The RBA has released their Financial Stability Review today. It is worth reading the 70 odd pages as it give a comprehensive picture of the current state of play, though through the Central Bank’s rose-tinted spectacles!

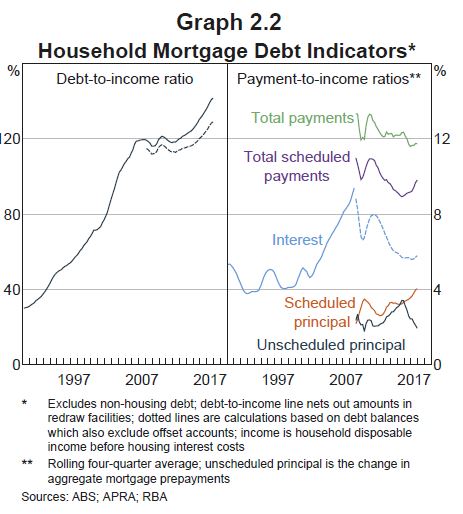

They home in on the say $480 billion interest only mortgage loans due for reset over the over the next four years, which is around 30 per cent of outstanding loans. Resets to principal and interest will lift repayments by at least 30%. Some borrowers will be forced to sell.

This scenario mirrors the roll over of adjustable rate home loans in the United States which triggered the 2008 sub-prime mortgage crisis. Perhaps this is our own version!

We have previously estimated more than $100 billion in these loans would now fail current tighter underwriting standards.

One area of potential concern is for borrowers at the end of their current IO period. Much of the large stock of IO loans are due to convert to P&I loans between 2018 and 2021, with loans with expiring IO periods estimated to average around $120 billion per year or, in total, around 30 per cent of the current stock of outstanding mortgage credit. The step-up in mortgage

payments when the IO period ends can be in the range of 30 to 40 per cent, even after factoring in the typically lower interest rates charged on P&I loans.However, a number of factors suggest that any resulting increase in financial stress should not be widespread. Most borrowers should be able to afford the step-up in mortgage repayments because many have accumulated substantial prepayments, and the serviceability assessments used to write IO loans incorporate a range of buffers, including those that factor in potential future interest rate increases and those that directly account for the step-up in payments at the end of the IO period.

Moreover, these buffers have increased in recent years. In addition to raising the interest rate buffer, APRA tightened its loan serviceability standards for IO loans in late 2014, requiring banks to conduct serviceability assessments for new loans based on the required repayments over the residual P&I period of the loan that follows the IO period.

Prior to this, some banks were conducting these assessments assuming P&I repayments were made over the entire life of the loan (including the IO period), which in the Australian Securities and Investments Commission’s (ASIC’s) view was not consistent with responsible lending requirements. As a result, eight lenders have agreed to provide remediation to borrowers that face financial stress as a direct result of past poor IO lending practices.

However, to date, only a small number of borrowers have been identified as being eligible for such remediation action. Some borrowers have voluntarily switched to P&I repayments early to avoid the new higher interest rates on IO loans, and these borrowers appear well placed to handle the higher repayments.

Some IO borrowers may be able to delay or reduce the step-up in repayments. Depending on personal circumstances some may be eligible to extend the IO period on their existing loan or refinance into a new IO loan or a new P&I loan with a longer residual loan term. The share of borrowers who cannot afford higher P&I repayments and are not eligible to alleviate their situation by refinancing is thought to be small.

In addition, borrowers who are in this situation as a result of past poor lending practices may be eligible for remediation from lenders. Most would be expected to have positive equity given substantial housing price growth in many parts of the country over recent years and hence would at least have the option to sell the property if they experienced financial stress from the increase in repayments. The most vulnerable borrowers would likely be owner-occupiers that still have a high LVR and who might find it more difficult to refinance or resolve their situation by selling the property.

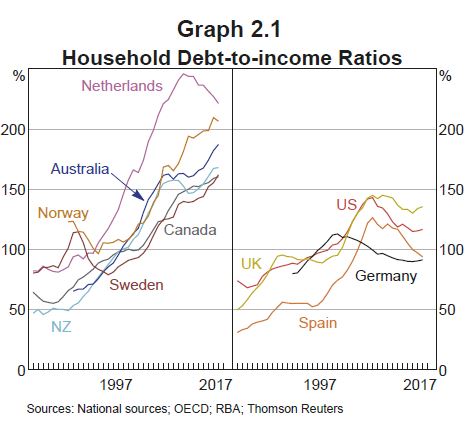

Looking more broadly at household finances, they say that the ratio of total household debt to income has increased by almost 30 percentage points over the past five years to almost 190 per cent, after having been broadly unchanged for close to a decade.

