SocietyOne, Australia’s consumer marketplace lender, has set new records for lending with growth in 2017 already surpassing the level of volumes for the whole of 2016.

Total lending since the company started operating five years ago has now topped $350 million as the current loan book also reached $200 million for the first time in SocietyOne’s history.

These were new records for a consumer finance marketplace lender in Australia with SocietyOne having originated more than twice the loans than that of the company’s nearest competitor. SocietyOne has now enjoyed seven successive quarters of strong growth as it scales up.

New lending to borrowers in 2017 has so far totalled $141 million, topping the $139 million which was advanced over the course of 2016.

Jason Yetton, CEO and Managing Director of SocietyOne, said: “We have continued to build on the strong momentum achieved in 2016 and have seen sustained year-on-year growth with comparable lending volumes now above the levels achieved for the whole of last year.

“Our growth in 2017 underlines the demand from consumers for a real alternative to the major banks. Consumers are looking for a better deal on their finances and our risk-based pricing is attractive for customers that have demonstrated that they have a good credit history.

“Customers have responded positively to a number of improvements we have delivered over the past year. These have included a strong focus on better service outcomes and speed of loan approvals, increasing the maximum loan amount on personal loans to $50,000 and continued success with our advertising and marketing activities, including the “Make It Happen” campaign that launched in June.

“Our customers are also loving the differentiated service experience that we offer. We have had more than 600 customer reviews on ProductReview.com.au with an average rating of 4.7 out of 5. We also track Net Promoter Scores on our lending and this now stands at +63.”

Of the $350 million of lending to date, $270 million has been advanced to consumer borrowers as personal loans and $80 million to farmers via their agents through SocietyOne’s unique secured livestock lending product.

Launched as a pilot in March 2014, SocietyOne AgriLending is now scaling up and during the third quarter was recognised for its support of Australian cattle and sheep farmers at the 2017 Australian Business Banking Awards by being named as a finalist in the industry specialisation category. The last quarter saw improvements to both the product and the technology platform.

The first three-quarters of 2017 have also seen a record amount of funding made available by investor funders with new mandates secured from existing and new institutions and high net worth individuals. The total number of funders since inception has risen to 320 and committed available funding as at 30 September 2017 stood at $61 million.

SocietyOne enjoys strong support from the customer-owned banking sector with the number of mutual banks and credit unions as funders now numbering 20. Mutual institutions have to date provided $100 million of funding out of the $350 million advanced to borrowers.

As for the outlook, Mr Yetton said the company was looking forward to another strong quarter ahead and welcomed moves by the Federal Government to encourage more competition in the banking sector by legislating for comprehensive credit reporting and open banking.

“With a more dynamic approach to both comprehensive credit reporting and open banking on the horizon, Australians are becoming increasingly aware of the better choices now available,” he said.

“As the undisputed leader in marketplace lending for personal loans, our customers are clearly telling us there are more attractive ways to sort out their finances, whether it is consolidating credit card debt, renovating their homes, buying a car, going on holiday or paying for a wedding.

“I’m also pleased at the way we are getting behind Australian livestock farmers as the growth in SocietyOne AgriLending has shown. The team is standing ready to help them even more so as rural and regional Australia waits for the rains that will kick start the Spring growth and rearing season.”

How Might Increases in the Fed Funds Rate Impact Other Interest Rates?

The Federal Reserve’s main instrument for achieving stable prices and maximum employment is the target for the federal funds rate. The idea is that by affecting the rate at which banks lend to each other overnight, other interest rates may be affected. In turn, this would also affect nominal variables (such as inflation) and real variables (such as output and employment).

In December 2015, the Fed ended seven years of near-zero policy rates. Through a series of increases since then, the target rate has been gradually raised by one percentage point. The current monetary policy outlook, as stated recently by Fed Chair Janet Yellen, is to continue increasing the target rate due to worries that a strong labor market may create inflationary pressures.1

Questions about Rate Increase Impacts

The fed funds rate is thus expected to continue rising in the near future. This would undoubtedly mean that other short-term interest rates will increase in tandem.

