I discuss the report with Chris Bates, mortgage broker and financial planner – he is not impressed!

Chris can be found at www.wealthful.com.au & www.theelephantintheroom.com.au plus via LinkedIn: https://www.linkedin.com/in/christopherbates

"Intelligent Insight"

I discuss the report with Chris Bates, mortgage broker and financial planner – he is not impressed!

Chris can be found at www.wealthful.com.au & www.theelephantintheroom.com.au plus via LinkedIn: https://www.linkedin.com/in/christopherbates

At its meeting today, the Board decided to leave the cash rate unchanged at 1.50 per cent.

I think they are living in a parallel universe!

The global economy grew above trend in 2018, although it slowed in the second half of the year. Unemployment rates in most advanced economies are low. The outlook for global growth remains reasonable, although downside risks have increased. The trade tensions are affecting global trade and some investment decisions. Growth in the Chinese economy has continued to slow, with the authorities easing policy while continuing to pay close attention to the risks in the financial sector. Globally, headline inflation rates have moved lower due to the decline in oil prices, although core inflation has picked up in a number of economies.

Financial conditions in the advanced economies tightened in late 2018, but remain accommodative. Equity prices declined and credit spreads increased, but these moves have since been partly reversed. Market participants no longer expect a further tightening of monetary policy in the United States. Government bond yields have declined in most countries, including Australia. The Australian dollar has remained within the narrow range of recent times. The terms of trade have increased over the past couple of years, but are expected to decline over time.

The central scenario is for the Australian economy to grow by around 3 per cent this year and by a little less in 2020 due to slower growth in exports of resources. The growth outlook is being supported by rising business investment and higher levels of spending on public infrastructure. As is the case globally, some downside risks have increased. GDP growth in the September quarter was weaker than expected. This was largely due to slow growth in household consumption and income, although the consumption data have been volatile and subject to revision over recent quarters. Growth in household income has been low over recent years, but is expected to pick up and support household spending. The main domestic uncertainty remains around the outlook for household spending and the effect of falling housing prices in some cities.

The housing markets in Sydney and Melbourne are going through a period of adjustment, after an earlier large run-up in prices. Conditions have weakened further in both markets and rent inflation remains low. Credit conditions for some borrowers are tighter than they have been. At the same time, the demand for credit by investors in the housing market has slowed noticeably as the dynamics of the housing market have changed. Growth in credit extended to owner-occupiers has eased to an annualised pace of 5½ per cent. Mortgage rates remain low and there is strong competition for borrowers of high credit quality.

The labour market remains strong, with the unemployment rate at 5 per cent. A further decline in the unemployment rate to 4¾ per cent is expected over the next couple of years. The vacancy rate is high and there are reports of skills shortages in some areas. The stronger labour market has led to some pick-up in wages growth, which is a welcome development. The improvement in the labour market should see some further lift in wages growth over time, although this is still expected to be a gradual process.

Inflation remains low and stable. Over 2018, CPI inflation was 1.8 per cent and in underlying terms inflation was 1¾ per cent. Underlying inflation is expected to pick up over the next couple of years, with the pick-up likely to be gradual and to take a little longer than earlier expected. The central scenario is for underlying inflation to be 2 per cent this year and 2¼ per cent in 2020. Headline inflation is expected to decline in the near term because of lower petrol prices.

The low level of interest rates is continuing to support the Australian economy. Further progress in reducing unemployment and having inflation return to target is expected, although this progress is likely to be gradual. Taking account of the available information, the Board judged that holding the stance of monetary policy unchanged at this meeting would be consistent with sustainable growth in the economy and achieving the inflation target over time.

Australian retail turnover fell 0.4 per cent in December 2018, seasonally adjusted, according to the latest Australian Bureau of Statistics (ABS) Retail Trade figures.

This confirms the earlier data, which shows households just do not have the money to spend, (and spent in November to get the discounts).

This follows a 0.5 per cent rise in November 2018.

“Household goods (-2.8 per cent) and Clothing and footwear (-2.4 per cent) led the falls after strong rises in November from Black Friday promotions,” said Ben James, Director of Quarterly Economy Wide Surveys. “There were also falls in Department stores (-1.1 per cent) and Other retailing (-0.1 per cent).”

The falls were partially offset by rises in Food retailing (0.5 per cent) and Cafes, restaurants and takeaway food services (1.1 per cent).

