We have re-run our Probability of Mortgage Default modelling, based on our most recent household surveys. This modelling takes the basic household finance data in our survey, and models the impact of economic changes, inflation, income growth, and other factors, to estimate the probability of 30+ day mortgage default at a post code level.

As part of our household surveys, we capture data on mortgage stress, and when we overlay industry employment data and loan portfolio default data, we can derive a relative risk of default score for each household segment, in each post code. This data covers mortgages only (not business credit or credit cards, which have their own modelling). We use this to develop a percentage risk of default measure.

There are some significant variations across the data, though overall, we expect mortgage default rates to continue to rise over the next 12-18 month, thanks to low wage growth, employment changes, and other factors. This despite record low interest rates.

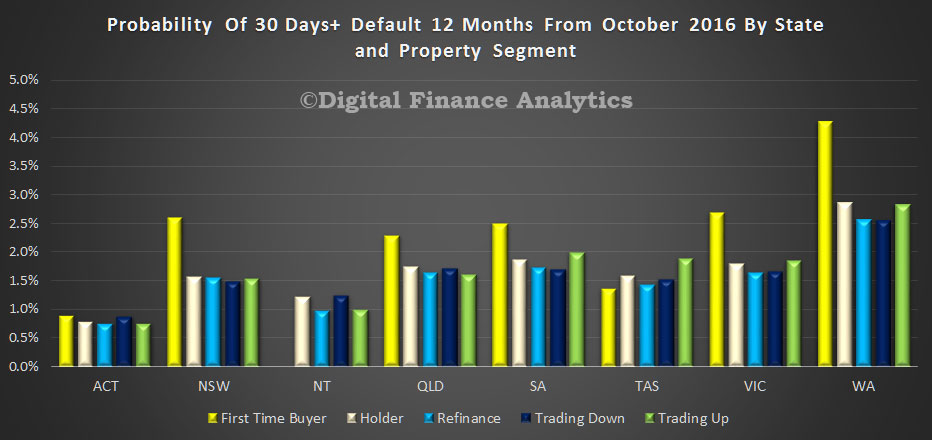

Western Australia and Queensland mining areas will bear the brunt, whereas New South Wales, Victoria and ACT are best placed. Households with units in the CBD and surrounds will also be under pressure. This will likely put some downward pressure on home prices in these areas.

Here is a summary of default probability by state, and owner occupied household segments. First Time Buyers in WA are at highest risk.

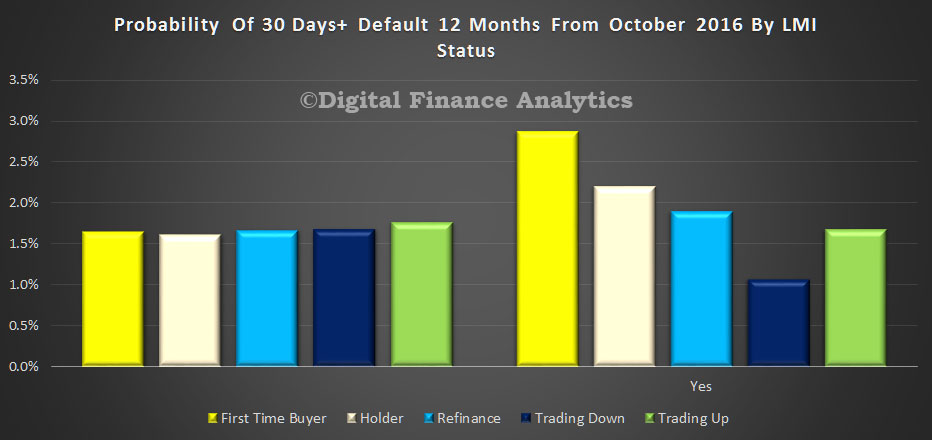

Looking at the same data, by Lender Mortgage Insurance (LMI) status, we see that those needing LMI (generally with an LVR above 80%) are at a higher level of risk, compared with those who do not have LMI.

Looking at the same data, by Lender Mortgage Insurance (LMI) status, we see that those needing LMI (generally with an LVR above 80%) are at a higher level of risk, compared with those who do not have LMI.

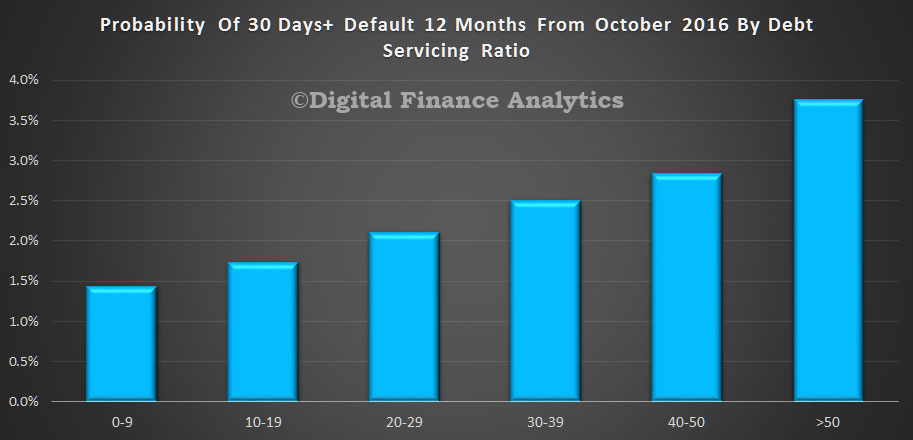

Loans with a higher debt servicing ratio (DSR) are more at risk. We think DSR is the better risk measure, as our modelling highlights.