But what about long-term interest rates? What would the impact be on those rates that arguably matter the most for real economic activity, such as mortgages rates, Treasury bond yields and corporate bond yields?

The future is always hard to predict, but we can take an educated guess by looking at the recent behavior of short-term and long-term interest rates, and how they move with the fed funds rate.

Impact on Treasury Yields

The figure below displays three key interest rates over a period of 30 years:

- The federal funds rate

- The interest rate on a one-year Treasury bond

- The interest rate on a 10-year Treasury bond

As we can see, the fed funds rate and the one-year Treasury rate track each other very closely. Although it is still debatable whether the Fed leads or follows the market, movements in the policy rate are associated with similar movements in short-term interest rates.2

In contrast, the interest rate on a 10-year Treasury bond does not appear to move as closely with the fed funds rate. While there appears to be some co-movement, the 10-year interest rate appears to follow its own declining path.3

Impact on Mortgage Rates

Is the interest rate on a 10-year Treasury bond representative of long-term interest rates? The next figure compares this rate to the average rate on a 30-year mortgage.

Clearly, the two move very closely together, though there is a difference in level due to the higher risk, lower liquidity and longer term of mortgages. If we were instead to look at other long-term interest rates, such as the average rate on corporate bonds, the results would be similar.

Impact on the Yield Curve

Given that movements in the fed funds rate are closely linked to movements in short-term interest rates, but less so to movements in long-term interest rates, changes in the policy rate are likely to impact the yield curve.4 The next figure compares the fed funds rate with the difference between 10-year and one-year Treasury bond rates.

This difference is meant to represent the yield curve at each moment in time with a single number. Note that there is a strong negative correlation between the fed funds rate and the term premium of Treasury bonds. When the policy rate increases, the spread between one- and 10-year Treasury bonds decreases.

Although it is still too early to tell, this pattern appears to be present in the latest period of interest rate hikes.

Overall Impact of Fed Funds Rate Target Increases

If the past is any evidence, the projected increase in the fed funds rate will successfully raise short-term interest rates but have a limited impact on long-term interest rates. This will imply a reduction in the term premium for bonds and loans.

These observations rely on the Fed not letting inflation stray significantly away from its annual target, which has been set at 2 percent. It is thus likely that, despite the continuing rate hikes, the government, firms and households will all continue to enjoy historically low interest rates on their long-term liabilities.

There is, of course, the possibility that some unforeseen and fundamental change in the economy will drive long-term interest rates up, but this increase would unlikely be driven by monetary policy alone.

Notes and References

1 For example, see Appelbaum, Binyamin. “Janet Yellen Says Fed Plans to Keep Raising Rates,” New York Times, Sept. 26, 2017.

2 The interest rate on a three-month Treasury bond would look even more similar to the fed funds rate.

3 For further analysis on these trends, see Martin, Fernando M. “A Perspective on Nominal Interest Rates,” Economic Synopses, No. 25, 2016.

4 The yield curve plots interest rates as a function of maturity dates.

The Hundred-million Dollar Home Loan Fraud Conspiracy

ASIC says false documents were used for more than 500 loan applications valued at approximately $170 million submitted between about March 2008 and August 2010 to numerous banks and financial institutions.

These included the Commonwealth Bank of Australia, Westpac Banking Corporation, St George Bank, Bankwest, Adelaide Bank, Bank of Queensland, Choice Home Loans, Citibank, National Australia Bank, Pepper Homeloans and Suncorp Bank.

The false documents included bank statements, payslips, citizenship certificates and statutory declarations. These were predominantly used in support of applications for home loans for house and land packages as well as for the purchase or refinance of existing homes.

The sentencing follows an ASIC investigation into Footscray-based finance broking company Myra Home Loans Pty Ltd, which traded as Myra Financial Services (Myra).

Mr Najam Shah, 58, of Victoria, has been sentenced to 5 years jail after pleading guilty to one charge of conspiring to defraud financial institutions. Mr Shah must serve 3 years and 3 months before being eligible for parole.

The charge relates to Mr Shah’s role at Myra and the creation and use of false documents to support loan applications valued at a total of approximately $170 million.