Australia’s household debt-to-income ratio is high relative to many other advanced economies, including some that have also continued to see strong growth in household lending in the post-crisis period, such as Canada, New Zealand and Sweden.

Australia’s household debt-to-income ratio is high relative to many other advanced economies, including some that have also continued to see strong growth in household lending in the post-crisis period, such as Canada, New Zealand and Sweden.

Household debt in these economies is notably higher than in those that were more affected by the financial crisis and experienced deleveraging, including Spain, the United Kingdom and the United States. While Australia’s high level of household indebtedness increases the risk that some households might experience financial stress in the event of a negative shock, most indicators of aggregate household financial stress currently remain fairly low (notwithstanding some areas of concern, particularly in mining regions). In addition, total household mortgage debt repayments as a share of income have been broadly steady for several years.

Note of course this is because interest rates have been cut to ultra-low levels, and should rates rise, payments would rise significantly.

Note of course this is because interest rates have been cut to ultra-low levels, and should rates rise, payments would rise significantly.

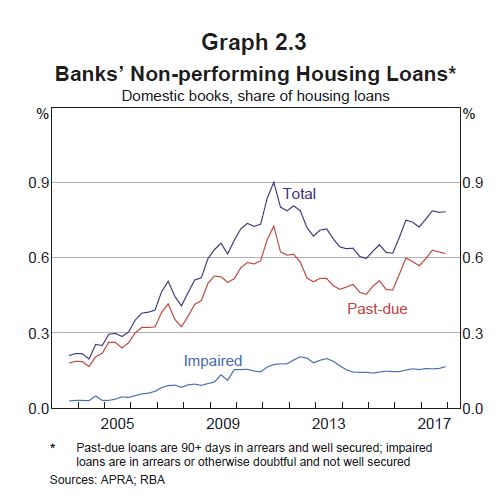

The RBA says that default rates on mortgages (More than $1.7 trillion) is low, but concedes higher in the mining heavy states.

Then they defend the situation by saying that household wealth is rising (though thanks mainly to inflated property values, currently beginning to correct), and continue to cite out of date HILDA survey data from 3 years ago to demonstrate that the share of households experiencing financial stress has been the lowest since at least the early 2000s. But this is so old as to be laughable, remembering the interest rates and living costs have risen, and incomes are flat in real terms.

Then they defend the situation by saying that household wealth is rising (though thanks mainly to inflated property values, currently beginning to correct), and continue to cite out of date HILDA survey data from 3 years ago to demonstrate that the share of households experiencing financial stress has been the lowest since at least the early 2000s. But this is so old as to be laughable, remembering the interest rates and living costs have risen, and incomes are flat in real terms.

And they argue again that households are prepaying on their mortgages. We agree some are, but not those in the stressed category. Averaging data is a wonderful thing!

Finally, a word on the profitability outlook of the banks.

Despite the recent lift, analysts are cautious about the outlook for profit growth. The recent benefits to profit growth from a widening of the NIM and falling bad debt charges are expected to fade, especially if short-term wholesale spreads remain elevated. The financial impact of the multiple inquiries into the financial services sector remains a key uncertainty, including the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry, the Productivity Commission’s Inquiry into Competition in Australia‘s Financial System, and the Australian Competition and Consumer Commission’s Residential Mortgage Products Price Inquiry. There is the potential that these will result in banks having to set aside provisions and/or face penalties for past misconduct or perhaps (more notably) being constrained in the operation of parts of their businesses.

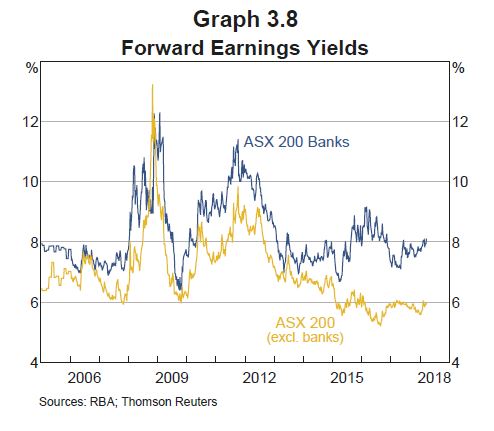

This uncertainty around banks’ future earnings has weighed on their share prices, which have underperformed global peers (although Australian banks still have higher price-to-book ratios). The decline in share prices has also seen banks’ forward earnings yields (a proxy for their cost of equity capital) further diverge from that of the rest of the Australian market since mid 2017 (Graph 3.8). Banks’ current forward earnings yields remain a little above their pre-crisis average, despite a large decline in risk-free rates since then.