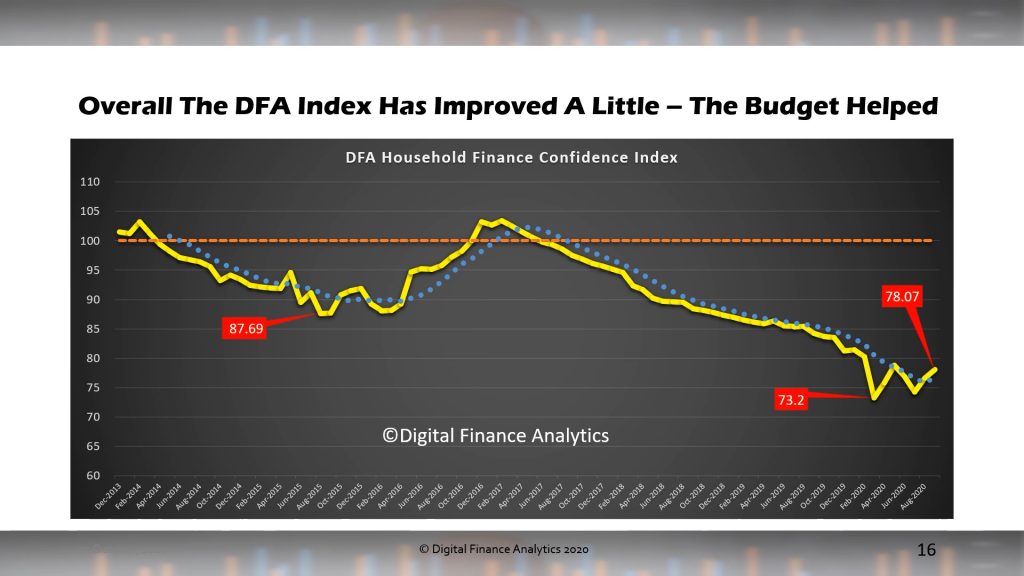

We have released the latest update to our Financial Confidence index, with data to 20th October 2020, later than usual, because we wanted to see if there was a post-budget bounce (as trumpeted by one index provider last week!).

We discussed the findings in our most recent live show:

There was a slight recovery, but nothing which takes our index out of the “gloom” zone. The latest reading is 78.07 still well below the neutral setting.