In seasonally adjusted terms, there were falls in New South Wales (-0.6 per cent), Victoria (-0.5 per cent), the Australian Capital Territory (-1.8 per cent), Queensland (-0.1 per cent), South Australia (-0.3 per cent), the Northern Territory (-0.3 per cent), and Tasmania (-0.2 per cent.). The only state to have a rise in December 2018 was Western Australia (0.1 per cent).

Online retail turnover contributed 5.6 per cent to total retail turnover in original terms in December 2018, down from 6.6 per cent in November 2018, highlighting the increasing importance of the November month for online sales. In December 2017 online retail turnover contributed 4.8 per cent to total retail.

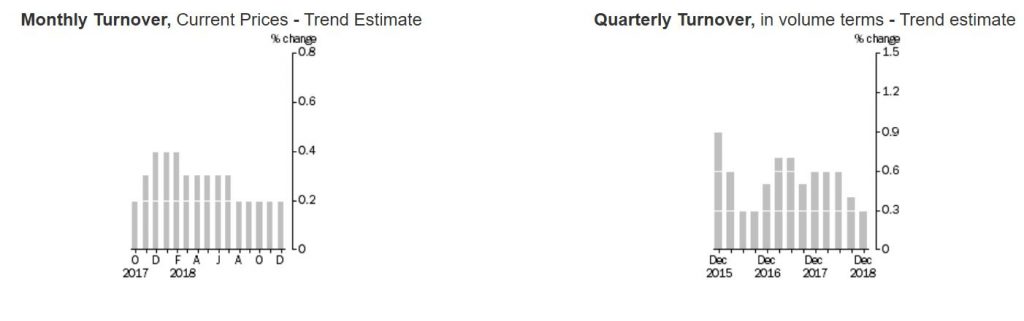

The trend estimate for Australian retail turnover rose 0.2 per cent in December 2018, following a rise of 0.2 per cent in November 2018. Compared to December 2017, the trend estimate rose 3.2 per cent.

For the December quarter 2018, there was a 0.1 per cent rise in seasonally adjusted volume terms. This follows a rise of 0.2 per cent in the September quarter 2018. The quarterly rise in volumes was led by Clothing and footwear (2.7 per cent), and Department stores (0.7 per cent). Food retailing (-0.2 per cent), Other retailing (-0.5 per cent), Cafes, restaurants and takeaway food services (-0.5 per cent), and Household goods (-0.3 per cent) fell in seasonally adjusted volume terms.

Every 10 to 15 years it’s the same.

Ever since financial deregulation in the 1980s we’ve had a finance industry scandal followed by an inquiry, a quick fix, and a declaration that it shouldn’t happen again.

In the early 1990s there were royal commissions into the A$1.7 billion Tri-continental/ State Bank Victoria collapse, the A$3.1 billion State Bank of South Australia collapse and the WA Inc collapse which explored the interrelated activities at Rothwells bank, the A$1.8 billion collapse of Bond Corporation and the A$1.2 billion siphoned from Bell Resources.

A decade later in 2003 Justice Owen reported on the A$5.3 billion collapse of Australia’s largest insurer HIH.

And now, bang on schedule, we have Kenneth Hayne delivering the final report of a royal commission into systemic misconduct in banking, superannuation and financial services industry to a government that voted 26 times against holding it.

There are two particularly striking things about the 10-15 year cycle.

One is the rhythm of public inquiries followed by reports, then (sometimes) trials, then books, then almost everyone forgetting (except for those personally scarred) only for problems to resurface later.

The other is that the times between have been punctuated by government-commissioned banking and financial system reviews: the 1991 Campbell Inauiry, the 1996 Wallis Inquiry, the 2010 Cooper superannuation review and the 2012 Murray Review . Each either missed or downplayed the links between poor governance, industry structure, systemic misconduct and prudential risk.

Commissioner Kenneth Hayne’s 1000-page final report hasn’t gone far enough to end this cycle.

While his referral of 24 misdeeds for possible criminal and civil prosecution will help in righting past wrongs and perhaps focus the minds of directors and executives, the impact will be generational rather than permanent.

The flurry of prosecutions and actions will again reveal problems with the law – gaps in coverage, inadequate penalties and cases the law won’t allow to stand up.

Taken together the recommendations are a patchwork of measures that if implemented will over time be eaten away – and at some point will be dismantled – because the rationale for their adoption will be forgotten.

