The latest edition of our finance and property news digest with a distinctively Australian flavour.

The Calm Before The Storm – The DFA Daily 3rd June 2020

The latest edition of our finance and property news digest with a distinctively Australian flavour.

The Coronavirus Files – Part 1: 12 Weeks To Eternity – The Crisis We Didn’t Have To Have

Salvatore Babones is an American sociologist, associate professor at the University of Sydney, and an expert in the areas of Chinese and American economy and society. His research is related to macro-level structure of the world economy, with a particular focus on China’s global economic integration.

He has just completed an important paper on the virus. And he shares his insights with us on release.

This is the first of a short series.

Get The Latest On Mortgage and Rental Stress Live Tonight

Wanted Escape Hatches – The DFA Daily 1st June 2020

The latest edition of our finance and property news digest with a distinctively Australian flavour.

Live event tomorrow:

Let Them Eat Bricks – The DFA Daily 31 May 2020

The latest edition of our finance and property news digest with a distinctively Australian flavour.

Bookmark our upcoming live event on May 2020 Mortgage Stress, Tuesday 2nd June 20:00

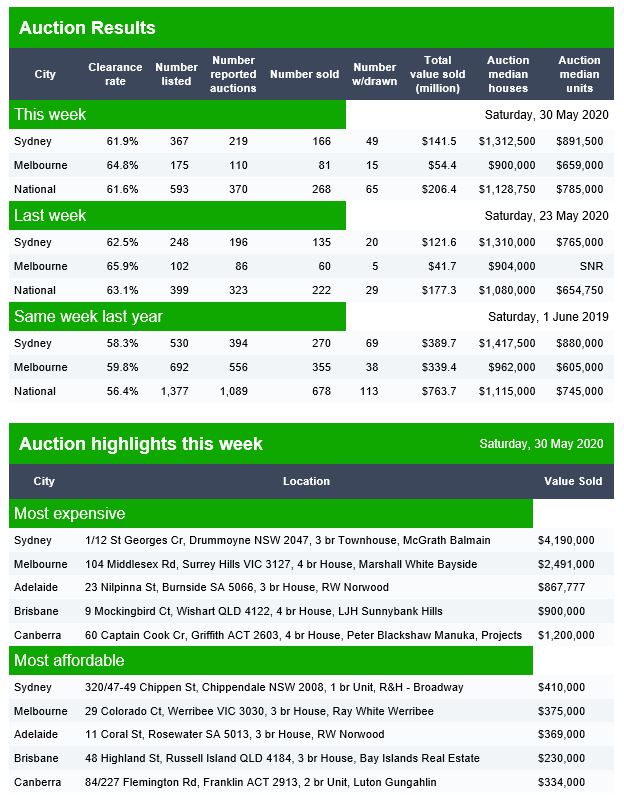

Auction Results 30 May 2020

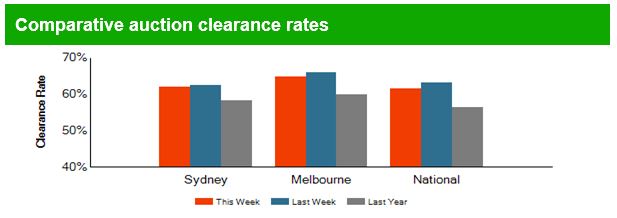

Domain released their preliminary results for today. Volumes were slightly higher than last week, but still well down on a year ago. 593 auctions were listed, compared with 1,377 last year. So the quoted clearance rates really are meaningless for now.

Canberra listed 16 auctions, reported 15 and sold 11, with 4 passed in giving a Domain clearance of 73%.

Brisbane listed 23, reported 18 and sold 7, with 1 withdrawn and 11 passed in so giving a Domain clearance of 37%.

Adelaide listed 12 auctions, reported 8 and sold 3, with 5 passed in so giving a n/a result from Domain.

Australia – In The Eye Of The Storm And Heading Over The Cliff? – With Taric Brooker

My latest conversation with Journalist Tarric Brooker. Where are we headed, and will the right decisions be made?

Tarric uses the handle @AvidCommentator on Twitter.

The Latest From The Property Market Front Line – With Chris Bates

The latest in our discussions with Mortgage Broker and Financial Adviser Chris Bates. We look at the latest developments in the property markets, and who the winners and losers may be.

