We have released our alternative SMP today, mirroring the RBA’s rose-tinted efforts. Who will be more right?

This is a show based on recent recordings and incorporating the latest updated charts and data.

"Intelligent Insight"

We have released our alternative SMP today, mirroring the RBA’s rose-tinted efforts. Who will be more right?

This is a show based on recent recordings and incorporating the latest updated charts and data.

We review the latest ABS data on trade.

https://www.abs.gov.au/ausstats/abs@.nsf/mf/5368.0?OpenDocument

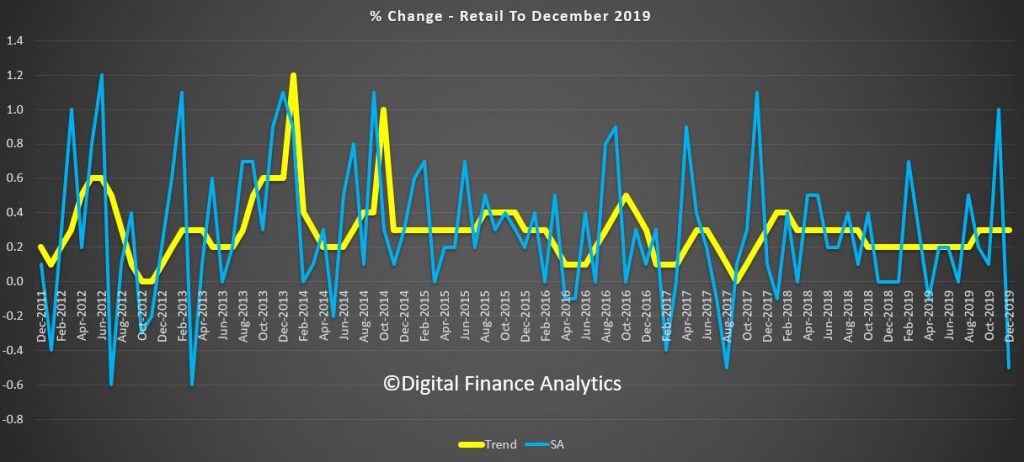

We look at the latest retail data from the ABS – December was woeful, and there is no evidence of the so called retail bounce.

Australian retail turnover fell 0.5 per cent in December 2019, seasonally adjusted, according to the latest Australian Bureau of Statistics (ABS) Retail Trade figures.

https://www.abs.gov.au/AUSSTATS/abs@.nsf/DetailsPage/8501.0Dec%202019?OpenDocument

Governments have turned a corner on the Coronavirus, now prioritising preventative measures to combat its spread rather than minimising economic and market impact.

In today’s webinar, hear from Nucleus Wealth’s Head of Investment Damien Klassen, Chief Strategist David Llewellyn Smith and Head of Operations Tim Fuller, as they cover “How to invest during Coronavirus pandemic”

In this episode, we cover why the economic impacts of Coronavirus will far exceed that of SARS did in 2003, the time for cautious investing being now, countries and sectors to avoid investment in, and as always our investment implications wrap-up.

To listen in podcast form click here: http://bit.ly/NucleusPod

The information on this podcast contains general information and does not take into account your personal objectives, financial situation or needs. Past performance is not an indication of future performance.

Damien Klassen and Tim Fuller are an authorised representative of Nucleus Wealth Management. Nucleus Wealth is a business name of Nucleus Wealth Management Pty Ltd (ABN 54 614 386 266 ) and is a Corporate Authorised Representative of Nucleus Advice Pty Ltd – AFSL 515796.

Australian retail turnover fell 0.5 per cent in December 2019, seasonally adjusted, according to the latest Australian Bureau of Statistics (ABS) Retail Trade figures.

This follows a rise of 1.0 per cent in November 2019.

“The December fall comes after a strong November, led by Black Friday sales” said Ben James, Director of Quarterly Economy Wide Surveys. “There were also some effects from bushfires and associated smoke haze apparent in New South Wales data. Specifically, food retailing and cafes, restaurants and takeaway food services were negatively impacted.”

There were falls for department stores (-2.8 per cent), cafes, restaurants and takeaway food services (-0.9 per cent), clothing, footwear and personal accessory retailing (-1.5 per cent), food retailing (-0.3 per cent), and household goods retailing (-0.3 per cent). These falls were partially offset by a rise in other retailing (0.2 per cent).

