The employment and wage data from the ABS last week was not flash, with job growth momentum easing, unemployment higher and wages growth continuing at glacial speed.

So its worth asking what is really going on under the hood. To do that we have looked at ABS data over the last decade to drill into the detail. And frankly its not pretty.

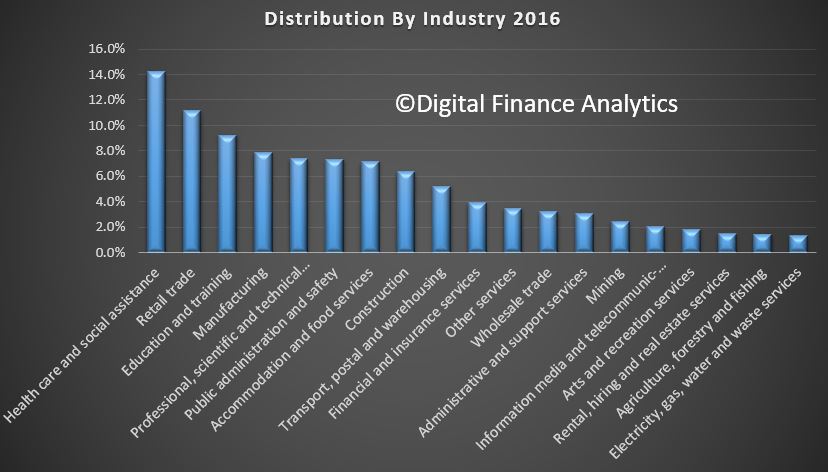

First we looked at employment across the industry sectors. Health care leads the way now at 14.2%, in terms of the number of people employed, followed by retail at 11.1%, education and training at 9.2% and manufacturing at 7.9%. For comparison purposes, about 12 % of the U.S. workforce is employed in the health care sector.

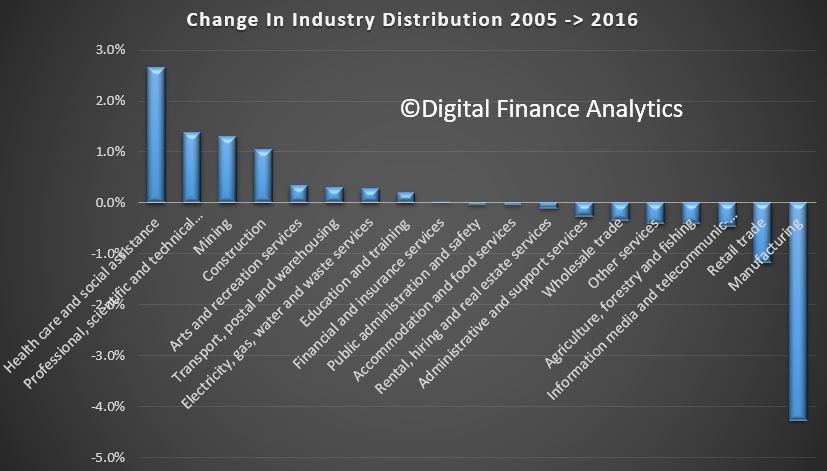

Then we compared the relative distribution by industry groups now, and back in 2005. Over that decade or so there has been a considerable shift in industry distribution.

Then we compared the relative distribution by industry groups now, and back in 2005. Over that decade or so there has been a considerable shift in industry distribution.

The fastest growing sector in Health care, which have expanded relatively by 2.7%. The next largest growth sector was Professional and Technical Services at 1.4% and Mining at 1.3%. Construction grew relatively by 1.1%. At the other end of the spectrum, Manufacturing fell by a massive 4.3%, followed by Retail down 1.2% and information technology and media down 0.5%.

Or in other words, relativity more people are working in the health care sector than a decade ago. Drilling further into the data we also see a significant rise in the number of females working in this sector, as well as significant growth in part-time employment in the sector.

