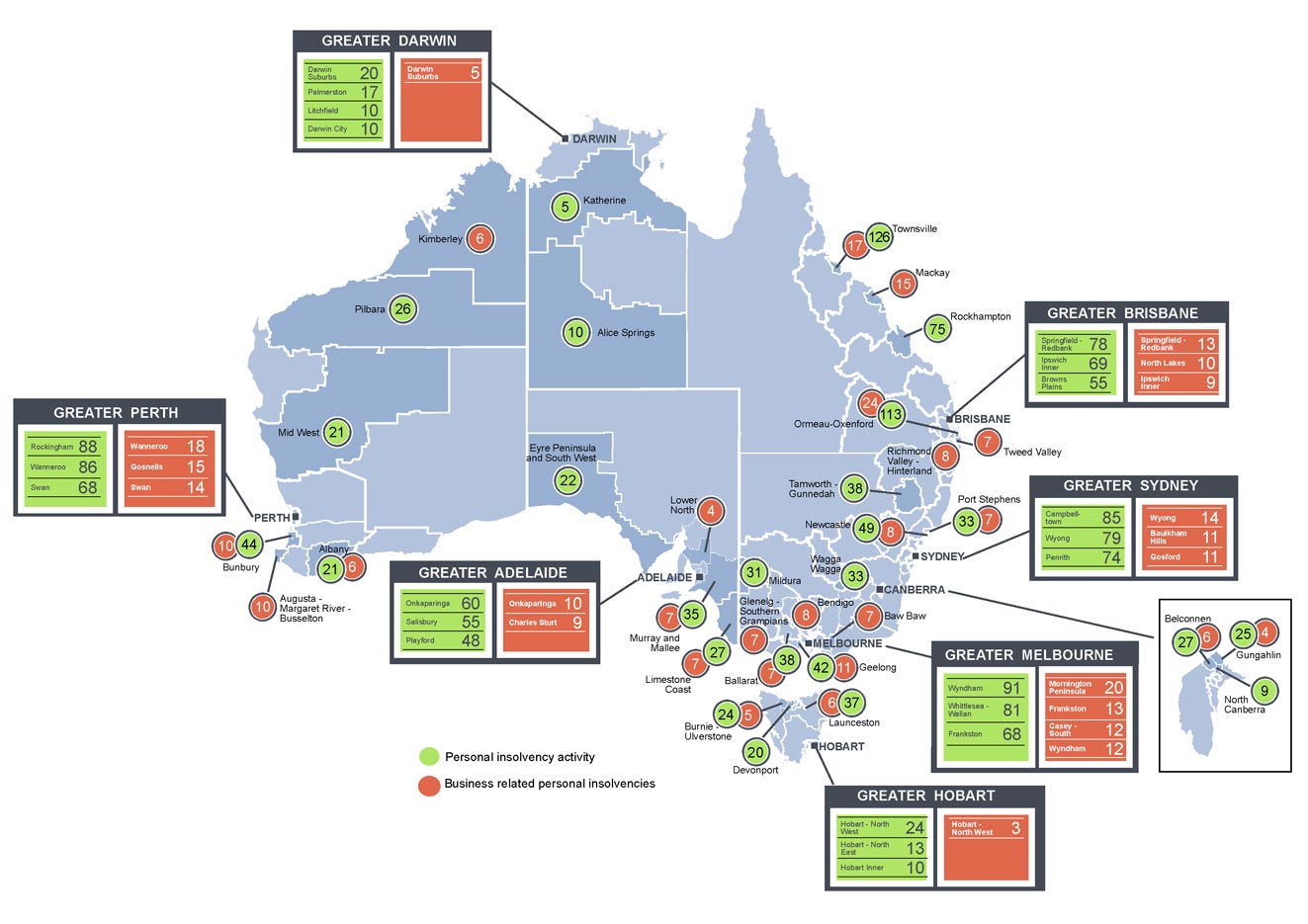

The Australian Financial Security Authority (AFSA) released regional personal insolvency statistics for the March quarter 2017. Looking across the regions, again we see signs of people in financial difficulty. This data will feed into our updated mortgage stress modelling to be published in early June.

