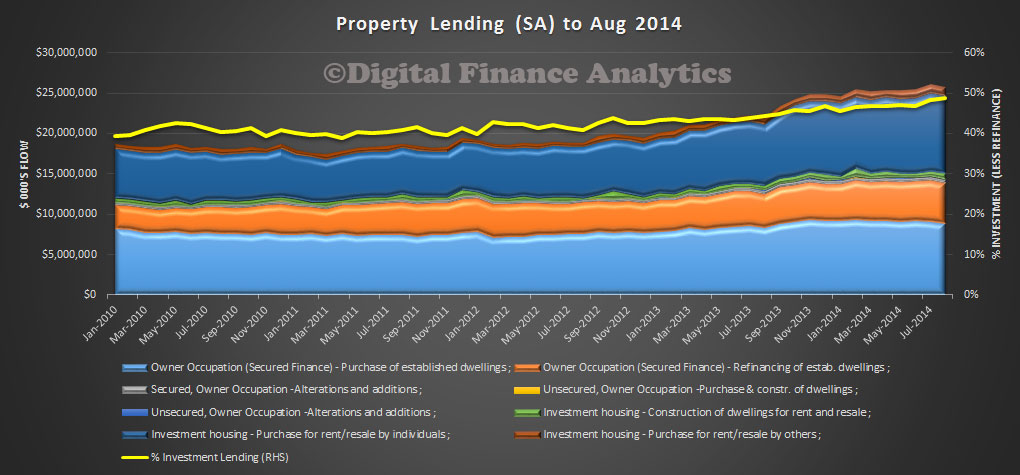

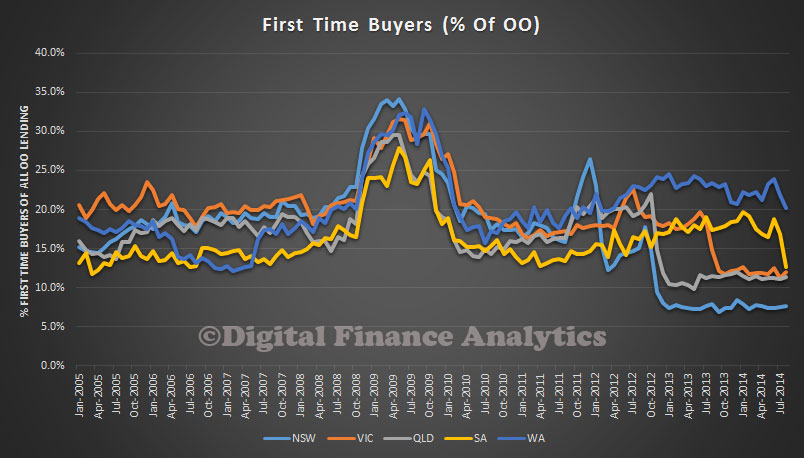

The most recent ABS data continues to underscore the fact that Owner Occupied First Time Buyers are sitting out of the market. In original terms, the number of first home buyer commitments as a percentage of total owner occupied housing finance commitments fell to 11.8% in August 2014 from 12.2% in July 2014.

