The Treasury memo showed the Labor policy of limiting negative gearing to existing homeowners will have a limited impact as the changes are unlikely to encourage investors to sell quickly. Also, owner-occupiers dominate the housing market and the costs of selling are high.

However, this assumes that people are forward-looking, well-informed, good with numbers and perfectly responsive to new information. Behavioural economics shows us that people do not always think so deeply and logically about their choices.

How any changes to negative gearing are sold to us – as a loss or gain, as a one-off or ongoing, in terms of short versus long term costs and benefits – will impact how Australians react.

Most of us aren’t whizzes with mathematics. As Nobel prize winner Herbert Simon has shown, in place of complex mathematical algorithms we use heuristics. These are simple rules of thumb that draw on our intuitions, experience and gut feel.

Heuristics and biases

One common example of a heuristic is the availability heuristic. This is when we make decisions based on easily available information such as recent events and highly emotive experiences. Our brains work better with narratives and stories than with facts and figures.

Nobel economics laureates George Akerlof and Robert Shiller have applied a similar insight to analyse people’s perceptions of housing market fluctuations. They noted that we hear lots of stories about how house prices are on an upward trend. Via the availability heuristic, we easily remember these emotionally engaging stories, much better than we can remember the dry facts about the history of house price instability and housing market crashes.

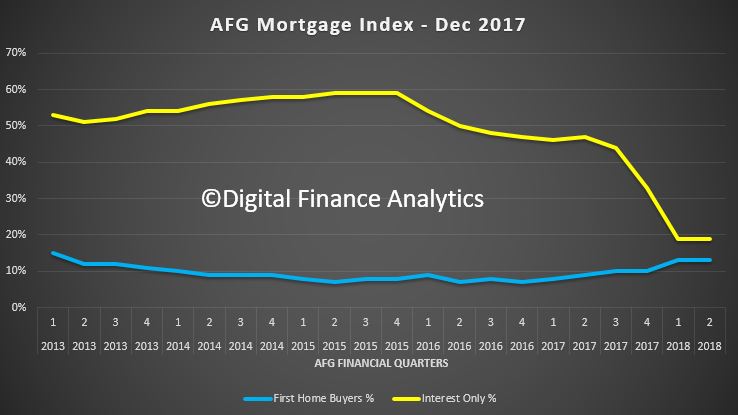

This leads us to overestimate the chances of continuing house price rises, and to underestimate the chances of a fall, driving unsustainable house price increases – as witnessed, for example, in the American sub-prime property markets before the global financial crisis.

While heuristics can help us to decide quickly, they sometimes lead us into systematic mistakes – “behavioural biases”. This does not mean that we’re all hopelessly irrational. But for negative gearing it matters how a potential change is framed, and how that fits into our heuristics and biases.

Most economists (including those at Treasury) assume that one dollar is a perfect substitute for any other dollar. Whether we save A$100 via a tax break, win A$100 from a scratch card or earn A$100 from working overtime, it makes no difference.

Contrary to this view, behavioural economics has shown that the way we treat money is different depending on the contexts in which we earn and spend it. We have different “mental accounts” for consumption, wealth, regular income and windfalls. We are more likely to splurge money we’ve won from a scratch card than money we’ve earnt doing overtime.

This is another reason why framing is important. How the government frames a negative gearing change will determine the mental account to which we assign it, and therefore how we respond.

If negative gearing changes are considered a one-off hit – the opposite of a scratch card windfall – then property owners won’t worry so much. On the other hand, if the change to negative gearing is seen as an ongoing drain on our incomes, then they will worry a lot.

Another factor that will come into play is loss aversion – people are much more likely to worry about losses than gains. Evidence from behavioural experiments shows that home-owners over-estimate the value of their properties. This makes them reluctant to sell at reduced prices in a falling market.

It also means that Australians will resist negative gearing changes if these are framed as a loss, creating political pressures for a policy u-turn. It is difficult to predict how people might respond, but behavioural economics shows that any ructions might be avoided if the negative gearing change is framed as a gain.

For instance, Treasury predicts that the additional revenue raised from restricting negative gearing could be up to A$3.9 billion. Therefore, the negative gearing changes could cover more than 80% of federal government expenditure on veterans and their families.

In the long and short term

Treasury’s modelling notes there might be downward pressure on house prices in the short term from changing negative gearing, but that this will be small overall.

But a range of models and experiments have shown that people are disproportionately focused on tangible, short-term outcomes. For example, most of us find it hard to persuade ourselves to go the gym: the short-term costs are inconvenience and discomfort and the benefits seem intangible and distant. This is called “present bias”.

Recent work in behavioural economics confirms that framing (alongside a range of other socio-psychological influences) has a strong impact on our choices. Framing will determine how we perceive the policy, which mental account we will use to process it and how the various heuristics and biases identified by economics and psychologists will play out.

In the debates around negative gearing policy changes, these behavioural insights have not been highlighted. So perhaps Treasury could have added some psychology, alongside the economics, in arguing that house price falls are likely to be limited.