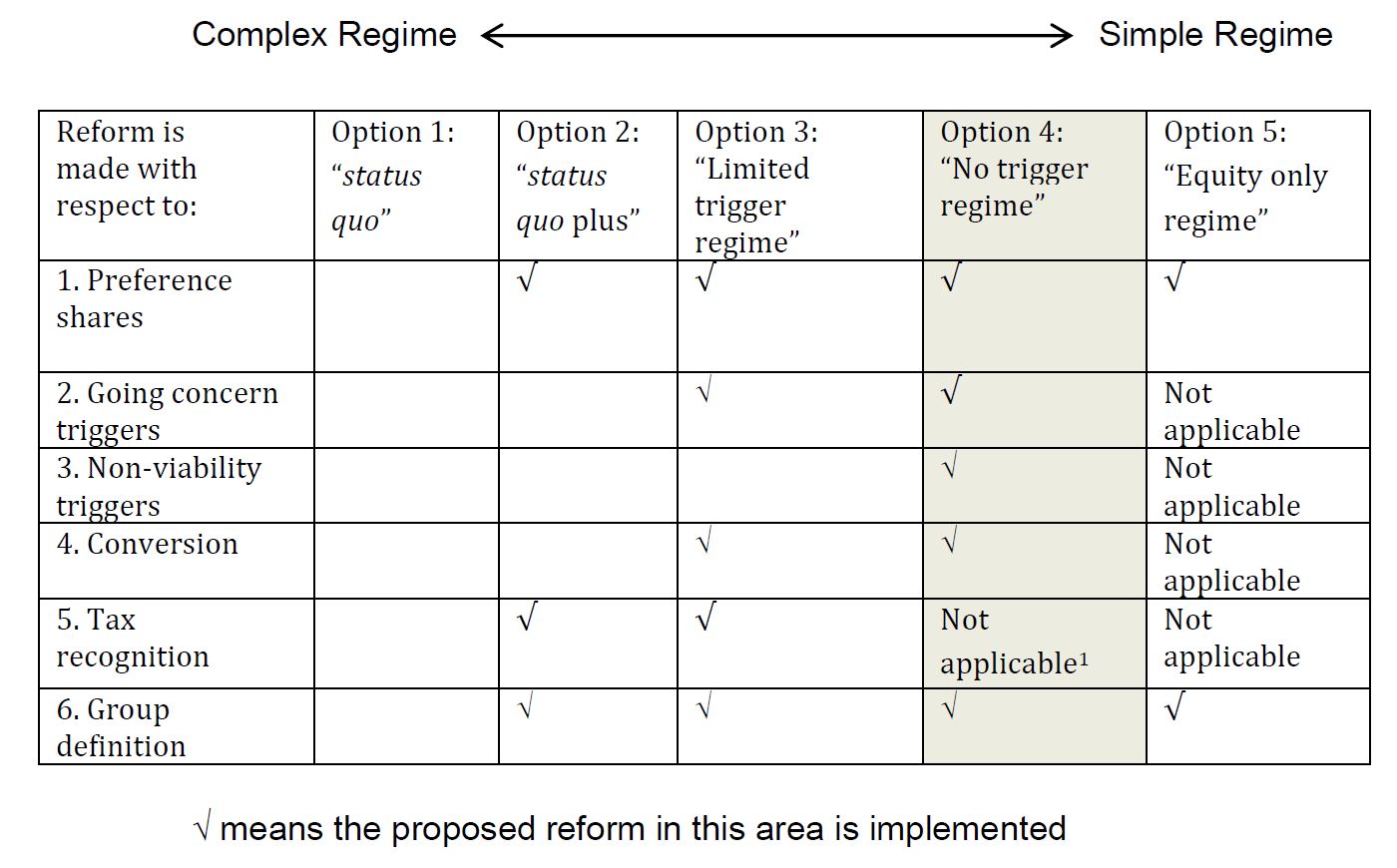

Important considerations for regulations about bank capital include: the Reserve Bank’s regulatory approach; the resolution regime in the event of a bank facing difficulties; international standards issued by the Basel Committee on Banking Supervision; the Reserve Bank’s experience with the current capital regime; and the fact that dominant participants in the New Zealand banking market are subsidiaries of overseas banks. The consultation paper discusses these issues and outlines five options for reforming existing regulations.

The Bank’s proposed reforms to capital regulations aim to reduce the complexity of the regulatory regime; provide greater certainty about the quality of capital that banks hold; and reduce the scope for regulatory arbitrage.

The options consist of “bundles” of reform measures made across 6 dimensions. The measures are combined in such a way that the options provide a gradual shift from the status quo towards:

- Reduced complexity for the capital regime;

- Greater certainty as to the loss-absorbing quality of regulatory capital;

- A more level playing field; and,

- A reduced risk of regulatory arbitrage.

The consultation closes at 5pm on Friday 8 September.

The consultation closes at 5pm on Friday 8 September.

They also mention the “trans-Tasman context”

An important context for New Zealand’s bank capital regulations is the dominance of four large banks (the “big four”). Each of the big four is a locally incorporated subsidiary of an Australian-incorporated banking parent. Between them the “big four” account for almost 90% of aggregate bank assets in New Zealand.

The big four banks are subject to Australian and New Zealand bank capital regulations – capital issued by the big four potentially qualifies as capital both for the New Zealand bank and for the Australian parent. This is important for a couple of reasons:

- The Australian regulator’s requirements of the Australian parents can flow down into terms and conditions in the instruments issued by New Zealand banks and these may be problematic in the New Zealand context. An example would be the requirement that, in order to be recognised as capital for the Australian parent, contingent debt issued by the New Zealand subsidiary must, if it offers conversion, convert into listed ordinary shares (the New Zealand subsidiaries do not list their ordinary shares).

- Banks prefer requirements to be aligned, as this reduces their costs of compliance with both regimes.