On 13 February 2017, Mr Shah entered the guilty plea during an appearance at the County Court of Victoria. Mr Shah’s plea followed his arrest and charge in January 2015. By pleading guilty, Mr Shah admitted to conspiring to defraud financial institutions.

In sentencing Mr Shah, Judge Gucciardo noted that mortgage fraud of this nature damages the integrity of the lending system and that Mr Shah’s well organised deception enabled such corruption. He further noted that Mr Shah was motivated by greed.

ASIC Deputy Chair Peter Kell said, “ASIC will continue to ensure that mortgage brokers who provide false documentation are held to account. Today’s sentencing reflects both the severity of Mr Shah’s actions and the consequences facing those who do not abide by the law.”

The matter was prosecuted by the Commonwealth Director of Public Prosecutions.

ASIC’s investigation is continuing.

Myer launches Android and Apple Pay

Myer customers will be able to use Android Pay and Apple Pay to make purchases in store via the launch of a new credit card, the Myer Credit Card, issued by Macquarie Bank.

Using Visa payment technology, Myer shoppers will be able to pay for purchases from their digital wallet on their smartphone through the Myer Credit Card App.

Commenting on the launch, Myer chief executive and managing director Richard Umbers said he was excited to be bringing Android and Apple Pay via the Myer Credit Card.

“The card will provide our customers with an easier way to pay and reward them for their loyalty,” he said.

“We are delighted with our partnership with Macquarie and Visa, which will further accelerate the growth of Myer’s digital capability.”

Macquarie head of banking and financial services group Greg Ward said the company is delighted to have been chosen as the card issuer.

“For many years we have offered credit card products directly and through white label arrangements, and this is the latest step in supporting innovative digital banking solutions for Australians,” he said.

Customers will also be able to accumulate Myer one shopping credits on the credit card, a spokesperson for Myer said.

Visa group country manager for Australia, New Zealand and the South Pacific Stephen Karpin said it was an “exciting time” for Australian retail.

“With digital technology driving new and imaginative commerce experiences … how people pay is at the heart of these experiences,” he said.

“It’s for this reason we’re delighted to be working with Myer and Macquarie Bank to bring the future of commerce to Australians today.”

Auction Volumes Bounce Higher But Clearance Rates Fall

Auction activity across the combined capital cities increased this week after last week’s grand final and public holiday slowdown. 2,286 homes were taken to auction, returning a preliminary auction clearance rate of 68.1 per cent. The preliminary clearance was up from the 66.3 per cent last week when volumes dipped significantly across the capitals amidst the festivities of the grand finals and long weekend.

Melbourne was the only capital city to record a preliminary clearance rate above 70 per cent (72.1 %), while clearance rates across Sydney remained below 70 per cent for the eleventh consecutive week. Compared to one year ago, clearance rates continue to track lower with final results from the corresponding week last year recording a 76.4 per cent clearance rate, while volumes were a similar 2,290.

NAB announces start to Comprehensive Credit Reporting

NAB has announced it will commence its roll out of Comprehensive Credit Reporting in February 2018. Read our earlier post “Comprehensive Credit Reporting, Friend or Foe?”

Comprehensive Credit Reporting will provide a more complete picture of a customer’s situation, and mean that lenders like NAB are better able to match the provision of credit to a customer’s individual needs.

“Most Australians have a credit report, and with Comprehensive Credit Reporting, these reports will represent a more balanced reflection of their credit history,” NAB Chief Operating Officer, Antony Cahill, said.

“NAB has championed Comprehensive Credit Reporting from the start because we believe it’s the right thing to do for customers.”

“Comprehensive Credit Reporting will help ensure customers get the right product and credit that’s suitable for their needs, and it will drive more competition in the industry,” Mr Cahill said.

Currently, an Australian’s credit report contains only ‘negative’ information such as payment defaults, credit enquiries, bankruptcies, and court orders and judgements. Under Comprehensive Credit Reporting, positive credit information will be added – including accounts that have been opened, credit limits on those accounts, and details of monthly payments made.

“By having a more complete picture, we can have better discussions with customers and make the right products and credit limits available to them,” Mr Cahill said.