Even before they are implemented they will have to run the gauntlet of a massive subterranean lobbying effort from industry to water them down, something Hayne indicated he expected.

Even though Hayne emphasises the link between systemic misconduct, governance, structure and prudential (system-wide) risk, something that Treasury, the RBA and Australia’s three business regulator amigos, APRA, ASIC and the ACCC, have long rejected, he makes no concrete suggestions to tackle it.

As we have written previously, research tells us big systemically important shareholder-focused universal for-profit banks that cross-sell products are more profitable than smaller banks in the good times but are more prone to misconduct and to failure in the worse times.

Australia’s big four fit the bill – they’re big, they have been vertically integrated one-stop shops, they are very, very profitable and they are very focused on shareholder returns.

While the banks, apart from Westpac, have divested themselves of wealth management and insurance arms for now there is nothing stopping them reacquiring them in the future.

This means we are once again 10 or 15 years away from systemic misconduct resurfacing as big banks seek to become more profitable.

While heads might roll in yet another round of internal investigations to fix bank culture, it is wise to remember that as Adele Ferguson observed ANZ’s internal investigation of the Opes Prime collapse left the bigger governance lessons “unlearned”.

Directors and senior executives of failed companies continue to live charmed lives.

The directors of Babcock and Brown were cheered as they left the building, while friends and family of the disgraced One.Tel director Jodee Rich have resurfaced at Hayne and other public inquiries.

Some of the One.Tel directors have had long corporate careers. The former chair at of the collapsed Allco Finance Group Bob Mansfield went on to review the ABC.

As Adam Schwab bluntly put it, “corporate Australia is nothing if not forgiving”.

Hayne is persisting with a chasing bolting horses approach to misconduct that relies on detection and enforcement.

We have argued this approach is just not as a effective as other alternatives such as two-tier boards and employee directors which have a better track record of keeping stable doors closed and horses tethered.

Without them we could very easily have another crisis and another royal commission in 15 to 15 years time.

Ireland has taken a been prepared to change corporate structures. After the meltdown of its financial system triggered by the end of a “classic vanilla property boom” its parliament legislated to appoint public interest directors to the boards of its failed banks.

These changes were designed to ensure banks directors put the public interest first, ahead of shareholders interests and even customers interests.

It’s beyond time we did it here.

Authors: Andrew Linden, Sessional Lecturer, PhD (Management) Candidate, School of Management, RMIT University; Warren Staples,

Warren Staples

Senior Lecturer in Management, RMIT University

As the dust settles following the final Royal Commission Report, its clear that the recommendations have carefully avoided the root cause of the wells of pain which the hearings revealed. In fact the force of evidence from those hearings will be what sits in the memory, not the final report. Perhaps some of this was created by the carefully crafted terms of reference, which made it hard for the Commission to get to root causes; perhaps deliberately?

The report puts the onus on financial institutions and boards to change the culture. Good luck with that, on past experience. Especially if bonus payments are a critical part of remuneration.

Criminal proceedings may follow, and more than 20 institutions are there, but these now are referred back to the very regulators who were found wanting in the first place. And cases though the courts will take years. Will any bankers actually cope it for their illegal behaviour – we doubt it. NAB appears to have been called out for special mention.

ASIC and APRA clearly failed in their respective (if confused) roles and getting greater clarity via a super-regulator may help. But I am not sure the twin peaks model works nor are the regulators sufficiently resourced; and the big missing in action figure is the RBA, who leads the Council of Financial Regulators, along side the Treasury. They drove the debt bubble, and the banks responded. This whole structure is complex, opaque and can be gamed. In the new world, ASIC it seems will have clearer leadership in terms of legal compliance; good luck with that!

Removing commissions from Mortgage Brokers (over time) makes sense as it is clearly a case of conflicted remuneration. And pushing towards a unified best interests duty across mortgage and financial advice makes sense. I still do not know why we have put up with two regimes for so long, it was an accident of history which ASIC should have addressed.

Anti-hawking rules for insurance and superannuation makes sense and should always have been there. SME’s need more protection than they have, but this was not recommended.

The BEAR regime, is centred around compliance, and its extension to insurance and wealth management helps, a little. But the basis of assessment remains narrow and is thus incomplete.