Chris can be found at www.wealthful.com.au & www.theelephantintheroom.com.au plus via LinkedIn: https://www.linkedin.com/in/christopherbates

Banking On The Edge – The DFA Daily 29 May 2020

The latest edition of our finance and property news digest with a distinctively Australian flavour.

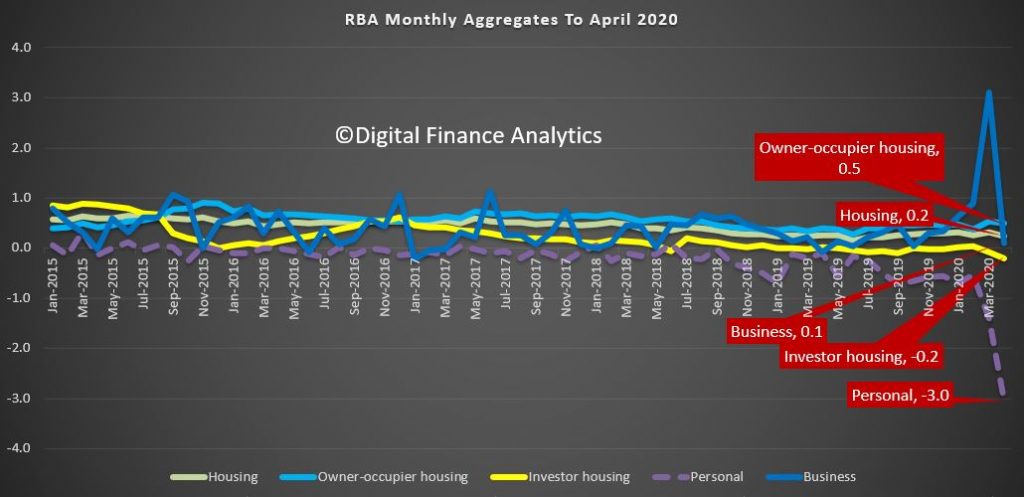

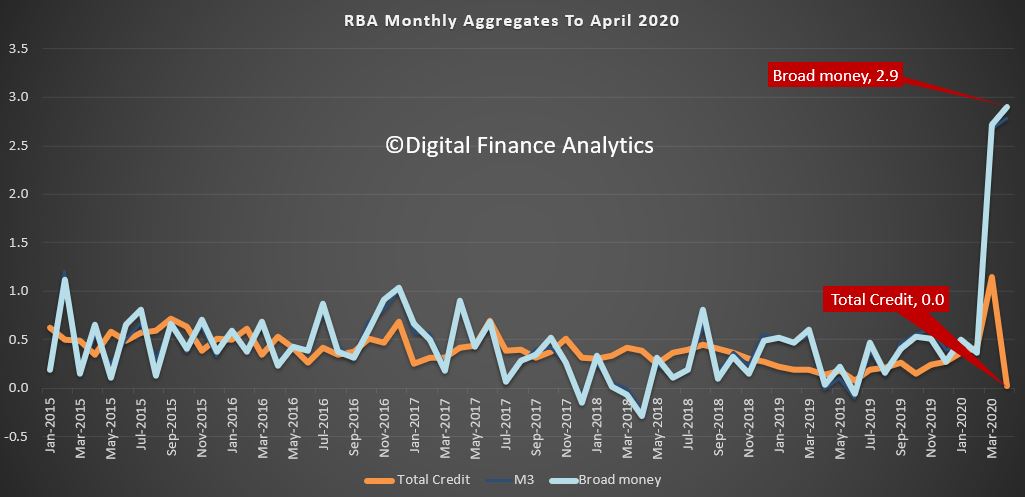

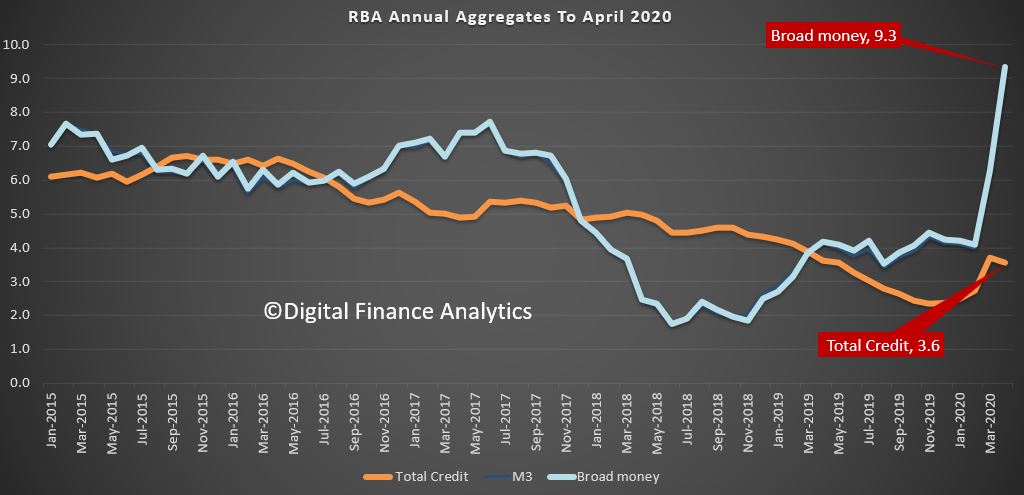

Being the last working day of the month, we got the latest credit data for April from both the RBA and APRA. Overall the RBA reported that private credit was flat over the month, with owner occupied balances up 0.5%, investment lending down 0.2%, making net housing up 0.2% – reflecting