NAB is phasing its roll out of Comprehensive Credit Reporting, commencing with personal loans, credit cards and overdrafts, to ensure it is a smooth transition for customers.

“A number of smaller players have already started participating in Comprehensive Credit Reporting, and we look forward to seeing it roll out across the industry,” Mr Cahill said.

Comprehensive Credit Reporting has been supported by the Federal Government, and will bring Australia in line with many other countries including New Zealand, the USA, and the United Kingdom.

The Growing Gap Between Employment And Financial Security

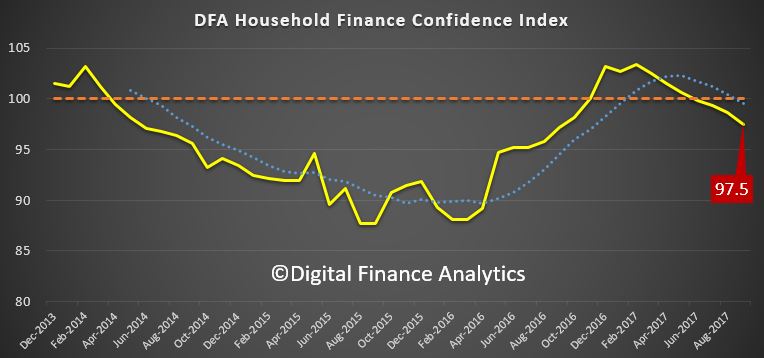

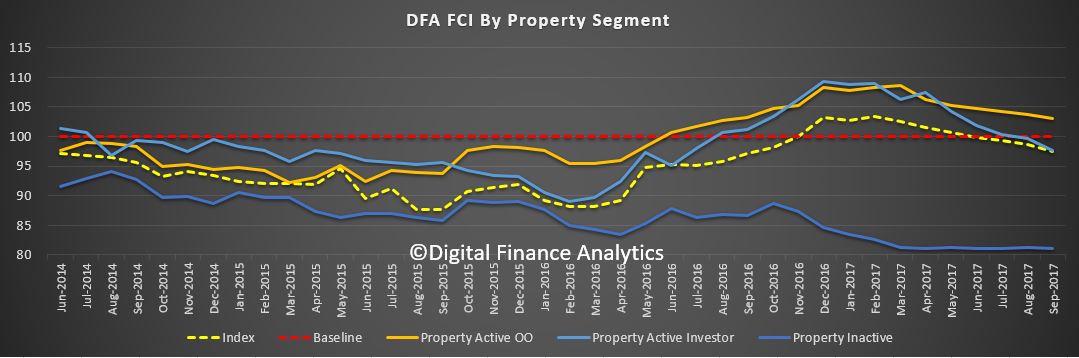

The September update of the Digital Finance Analytics Household Finance Security Index, released today, underscores the growing gap between employment, which remains relatively strong, and the Financial Security of households. We discussed this recently on ABC The Business. The Index fell from 98.6 in August to 97.5 in September.

This is below the 100 neutral setting, and continues the decline since December 2016. Watch the video, or read the transcript.

This is below the 100 neutral setting, and continues the decline since December 2016. Watch the video, or read the transcript.

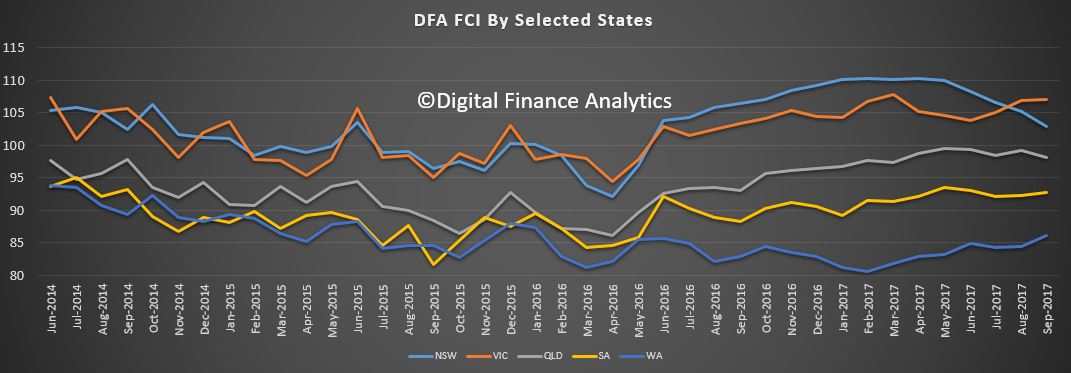

The state by state view highlights a fall in NSW, while VIC holds higher, and there was a rise in WA from February 2017 lows. This highlights the fact the households across the national are under different levels of pressure.