And the big question, which was hooked into the long grass, was structural separation, between product sales and manufacturer; and advice. This to me is a root cause of the conflicts and bad behaviour. Hayne says:

Enforced separation of product and advice would be a very large step to take. It would be both costly and disruptive. I cannot say that the benefits of requiring separation would outweigh the costs, and the Productivity Commission concluded that ‘forced structural separation is not likely to prove an effective regulatory response to competition concerns in the financial system’.

I observe, however, that the Productivity Commission recommended, and I agree, that commencing in 2019, the Australian Competition and Consumer Commission (the ACCC) ‘should undertake 5 yearly market studies on the effect of vertical and horizontal integration in the financial system’.

I am not persuaded that it is necessary to mandate structural separation between product and advice.

Now some entities have already jettisoned wealth management businesses for example, but consumers may well still face inherent and undisclosed conflicts. Our large opaque integrated financial services players remain just that.

Thus bankers can issue a sigh with relief, despite the estimated $6 billion + and counting remediation bill. And I do not see anything here to reverse the tighter lending standards which are now rightly in force, so expect mortgage growth, and home prices to slide further.

But the once in a generation opportunity to fundamentally reform the financial system has been missed, I am afraid, and as a result consumers will continue to pay more than they should for their financial services, big players will still dominate, and regulators will remain pussycats. Not a good outcome in my view.

We will see the Polys mouth words about “consumer trust and protection”, yet in practice do very little. I have a diary card for 5 years from now, for the next review, and one 5 years after that.

On the day the final report is published, we discus the main recommendations.

The final report from the Banking Royal Commission has been released, and it makes interesting reading. Here is a brief summary of the 950 pages. More to follow.

At the high level, the greed driven attitudes of the industry are highlighted as leading to the poor practice and illegal behaviour. This was driven by high pressure sales tactics. As a result the community trust in the financial sector has been lost. Change is needed – and culture of the entities and their boards are at the heart of it.

Consumers must be treated honestly and fairly.

The Treasurer says it was a scathing assessment driven by greed and poor behaviour. The price paid was financial, but also hitting people directly. Trust needs to be restored, whilst keeping competition, and the flow of credit.

Consumers will benefit from better protection. It will raise accountability and governance, enhance regulation, and provide for effective remediation.

It does not remove the twin peaks model, (APRA and ASIC).

More than 20 referrals to the regulators for criminal charges. No individuals were named.

The report has 76 Recommendations covering a wide range of issues. The Government says its will “take action” on them all. (Does not mean full implementation).

Of note is the establishment of a new super regulator to sit across APRA and ASIC to gauge their effectiveness and clarify roles and responsibilities. The Federal Court will have extra responses to progress the referrals.

Mortgage brokers will have a best interests duty and trailing commission will be banned in due course (July 2020). In addition there is a recommendation to move to fee for service paid by customers though the Government is slowing any such change (a 3 year review in the view of the impact of competition).

There will be one account for new superannuation savers and fees to be banned from My Super accounts. Changes to the add on to insurance via a cooling off period.

A Compensation scheme of last resort.

Expansion of the BEAR cultural framework.

No changes to responsible lending – its all about policing and compliance.

Nothing on structural separation, or horizontal or vertical integration. So the industry structure remains untouched.

The legislative response seems muted, and delayed to kick the burden down the track, after the election.

So my take is some progress, but not as much as perhaps many will wish for….

A quick review of the DFA contribution to 60 Minutes aired last night.

We covered the issues of home price falls, negative equity and property construction standards.

See our more detailed post on negative equity.