deferred repayments in part, business was up just 0.1% after a big spike last month, and personal credit dropped 3% over the month – a noticeable drop by any standards.

Although total credit was flat, the broad money measure rose 2.9% over the month thanks to the various government and RBA schemes to support the economy. Something to bear in mind when we talk about removing the stimulus!

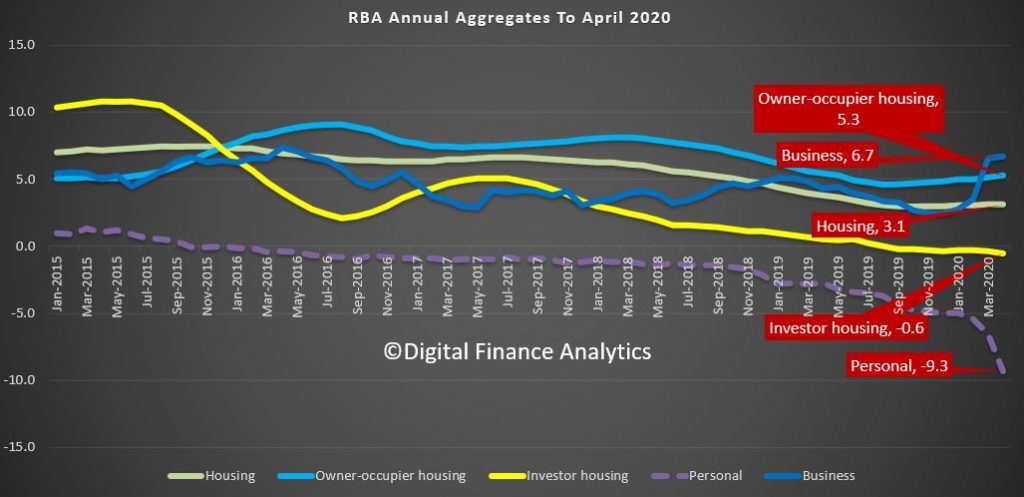

Annualised, owner occupied growth was at 5.3%, while investors were down 0.6% over the year and total housing lending was 3.1% and a little lower than last month. Personal credit is down 9.3% over the year and business credit is up 6.7% thanks to last month spike.

