Latest on the Cash Restrictions Bill.

The Fiction Continues…

A reprise of the current market moves, and a discussion about the underlying drivers, as well as the top 5 issues we get asked about. Plus a quick preview of a new intro…

0:00 Start

0:30 Market Moves

0:26 Nucleus Wealth Article On Capitalism

8:53 Markets

16:14 Drivers

17:33 Top 5 Topics

20:42 New Intro Candidate

21:06 Outro

Suspending the debt cycle: Is capitalism finished?

Posted on by Damien Klassen

Economic cycle background

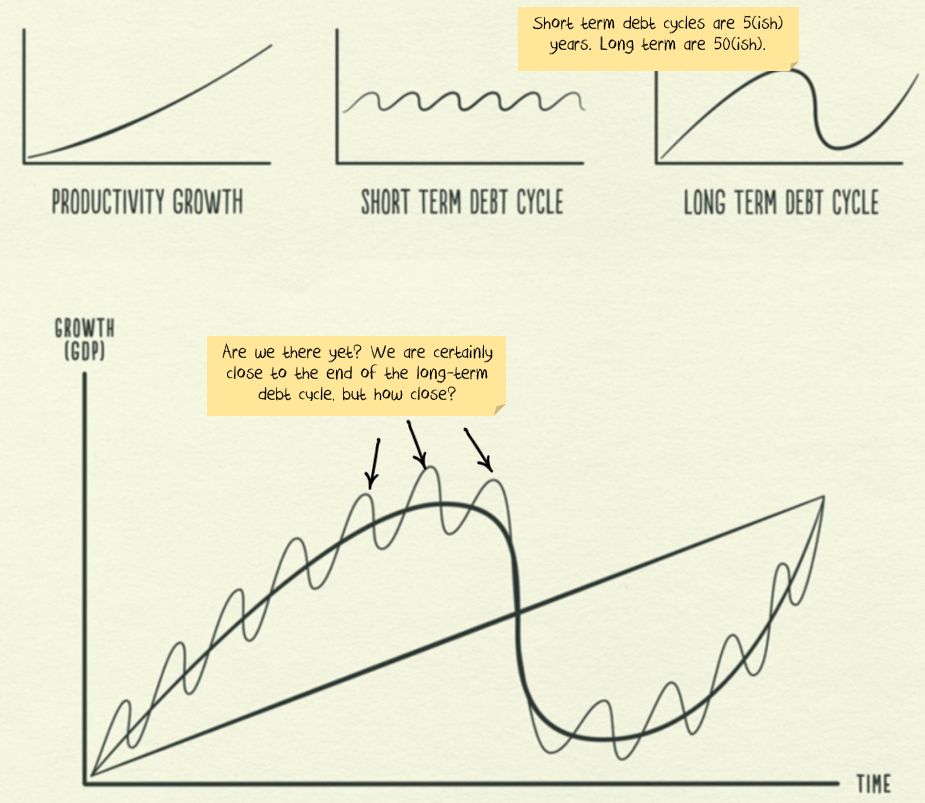

Ray Dalio has a series of explanatory videos that talk about debt cycles and in particular the contrast between a short debt cycle and a long debt cycle.

