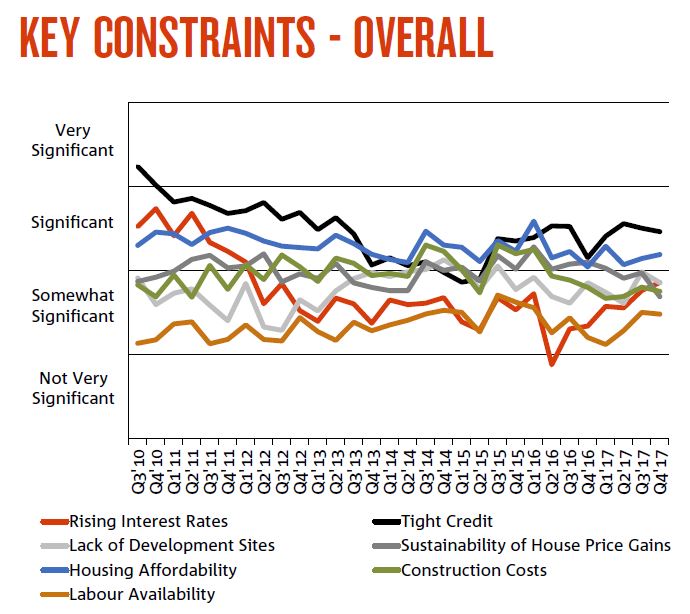

NAB released their Q4 2017 Property Survey. They see property prices easing as foreign buyers lose interest, and a big rotation from the east coast. Tight credit will be a significant constraint.

National housing market sentiment (measured by the NAB Residential Property Index) was unchanged in Q4, as big gains in SA/NT and WA (but still negative) offset easing sentiment in the key Eastern states (NSW and VIC).

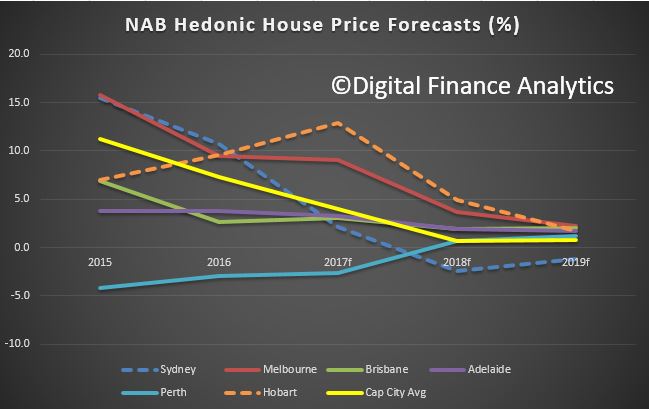

Confidence levels also turned down, led by NSW and VIC, but SA/NT a big improver. SA/NT is now also the only state expected to record faster house price growth over the next 1-2 years, but prices are expected to grow fastest in QLD and fall in NSW. Income yields should however improve over the next 1-2 years as rental expectations exceed house prices in most states except QLD and WA. First home buyers (especially those buying for owner occupation) continue raising their profile in new and established housing markets, with their share of demand reaching new survey highs.

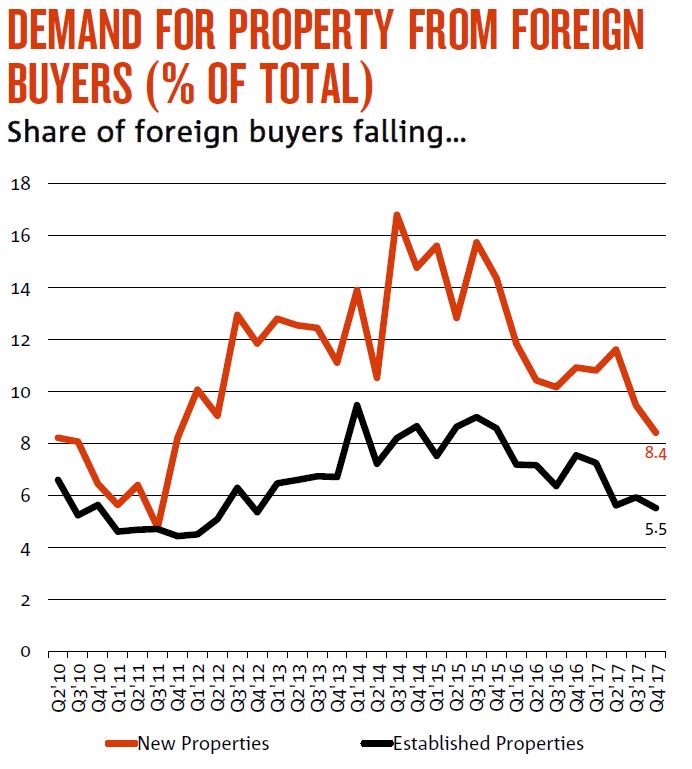

In contrast, the share of foreign buyers continued to fall in all states, except QLD (new property) and VIC (established housing), with property experts predicting further reductions over the next 12 months.

NAB’s view for 2018 is largely unchanged, but the degree of moderation has been ramped up – driven by revisions to Sydney. House prices are forecast to rise 0.7% (previously 3.4%) and remain subdued in 2019 (0.8%).

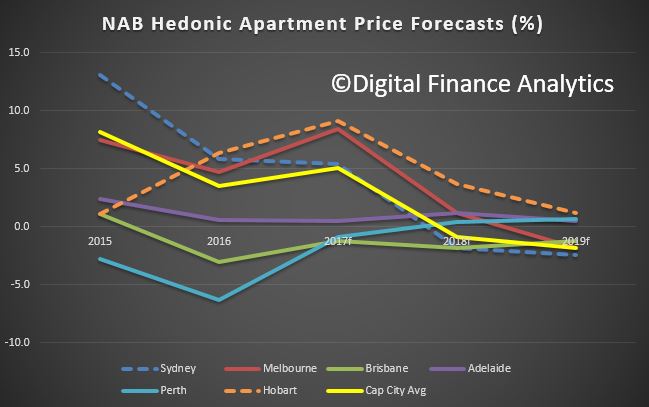

Apartments will under-perform, reflecting large stock additions and softer outlook for foreign demand.