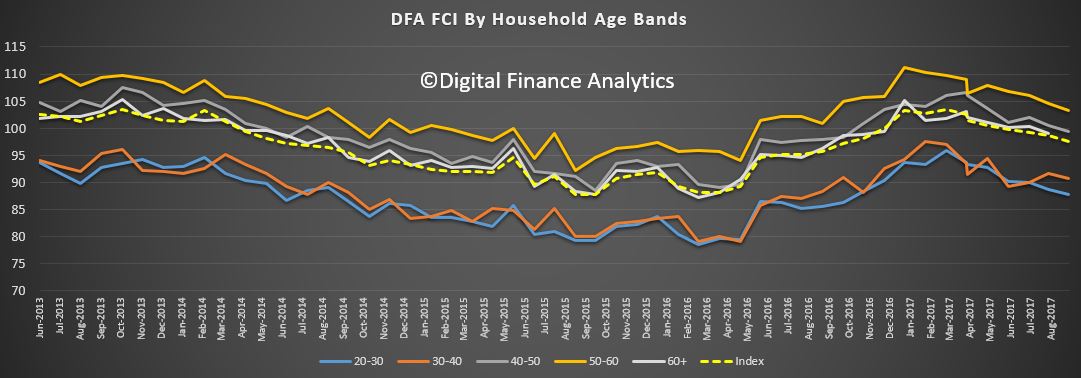

Tracking by age bands we find younger households are significantly less confident, compared with those aged 50-60 years. But across the board, the general trend is lower.

Tracking by age bands we find younger households are significantly less confident, compared with those aged 50-60 years. But across the board, the general trend is lower.

Property ownership remains a large factor, with those renting still below those owning property. We also see an ongoing decline in property investor confidence, thanks to tighter underwriting standards, higher mortgage rates, and the reduction in interest only loans availability.

Property ownership remains a large factor, with those renting still below those owning property. We also see an ongoing decline in property investor confidence, thanks to tighter underwriting standards, higher mortgage rates, and the reduction in interest only loans availability.

