Join us for a live Q&A as I discuss the latest issues in the Property Market with our insider Edwin Almeida from Ribbon Property You can ask a question live.

Why Household Financial Stress Remains High

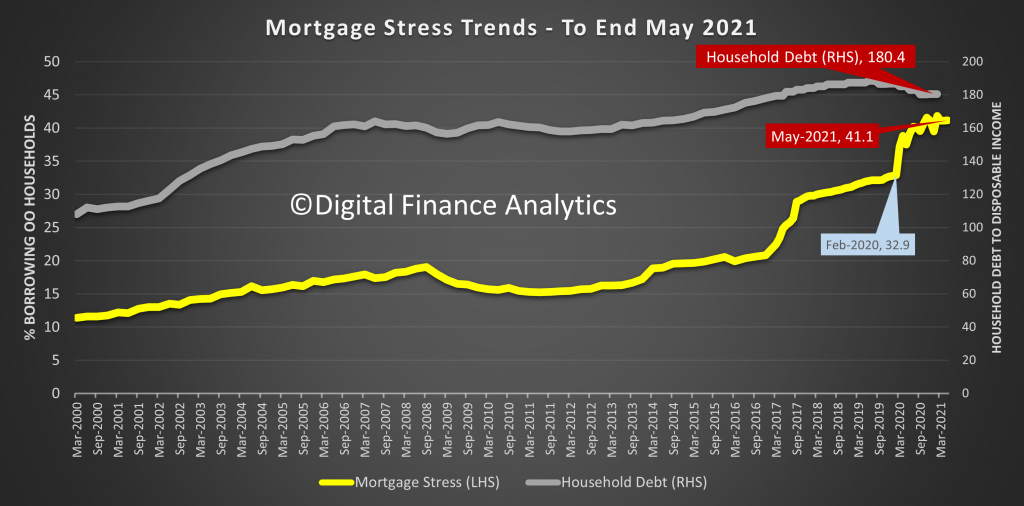

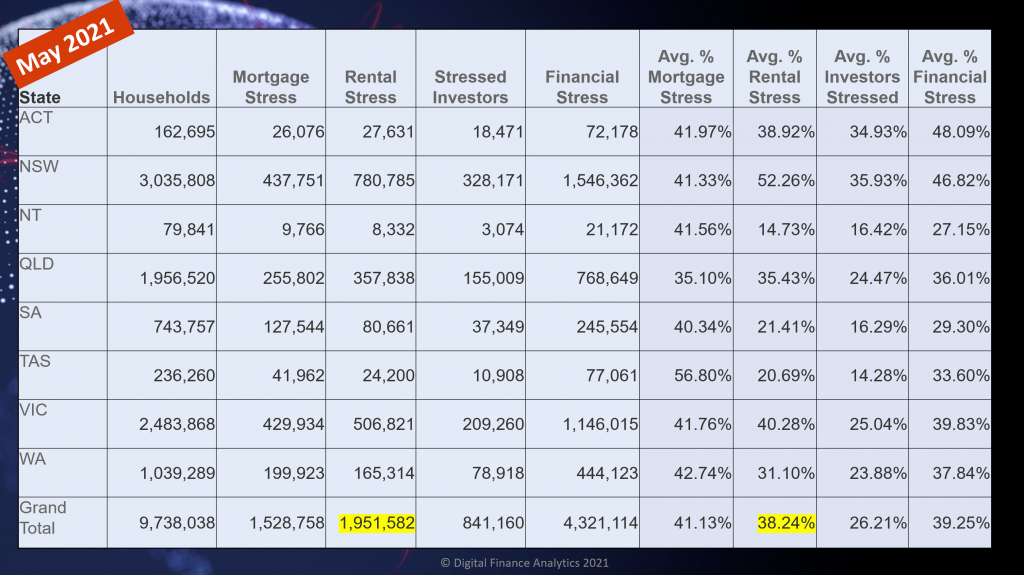

The latest data from our household surveys for May revealed little change in mortgage stress among households – still at around 41%, but there was a shocking rise in rental stress as the JobSeeker and JobKeeper supports were withdrawn, and the random lock-downs continue.

