I caught up with Damien Klassen Head of Investments, at Nucleus Wealth to discuss their investment strategy in the current uncertain climate – ahead of some important announcements coming later in the week.

It’s Edwin’s Monday Evening Property Rant #11

To Fix, Or Not To Fix, That Is The Question …. With Steve Mickenbecker

Steve Mickenbecker is the Group Executive, Financial Services at Canstar. In this discussion we explore the rate options and whether fixing a mortgage at the moment is a smart move.

After The U.S. Election, What Are The Implications? – With Salvatore Babones

In part 2 of my discussion with Salvatore Babones we consider some of the policy implications of a Biden Presidency.

Salvatore Babones is Australia’s globalization expert. He is an associate professor at the University of Sydney, an adjunct scholar at the Centre for Independent Studies, a columnist for Foreign Policy and Quadrant, and a regular contributor to The National Interest. A proud American by birth and by habit, he has lived in Sydney since 2008.

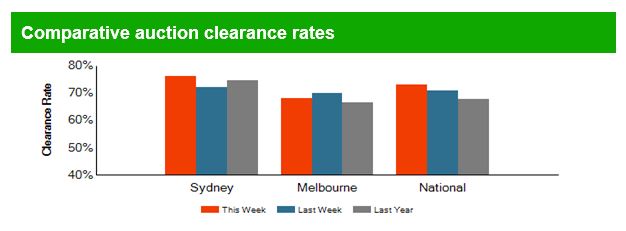

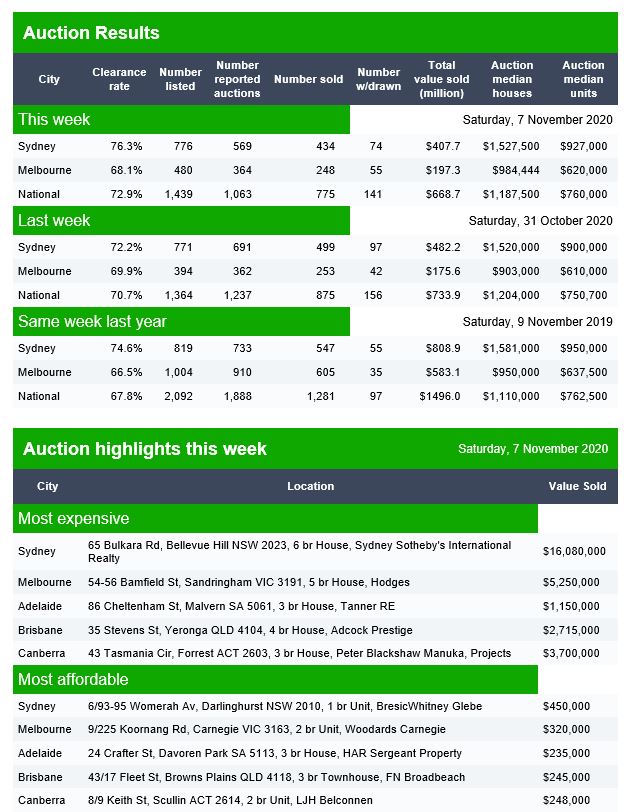

Auction Results 7th November 2020

Domain published their preliminary results for today.

Canberra listed 72 auctions, reported 63 with 50 sold, 4 withdrawn and 9 passed in to give a Domain clearance of 79%.

Brisbane listed 61 auctions, reported 36 with 17 sold, 7 withdrawn and 12 passed in to give a Domain clearance of 47%.

Adelaide listed 50 auctions, reported 31 with 26 sold, 1 withdrawn and 4 passed in to give a Domain clearance of 84%.

The RBA In Its Own Words….

We examine the latest Statement on Monetary Policy.

Chaos City With Tarric Brooker

The latest of my Friday chats with Tarric Brooker, Journalist. He is @AvidCommentator on Twitter.

Only Our 10th Prime Minister Can Save Australia – Part 2

Some additional content following our earlier show – Joseph Lyons in his own words…

Our previous show, part 1 is here:

Where Are We On The U.S. Election? – With Salvatore Babones

Salvatore Babones is Australia’s globalization expert. He is an associate professor at the University of Sydney, an adjunct scholar at the Centre for Independent Studies, a columnist for Foreign Policy and Quadrant, and a regular contributor to The National Interest. A proud American by birth and by habit, he has lived in Sydney since 2008.

We discuses the current state of play in the election and what is really going on.

Recorded 17:00 5th November 2020

What’s Driving Vehicle Financing?

I caught up with Scott Montarello – Co-Founder and Co-CEO (Operations) at driva.com.au.

We discussed vehicle finance, and why many end up with loans which are more expensive than they need to be.

Note there is no commercial relationship between driva and DFA.