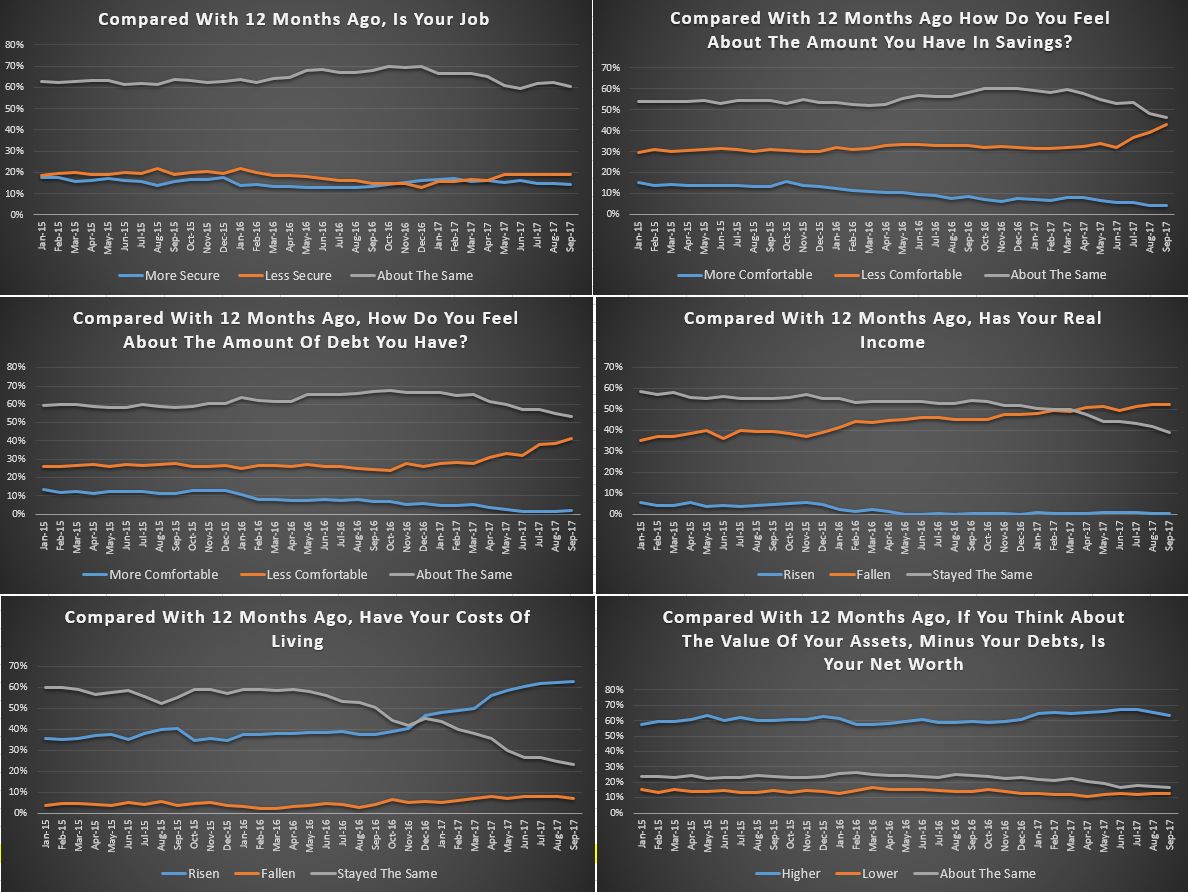

Looking at the scorecard, there was a 4% fall in households comfortable with their savings, as they are forced to raid them to cover ongoing expenses (and the low returns on deposit balances as the banks seek to build margin). There was a rise of nearly 3% of households who were uncomfortable with the amount of debt they hold, reflecting higher mortgage rates, especially on investment loans and interest only loans, and concerns about future rate movements. Finally, more households reported their overall net worth has deteriorated as home prices came under pressure.

Looking at the scorecard, there was a 4% fall in households comfortable with their savings, as they are forced to raid them to cover ongoing expenses (and the low returns on deposit balances as the banks seek to build margin). There was a rise of nearly 3% of households who were uncomfortable with the amount of debt they hold, reflecting higher mortgage rates, especially on investment loans and interest only loans, and concerns about future rate movements. Finally, more households reported their overall net worth has deteriorated as home prices came under pressure.

The disconnect is that while people can, in the main, get some work, their earned income is not rising as fast as costs. We also find more households relying of a larger mix of fragmented part-time jobs, which tend to be less predictable. As a result, we expect the current trends to continue, as momentum in the housing sector ebbs. There is no obvious circuit breaker available in the current low interest rate, low growth environment.

The disconnect is that while people can, in the main, get some work, their earned income is not rising as fast as costs. We also find more households relying of a larger mix of fragmented part-time jobs, which tend to be less predictable. As a result, we expect the current trends to continue, as momentum in the housing sector ebbs. There is no obvious circuit breaker available in the current low interest rate, low growth environment.

By way of background, these results are derived from our household surveys, averaged across Australia. We have 52,000 households in our sample at any one time. We include detailed questions covering various aspects of a household’s financial footprint. The index measures how households are feeling about their financial health. To calculate the index we ask questions which cover a number of different dimensions. We start by asking households how confident they are feeling about their job security, whether their real income has risen or fallen in the past year, their view on their costs of living over the same period, whether they have increased their loans and other outstanding debts including credit cards and whether they are saving more than last year. Finally we ask about their overall change in net worth over the past 12 months – by net worth we mean net assets less outstanding debts.

We will update the results again next month.