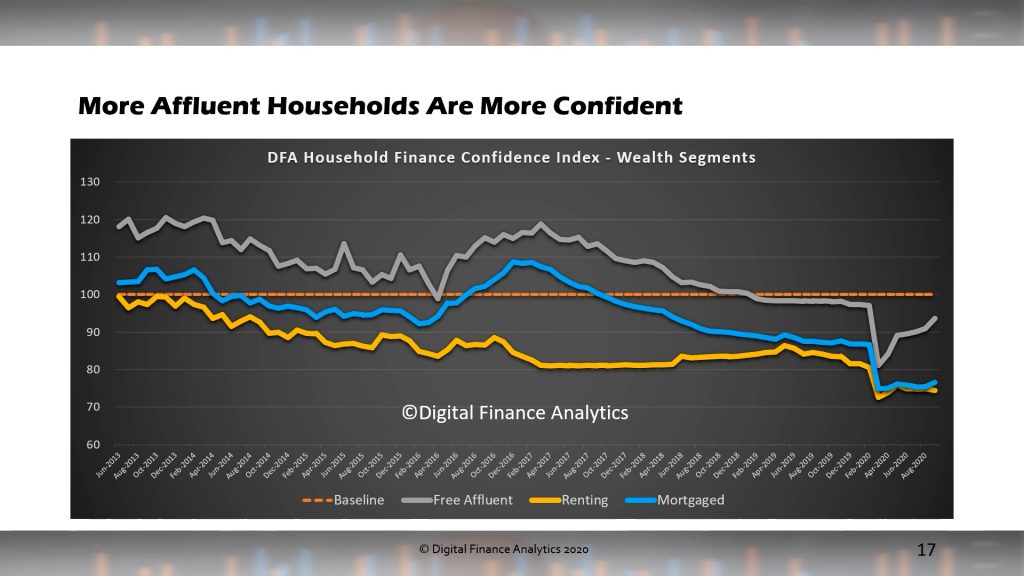

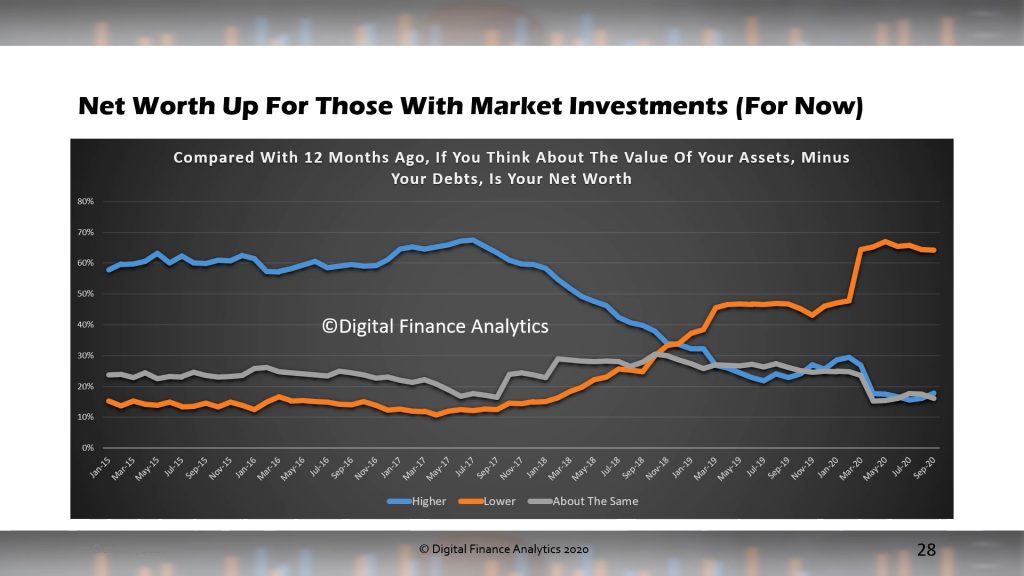

By our affluence segmentation, those mortgage free, and holding market investments improved as markets improved, while those with mortgages and those renting saw little change.

