Over the past few months, we asked 1,555 institutions about their profitability and resilience – in numerical terms, that’s 88% of all German institutions. With aggregate total assets of around €3,000 billion, they represent roughly 41% of the entire German banking sector.

Thanks to the results of the survey, we can provide an exclusive insight into the current and future risk situation facing German banks and savings banks. The survey was based both on assumptions made by the institutions and on stress scenarios defined by the supervisors.

The check-up covers three areas. First, it analyses profitability on the basis of business figures – here, we look not only at the institutions’ planning and forecasts up until 2021, but also at how the annual results would change under the assumption of different interest rate levels in the future. We supplemented these quantitative analyses with qualitative questions, whereby the banks and savings banks gave a uniform assessment of the future of their institution and the banking sector.

The second area is stress testing. In this context, we analysed what would happen to the capital base of the institutions if they had to cope with particular external stress events. For the first time, in addition to the classic stress factors of interest rate, market and credit risk, we also stress tested residential real estate.

Residential real estate also formed part of the third area of analysis, in which we examined other key risks. Besides risks in the residential real estate sector, we performed a detailed analysis of lending standards and the position of building and loan associations.

Our examination centres on the question of how the low-interest-rate environment is affecting the resilience of banks and savings banks. In order to grasp the effects of possible future interest rate levels on credit institutions, we calculated how the profitability of the institutions would change if the interest rate level were to move in one direction or the other. What were the underlying scenarios we used?

For the first area, the analysis of profitability, we first asked the institutions to provide their three-years plans using a uniform template and requested forecasts for a further two years. In addition to this, we examined supervisory interest rate scenarios: a sustained low-interest-rate environment, a positive interest rate shock of 200 basis points, a negative interest rate shock of 100 basis points, and a turn in the yield curve of +200 basis points at the short end and -60 basis points at the long end, each at the beginning of this year. The institutions’ balance sheets could be altered for some scenarios, and not for others.

For the stress test, the impact of a positive interest rate shock of 200 basis points was compared with that of a continued low-interest-rate environment. The scenario also assumes a 200 basis point increase in the probability of default and a 20% increase in the loss given default. Moreover, for interest-bearing securities, risk premiums were assumed to rise by between 30 and 1,500 basis points, depending on credit quality. A 20% loss in value was assumed for other securities, such as equities.

Ladies and gentlemen, when doctors start explaining all their findings down to the very last detail, some patients might think, “Don’t beat around the bush, just tell me what I have”. So here are the key diagnoses, to start with.

- Small and medium-sized German credit institutions expect their profits to continue shrinking between 2016 and 2021, according to their planning. In concrete terms, they expect their pre-tax profit to dwindle by 9% and their total return on capital to fall by 16%.

- In the same period, the aggregate common equity tier 1 (CET1) ratio is expected to rise from 15.9% to 16.5%.

- Further cuts in interest rates would reduce overall pre-tax profitability by up to 60%. All told, however, these effects are less drastic than in the 2015 survey.

- Under the conditions prevailing in our stress test, around 4.5% of the institutions would fail to meet the prudential requirements set out in pillars I and II plus the capital conservation buffer, taking into account hidden reserves.

- One thing that increases in the low-interest-rate environment is competition: over 70% of institutions expect competition from other banks and savings banks to pick up – and as many as 85% see fintechs as a source of mounting rivalry.

- On this score, nearly every second institution can see a prospect of mergers and takeovers in the medium term.

- One set of findings I am sure you will all be interested in is from the residential real estate market. This much I can tell you already: we are seeing the unsecured portion of housing loans increasing at one in three institutions, but there is no sign of a worrying easing of credit standards.

- And the good news is that a simulated extreme drop in housing prices in Germany would shave just one percentage point, or thereabouts, off institutions’ CET1 ratio.

2 Ongoing decline in profitability forcing banks to fight back

Let us now take a closer look at the details, starting with earnings. In this part of the survey, we asked credit institutions for their budgeted figures for the period until 2021. You can see straight away that the trend does not look good. Smaller and medium-sized German credit institutions are expecting results – measured in terms of their pre-tax total return on capital – to shrink by an average of 16% by 2021. The 2015 survey had even projected a decline by one-fourth.