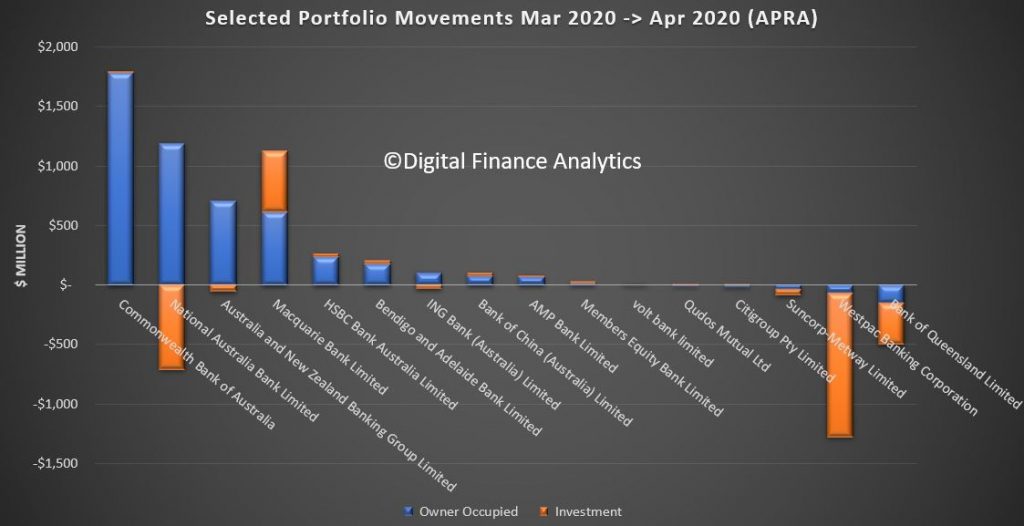

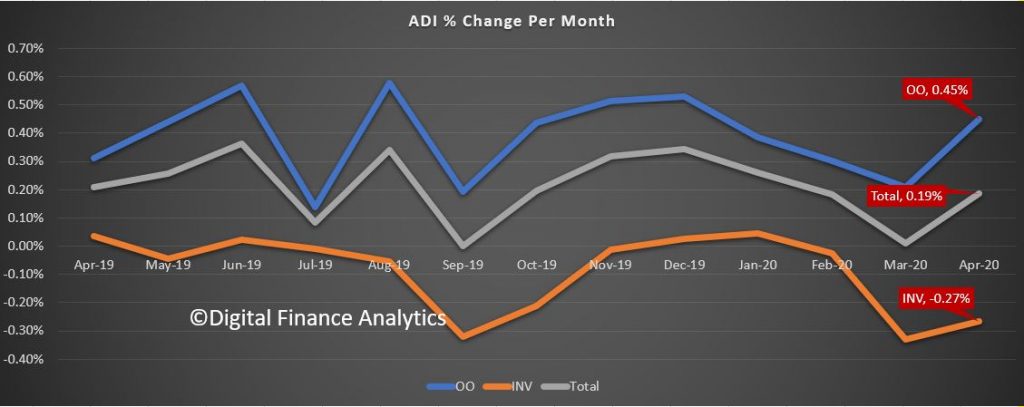

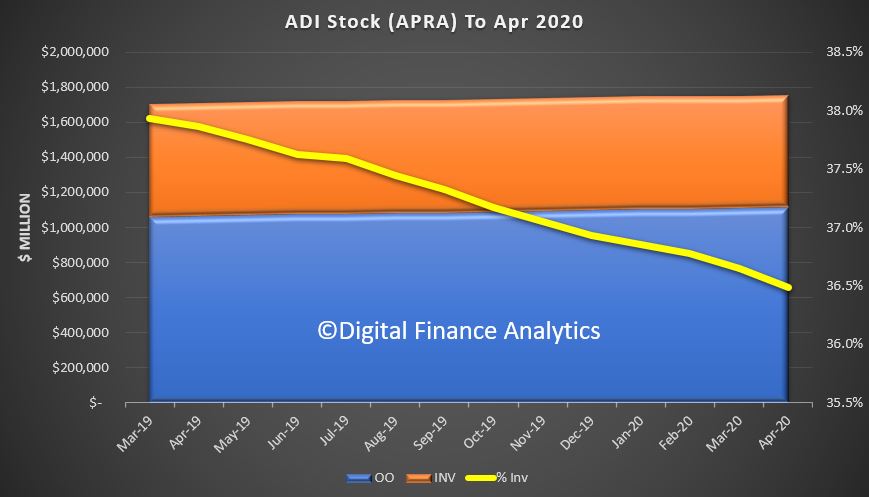

APRA showed that total bank lending for mortgages rose 0.19% over the month, with lending balances for owner occupiers up 0.45% to $1.11 trillion dollars while investor lending fell again, down 0.27% to 0.64 trillion dollars. Investor lending dropped again to 36.5% of balances.

Total mortgage credit is another new high 1.754 trillion dollars.

Looking at the individual movements, CBA wrote the largest net increase in owner occupied loans, followed by NAB, ANZ and Macquarie. Macquarie was streets ahead on investor lending, while NAB, Westpac and Bank Of Queensland saw the biggest falls. ME Bank was back in line this month after the securitisation deal last month. Once again bear in mind this is as reported to APRA, and reflects the net of new loans written, balances extended, and loans paid off. On these numbers many banks are shedding investment loans quite fast. Question is – is this by design or accident?