We look at another massive week in property and finance, examine the arguments around mortgage rate rises, and consider which households are more likely to buy in the current market.

Welcome to the Property Imperative weekly to 23rd September 2017, our summary of the key events from the past week. Watch the video, or read the transcript.

Welcome to the Property Imperative weekly to 23rd September 2017, our summary of the key events from the past week. Watch the video, or read the transcript.

We start with mortgage arrears. Moody’s said the number of Australian residential mortgages that are more than 30 days in arrears has shot up to a five year high with a 30+ delinquency rate of 1.62% in May this year and with record high rates in Western Australia, the Northern Territory and South Australia. Arrears were also up in Queensland and the Australian Capital Territory while levels decreased in New South Wales, Victoria and Tasmania.

Ratings agency Standard & Poor’s (S&P) Global Ratings also recorded an increase in the number of delinquent housing loans underlying Australian prime residential mortgage-backed securities (RMBS). This rate rose from 1.15% in June to 1.17% in July. Delinquent loans underlying the prime RMBS at the major banks made up almost half of all outstanding loans and increased from 1.08% to 1.11% from June to July. For the regional banks, this level rose from 2.30% to 2.35%.

Fitch says 30+ days arrears were 3 basis points higher compared with last year despite Australia’s improved economic environment and lower standard variable interest rates. However, default rates on Retail Mortgage Back Securities was 1.17%, 4 basis points better than the previous quarter. They made the point that losses experienced after the sale of collateral property remained extremely low, with lenders’ mortgage insurance payments and/or excess spread sufficient to cover principal shortfalls in all transactions during the quarter. So, banks are protected in this environment, even if households are not.

Much of the debate this week centred on how well the economy is doing, and what this means for interest rates. Globally, the Fed is maintaining its tightening stance, with the removal of some stimulus and further lifts in their benchmark rate soon. The financial markets reacted by lifting bond yields, and if this continues the cost of overseas funding will rise, making out of cycle mortgage rate hikes more likely here.

The RBA was pretty positive about the outlook for the global economy, as well as conditions locally. Governor Philip Lowe said to quote “The Next Chapter Is Coming”. In short, the global economy is on the up, central banks are beginning to remove stimulus, and locally, wage growth is low, despite reasonable employment rates. Household debt is extended, but in the current low rates mostly manageable, but the medium term risks are higher. Business conditions are improving. He then discussed the growth path from here, including the impact of higher debt on household balance sheets. He said we will need to deal with the higher level of household debt and higher housing prices, especially in a world of more normal interest rates. In this environment, a small shock could turn into a more serious correction as households seek to repair their balance sheets.

I debated the trajectory of future interest rates, and the impact on households with Paul Bloxham the Chief Economist HSBC on ABC’s The Business. In essence, will the RBA be able to wait until income growth recovers, thus protecting household balance sheets, or will they move sooner as global rates rise, and put households, some of whom are already under pressure, into more financial stress?

The Government announced late on Friday night (!) before the school holidays, a consultation on the formation of a new entity to help address housing affordability – The National Housing Finance and Investment Corporation or NHFIC. It also includes, a $1 billion National Housing Infrastructure Facility (NHIF) which will use tailored financing to partner with local governments in funding infrastructure to unlock new housing supply; and an affordable housing bond aggregator to drive efficiencies and cost savings in the provision of affordable housing by community housing providers.

Actually, this simply extends the “Financialisation of Property” by extending the current market led mechanisms, on the assumption that more is better. Financialisation is, as the recent UN report said:

… structural changes in housing and financial markets and global investment whereby housing is treated as a commodity, a means of accumulating wealth and often as security for financial instruments that are traded and sold on global markets.

So, we are not so sure about these proposals. Also, we are not convinced housing supply problems have really created the sky-high prices and affordability issues at all. And, by the way, the UK, on which much of this thinking is based, still has precisely the same issues as we do, too much debt, too high prices, flat incomes, etc. Anyhow, the Treasury consultation is open for a month.

More lenders dropped their mortgage rates to attract new business, including enticing property investors. For example, Virgin Money decreased the principal and interest investment rates by between 5 and 10 basis points, for loans with an LVR of 80% or below. Westpac cut its two-year fixed rate for owner-occupiers paying principal and interest by 11 basis points to 4.08 per cent (standalone rate) or 5.16 per cent comparison.

Net, net, demand is weakening and the Great Property Rotation is in hand. Lenders are tightening their underwriting standards further. This week NAB said it would apply a loan to income test to interest-only and principal and interest loans. The new ratio, which aims to determine the “customer’s indebtedness to the loan amount” takes the total limit of the loan and divides it by the customer’s total gross annual income (as disclosed in the application). Ratios greater than eight will be declined, according to the new policy. This is still generous, when you consider the LTI guidance from the Bank of England is 4.5 times. But good to see Loan to Income ratios being brought to bear – as they are by far the best risk metrics, better than loan to value, or debt servicing ratios.

Our latest surveys showed that more first time buyers are looking to purchase now. We see that 27% want to buy to capture future capital growth, the same proportion seeking a place to live! 13% are seeking tax advantage and 8% greater security of tenure. But the most significant change is in access to the First Home Owner Grants (8%), thanks to recent initiatives in NSW and VIC, as well as running programmes across the country. The largest barriers are high home prices (44%), availability of finance (19% – and a growing barrier thanks to tighter underwriting standards), interest rate rises (9%) and costs of living (6%). Finding a place to buy is still an issue, but slightly less so now (18%).