Even Property “experts” accept that affordability has deteriorated recently, as house prices rocket higher in many suburbs, although of course real interest rates are very low, for now, if rising ahead.

Our approach to measuring stress is unique in that we examine household cash flow – money in and money out. Given that many households saved hard last year though the heights of COVID, it is not surprising to see many now draining down those savings, by spending more. This means that their cash flow will in net terms be negative for now, and so will register as stressed. That said, if spending continues unabated financial difficulties will eventuate.

In addition we continue to see more households reaching for credit (from Buy Now Pay Later, to Pay Day loans) as well as equity release from property. In fact the latest hikes in perceived values has led to a run of refinancing, to try and pay down debt, or to provide funds to offspring for property purchase via the Bank of Mum and Dad. Again these one-off moves can adversely impact household stress measures in our methodology.

And we also note that many prefer not to accept the truth that some households are not home and clear in terms of their finances, given the uncertain part-time work, multiple jobs and zero hours contracts which many are on. But we continue to analyze households in net cash flow terms. If more funds drain away, compared with income, they are classified as stressed.

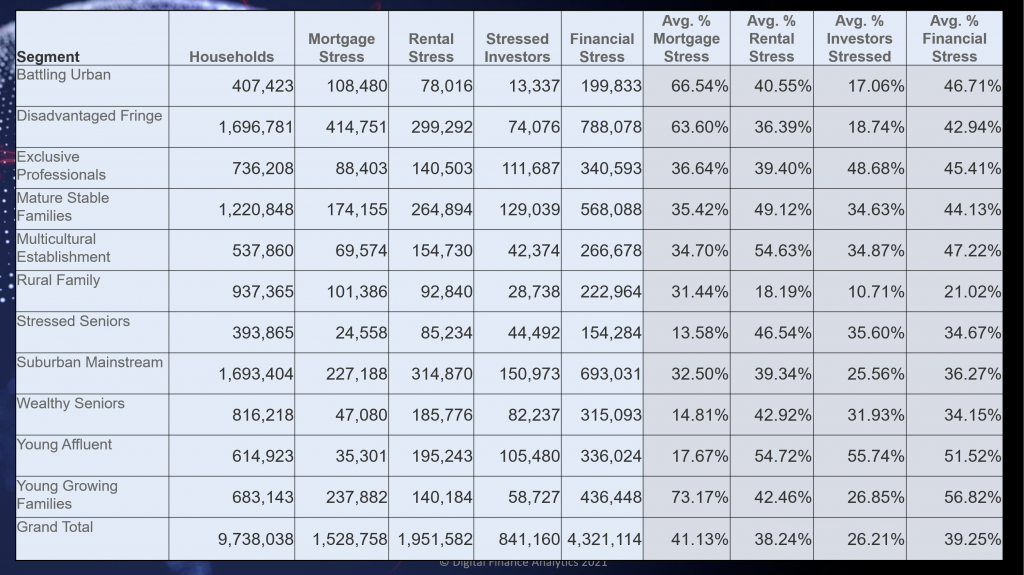

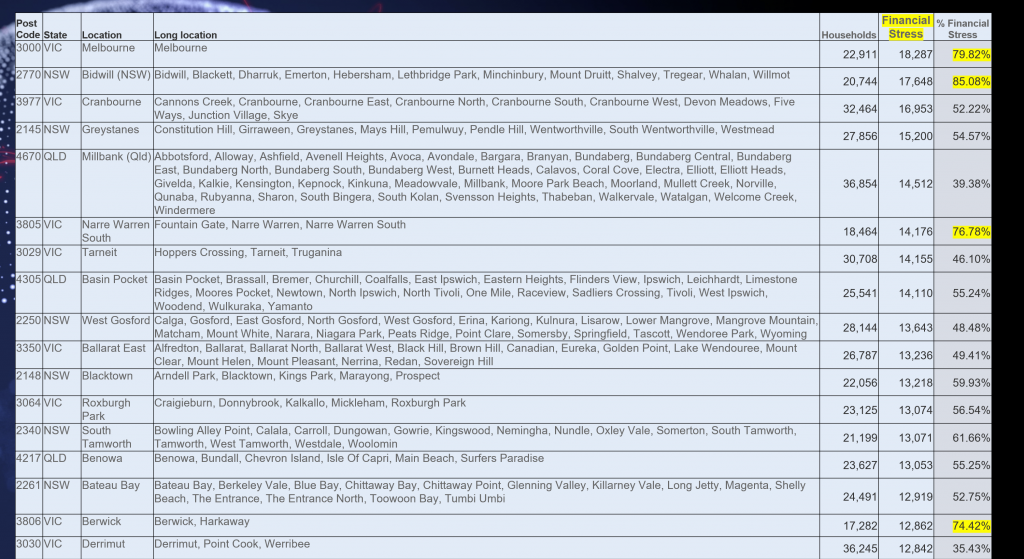

Across our segments we continue to see quite different dynamics emerging, with many younger households (often first time buyers) impacted, alongside the high growth corridors containing many first generation Australians, as well as some more affluent groups. Financial Stress takes no prisoners.