UK Government Plans to Increase Social Housing Grants

Last Wednesday, UK Prime Minister Theresa May announced that housing associations and local authorities will receive an additional £2 billion in grants for social (i.e., public) housing, including social rented homes. She also announced that rent increases will be set at CPI plus 1% starting in fiscal 2021 (which starts 1 April 2020) for five years. These announcements are credit positive for English housing associations because they signal greater support for the social rented sector.

Increased grant funding will reduce external financing needs and provide incentives to focus on social renting activities, which provide more stable cash flow than markets sales. The rent-setting regime provides clarity about housing associations’ operating environment and signals a shift from the previous government policy, which had negative financial effects on the sector.

The amount of grant funding available under the Affordable Homes programme for housing associations and local authorities will increase by £2 billion to £9.1 billion over the length of the program. Housing associations historically have relied on government grants to finance the production of new social homes, but such grants have significantly dwindled since the financial crisis.

The new grant programme aims to fund the construction of an additional 25,000 homes, and we expect the average subsidy per home to more than double to £80,000 from £32,600 in the last allocation round of the programme in 2016 and from £23,500 in the 2014 round. Although the distribution of the grants will depend on yet-to-be-defined criteria that determines which areas are most in need, we expect the 39 English housing associations that we rate to receive £650-£900 million of new grant funding, which would contribute to financing 8,000-11,250 homes.

The additional grants will reduce housing associations’ external financing needs, and should reduce future borrowing, which we currently expect will reach nearly £4 billion during fiscal 2018-20. However, some housing associations may choose to use the freed-up financial capacity to further increase their production of homes for open market sale rather than to stabilise indebtedness.

The grant programme signals a rebalancing of the government’s position in favour of rented social housing. The social letting business provides more stable cash flows for housing authorities than low-cost home ownership programmes, which had been at the centre of the previous housing policy. The lack of grants for building social rented homes and political pressure had encouraged housing associations to subsidise social homes by building units for open market sale that expose housing associations to the cyclicality of the housing market. The share of such sales to turnover has steadily increased over the past five years, reaching 15% in fiscal 2016 for our rated issuers and more than 40% for a small number of housing associations. Hence, this shift in the availability of funding and the direction of policy is credit positive.

Banks need a ‘better cost structure’: Narev

Australia’s major banks must use data analytics, artificial intelligence and robotics to increase productivity and reduce costs, says outgoing CBA chief executive Ian Narev.

Speaking at a Morningstar conference in Sydney on Friday, outgoing CBA chief executive Ian Narev said the major banks must “adapt or die” when it comes to new technology.

“Over five to 10 years in [the banking] industry, if you do not successfully adapt, you will not succeed,” Mr Narev said.

“I say that without any sense of hyperbole at all. And [CBA] does not feel at all complacent about where we are, because you have got to keep going, but we feel pretty good about our relative position today.”

First, banks need to realise that their customers want to do business online – and will compare their banking experience with Facebook, Apple and Amazon, Mr Narev said.

“Number two is that the opportunities to apply artificial intelligence, data analytics, robotics to fundamental productivity is critical because we need a better cost structure,” Mr Narev said.

“While we are evolving to a better cost structure, we also need to be the responsible employer of 50,000 people and help our own workforce make the transition, which we are very committed to doing.

“So for us, this has been a topic of real focus for the last few years. It will remain a topic into the future. We are committed to adapt.”

Mr Narev also took the opportunity to reiterate his apologies to CBA’s shareholders and customers for “not reaching the standards we should have” regarding AUSTRAC’s accusations of CBA’s failings relating to anti-money laundering compliance.

“We let down our stakeholders and, regardless of the ins and outs of the legal claim, I am sorry for that as the chief executive. I take accountability for it and can assure you that we are taking it extremely seriously,” Mr Narev said.

Mr Narev, who is due to leave CBA by 1 July 2018, also joked about the identity of his successor.

“We have got uncertainty with leadership succession, although I can give you a guarantee that the next chief executive of the Commonwealth Bank will be better than the current one,” he said.

Do tax cuts stimulate the economy more than spending?

During the presidential campaign, Donald Trump promised to boost the economy both by cutting taxes and investing more money in infrastructure.

Usually, however, politicians and policymakers have favored one type of stimulus over the other. Conservatives like tax cuts, while liberals favor more spending.

