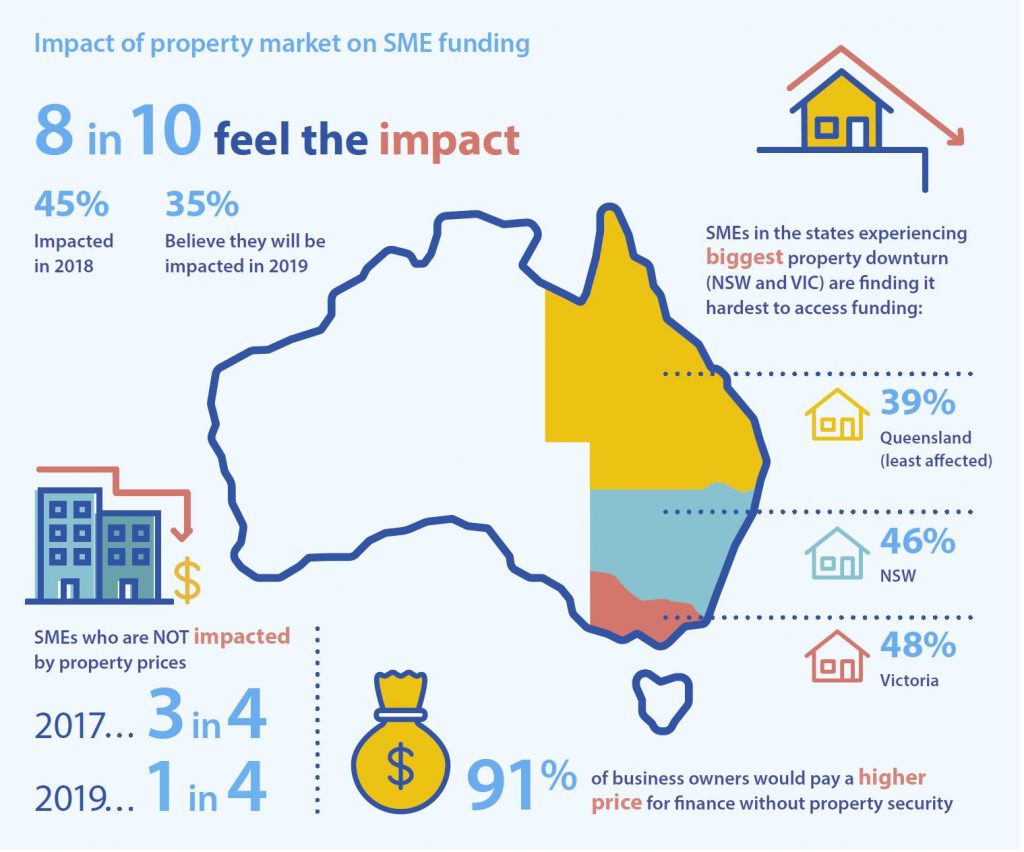

Almost half the SMEs (44.5%) say property market conditions are already making it harder for them to access business funding, likely due to softening house prices in major markets, according to the latest Scottish Pacific Business Finance report, based on research by East & Partners who interviewed 1,257 SME businesses with annual revenues of A$1-20 million over a seven-week period ending 18 January 2019.

Of course this is a relatively narrow segment of the SME market, as many will have significantly lower turnover.

The report said that a further 35% haven’t yet felt the impact, but fully expect the housing price correction and broader property market conditions

including slowing loan approvals will have a significant impact on their borrowing capacity.

When property market impact was last assessed in September 2017, three out of four SMEs said property prices were having no direct impact on their businesses. This round, only one in five SMEs said they had not yet seen a direct impact.

This minority of non-affected SMEs perhaps reflects how broad the base of Australia’s small business sector is, with more than two million enterprises across a wide range of industries and regional markets.

Property prices are having more impact on SMEs in Victoria and NSW (affecting 48% and 46% respectively), with Queensland small businesses (39%) the most buffered.

Declining or no-change SMEs are being hit harder by property market movements, with 54% of non-growth SMEs already impacted (compared to 36% of growth SMEs).

For these non-growth SMEs, finances are already stretched thin and they are feeling “when it rains it pours”. These are the businesses that currently need the most support to get through tough market conditions.

More than 91% of SMEs would be prepared to pay a higher rate to obtain finance if they didn’t have to provide real estate security. This overwhelming sentiment is voiced at a time when a sharp correction in residential property prices is affecting capital cities, coupled with falling building approval data and predictions by analysts such as Core Logic and UBS of tough market conditions still to come.

Of the nine out of 10 business owners who say they would be willing to pay a higher rate for finance if they could avoid using property as security, almost two-thirds (65%) indicated they ‘definitely’ would be willing, and more than a quarter (26%) said ‘probably’. Fewer than 1% of SMEs ‘definitely’ would not consider higher rates in place of borrowing against the family home, and just over 1.5% said it would be ‘unlikely’.

According to the Productivity Commission’s draft report into Australian financial system competition, a third to a half of Australian SME loan value is reliant on property security. For the major banks, 35% of their

small business lending (by loan value) is secured by real estate. For banks outside the majors this figure is higher, at almost 47%.