Today we continue our analysis of the latest results from our Household Surveys by drilling down into the segment specific analysis, having in our previous post looked at the changing dynamics across our household segments.

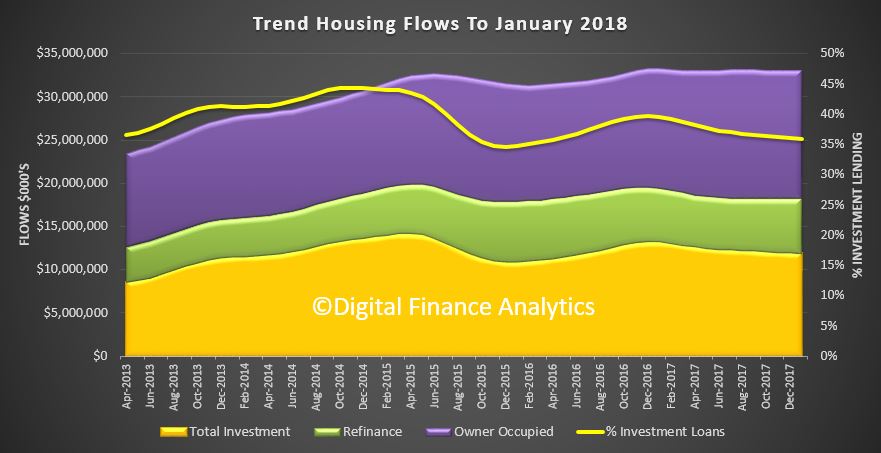

We start with the Property Investor segments, which are becoming significantly less active thanks to a tightening of lending standards, higher mortgage rates and more limited capital growth. As a reminder the latest available ABS data shows that lending flows to investors is slowing, and especially interest only loans, and the number with interest only loans who are now being forced to move to the more expensive principle and interest loans is rising.

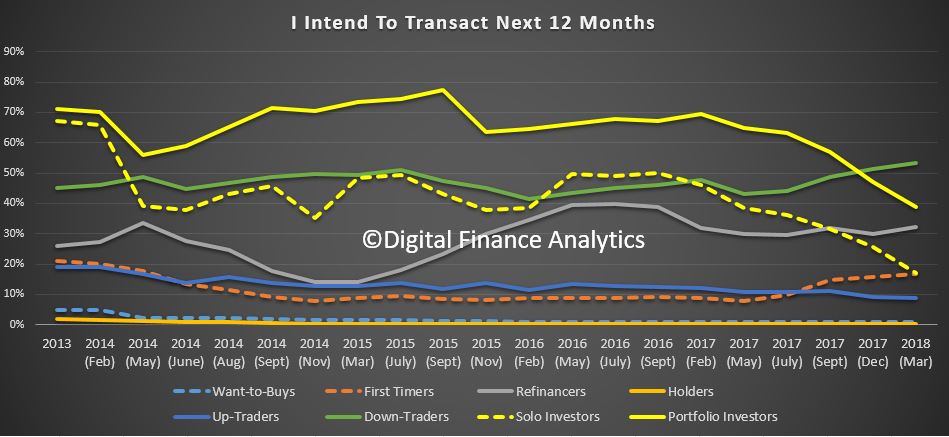

Yesterday we showed how their buying intentions were tanking.

Yesterday we showed how their buying intentions were tanking.