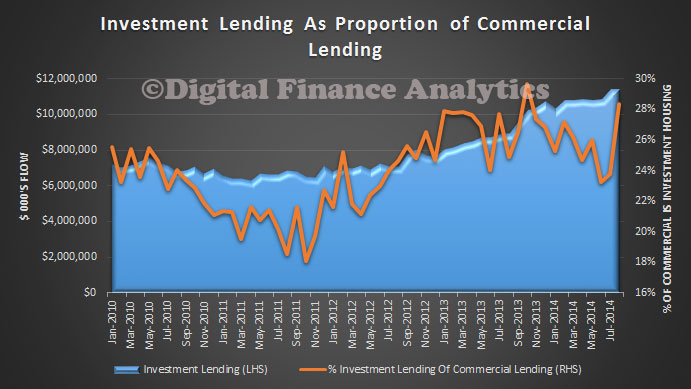

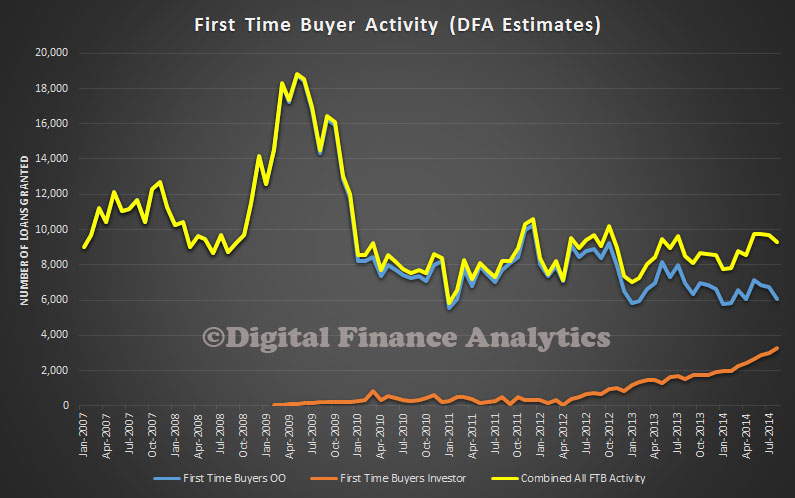

However, this is not telling us the full story. We have been tracking the rise and rise of first time buyers who are going direct to investment property. The chart below shows the state of play, and the significant rise in the number of first time buyers going to the investment sector, especially in Sydney and Melbourne.

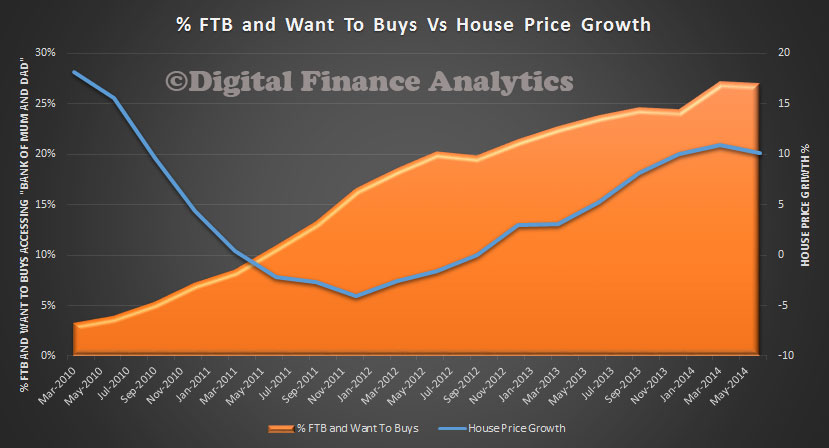

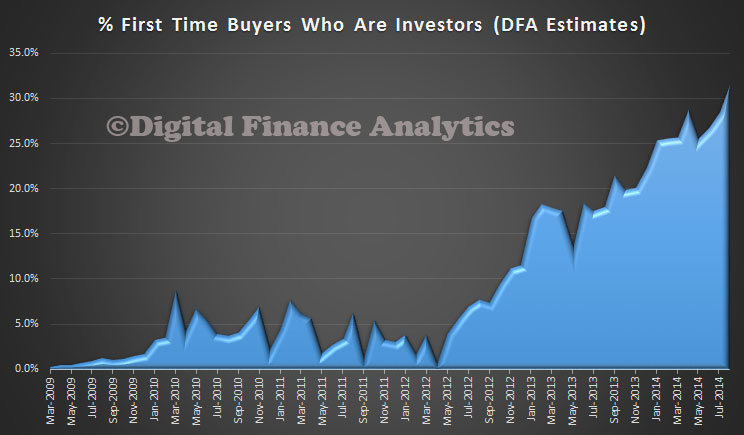

Another way to look at the data is the percentage of FTB who went for investment housing. In the latest data we estimate that around 30% of potential first time buyers went for the investment option. These are not identified in the official figures. I would also add that the small sample sizes prior to 2012 may impact the trend data, but the DFA samples, into 2013 and beyond are large enough to be meaningful and significant.

Another way to look at the data is the percentage of FTB who went for investment housing. In the latest data we estimate that around 30% of potential first time buyers went for the investment option. These are not identified in the official figures. I would also add that the small sample sizes prior to 2012 may impact the trend data, but the DFA samples, into 2013 and beyond are large enough to be meaningful and significant.