In seasonally adjusted terms, there were falls in New South Wales (-1.2 per cent), Queensland (-0.5 per cent), South Australia (-1.3 per cent), the Northern Territory (-0.4 per cent), and the Australian Capital Territory (-0.1 per cent). Victoria (0.0 per cent) and Western Australia (0.0 per cent) were relatively unchanged. Tasmania (1.1 per cent) rose in seasonally adjusted terms in December 2019.

The trend estimate for Australian retail turnover rose 0.3 per cent in December 2019, following a 0.3 per cent rise in November 2019. Compared to December 2018, the trend estimate rose 2.8 per cent.

Online retail turnover contributed 6.6 per cent to total retail turnover in original terms in December 2019. In December 2018, online retail turnover contributed 5.6 per cent to total retail.

Economist John Adams and Analyst Martin North looks at the latest AFR salvo, as the establishment fight back to try to keep the cash bill in play.

https://www.afr.com/policy/economy/why-fiscal-policy-fine-tuning-ignores-political-reality-20200204-p53xj4

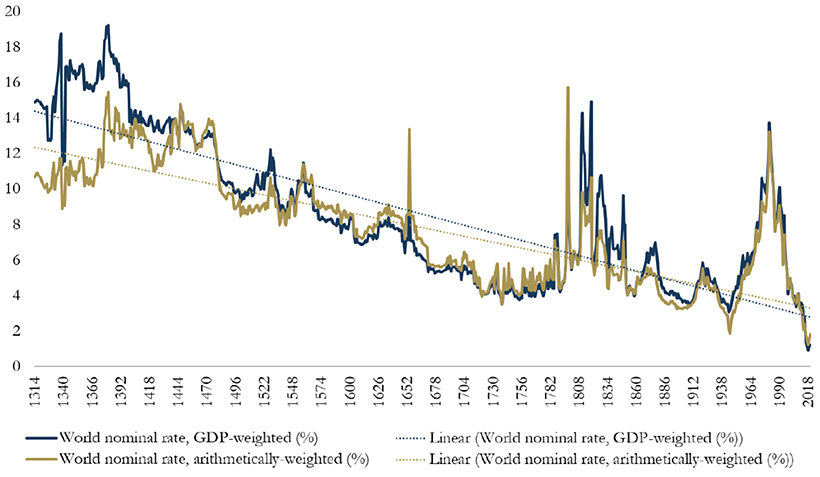

The normal line of argument has been that its central banks pumping liquidity into the financial markets which have led to falling real interest rates, and that they might indeed take them into negative territory. This is all to do with “secular stagnation” (reflecting poor productivity, globalisation, weak wages growth, and monetary policy intervention by central banks).

Last year the IMF in a working paper suggested that a cut of 4% or there abouts would be required to react to a financial crisis similar to the scale of the GFC. That would pull rates deeply negative, and of course so far (Sweden apart) no one has found a way back, as Japan and the Eurozone illustrates.

Many sovereign rates sit in negative territory, and there is an unprecedented $10 trillion in negative-yielding debt. This new interest rate climate has many observers wondering where the bottom truly lies.

Now, most economists are on a quest to return to a “stable positive rate”, eventually, considering negative rates to be there for am emergency, and temporary.

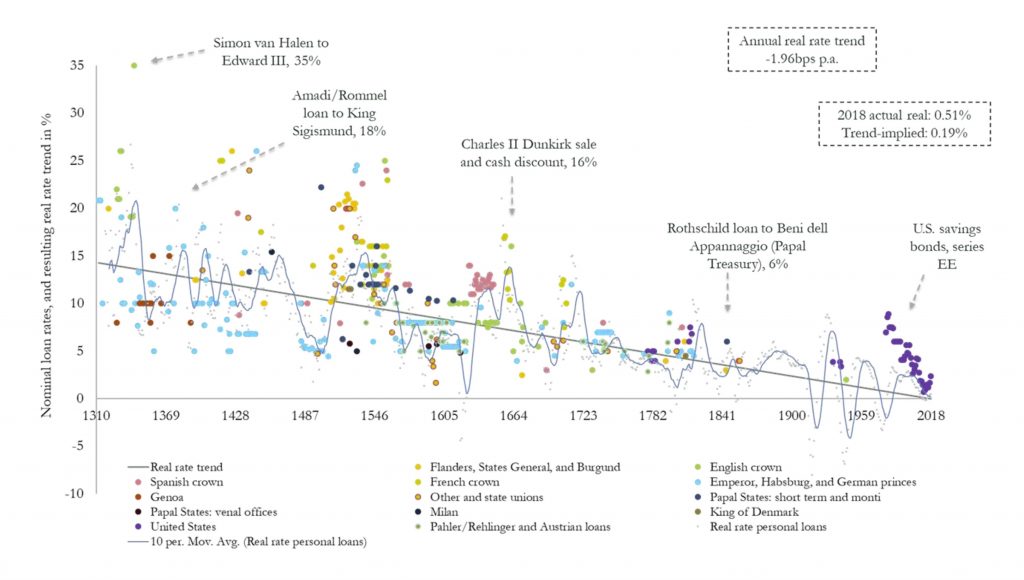

But a working paper from the Bank of England Eight centuries of global real interest rates, R-G, and the ‘suprasecular’ decline, 1311–2018 by Paul Schmelzing really puts the cat among the pigeons.