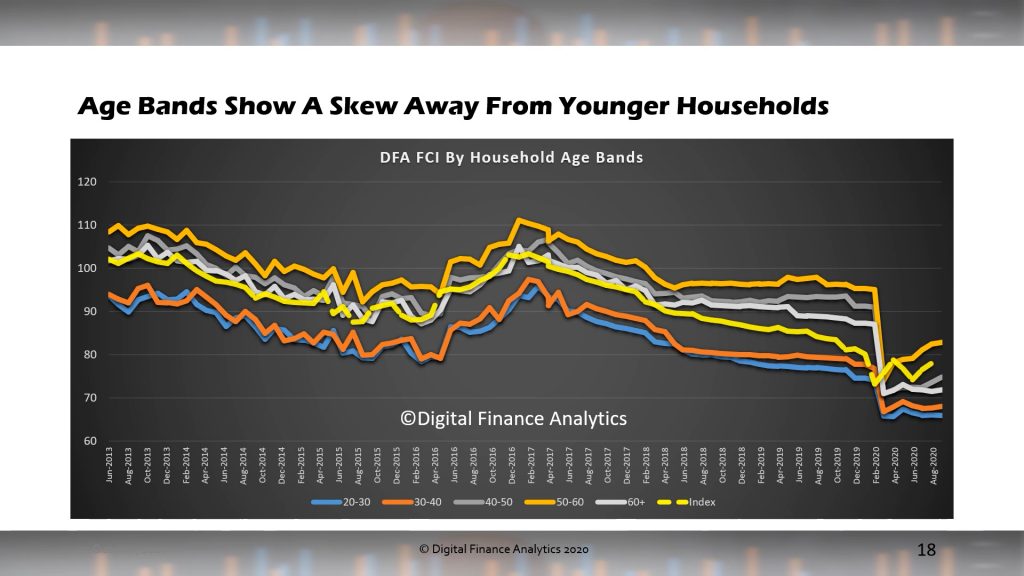

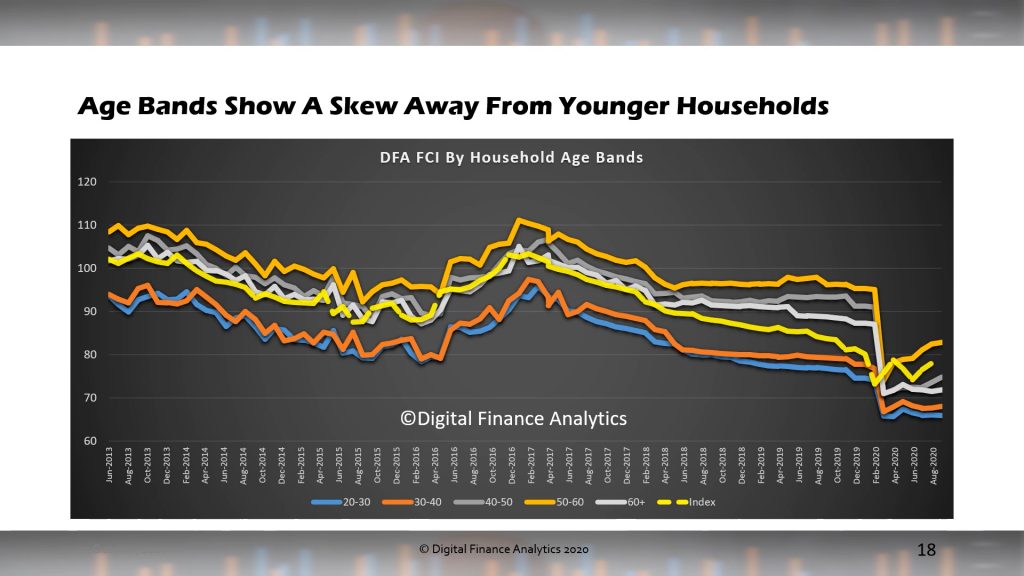

Across the age groups, younger households were least confident, reflecting fragmented jobs and incomes, and high leverage. Older households, especially those mortgage free were more positive, but older groups, reliant on bank savings also remain in gloom territory.

Across the states, Victoria showed a further slide (this may change if the lock-down is relaxed as anticipated), whereas WA continues to move higher, as the local economy recovers.

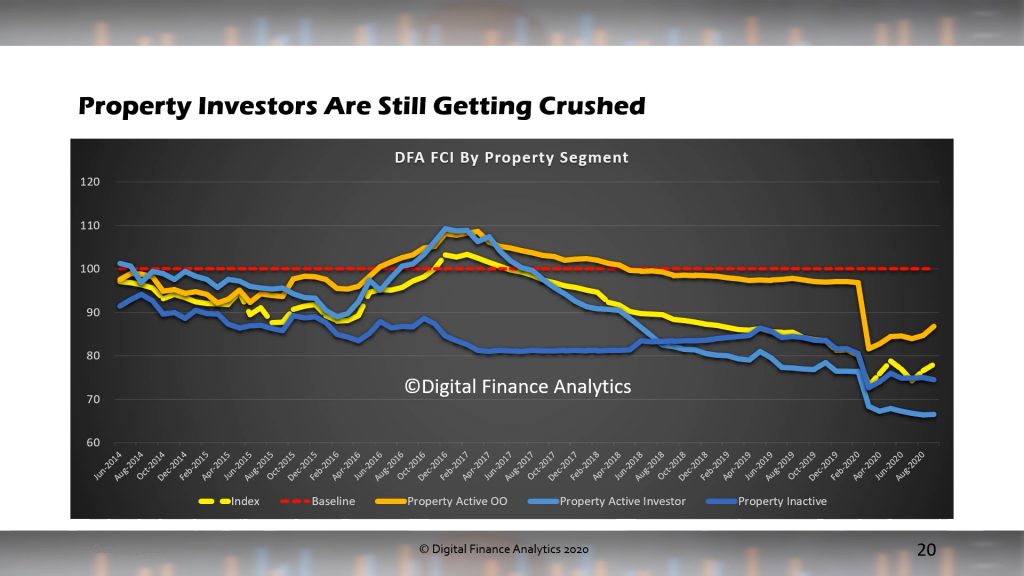

Across the property segments, property investors continue to languish, thanks to lower rental returns, higher vacancy rates and limited capital growth. Owner occupied households benefited from lower rates, and refinance, while those renting benefited from higher availability and lower rents (though some are confronting risks of being forced to leave due to investors wanting to sell, or to give notice).