On the other hand, Property Investors, who have been responsible for much of the buoyant tone in the eastern states are less bullish. For example, in 2015, 77% of portfolio investors were intending to transact, today this is down to 57%, and the trend is down. Solo investors are down from a high of 49% to 31%, and again is trending lower. Turning to the barriers which investors face, the difficulty in getting finance is on the rise (29%), along with concerns about rate rises (12%). Other factors, such as RBA warnings (3%), budget changes (1%) only registered a little but concerns about increased regulation rose (7%). Around one third though already hold investment property (33%) and so will not be buying more in the next year. So, net demand is weakening.

CBA was the latest major bank to jettison lines of business, as banks all seek to return to their core banking business, by announcing the sale of 100% of its life insurance businesses in Australia (“CommInsure Life”) and New Zealand (“Sovereign”) to AIA Group for $3.8 billion. We have been watching the expansion and contraction cycle for many years, as banks sought first to increase their share of wallet by acquiring wealth and insurance businesses, then found that bankassurance, as the model was called, was difficult to manage and less profitable than expected, as well as being capital intensive. Hence the recent sales – and expect more ahead. We think considerable shareholder value has been destroyed in the process, especially if you also overlay international expansion and then contraction. Now all the Banks are focussing on their “core business” aka mortgages – but at a time when growth here is on the turn. The moves will release capital, and thanks to weaker competition across the local markets, they can boost returns, but at the expense of their customers.

The Productivity Commission Inquiry into Banking Competition is well in hand, with submissions released this week from the Customer Owned Banking Association. They said that we don’t have sustainable banking competition at the moment. A lack of competition can contribute to inappropriate conduct by firms, and insufficient choice, limited access and poor quality products for consumers. The current regulatory framework over time has entrenched the dominant position of the largest banks. Promoting a more competitive banking market does not require any dilution of financial safety or financial system stability. They also showed that borrowers could get better rates from Customer Owned Lenders, compared with the big players. So shop around.

So back to property. The ABS Property Price Index to June 2017 show considerable variations across the states, with Melbourne leading the charge, and Perth and Darwin languishing. Annually, residential property prices rose in Sydney (+13.8%), Melbourne (+13.8%), Hobart (+12.4%), Canberra (+7.9%), Adelaide (+5.0%) and Brisbane (+3.0%) and fell in Darwin (-4.9%) and Perth (-3.1%). The total value of residential dwellings in Australia was $6.7 trillion at the end of the June quarter 2017, rising $146 billion over the quarter.

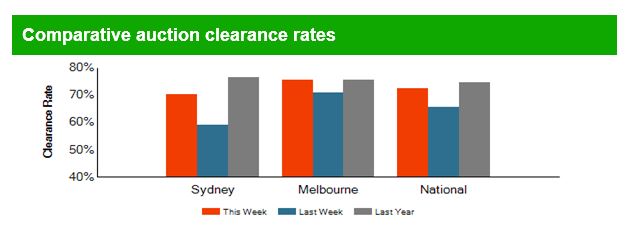

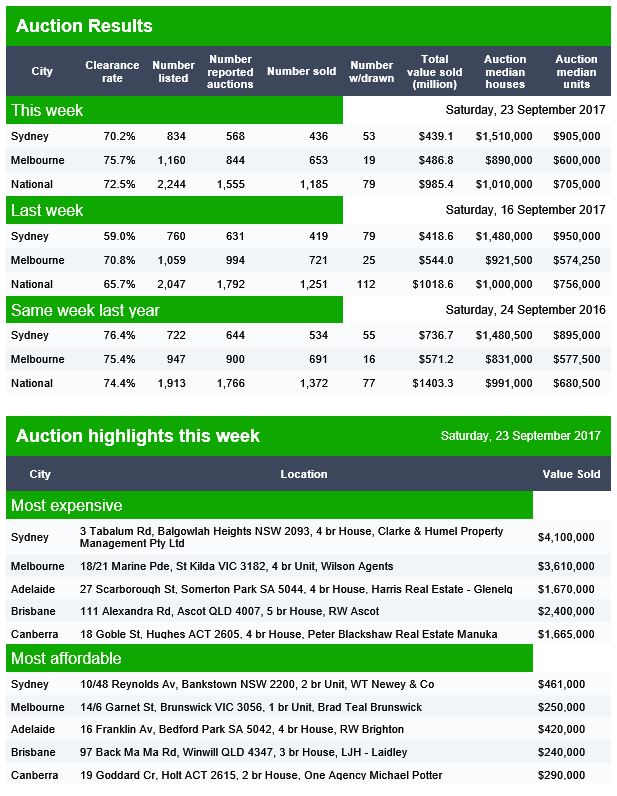

Auction clearance rates are still quite strong, if off their highs, but we expect loan and transaction volumes to continue to drift lower as we head for summer.

Putting all the available data together we think home prices in the eastern states will still be higher at the end of the year, but as rates rise from this point, price momentum will ease further, that is unless income growth really does start lifting. The current 6% plus growth in mortgage lending, when incomes and inflation are around 2% is a recipe for disaster down the track. Despite all the jawboning about future growth prospects we think the debt burden is going to be a significant drag, and the risks remain elevated.

And that’s the Property Imperative Weekly to 23th September.