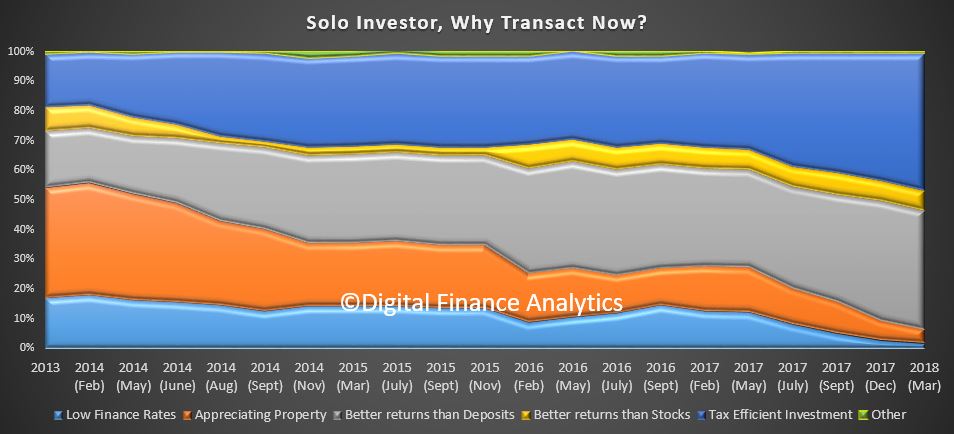

So now lets go deeper into the data, starting with solo investors – those with just one or two properties, and their motivations. The predominate reason for investors to hold property now relate to the tax benefits which can be accessed at 46%, up 3% from December 2017. This includes the ability of offset costs (including interest costs) against tax, as well as access to the very beneficial capital gains. The other driver is the perceived better returns compared with bank deposits at 39%, despite the fact that it you tot up all the various costs of an investment property, including returns from rentals, half the properties are under water! Other factors, such as access to low finance rates (1.9%) and appreciating property values (4.7%) are becoming less significant.

So now lets go deeper into the data, starting with solo investors – those with just one or two properties, and their motivations. The predominate reason for investors to hold property now relate to the tax benefits which can be accessed at 46%, up 3% from December 2017. This includes the ability of offset costs (including interest costs) against tax, as well as access to the very beneficial capital gains. The other driver is the perceived better returns compared with bank deposits at 39%, despite the fact that it you tot up all the various costs of an investment property, including returns from rentals, half the properties are under water! Other factors, such as access to low finance rates (1.9%) and appreciating property values (4.7%) are becoming less significant.

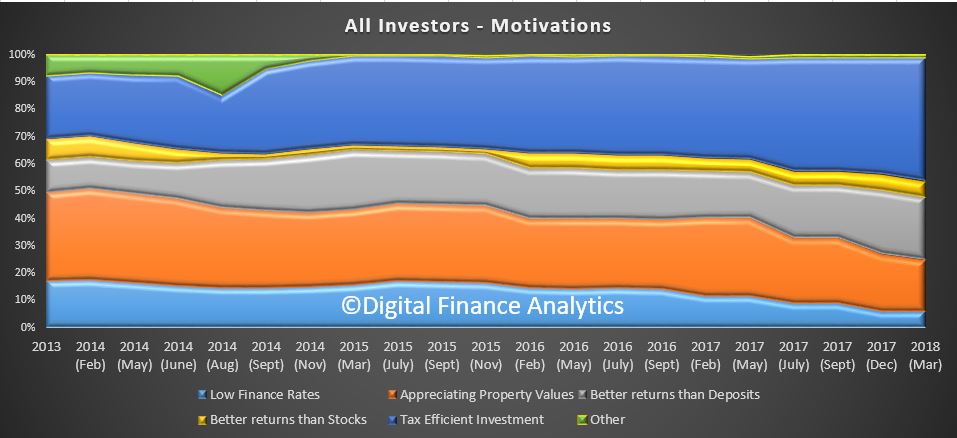

The pattern for portfolio investors is vary similar. So looking across all investors, we see a similar footprint, with the drive to gain tax efficiency (45%, up 2.4%), better returns than deposits (23%) and low finance rates down to 6.1%. Appreciating property values account for 18% of the motivation, down 2% on the previous quarter and continues to slide.

The pattern for portfolio investors is vary similar. So looking across all investors, we see a similar footprint, with the drive to gain tax efficiency (45%, up 2.4%), better returns than deposits (23%) and low finance rates down to 6.1%. Appreciating property values account for 18% of the motivation, down 2% on the previous quarter and continues to slide.