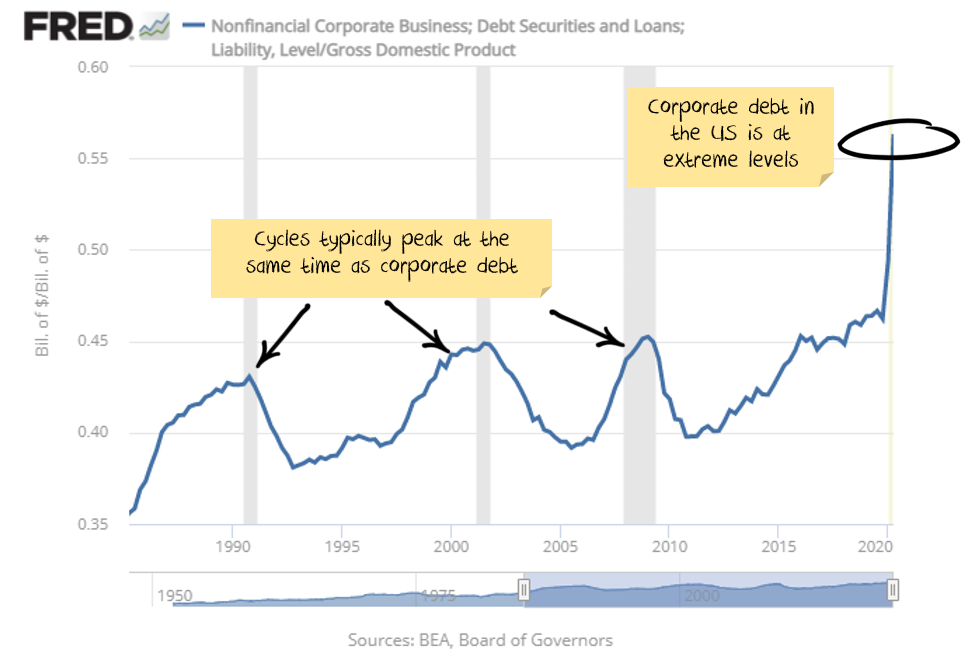

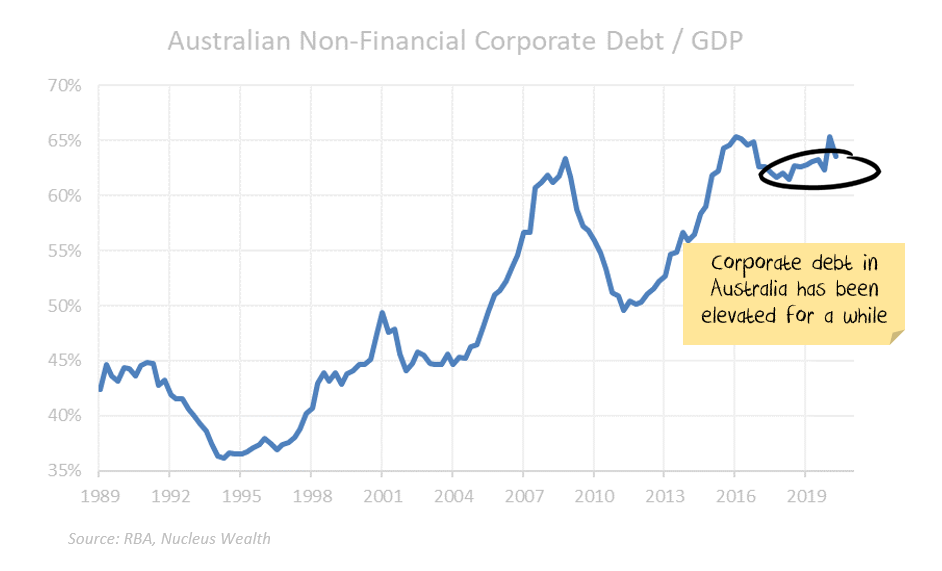

With record levels of corporate debt around most of the globe:

COVID-19 lockdowns suggested that this would be the end of the current short term debt cycle and potentially the end of the current long term debt cycle.

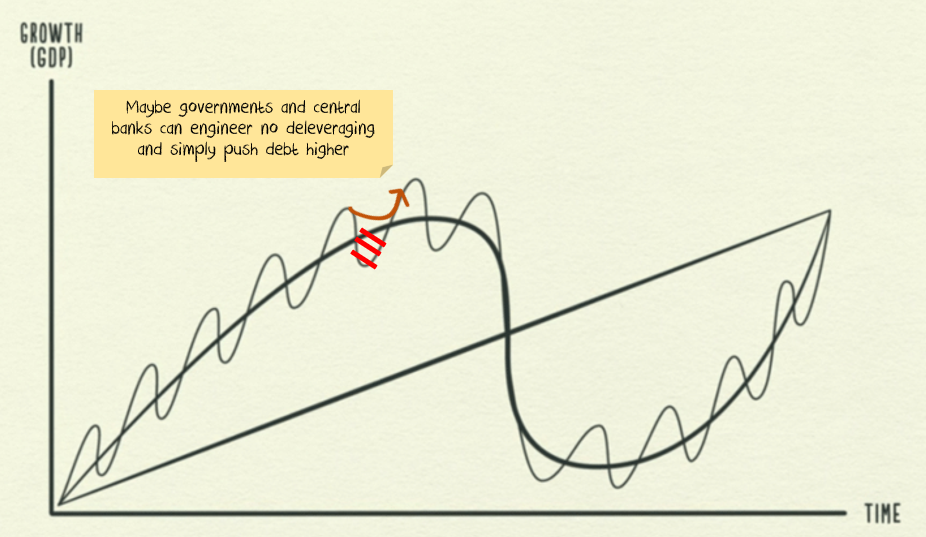

Governments and central banks to the rescue

Swift intervention by central banks and governments hit pause on the start of deleveraging. In effect they threw a lot of money at the economy, most ended up cushioning the blow for people who suffered from the shutdown. But a significant amount also ended up with people who didn’t suffer. Also, without travel, many more affluent people travelled less and consequently increased their saving and investment.