Loans with a higher debt servicing ratio (DSR) are more at risk. We think DSR is the better risk measure, as our modelling highlights.

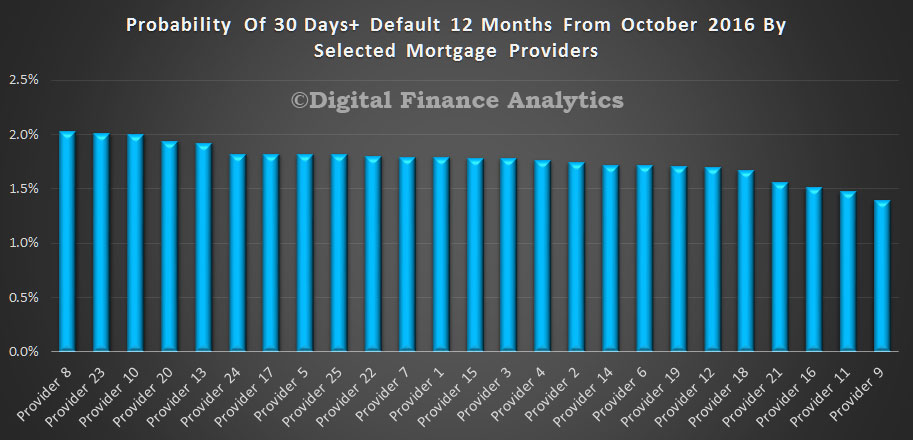

Probability of default does vary by mortgage provider. Here is a sample from lenders from our database. Clearly lenders have different underwriting rules and standards, as well as different channels to market.

Probability of default does vary by mortgage provider. Here is a sample from lenders from our database. Clearly lenders have different underwriting rules and standards, as well as different channels to market.

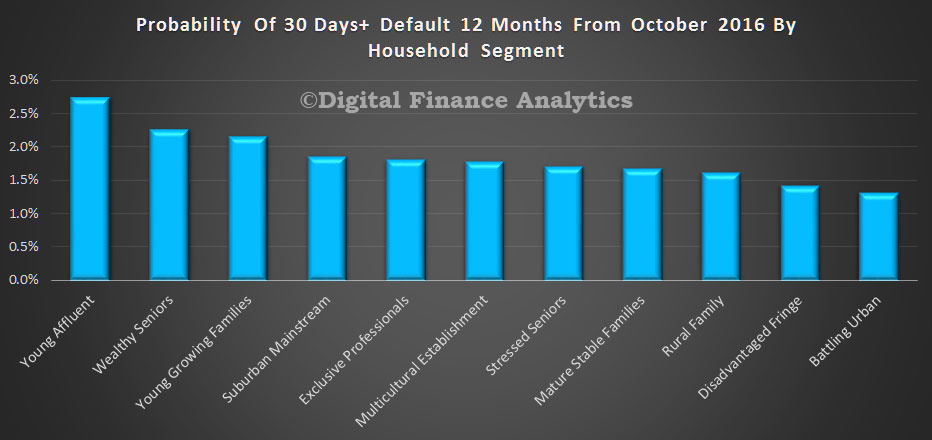

Looking at our master segmentation, we see that more affluent younger and wealth seniors are at risk. This is because they are more highly geared, and therefore most sensitive to changes in income.

Looking at our master segmentation, we see that more affluent younger and wealth seniors are at risk. This is because they are more highly geared, and therefore most sensitive to changes in income.

Interestingly, those disadvantaged households on the edge of cities, and battling urban households are at lower risks of default. This is because they have not been able to gear up as much as other household groups as lending standards have tightened.

However, as expect many young growing families are finding it difficult to make their mortgage repayments, and with incomes static, this will only get worse.

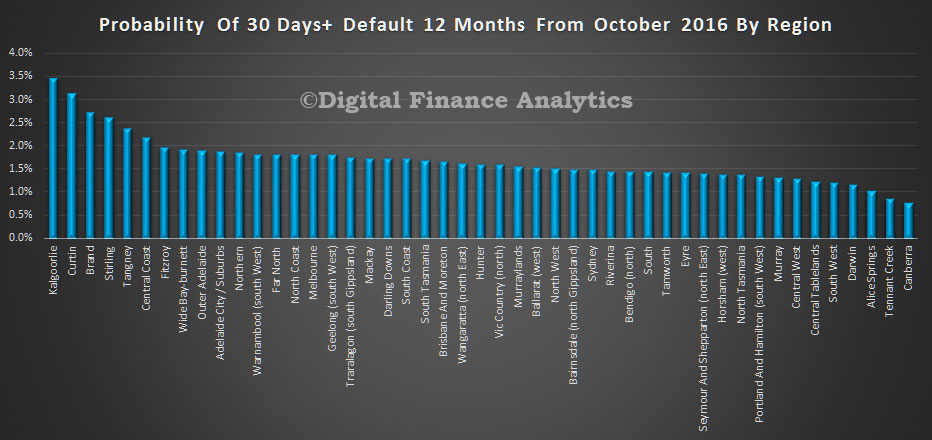

Finally, here is a view by region across Australia. Locations in WA have the highest potential risk, whilst Canberra has the lowest.

Finally, here is a view by region across Australia. Locations in WA have the highest potential risk, whilst Canberra has the lowest.

We should say this is an estimate, as of course economic predictions do change. That said, it has proven to be quite an accurate tool for risk assessment purposes.

We should say this is an estimate, as of course economic predictions do change. That said, it has proven to be quite an accurate tool for risk assessment purposes.

2 thoughts on “Probability Of Mortgage Default Rises”