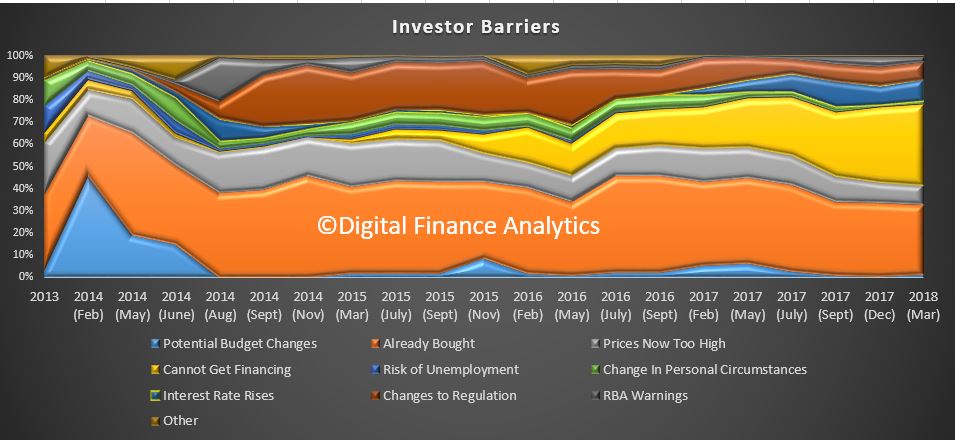

Turning to the investor barriers, we see a significant rise in the number of investors who are unable to get finance, up 3% to 36.7%, a trend which started in 2015, but is now accelerating. A further 10% see potential interest rate rises a barrier, up more than 1% from December 2017. We note that RBA warnings have only a small impact, at 2.5%, down 2% from our last surveys.

Turning to the investor barriers, we see a significant rise in the number of investors who are unable to get finance, up 3% to 36.7%, a trend which started in 2015, but is now accelerating. A further 10% see potential interest rate rises a barrier, up more than 1% from December 2017. We note that RBA warnings have only a small impact, at 2.5%, down 2% from our last surveys.

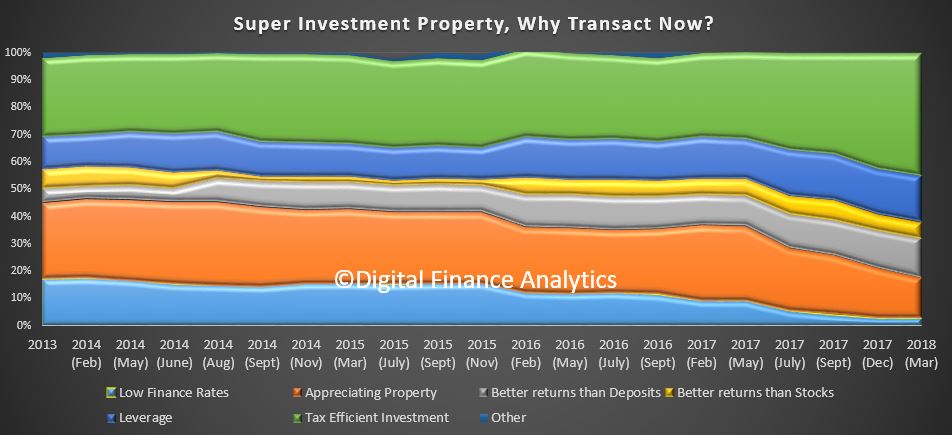

Looking across to property investment via a self- managed superannuation fund, once again tax benefits at 45%, up 2%, and better returns than deposits at 14%, plus leverage 17% account for the majority of the motivations to transact. 14.6% of SMSF property investors are still expecting further property gains, but this is down more than 2% from last time. Low finance rates accounted for only 2% of motivations.

Looking across to property investment via a self- managed superannuation fund, once again tax benefits at 45%, up 2%, and better returns than deposits at 14%, plus leverage 17% account for the majority of the motivations to transact. 14.6% of SMSF property investors are still expecting further property gains, but this is down more than 2% from last time. Low finance rates accounted for only 2% of motivations.