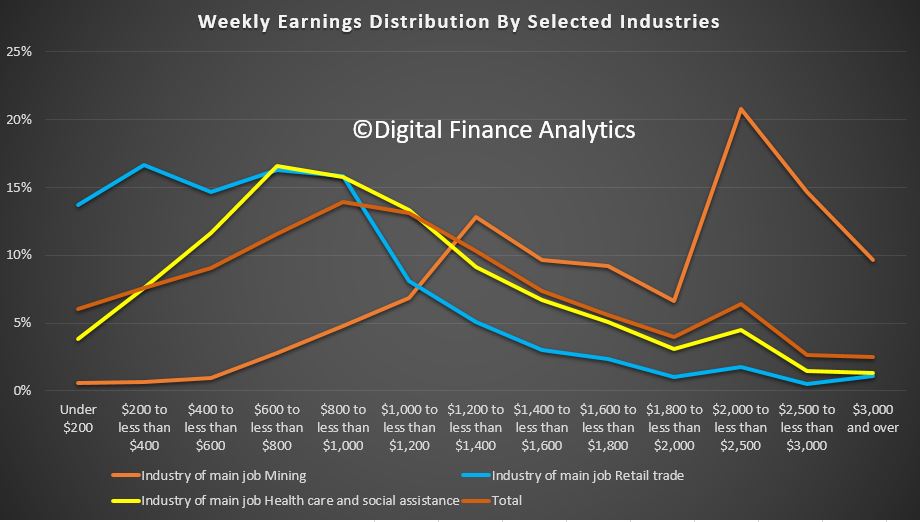

The final piece of analysis looks at relative weekly income across specific industry sectors. More than half of all people working in retail earn less than $600 a week. More than half of people in the healthcare sector earn less than $800 a week. Half the average of all industry sectors earns less than $1,000 a week, whilst half of those in the resource and mining sector earn more than $1,800 a week. So Retail and Health care sectors are intrinsically low paid.

The final piece of analysis looks at relative weekly income across specific industry sectors. More than half of all people working in retail earn less than $600 a week. More than half of people in the healthcare sector earn less than $800 a week. Half the average of all industry sectors earns less than $1,000 a week, whilst half of those in the resource and mining sector earn more than $1,800 a week. So Retail and Health care sectors are intrinsically low paid.

Now lets put that together. All this goes some way to explain the shifts in employment and income. The health care sector has been an important generator of jobs in recent years, and health care is expected to continue to expand employment in coming years, but the jobs will continue to shift to low-paying support occupations reflecting changing demographics and greater demand. About 40 percent of the sector’s workers are not directly involved in treating a patient; instead, they work in jobs such as office or administrative work and food preparation. Others are working in health support occupations like home care and personal assistance. These jobs are paid significant less than care practitioners.

Now lets put that together. All this goes some way to explain the shifts in employment and income. The health care sector has been an important generator of jobs in recent years, and health care is expected to continue to expand employment in coming years, but the jobs will continue to shift to low-paying support occupations reflecting changing demographics and greater demand. About 40 percent of the sector’s workers are not directly involved in treating a patient; instead, they work in jobs such as office or administrative work and food preparation. Others are working in health support occupations like home care and personal assistance. These jobs are paid significant less than care practitioners.

But, the health care sector is more labour intensive than other sectors, such as manufacturing, and this translates into a relatively lower share of output. So growth in health care does not guarantee broad-based prosperity because beyond the high pay of health care practitioners, the health care jobs in highest demand pay lower-than-average wages.

In fact the truth is the growth in jobs are in sectors which are service industries, and these to not really create new value, they simply circulate money in the system , perhaps from superannuation savings to pay for medical care.

Thus the growth in jobs in not assisting overall economic growth, and the lower average wages is depressing overall wage growth. Workers in the health care sector are also less likely to press hard for pay rises.

So the bottom line is we have a structural problem in the economy, where more people are doing important work helping those needing health care assistance, but the overall economic contribution impact is net negative, hence the low GDP growth and wages growth. Or in other words, more jobs are not necessarily good or well paid jobs. And that’s a structural problem, given the current demographic shifts. Welcome to the bed pan economy.