What is behind this drop in profitability? This chart shows the aggregate decline in results over the 2016-21 period, broken down by type of result. The heaviest losses are projected to come from the 0.27% pre-tax drop in net interest income, corresponding to a contraction of more than 3 billion euro in absolute terms, and from the increase in loss provisions – the latter including positions such as expected credit losses. Here, the decline in annual earnings to the tune of 0.43 percentage points is equivalent to future loss provisions amounting to more than €5 billion in absolute terms.

The overall decline, however, will first be offset by an improvement in net commission income in the amount of 0.24 percentage points, corresponding to a figure of almost €3 billion in absolute terms. The second dampening factor at play here is the reduction by 0.5 percentage points (equivalent to more than 6 billion euro) in additional reserves – these factors will keep the decline in profitability in check at a negative 1 billion euro.

On aggregate, then, the banking sector is expecting to see a steady decline in profitability in the years ahead – however, there are growing signs that institutions are beginning to fight back. But these steps still don’t go far enough – further, more decisive action will be needed to turn things around.

Let’s now move on and look at what happens when interest rates change. To illuminate this point, we specified a number of uniform interest rate scenarios and asked banks and savings banks to calculate how their business figures until 2021 would change if interest rates remained static, increased or declined. The blue bar highlights the 16% decline in total return on capital I have just described.

If the interest rate level stayed low or even shrank further, their results would slump, as you can see from the dark blue line (-41%) and especially the solid red line (-60%). Assuming a dynamic balance sheet, portfolio adjustments can cushion this impact accordingly, as the red dashed red line (again -41%) illustrates. A rise in interest rates would be a different story. To begin with, the short-term burden of interest rate risk would materialise, hitting bank profitability. But on a more cheery note, over the medium to long term, results would even move back above the current figure from 2016 (+7%).

But banks and savings banks are not projecting such an upbeat scenario as this interest rate scenario is not regarded as being likely to happen.

Institutions’ earnings, then, are under pressure. This might lead them to take on greater risks, which are normally rewarded by higher returns. If that does not work out, institutions will end up taking excessive risk on board. For this reason, supervisors need to focus on the resilience of the institutions.

And as you can see from the chart, one in three institutions are expecting their CET1 ratio to contract. The left-hand side of the black bar shows institutions whose ratios are declining. Another thing the survey responses tell us is that as many as two out of three institutions are projecting a drop in their total capital ratio. However, that’s not a point we should overdramatise because the average outcome across all institutions is that while the total capital ratio looks set to shrink from 18.3% to 17.8%, the CET1 ratio is projected to climb from 15.9% to 16.5%.

The main question, though, is what the one in three institutions which are expecting the CET1 ratio to drop are planning to do. The institutions in this group, which account for a handsome 32% of participants, are planning to increase their total assets and exposures, but not to step up their equity capital to the same extent – on aggregate, this will slightly reduce the capital ratio.

These are all early warning signals of a heightened propensity among credit institutions to take risks, and we are monitoring developments very closely indeed.

3 Continued intense competition a catalyst for merger plans

But why are institutions taking on greater risks? One likely reason is that there aren’t any superior straightforward alternatives. Efficiency gains can only be achieved through costly optimisation measures. And low-risk investments are hotly contested in Germany’s banking sector, plus their returns have been depressed by the low-interest-rate environment.

In this setting, speculation has long been rife over further consolidation, and not just in the German banking sector. Our survey now delivers clear indications not only that competition remains as fierce as ever, but also that institutions are even expecting it to intensify – and not only because of fintechs, but also due to other credit institutions, especially regional ones.

It is hardly surprising that consolidation continues to make headway under these conditions. But what we did not expect were the figures on future mergers: Around every tenth institution is already in the process of implementing a merger or has specific merger plans. What’s more, almost half of all banks can envisage a merger in the next five years. However, considerably more banks see themselves as the acquiring institution rather than as the institution to be acquired. That’s another reason why I expect we will ultimately see fewer mergers than the responses might initially suggest.

The number of German institutions is likely to continue falling in the years ahead, too. In our role as bank supervisors, we only want to warn banks that not all mergers are sustainable. In this respect, too, banks would do well to carry out a comprehensive check-up to identify avoidable problems in good time.