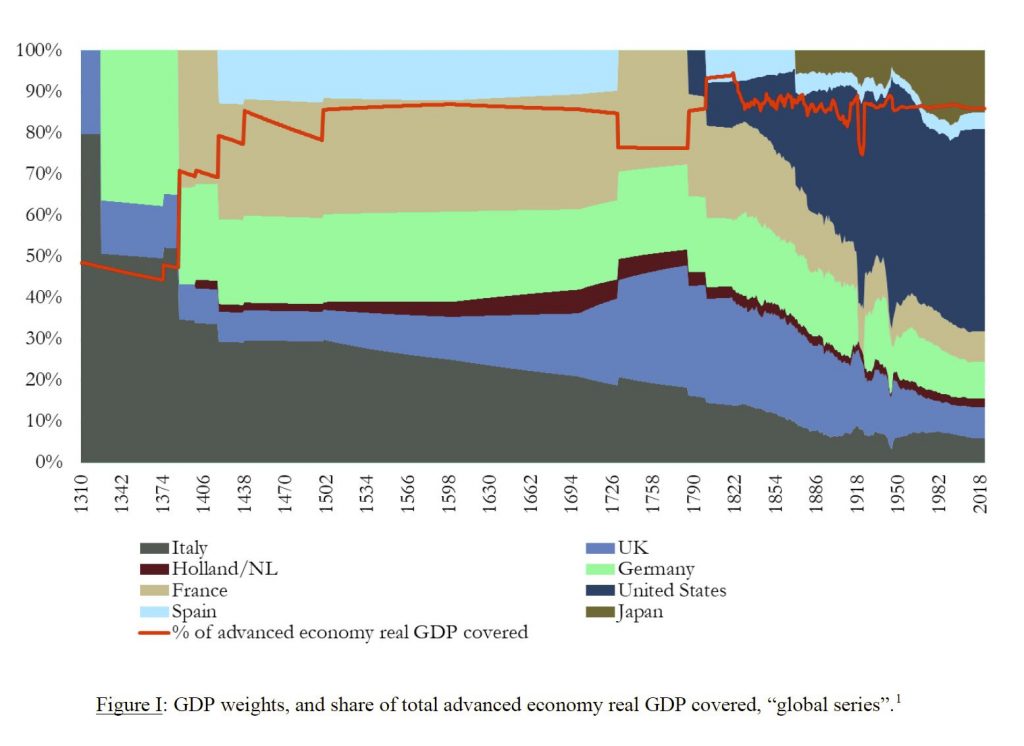

The paper creates a long term global series, weighted by GDP from 1310 to the present day. The series only includes yields which are not contracted short-term, which are not paid in-kind, which are not clearly of an involuntary nature, which are not intra-governmental, and which are made to executive political bodies. In other words, cash lending against annual payments in “chicken” and other commodities, or against leases for offices, against jewellery, land or other real estate with no known equivalent cash value are all excluded.

The GDP weights over time, and the share of advanced economy GDP covered by the series varies as history played out and empires rose and fell.

Data robustness is an issue, as the paper recognises as late medieval and early modern data can of course never be established with the same granularity as modern high-frequency statistics. One still has to rely on interpolations, deal with the peculiarities of early modern finance, and acknowledge that the permanency of wars, disasters, and destitution since medieval times may have irrecoverably destroyed a significant share of the evidence desired. However, the story is pretty clear.

The data here suggests that the “historically implied” safe asset provider long-term real rate stands at 1.56% for the year 2018, which would imply that against the backdrop of inflation targets at 2%, nominal advanced economy rates may no longer rise sustainably above 3.5%. Whatever the precise dominant driver –simply extrapolating such long-term historical trends suggests that negative real rates will not just soon constitute a “new normal” – they will continue to fall constantly. By the late 2020s, global short-term real rates will have reached permanently negative territory. By the second half of this century, global long-term real rates will have followed.