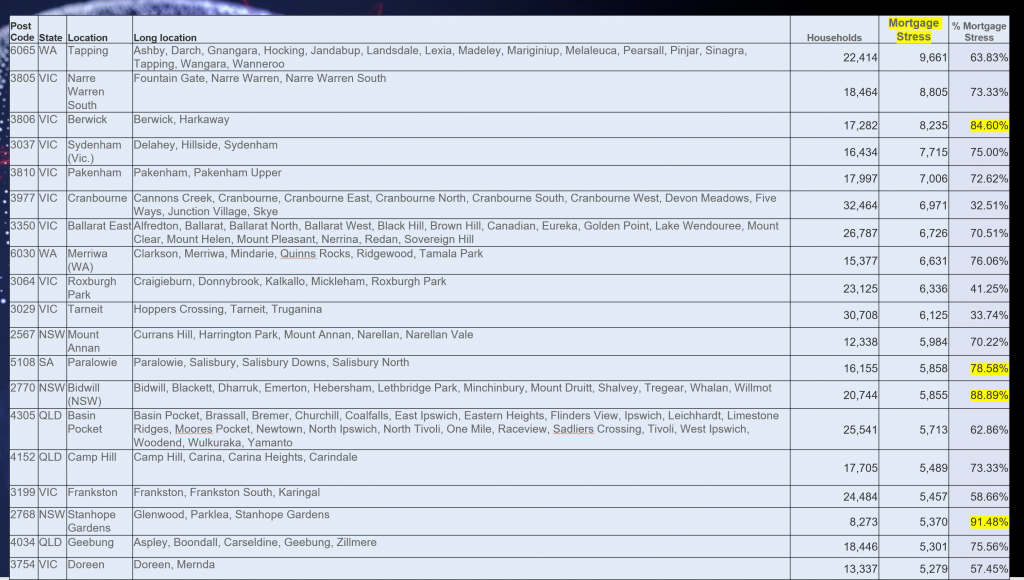

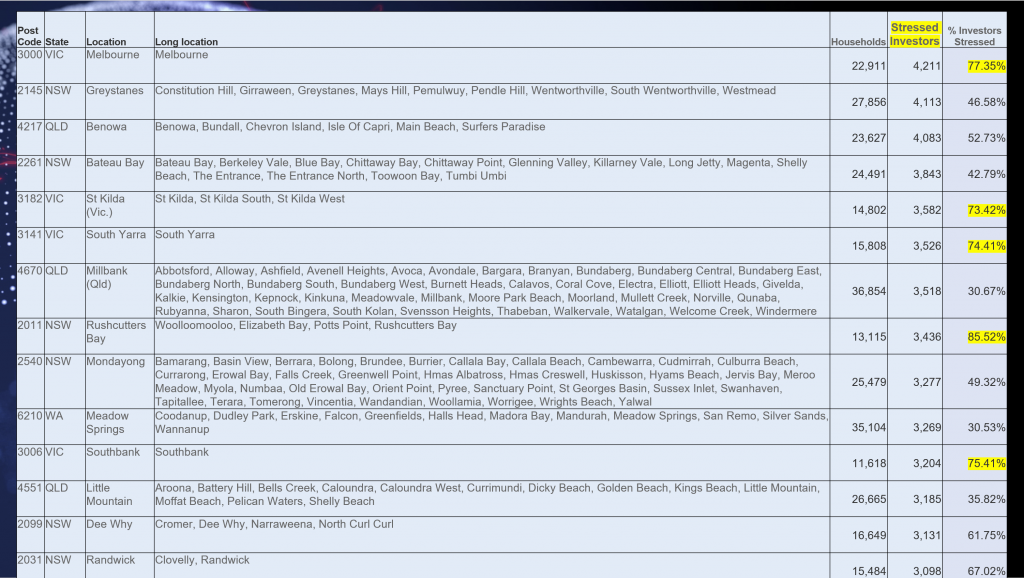

The mortgage stress counts are highest in high growth corridors in WA and VIC – where in some cases more than 80% of households in the area have cash flow issues.

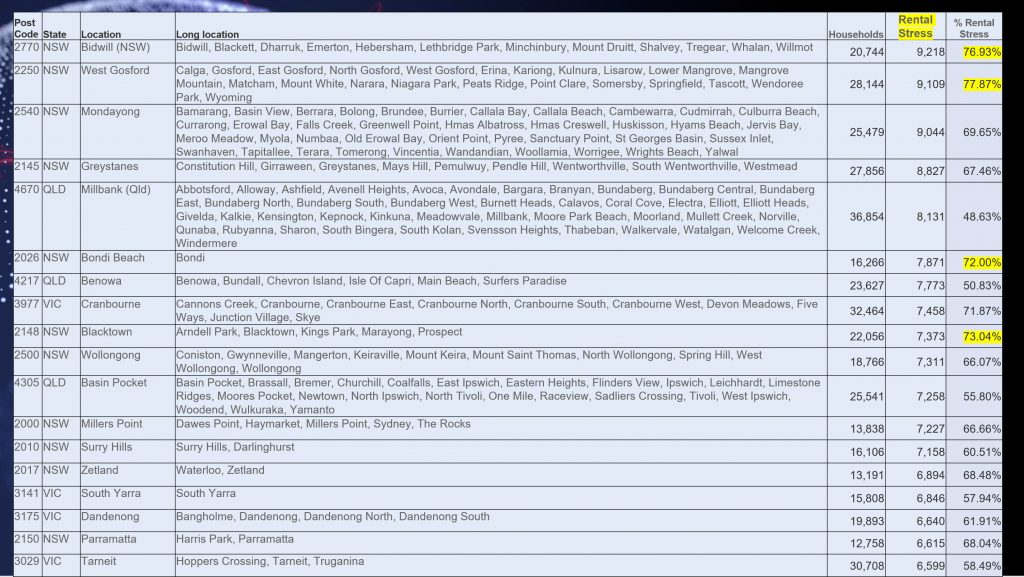

Rental stress is more strongly registered in NSW and QLD, with Western Sydney and the Central Coast and Bundaberg in the top 10.

Property investors are having difficulty in Melbourne 3000, thanks to the lack of students and ongoing lock-downs. A number of VIC suburbs are impacted thanks to high vacancy rates, negative net yields and falling apartment values.

Overall financial stress, our aggregate measure reveals that Melbourne 3000 has the highest stress levels. That is followed by a number of the high growth corridors.

The continued pressure on households from low income growth, and rising living costs will persist, while the risks of interest rate rises grow with the competition of the Term Funding Facility at the end of June.

Households continue to wait for a magic bullet to solve their financial flow issues, and while some can draw on savings and equity, or reach for more credit, unless spending patterns are understood (half have no budgets), we think these trends will continue to bubble away.

Of course, financial stress is not the same a mortgage default, but those with cash flow issues are more likely later to end up having to sell their home, unless remedial action is taken.

Households in financial stress should certainly speak to their lender, prioritise spending, and be cautious about further loan commitments. There is no income growth “get out of jail card” for now.

Its Edwin’s Monday Evening Property Rant!

My regular chat with Edwin Almeida, our property insider.

https://www.ribbonproperty.com.au/

Join us for our live Q&A show tomorrow, where Edwin will be answering questions live.

Go to the Walk The World Universe at https://walktheworld.com.au/

Property Signs: 14th June 2021

The latest edition of our finance and property news digest with a distinctively Australian flavour.