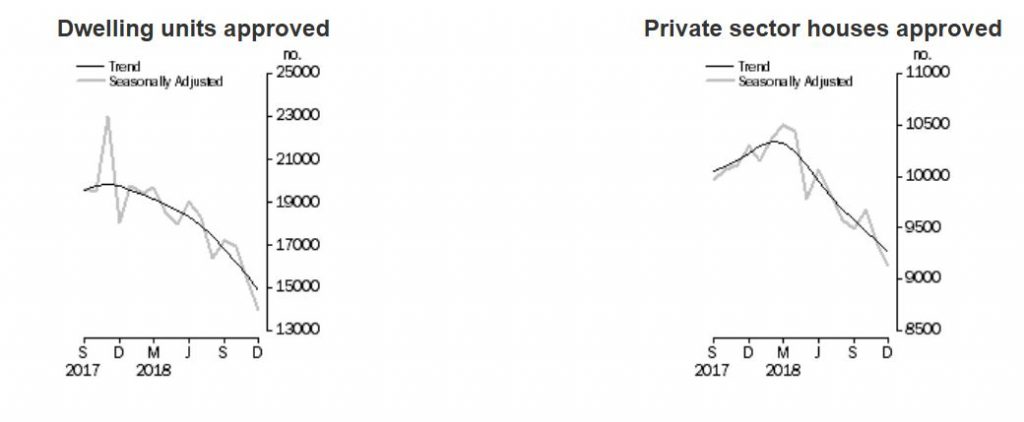

The number of dwellings approved in Australia fell by 4.1 per cent in December 2018, in trend terms, according to data released by the Australian Bureau of Statistics (ABS) today.

“The trend for the total dwelling approvals series has continued to decline over the past year,” said Daniel Rossi, Director of Construction Statistics at the ABS. “The series is now at its lowest level since June 2013.”

The decrease in December was driven by private sector dwellings excluding houses (e.g. townhouses and apartments), which fell 8.5 per cent. Private sector houses also declined, by 1.1 per cent.

Among the states and territories, dwelling approvals fell in December in the Australian Capital Territory (21.3 per cent), Queensland (6.5 per cent), New South Wales (5.0 per cent), Western Australia (3.8 per cent), South Australia (1.5 per cent) and Victoria (1.4 per cent) in trend terms. The Northern Territory (1.7 per cent) and Tasmania (1.1 per cent) recorded increases.

Approvals for private sector houses fell 1.1 per cent in December in trend terms. Queensland (3.6 per cent), New South Wales (1.6 per cent) and Western Australia (0.6 per cent) declined, while increases were recorded in South Australia (0.6 per cent) and Victoria (0.2 per cent).

In seasonally adjusted terms, total dwellings fell by 8.4 per cent in December, driven by a 18.8 per cent decrease in private dwellings excluding houses. Private houses also fell 2.2 per cent.

The value of total building approved fell 1.5 per cent in December, in trend terms, and has fallen for the past 13 months. The value of residential building fell 2.6 per cent, while non-residential building rose 0.2 per cent.

ASIC says Commonwealth Financial Planning Limited (CFPL) has failed to provide ASIC with an attestation and with an acceptable Final Report from the independent expert, both of which were required under a Court Enforceable Undertaking (EU) entered into with ASIC in April 2018 in relation to CFPL’s fees for no service conduct.

As a result, CFPL is now required under the EU to immediately take all necessary steps to:

The EU, which commenced on 9 April 2018 and was varied on 20 December 2018, required CFPL to provide to ASIC by 31 January 2019:

On 31 January 2019, Ernst & Young issued its second report under the EU, identifying further concerns regarding CFPL’s remediation program and its compliance systems and processes – including that there remains ‘a heavy reliance’on manual controls, which ‘have a higher inherent risk of failure due to human error or being overridden’. Ernst & Young recommended CFPL address these issues within a further 120 days.

On the same day, CBA’s accountable person provided a written update to ASIC on the remediation program and work being done in relation to CFPL’s systems, processes and controls. Having regard to the concerns raised by the independent expert and the contents of CBA’s written update, ASIC considered that the notification did not meet ASIC’s requirements under the EU for an acceptable attestation.

As a result, ASIC’s requirement under the EU that CFPL stop charging or receiving ongoing service fees and not enter into any new ongoing service arrangements, has been triggered. ASIC included this requirement in the EU to ensure that if CFPL were not able to satisfy ASIC that the fees for no service conduct would not be repeated, CFPL would have to stop charging ongoing service fees so as to significantly reduce any further risk to clients. Existing clients will continue to receive services under their ongoing service agreements but will not be charged by CFPL.

ASIC has received CFPL’s confirmation that it is complying with this requirement to stop entering into new ongoing service agreements and to cease charging existing clients fees under these agreements. This requirement will continue until CFPL is able to satisfy ASIC that all of the outstanding issues have been remedied. ASIC will be monitoring CFPL’s compliance with this obligation.

ASIC has also been informed by CFPL that it is now in the process of transitioning its ongoing service model to one whereby customers are only charged fees after the relevant services have been provided. ASIC will monitor CFPL’s transition to the new model.

Under CFPL’s remediation program overseen by ASIC, CFPL has to date reported to ASIC that it has paid approximately $119 million to customers impacted by its fees for no service conduct.