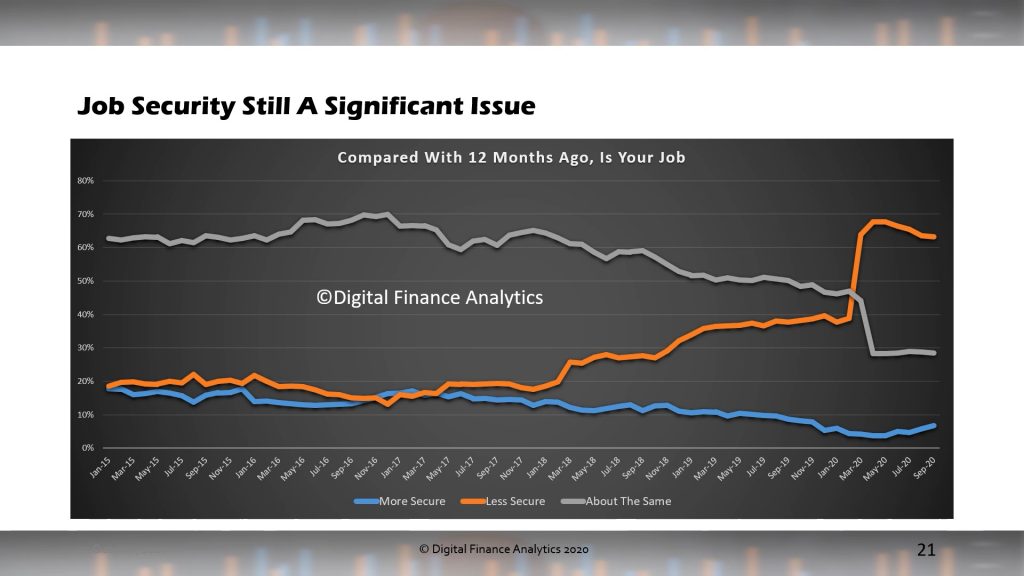

Across the components of the index, job security remains a significant issue with more than 60% of households less secure than a year ago. Many are working less hours, while structural unemployment continues to rise. Many SMEs are also cutting.

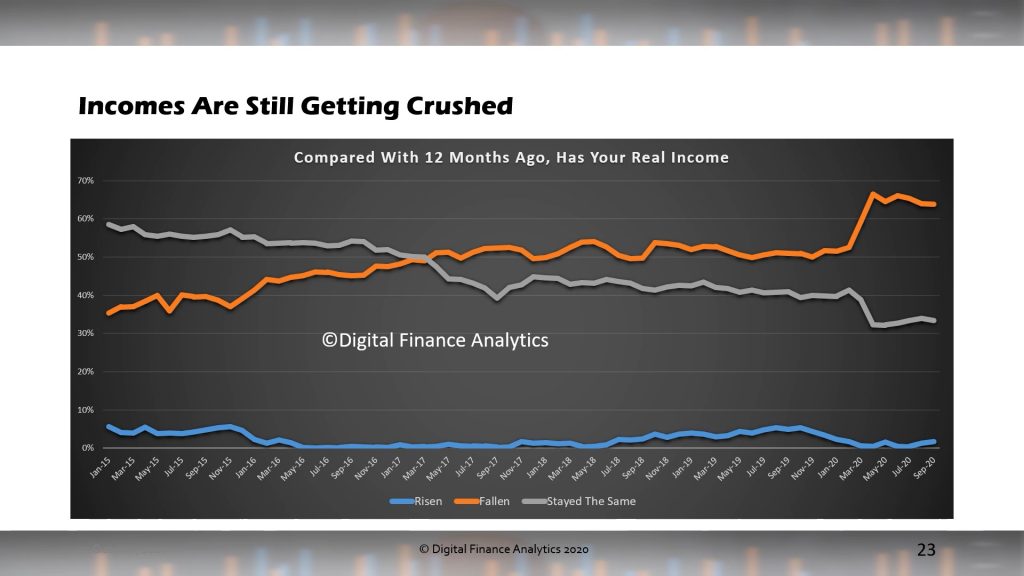

Incomes remain under pressure, thanks to less hours worked, and lower pay rates. Reductions to JobKeeper and JobSeeker are also hitting some now.