New South Wales

New South Wales

- Greater Sydney

- In the March quarter 2017 compared to the December quarter 2016:

- the number of debtors rose 11.0%; the main contributor to the increase was Wyong

- the number of debtors who entered a business related personal insolvency rose 8.6%; the main contributors to the increase were Wyong and Penrith.

- In the March quarter 2017 compared to the December quarter 2016:

- Rest of NSW

- In the March quarter 2017 compared to the December quarter 2016:

- the number of debtors rose 1.9%; the main contributor to the increase was Lachlan Valley

- the number of debtors who entered a business related personal insolvency fell 10.7%; the main contributor to the fall was Coffs Harbour.

- In the March quarter 2017 compared to the December quarter 2016:

Australian Capital Territory

- In the March quarter 2017 compared to the December quarter 2016:

- the number of debtors rose 26.9%; the main contributor to the increase was Belconnen

- the number of debtors who entered a business related personal insolvency rose 84.6% (from 13 debtors to 24).

Victoria

- Greater Melbourne

- In the March quarter 2017 compared to the December quarter 2016:

- the number of debtors rose 13.4%; the main contributor to the increase was Whittlesea – Wallan

- the number of debtors who entered a business related personal insolvency rose by 5.7%; the main contributor to the increase was Mornington Peninsula.

- In the March quarter 2017 compared to the December quarter 2016:

- Rest of Vic

- In the March quarter 2017 compared to the December quarter 2016:

- the number of debtors rose 10.8%; the main contributor to the increase was Glenelg – Southern Grampians

- the number of debtors who entered a business related personal insolvency rose 8.3%; the main contributor to the increase was Bendigo.

- In the March quarter 2017 compared to the December quarter 2016:

Queensland

- Greater Brisbane

- In the March quarter 2017 compared to the December quarter 2016:

- the number of debtors rose 19.3%; the main contributor to the increase was Ipswich Inner

- the number of debtors who entered a business related personal insolvency rose 13.9%; the main contributor to the increase was Springfield – Redbank.

- In the March quarter 2017 compared to the December quarter 2016:

- Rest of Qld

- In the March quarter 2017 compared to the December quarter 2016:

- the number of debtors rose 9.4%; the main contributor to the increase was Caloundra

- the number of debtors who entered a business related personal insolvency fell 2.1%; the main contributor to the fall was Rockhampton.

- In the March quarter 2017 compared to the December quarter 2016:

South Australia

- Greater Adelaide

- In the March quarter 2017 compared to the December quarter 2016:

- the number of debtors rose 12.6%; the main contributor to the increase was Marion

- the number of debtors who entered a business related personal insolvency rose 9.8%.

- In the March quarter 2017 compared to the December quarter 2016:

- Rest of SA

- In the March quarter 2017 compared to the December quarter 2016:

- the number of debtors rose 51.0%; the main contributor to the increase was Murray and Mallee

- there were 25 debtors who entered a business related personal insolvency in the March quarter 2017, a rise from 12 in the December quarter 2016.

- In the March quarter 2017 compared to the December quarter 2016:

Northern Territory

- The number of debtors rose 18.8% in Greater Darwin in the March quarter 2017 compared to the December quarter 2016

- There were 18 debtors in rest of NT in the March quarter 2017, a fall from 20 in the December quarter 2016

- There were 13 debtors who entered a business related personal insolvency in Northern Territory, a fall from 16 in the December quarter 2016.

Western Australia

- Greater Perth

- In the March quarter 2017 compared to the December quarter 2016:

- the number of debtors rose 11.6%; the main contributor to the increase was Cockburn

- the number of debtors who entered a business related personal insolvency was unchanged at 155 debtors.

- In the March quarter 2017 compared to the December quarter 2016:

- Rest of WA

- In the March quarter 2017 compared to the December quarter 2016:

- the number of debtors rose 5.3%; the main contributor to the increase was Albany

- the number of debtors who entered a business related personal insolvency rose 9.1%; the main contributor to the increase was Bunbury.

- In the March quarter 2017 compared to the December quarter 2016:

Tasmania

- In the March quarter 2017 compared to the December quarter 2016:

- the number of debtors who entered a personal insolvency in Greater Hobart fell 7.2%; the main contributor to the fall was Brighton

- the number of debtors rose 35.5% in rest of Tas; the main contributor to the rise was Launceston

the number of debtors who entered a business related personal insolvency in Tasmania was unchanged at 28 debtors.