The standard deviation of the real rate – its “volatility” – meanwhile, has shown similar properties over the last 500 years: fluctuations in benchmark real rates are steadily declining, implying that rate levels are set to become both lower, and stickier. But downward-trending absolute levels, and declining volatilities have persisted against a backdrop of a secularly growing importance of public and monetary balance sheets. This would suggest that expansionary monetary and fiscal policy responses designed to raise real interest rates from current levels may at best have a cyclical effect in the longer-term context.

According to the report, another trend has coincided with falling interest rates: declining bond yields. Since the 1300s, global nominal bonds yields have dropped from over 14% to around 2%.

He concludes:

I sought to suggest that a long-term reconstruction of real rate developments points towards key revisions concerning at least two major current debates directly based on – or deriving from – the narrative about long-term capital returns.

First, my new data showed that long-term real rates – be it in the form of private debt, non-marketable loans, or the global sovereign “safe asset” – should always have been expected to hit “zero bounds” around the time of the late 20th and early 21st century, if put into long-term historical context.

In fact, a meaningful – and growing – level of long-term real rates should have been expected to record negative levels. There is little unusual about the current low rate environment which the “secular stagnation” narrative attempts to display as an unusual aberration, linked to equally unusual trend-breaks in savings-investment balances, or productivity measures. To extent that such literature then posits particular policy remedies to address such alleged phenomena, it is found to be fully misleading: the trend fall in real rates has coincided with a steady long-run uptick in public fiscal activity; and it has persisted across a variety of monetary regimes: fiat- and non-fiat, with and without the existence of public monetary institutions.

Secondly, sovereign long-term real rates have been placed into context to other key components of “nonhuman wealth returns” over the (very) long run, including private debt, and real land returns, together with a suggestion that fixed income-linked wealth has historically assumed a meaningful share of private wealth. There is a very high probability, therefore, to suggest that “non-human wealth” returns have by no means been “virtually stable”, only if business investments have both shown an extreme increase in real returns, and an extreme increase in their total wealth share, could the framework be saved.

If compared to real income growth dynamics we equally detect a downward trend across all assets covered in the above discussion.

There is no reason, therefore, to expect rates to “plateau”, to suggest that “the global neutral rate may settle at around 1% over the medium to long run”, or to proclaim that “forecasts that the real rate will remain stuck at or below zero appear unwarranted” as some have suggested.

With regards to policy, very low real rates can be expected to become a permanent and protracted monetary policy problem – but my evidence still does not support those that see an eventual return to “normalized” levels however defined, who contemplate a “nadir” in global real rates in the 2020s): the long-term historical data suggests that, whatever the ultimate driver, or combination of drivers, the forces responsible have been indifferent to monetary or political regimes; they have kept exercising their pull on interest rate levels irrespective of the existence of central banks, (de jure) usury laws, or permanently higher public expenditures. They persisted in what amounted to early modern patrician plutocracies, as well as in modern democratic environments, in periods of low-level feudal Condottieri battles, and in those of professional, mechanized mass warfare.

In the end, then, it was the contemporaries of Jacques Coeur and Konrad von Weinsberg – not those in the financial centres of the 21st century – who had every reason to sound dire predictions about an “endless inegalitarian spiral”. And it was the Welser in early 16th century Nuremberg, or the Strozzi of Florence in the same period, who could have filled their business diaries with reports on the unprecedented “secular stagnation” environment of their days. That they did not do so serves not necessarily to illustrate their lack of economic-theoretical acumen: it should rather put doubt on the meaningfulness of some of today’s concepts.

So negative rates are coming and are here to stay!

The government has released the draft legislation implementing 22 recommendations and two additional commitments which arose from the Hayne Royal Commission, including recommendations 1.6 and 2.7 which establish a compulsory scheme for checking references for prospective financial advisors and mortgage brokers. Via Australian Broker.

Before the royal commission began, under ASIC’s Regulatory Guide 104, both Australian financial services licensees and Australian credit licensees were meant to undertake appropriate background checks before appointing new representatives, through referee reports, searches of ASIC’s register of banned and disqualified persons or police checks.

However, despite this requirement’s existence, the royal commission found financial services licensees weren’t doing enough to communicate the backgrounds of prospective employees among themselves, highlighting that licensees “frequently fail to respond adequately to requests for references regarding their previous employees” and that they do not “always take the information they receive seriously enough”.

As such, financial advisers facing disciplinary action from an employer were able to simply leave and find another to employ them.

Recommendation 1.6 and 2.7 seek to address this systemic weakness.