4 Elevated risks through housing loans

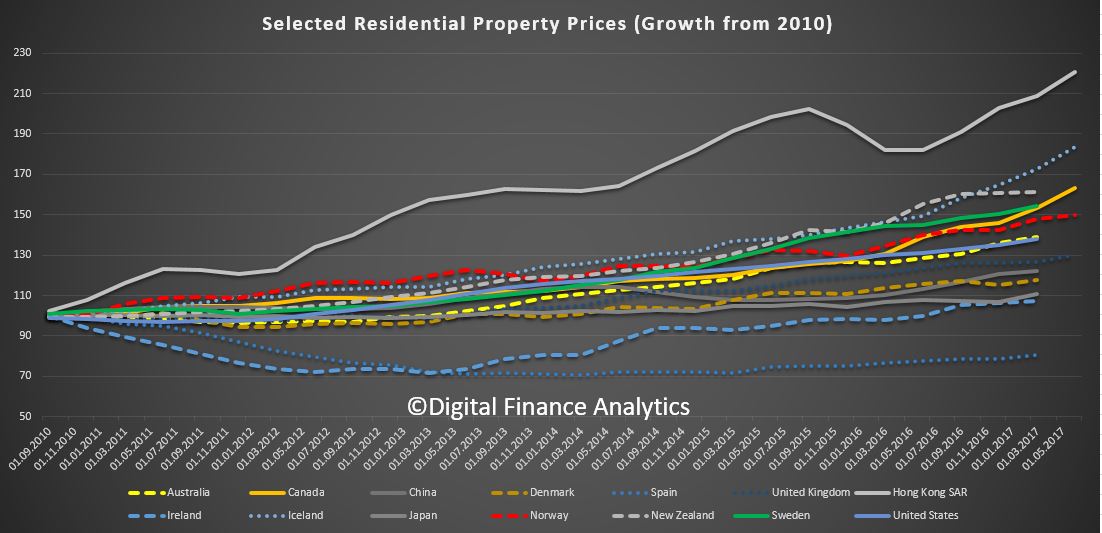

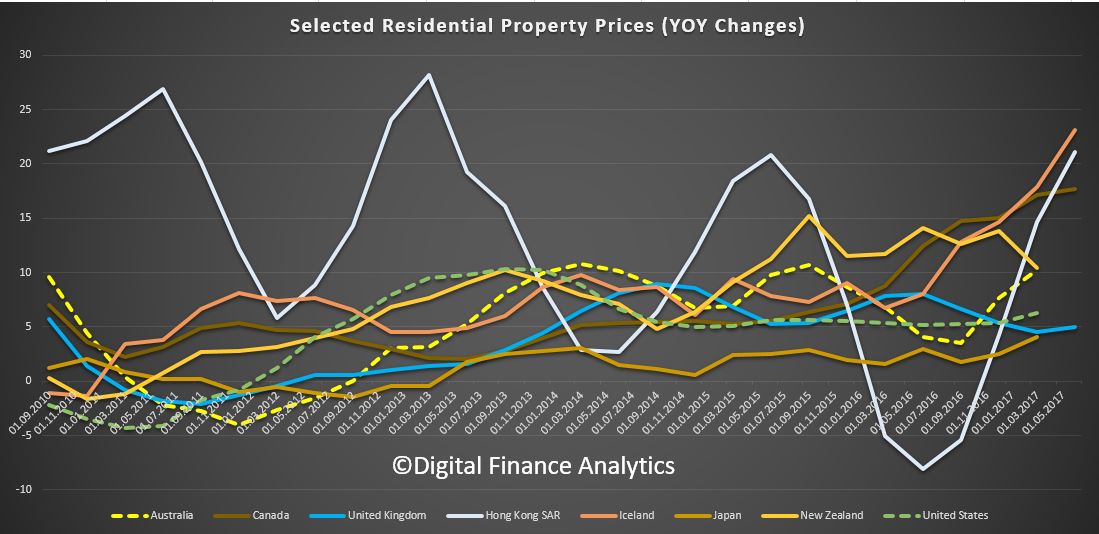

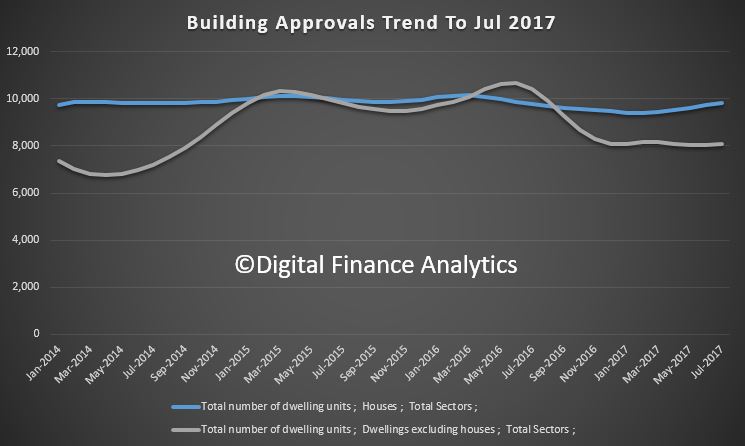

And now we come to a new element of our check-up: the housing market. Fear of a housing market bubble and rising real estate risks in banks’ balance sheets has been the subject of heated debate for some months now, not least because of constantly rising property prices. Bundesbank calculations show that we are experiencing price hikes in major towns and cities of 15% to 30% above the level that is justified by the fundamentals. Credit growth in Germany has likewise gathered momentum of late, notably at the smaller institutions. But this needs to be put into perspective: growth is still comparatively moderate compared with the euro area in the early 2000s.

And our survey currently sounds something of an “all-clear” for Germany. We see no far-reaching loosening of credit standards or conditions. If these were significantly softened, this would point to the emergence of a housing bubble capable of threatening financial stability. But we have found no sign of that.

What we certainly do see, though, is a growing tendency among institutions to incur greater risks. These movements have been minor so far – but we need to be especially alert to them.

What exactly do we see? First, in the current low-interest-rate environment, there is an increase in mortgage loans in banks’ balance sheets – both the overall volume and the average loan size have risen distinctly. Customers seem to be taking advantage of the low interest rates to offset part of the price increases – and because rates are so low, they can also finance their purchases without any additional costs. Moreover, the rate fixation period is simultaneously being extended. On top of that, institutions also seem to be willing to grant loans against less collateral. The sum result of these factors is increased risk-taking on the part of banks.

Parallel to this, the interest rate margins, that is the interest they demand minus their funding costs, have contracted significantly over the last two years. One reason for this appears to be the fierce competition for mortgage business, which remains a safe and therefore attractive business segment for banks.

Let us move on now to the housing stress test. How well would banks and savings banks cope with a bust in the housing sector? To put it in no uncertain terms: we do not see any real estate bubble that should give us cause for concern. Nevertheless, we do need to be on our guard. That is why we took the precaution of performing the housing stress test. To this end, we simulated a decline in housing prices and examined how such an occurrence would impact on banks in terms of losses and their capital ratio.