Also, evictions and bankruptcies were made more difficult, and interest-rate holidays on loans given. The new rules prevented negative outcomes while encouraging positive ones. The stock market boomed.

Is capitalism finished?

We have been cautious on risk for months, avoiding the crisis at the start, but with minimal participation in the market recovery. And, to date, we have been wrong. We did identify the most likely reason to be wrong would be if governments would take ever more extreme steps to cancel capitalism. And that is what happened.

In many countries, “extend and pretend” has replaced the threat of bankruptcy. Someone who can’t pay their rent is not evicted but allowed to accrue debt. Don’t foreclose on those who can’t pay their interest. Instead, build up their interest payments into a larger debt burden.

The end game seems to be a cohort of zombie consumers and businesses. Weighed down by debt burdens too massive to ever pay off, but supported by interest rates low enough to keep them from defaulting.

US Treasury Secretary Mnuchin is letting several minor lending programs expire at the end of the year, to the loud complaints of many – including the US central bank. Many programs will likely be re-instated once Biden is in power. In other countries, there is very little consideration given to finishing similar programs.

It would seem we have a zombie future.

Can the debt cycle blast higher?

The question from here is whether a new debt boom can be launched without the old one ever having peaked.

Until recently, I thought the odds favoured the end of the cycle. I was wrong.

I’m still sceptical of a debt boom for businesses. Governments and central banks will try, but debt levels are already high and further interest rate reductions will be limited.

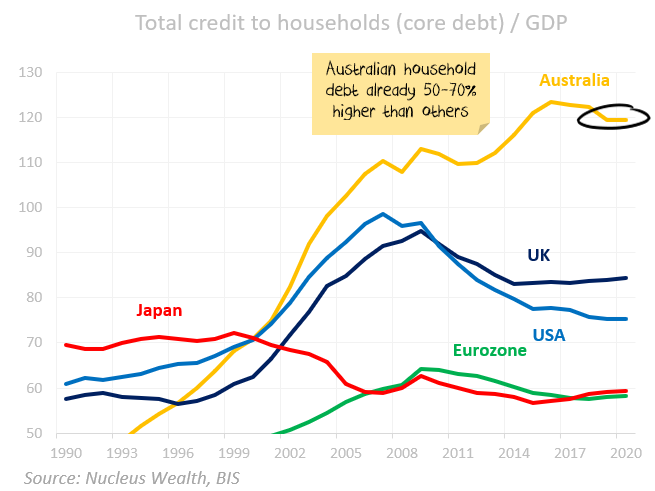

Another household debt boom is possible. Although Australia has already played this card:

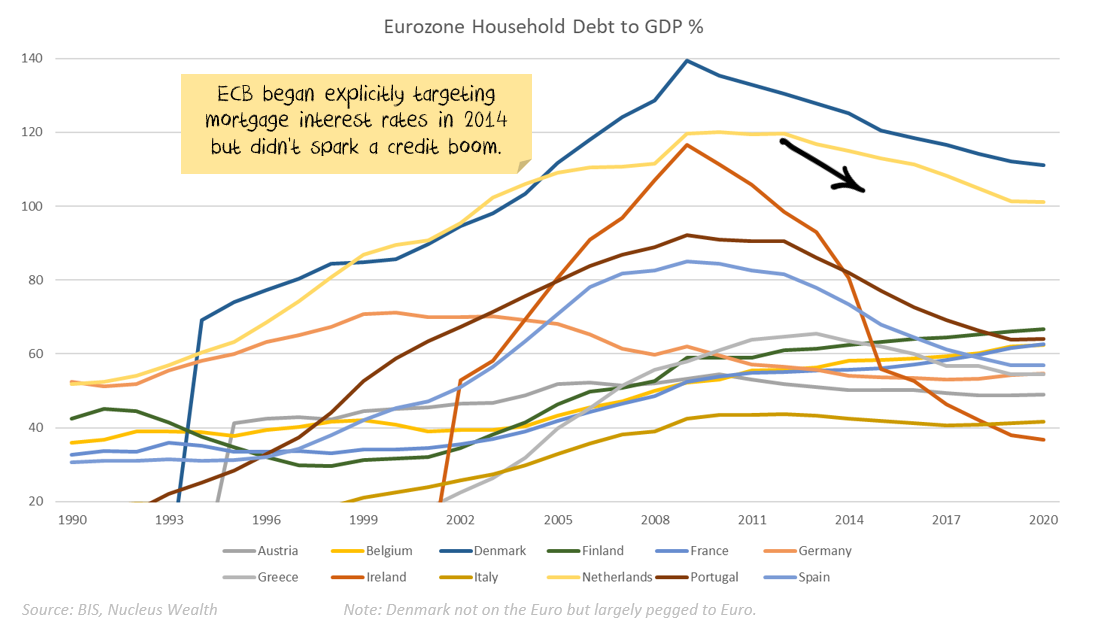

The other difficulty is that despite the European Central Bank’s best efforts, household debt has been declining across much of the Eurozone.

The most likely outcome now appears to be continued increases in government debt, but limited increases in corporate debt. Household debt is an open question.

Are we reduced to watching governments and central banks?

Mostly. It seems clear that policymakers have decided on zombification. Limit bankruptcies. Increase debt. Never raise interest rates again.

It doesn’t make for a healthy economy. But it limits short term pain which appears to be the current goal of every politician.

The economic plan is to try to get a debt-funded consumer boom going so that bankruptcy protection and consumer support can be removed.

Policy mistakes are what matters from here. The goal? Prevent a business cycle from occurring.

Indications that a normal business cycle is occurring will be a sign to sell. Too much support and markets will grind higher.

Damien Klassen is Head of Investments at Nucleus Wealth.

What First Time Buyers Should Know

This is an edited replay of our live Q&A where I discuss the challenges facing First Time Buyers in the current market. I was joined by Veronica Morgan, a Buyers Agent, Co-host of Elephant in the Room Podcast, and the Home Buyer Academy and Meighan Wells.

Meighan Wells & Veronica Morgan are co-founders of Home Buyer Academy and they’ve created an online course and mentoring program for first home buyers called Your First Home Buyer Guide.

Original live stream: https://youtu.be/HrMguvnP_SI

WHERE to BUY Workshop

https://homebuyeracademy.com.au/workshop

Free mini course on How to Price a Property

https://homebuyeracademy.com.au/freecourse

Auction Ready book 30% off + free postage discount code: DFA

https://gooddeeds.com.au/auction-ready/

FINAL REMINDER: DFA Live The First Time Buyer Conundrum 8PM Sydney Tonight

Join us for a live Q&A as I discuss the challenges facing First Time Buyers in the current market. I will be joined by Veronica Morgan, a Buyers Agent, Co-host of Elephant in the Room Podcast, and the Home Buyer Academy.

Meighan Wells & Veronica Morgan are co-founders of Home Buyer Academy and they’ve created an online course and mentoring program for first home buyers called Your First Home Buyer Guide.

www.homebuyeracademy.com.au

Meighan will also join us for the discussion.

Its Edwin’s Monday Evening Property Rant

More from our property insider – Edwin Almeida.

https://www.ribbonproperty.com.au/

Go to the Walk The World Universe at https://walktheworld.com.au/

Its Deposit Bail-In “D” Day!

Robbie Barwick and I discuss the upcoming Senate vote on passing the amendment to secure bank deposits in Australia.

Details of the Bill: https://www.aph.gov.au/Parliamentary_Business/Committees/Senate/Economics/BankingDeposits

List of members: https://www.aph.gov.au/Senators_and_Members – .

Anthony Albanese Electorate: (02) 9564 3588 Canberra: (02) 6277 4022 A.Albanese.MP@aph.gov.au

Richard Marles Electorate: (03) 5221 3033 Canberra: (02) 6277 4330 Richard.Marles.MP@aph.gov.au

Stephen Jones: Electorate: (02) 4297 2285 Canberra: (02) 6277 4661 Stephen.Jones.MP@aph.gov.au

Go to the Walk The World Universe at https://walktheworld.com.au/

The First Time Buyers Dilemma – With Steve Mickenbecker

Steve Mickenbecker is a member of Canatar’s executive team and is a key financial commentator for the Canstar brand. He is active in all media as a commentator and educator across the finance range.