The latter looks to promote better information sharing about the performance history of financial advisers, focusing on compliance, risk management and advice quality, while the former made sure this change is extended to mortgage brokers as well.

According to the draft legislation, the reporting obligation “targets misconduct by and serious compliance concerns about individual mortgage brokers” and “recognises that in the industry, other parties such as lenders and aggregators are often well positioned to identify this misconduct”.

Obligation to undertake reference checking and information sharing

New law: Both Australian financial services licensees and Australian credit licensees are subject to a specific obligation to undertake reference checking and information sharing regarding a former, current or prospective employee.

Current law: Australian financial services licensees are subject to general obligations, including taking reasonable steps to ensure its representatives comply with the financial services laws and credit legislation.

Civil penalty for failure to undertake reference checking and information sharing

New law: Australian financial services licensees and credit licensees who fail to undertake reference checking and information sharing regarding a prospective employee are subject to a civil penalty.

Current law: No equivalent.

The proposed legislation will be in consultation until 28 February, with interested parties invited to make a submission before the deadline.

We look at the latest from the RBA in the light of current international issues.

https://www.rba.gov.au/media-releases/2020/mr-20-01.html

At its meeting today, the Board decided to leave the cash rate unchanged at 0.75 per cent.

The outlook for the global economy remains reasonable. There have been signs that the slowdown in global growth that started in 2018 is coming to an end. Global growth is expected to be a little stronger this year and next than it was last year and inflation remains low almost everywhere. One continuing source of uncertainty, despite recent progress, is the trade and technology dispute between the US and China, which has affected international trade flows and investment. Another source of uncertainty is the coronavirus, which is having a significant effect on the Chinese economy at present. It is too early to determine how long-lasting the impact will be.

Interest rates are very low around the world and a number of central banks eased monetary policy over the second half of last year. There is an expectation of a little further monetary easing in some economies. Long-term government bond yields are around record lows in many countries, including Australia. Borrowing rates for both businesses and households are at historically low levels. The Australian dollar is around its lowest level over recent times.

The central scenario is for the Australian economy to grow by around 2¾ per cent this year and 3 per cent next year, which would be a step up from the growth rates over the past two years. In the short term, the bushfires and the coronavirus outbreak will temporarily weigh on domestic growth. The household sector has been adjusting to a protracted period of slow wages growth and, last year, to a decline in housing prices, with the result that consumption has been quite weak. Following this period of balance-sheet adjustment, consumption growth is expected to pick up gradually. The overall outlook is also being supported by the low level of interest rates, recent tax refunds, ongoing spending on infrastructure, a brighter outlook for the resources sector and, later this year, an expected recovery in residential construction.

The unemployment rate declined in December to 5.1 per cent. It is expected to remain around this level for some time, before gradually declining to a little below 5 per cent in 2021. Wages growth is subdued and is expected to remain at around its current rate for some time yet. A further gradual lift in wages growth would be a welcome development and is needed for inflation to be sustainably within the 2–3 per cent target range. Taken together, recent outcomes suggest that the Australian economy can sustain lower rates of unemployment and underemployment.

Inflation remains low and stable. Over 2019, CPI inflation was 1.8 per cent and underlying inflation was a little lower than this. The central scenario is for CPI inflation to be around 2 per cent in the near term and to fluctuate around that rate over the next couple of years. In underlying terms, inflation is expected to increase gradually to 2 per cent over the next couple of years.

There are continuing signs of a pick-up in established housing markets. This is especially so in Sydney and Melbourne, but prices in some other markets have also increased. Mortgage loan commitments have also picked up, although demand for credit by investors remains subdued. Mortgage rates are at record lows and there is strong competition for borrowers of high credit quality. Credit conditions for small and medium-sized businesses remain tight.

The easing of monetary policy last year is supporting employment and income growth in Australia and a return of inflation to the medium-term target range. The lower cash rate has put downward pressure on the exchange rate, which is supporting activity across a range of industries. Lower interest rates have assisted with the process of household balance sheet adjustment. They have also boosted asset prices, which in time should lead to increased spending, including on residential construction. Progress is expected towards the inflation target and towards full employment, but that progress is expected to remain gradual.

With interest rates having already been reduced to a very low level and recognising the long and variable lags in the transmission of monetary policy, the Board decided to hold the cash rate steady at this meeting. Due to both global and domestic factors, it is reasonable to expect that an extended period of low interest rates will be required in Australia to reach full employment and achieve the inflation target. The Board will continue to monitor developments carefully, including in the labour market. It remains prepared to ease monetary policy further if needed to support sustainable growth in the economy, full employment and the achievement of the inflation target over time.