Therefore, we first needed to simulate a macroeconomic setting appropriate for the hypothetical house price developments, using a suitable model. This then enabled us to determine both the impact on default probabilities and on loss ratios for housing loans. Based on the changes in these parameters, we were able to derive the hypothetical increase in impairment charges as well as the losses in interest income, both of which diminish the capital base. Furthermore, using the standard approach, the banks’ risk-weighted assets expand on account of the reduction in the value of eligible collateral. These partial effects cause the CET1 of the banks in question to shrink.

From the upper chart you can see that we simulated very pronounced price corrections which, however, experience in other countries has shown to be plausible in a crisis situation. The dashed lines show the development of housing market crises in other countries. The dark blue line represents our extreme scenario, which simulates how a drop in prices similar to that experienced during the Spanish housing crisis from 2011 onwards would have affected the banks in our survey. In this simulation, prices plunge by 30%. The light blue line represents the less extreme, yet still severe, scenario – which we call “adverse”. In this case, prices fall by 20%, which is not exactly a small margin either.

The credit institutions would sustain heavy losses under the extreme scenario: the result would be a drop in their CET1 ratio of 0.9 percentage points. In this case, the small and medium-sized German banks and savings banks would have to raise additional capital of around €12 billion in order to lift their CET1 ratio back to its original level. And even under the somewhat less dramatic, adverse scenario, the CET1 ratio would still fall by 0.5 percentage points. Here, capital would have to be topped up to the tune of €5.6 billion.

So you see, the risks stemming from the residential mortgage market are relevant for banks. What is more, taking contagion into account would intensify the impact considerably. We see signs of growing competition to secure mortgage loan business in the low-interest rate environment. Nevertheless, the stress test shows that banks need to look closely at how well they would be able to cope with the associated risks in the event of a crisis.

The message to banks and savings banks, then, is that they ought to make provisions if they want to stay healthy in the long term – that is and remains, without a doubt, the best medicine.