In the Trump administration, tax cuts appear to have won the argument for now. Republicans unveiled the blueprint of a major tax overhaul, which White House officials predict will boost economic growth to more than 3 percent a year. In the meantime, infrastructure investment remains on the back-burner.

Did they make the right choice pushing for tax cuts before infrastructure spending? Are tax cuts more likely than new spending to prod companies to produce more, encourage more consumer spending and grow the economy at a faster rate?

Or put another way, which provides the biggest bang for the buck?

Spending versus tax cuts

British economist John Maynard Keynes was the first to suggest in the 1930s that an economy’s ills could be traced to the misalignment of what he called aggregate demand, which is made up of consumption, investment, government spending and net exports. So if there’s trouble in the economy, a government could try to move the needle by spending more (or less) money or by adjusting tax rates to spur consumers or businesses to buy more (or less) stuff.

For decades, from the 1940s through the 1970s, the U.S. mainly relied on manipulating government expenditures rather than tax cuts to goose the economy. Many politicians and academics interpreted Keynes to favor government spending as the best way to right the economic ship, but he also suggested tax policy could do the job of boosting demand.

In the past few decades, however, beginning with President Ronald Reagan and the advent of supply-side economics in the 1980s, governments have increasingly toyed with tax cuts to change aggregate demand in part because they are more likely to have an immediate effect on consumer and business expectations and incentives.

Lord John Maynard Keynes, center, represented the U.K. at the Bretton Woods Conference in 1944, which established the International Monetary Fund and post-war monetary system. AP Photo

An investigation

The question of whether tax cuts or spending has a greater economic impact – as well as the inverse – remains a major subject of discussion among economists and policymakers. With the help of my graduate students in a finance class I taught for three decades, I have tried to help shine some light on the answer.

The following analysis grew out of a series of research projects assigned to them in the past several years. Putting them together produced some insight on the questions I raised at the outset.

To compare the effects on the economy of increases in regular government spending with those of tax cuts, we compiled data on gross domestic product, government expenditures and average tax rates for households divided into five different income groups, or quintiles, from 1968 to 2010. We did that because a tax cut for someone who’s rich will be different than one for someone who spends most of what she earns. While the former might invest the extra cash, the latter is more likely to spend it, immediately stimulating the economy.

We focused on the middle three income groups because incomes among the top 20 percent are too disparate and the tax rate for the bottom is close to zero, making them very hard to measure.

We then tried to determine how much each variable – spending and tax rates of each quintile – correlated to a change in GDP. Our findings showed that US$1 in tax cuts for individuals making $20,001 to $61,500 a year in 2010 dollars (the second and third quintiles) was correlated with an increase in GDP more than double that of a rise in spending by the same amount. A tax cut for those in the fourth quintile earning $61,501 to $100,029 didn’t have as great effect but still correlated with a boost in GDP 1.4 times that of new spending.

These results are consistent with those conducted by economists David and Christine Romer in their study on the economic impact of changes in taxation, which also found that tax cuts correlated with more growth than spending increases.

What it means

So do these results answer our original question and show that tax cuts are always better?

Not exactly, although these results should appeal most to those who champion tax cuts for the middle class. For too long, ideology has dominated this debate and obscured the real answer if the goal is stronger economic growth: an appropriate mix of the two, well-tailored tax cuts for middle-income earners and effective government spending.

In addition, our analysis represents a relatively simplified take on a complicated topic. The last word on how tax cuts affect economic growth has yet to be written.

The real advantage of tax cuts is that they’re quick – taxpayers immediately have more money in their paychecks and companies often begin investing before the cuts have taken effect – while the impact of infrastructure or other spending takes much longer, even years, to work its way through the economy. But they both have their place in good economic policy.

Very often those advocating significant tax cuts claim that the cuts will pay for themselves in terms of ultimate tax revenues. That, of course, is an empirical issue but it misses the point. No one ever claims that expenditure increases pay for themselves (in terms of future tax revenues). The relevant point is how much does each encourage economic growth.

Author: Dale O. Cloninger, Professor Emeritus, Economics & Finance, University of Houston-Clear Lake