We heard from both Westpac and NAB on the outlook for interest rates both here and in the US. There is consensus that rates will rise in the US, but not in Australia.

Alan Oster, NAB Chief Economist says:

The RBA has indicated that it is in no rush to raise rates in lock-step with global central bank counterparts. However, lower unemployment, and evidence of wages growth moving upwards — even gradually — should be enough to give the RBA confidence that inflation will eventually lift above the bottom of the band. We continue to forecast two 25 basis point rate hikes in August and November, although acknowledge the risks are that these hikes could be delayed.

Whereas Bill Evans, Westpac’s Chief Economist sees no change in the RBA cash rate this year or next.

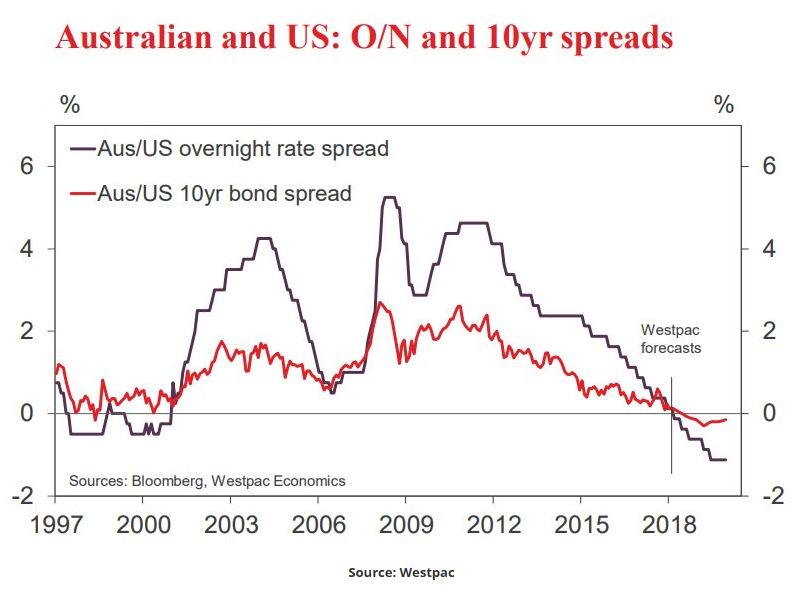

This raises an interesting question. How far can the “elastic stretch” between Australian and US rates? Bill Evans says “with two more Fed hikes expected in 2019, we now anticipate that the differential will reach negative 112 basis points by June 2019”.

That is uncharted territory with the previous record being negative 50 basis points in the late 1990s.

This suggests the Australian dollar will be lower, towards 70 cents, compared with its current rate of close to 80 cents relative to the US dollar.