From our surveys, we found that:

From our surveys, we found that:

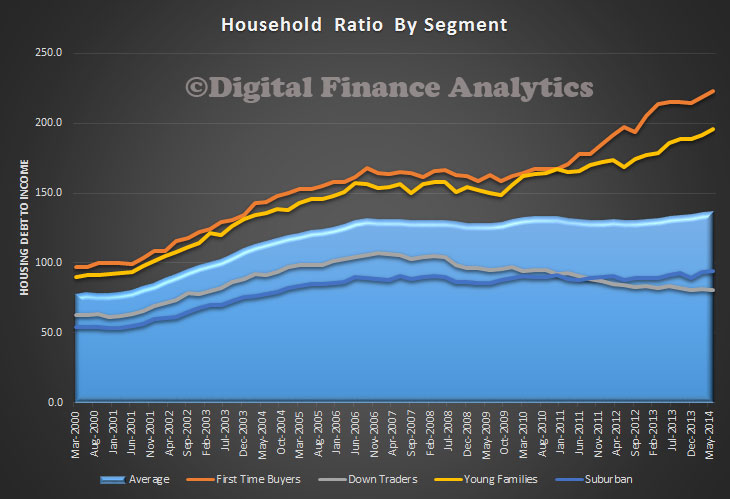

1. Most first time buyers were unable to afford to purchase a property to live in, in an area that made sense to them and were being priced out of the market.

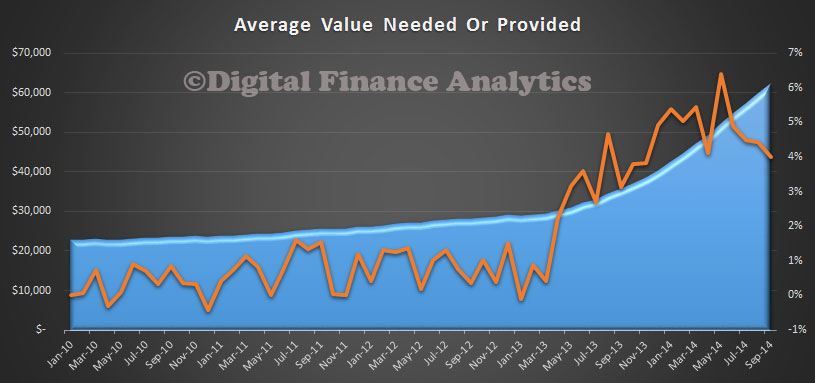

2. However, many were anxious they were missing out on recent property gains, so decided to buy a less expensive property (often a unit) as an investment, thanks to negative gearing, they could afford it. They often continue to live at home meantime, hoping that the growth in capital could later be converted into a deposit for their own home – in other words, the investment property is an interim hedge into property, not a long term play. Some are also teaming up with friends to jointly purchase an investment, so spreading the costs.

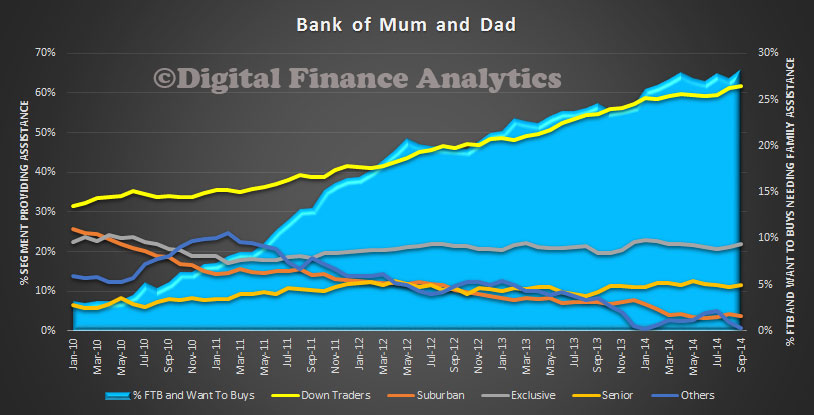

3. About one third who purchased were assisted by the Bank of Mum and Dad, see our earlier post. More would consider an investment property by accessing their superannuation for property investment purposes, a bad idea in our view.

Given the heady state of property prices at the moment, this growth in investment property by prospective first time buyers is on one hand logical, on the other quite concerning. We would also warn against increasing first time buyer incentives, as we discussed before.

Our analysis also highlights a deficiency in the ABS reporting, who are currently investigating the first time buyer statistics (because in some banks, first time buyers are identified by their application for a first owner grant alone). They should be tracking all first time buyer activity, not just those in the owner occupation category.