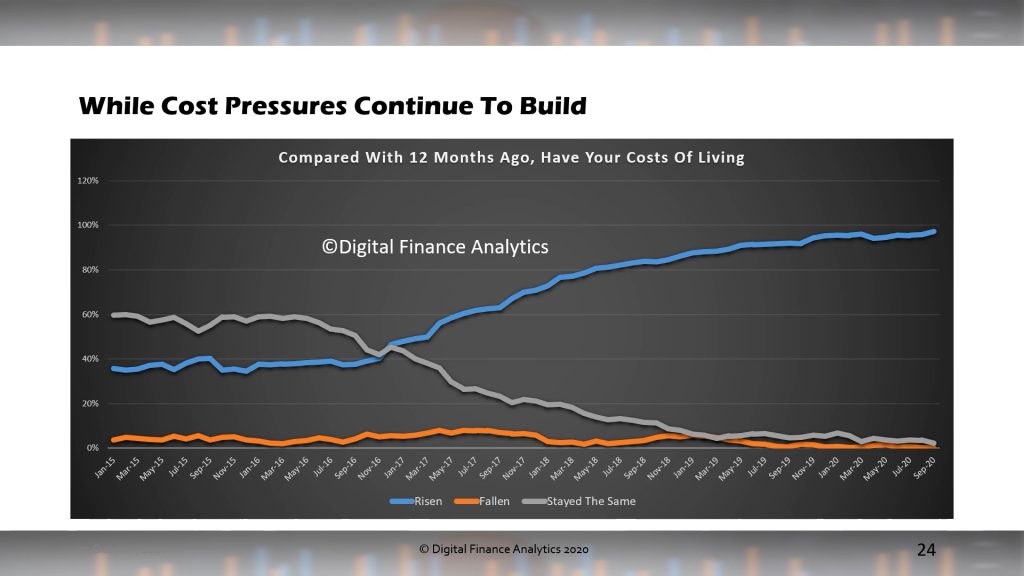

Costs pressures are still clearly in play, with most households seeing costs across multiple categories continuing to rise. Everyday costs at the supermarket appear to be rising faster than the official cpi.

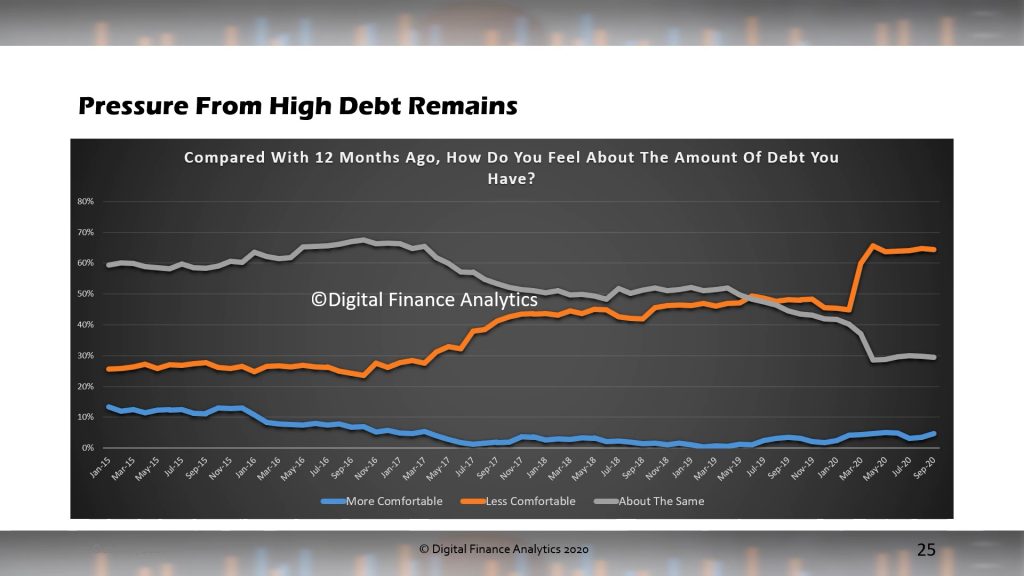

Those households with debt (not all are borrowing) are more concerned, especially those who were on principal and interest repayment holidays which are now ending. We continue to see expansion of credit (and Buy-Now-Pay-Later facilities) to those already in significant debt.

Savings are under pressure, especially with the continued crushing of deposit rates (thanks RBA…!). Those with savings in the banks have see rates drive towards zero in recent times. As a result more households are having to dip into capital, or moving to higher-risk investments. This largely silent group is drowned out by the clamour from the mortgaged sector and property bulls.

Finally, net worth has improved for those with market investments, for now, though 65% of households are still sitting on lower net worth than a year ago.

Given the current and expected monetary policy settings, we expect to see continued weakness in the index, until such time as employment and income growth accelerates. This is some way away yet.