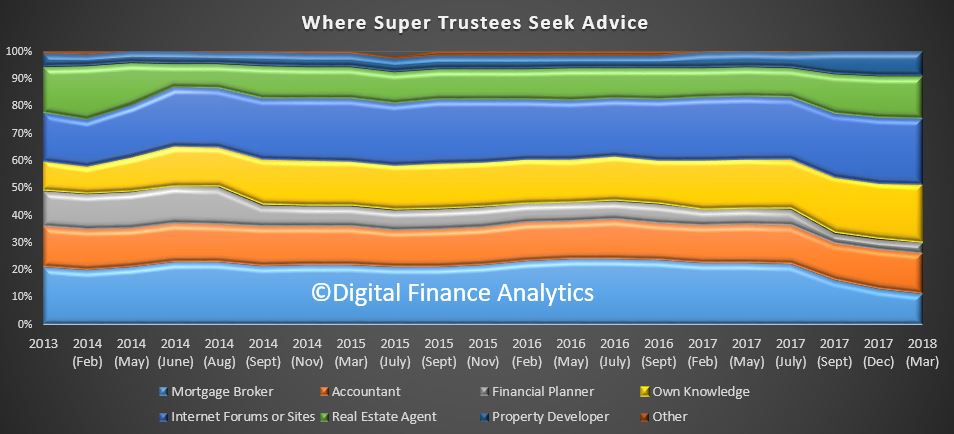

We also examine where trustees of SMSF’s obtain property investment advice. 24% obtain advice online from internet forums, 21% use their own knowledge, 15% use a real estate agent, 15% also use an accountant and 11% use a mortgage broker. We noted a 2% drop in those using a mortgage broker compared with December.

We also examine where trustees of SMSF’s obtain property investment advice. 24% obtain advice online from internet forums, 21% use their own knowledge, 15% use a real estate agent, 15% also use an accountant and 11% use a mortgage broker. We noted a 2% drop in those using a mortgage broker compared with December.

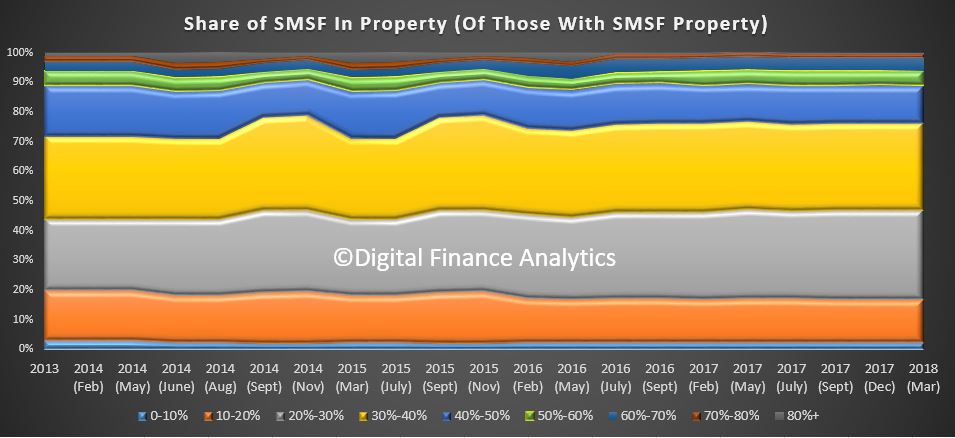

Finally, the asset allocation of a SMSF into property varies, with 30% holding 20-30% of their funds in property, 29% holding 30-40%, and more than 11% holding more than half of their SMSF assets in property. Only a very small proportion hold more than 80% of their funds in property. The mix has not really varied significantly over time, but the proportion of all super funds with property assets has risen from just over 3% to more than 5%, and rising. Such non- recourse borrowing has been identified by APRA as higher risk, so in their new guidelines, banks will need to hold higher capital against these loans. In addition of course David Murray’s Financial System Inquiry (FSI) recommended that SMSF’s should not be able to leverage into property. We support that recommendation, which the Government rejected.

Finally, the asset allocation of a SMSF into property varies, with 30% holding 20-30% of their funds in property, 29% holding 30-40%, and more than 11% holding more than half of their SMSF assets in property. Only a very small proportion hold more than 80% of their funds in property. The mix has not really varied significantly over time, but the proportion of all super funds with property assets has risen from just over 3% to more than 5%, and rising. Such non- recourse borrowing has been identified by APRA as higher risk, so in their new guidelines, banks will need to hold higher capital against these loans. In addition of course David Murray’s Financial System Inquiry (FSI) recommended that SMSF’s should not be able to leverage into property. We support that recommendation, which the Government rejected.

So standing back, it is clear that investors are getting skittish, hence the lower demand for property, as well as difficulty in gaining access to finance. This is why we think investment property demand will continue to fall. As they account for more than one third of all loans, this will put downward pressure on property prices.

So standing back, it is clear that investors are getting skittish, hence the lower demand for property, as well as difficulty in gaining access to finance. This is why we think investment property demand will continue to fall. As they account for more than one third of all loans, this will put downward pressure on property prices.

Finally, the number of first time buyer investors – those who are going direct to the investment sector continues to fall, as can be seen from our analysis of ABS and DFA datasets.

![]() Next time we will look at First Time Buyers.

Next time we will look at First Time Buyers.