Live event on Tuesday:

Go to the Walk The World Universe at https://walktheworld.com.au/

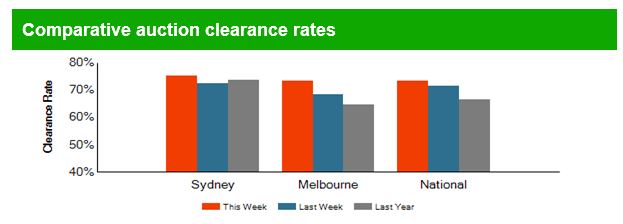

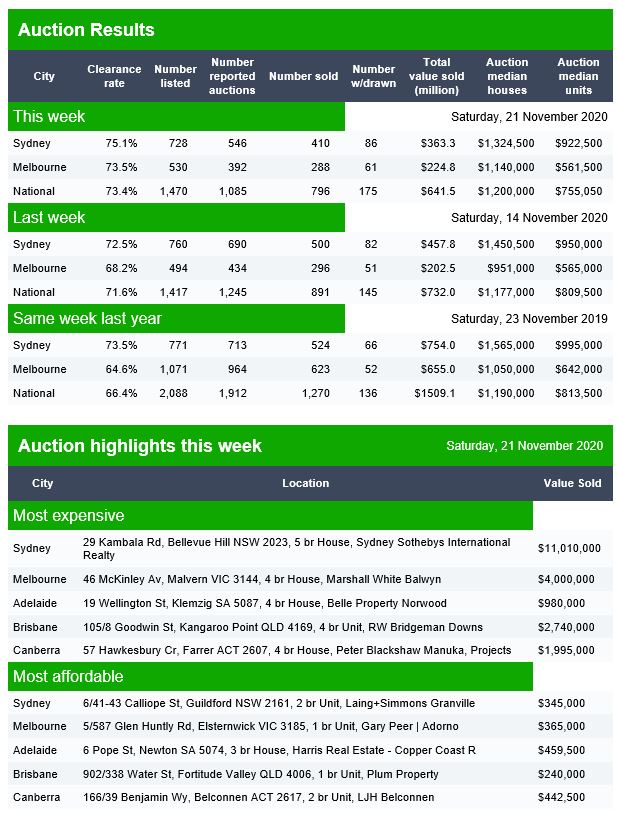

Auction Results 21 November 2020

Domain released their preliminary results for today. Volumes remain well below this time last year.

Canberra listed 72 auctions, reported 64, with 47 sold, 5 withdrawn and 12 passed in to give a Domain clearance of 73%.

Brisbane listed 73 auctions, reported 47 with 32 sold, 6 withdrawn and 9 passed in to give a Domain clearance of 68.

Adelaide listed 67 auctions, reported 36 with 19 sold, 17 withdrawn to give a Domain clearance of 53%.

Numberwanging 1 – 2 – 3: With Tarric Brooker

My latest Friday discussion with Journalist Tarric Brooker. Can we believe the official data, and does it make sense? Does it make you blind? Tarric is @AvidCommentator on Twitter.

0:00 Start

0:55 Economic Indicators

7:39 Extend And Pretend

10:35 Confidence

16:54 Narrative Versus Reality

23:06 China and Trade

25:56 Parliamentary Behaviour

35:34 Labor Getting Wedged

39:05 Housing Market

42:4 Get Granular

46:43 USA

48:16 Ending

Go to the Walk The World Universe at https://walktheworld.com.au/

A Spotlight On Hunters Hill

Hunters Hill is a suburb on the Lower North Shore of Sydney, in the state of New South Wales, Australia. Hunters Hill is located 9 kilometres north-west of the Sydney central business district and is the administrative centre for the local government area of the Municipality of Hunter’s Hill.

We examine the property market there.

0:00 Start

1:53 DFA One To One

2:50 Approach

3:56 Location

4:27 Photos

5:35 For Sale

6:56 Sold

7:57 Price Trends

11:23 Market Overview

13:23 Stress Trends

16:00 Price Scenarios

19:50 Trailer For First Time Buyer Show

Next live event: https://youtu.be/HrMguvnP_SI

Go to the Walk The World Universe at https://walktheworld.com.au/