Caveat Emptor! Note: this is NOT financial or property advice!!

Today’s post is brought to you by Ribbon Property Consultants.

Shoot Ribbon an email on info@ribbonproperty.com.au & use promo code: DFA-WTW/MARTIN to receive your 10% DISCOUNT OFFER.

If you are buying your home in Sydney’s contentious market, you do not need to stand alone. This is the time you need to have Edwin from Ribbon Property Consultants standing along side you.

Buying property, is both challenging and adversarial. The vendor has a professional on their side.

Emotions run high – price discovery and price transparency are hard to find – then there is the wasted time and financial investment you make.

Edwin understands your needs. So why not engage a licensed professional to stand alongside you. With RPC you know you have: experience, knowledge, and master negotiators, looking after your best interest.

Go to the Walk The World Universe at https://walktheworld.com.au/

A Thirst For Liquidity – With Tim Fuller

The latest from Tim Fuller, from the Walk The World Fund and Nucleus Wealth, in which he explores the next in his series of “L’s”.

Quickly, liquidity means the ease of turning an asset or investment into cash, and importantly, how quickly you can access this cash. The easier it is to convert to money, the more ‘liquid’ it is.

Go to the Walk The World Universe at https://walktheworld.com.au/

A Spotlight On Gympie 4570

Another deep dive of a suburb from our One to One series. This analysis is based on current available information and may change. We do not provide financial advice, and our conversation should not be taken as such. We are merely looking at the data from our surveys and economic modelling. This information is for your personal use only and will change ahead.

The Gympie Region is a local government area in the Wide Bay–Burnett region of Queensland, Australia, about 170 kilometres north of Brisbane. It is between the Sunshine Coast and Hervey Bay and centred on the town of Gympie.

Go to the Walk The World Universe at https://walktheworld.com.au/

A Spotlight On Maryborough: 4560

A deep dive on a specific suburb in our One To One series.

Maryborough is a city and a suburb in the Fraser Coast Region, Queensland, Australia. As of June 2018 Maryborough had an estimated urban population of 27,282, having grown slightly at an annual average of 0.12% year-on-year over the preceding five years.

For details of our service see: https://digitalfinanceanalytics.com/blog/dfa-one-to-one/

Go to the Walk The World Universe at https://walktheworld.com.au/

Let’s Paper Over Some More Cracks: Market Update 12 June 2021

The latest edition of our finance and property news digest with a distinctively Australian flavour.

CONTENTS

0:00 Start

0:15 Introduction

1:05 US Markets

2:13 Consumer Sentiment

5:00 Upcoming Fed Meeting

8:15 US Dollar Index and Gold

10:50 Secret Gold Activities

14:50 Oil Prices

17:44 Cryptos

19:40 UK Stocks and GDP

21:20 Andy Haldane Warns

22:20 German Stocks

22:38 Japan and China

22:50 More Higher Shipping Costs

23:26 Australian Markets

24:43 Stock Movements

27:39 Conclusions

Go to the Walk The World Universe at https://walktheworld.com.au/

June Economic Update With Nuggets News

My latest chat with Alex from Nuggets News. This is my edit. The original is at https://youtu.be/esdrdl7MuV8

Go to the Walk The World Universe at https://walktheworld.com.au/

Property Signs: 11th June 2021

We look at the latest new home sales data, talk about creaking high-rise in Melbourne, examine the US inflation numbers and also consider the implications of ScoMo’s latest comments on the borders staying shut well into next year.

And Today’s post is brought to you by Ribbon Property Consultants.

If you are buying your home in Sydney’s contentious market, you do not need to stand alone. This is the time you need to have Edwin from Ribbon Property Consultants standing along side you.

Buying property, is both challenging and adversarial. The vendor has a professional on their side.

Emotions run high – price discovery and price transparency are hard to find – then there is the wasted time and financial investment you make.

Edwin understands your needs. So why not engage a licensed professional to stand alongside you. With RPC you know you have: experience, knowledge, and master negotiators, looking after your best interest.

Shoot Ribbon an email on info@ribbonproperty.com.au & use promo code: DFA-WTW/MARTIN to receive your 10% DISCOUNT OFFER.

Go to the Walk The World Universe at https://walktheworld.com.au/