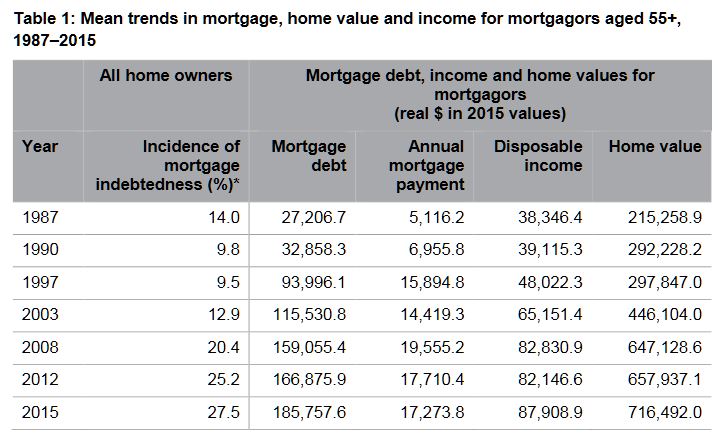

Between 1987 and 2015, average real mortgage debt among older Australians (aged 55+ years) blew out by 600 per cent (from $27,000 to over $185,000 in $2015), while their average mortgage debt to income ratios tripled from 71 to 211 per cent over the same period, according to new AHURI research.

The research, Mortgage stress and precarious home ownership: implications for older Australians, undertaken for AHURI by researchers from Curtin University and RMIT University, investigates the growing numbers of older Australians who are carrying high levels of mortgage debt into retirement, and considers the significant consequences for their wellbeing and for the retirement incomes system.

‘Our research finds that back in 1987 only 14

per cent of older Australian home owners were still paying off the mortgage on

their home; that share doubled to 28 per cent in 2015’, says the report’s lead

author, Professor Rachel

ViforJ of Curtin University.

‘We’re also seeing these older Australians’ mortgage debt burden increase from

13 per cent of the value of the average home in the late 1980s to around 30 per

cent in the late 1990’s when the property boom took off, and it has remained at

that level ever since. Over that time period, average annual mortgage

repayments have more than tripled from $5,000 to $17,000 in real terms.’

When older mortgagors experience difficulty in meeting mortgage payments,

wellbeing declines and stress levels increase, according to the report.

Psychological surveys measuring mental health on a scale of 0 to 100 reveal

that mortgage difficulties reduce mental health scores for older men by around

2 points and an even greater 3.7 points for older women. Older female

mortgagors’ mental health is more sensitive to personal circumstances than

older male mortgagors. Marital breakdown, ill health and poor labour market

engagement all adversely affect older female mortgagors’ mental health scores

more than men’s.

‘These mental health effects are comparable to those resulting from long-term

health conditions,’ says Professor ViforJ. ‘As growing numbers of older

Australians carry mortgages into retirement the rising trend in mortgage

indebtedness will have negative impacts on the wellbeing of an increasing

percentage of the Australian population.’

High mortgage debts later in life also present significant challenges for housing

assistance programs. The combination of tenure change and demographic change is

expected to increase the number of seniors aged 55 years and over eligible for

Commonwealth Rent Assistance from 414,000 in 2016 to 664,000 in 2031, a 60 per

cent increase. As a consequence the real cost (at $2016) of CRA payments to the

Federal budget is expected to soar from $972 million in 2016, to $1.55 billion

in 2031. The unmet demand for public housing from private renters aged 55+

years is also expected to climb from roughly 200,000 households in 2016, to

440,000 households in 2031, a 78 per cent increase.

There are also challenges for Government retirement incomes policy. The burden

of indebtedness in later life is growing; longer working lives and the use of

superannuation benefits to pay down mortgages are increasingly likely outcomes.