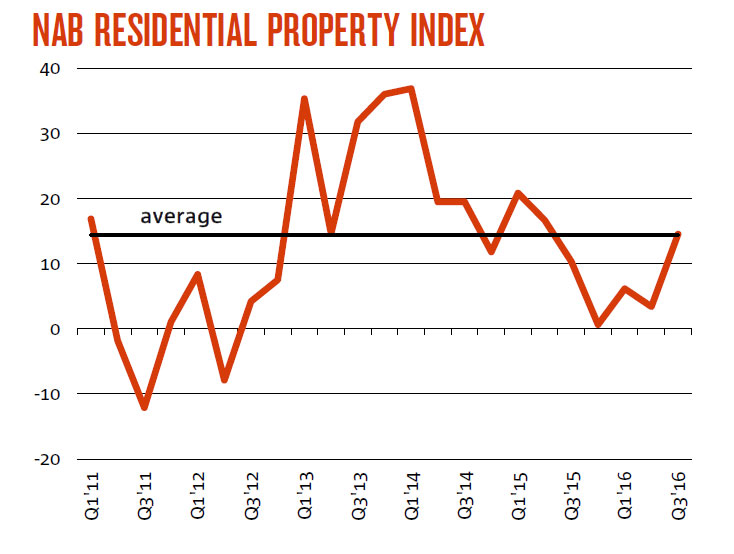

The NAB Residential Property Index improved to +15 from +3 in Q3, with sentiment rising in all states except SA/NT. NSW leads the states at +53 (up from +23) and Victoria improved notably to +40 (up from +23).

“The NAB Residential Property Survey continues to show significant variances in sentiment between the states, with the eastern seaboard still leading the charge and negative sentiment in mining-led states, particularly in WA which remained at a survey low -67 ” NAB Chief Economist Alan Oster said.

“Overall confidence has also waned slightly with the Index expected to remain unchanged in 2017, but falling to +30 points (from +39) in two years’ time.”

Looking forward, property professionals on average are expecting national house prices over the next 12 months to strengthen 1.3% and 1.4% in two years’ time.

But while their expectations for price growth in Victoria, NSW and SA/NT were revised up, they were cut back in Queensland and are expected to continue falling in WA.

Property professionals identified employment security as the biggest constraint on buyers of existing property in Australia.

During Q3, the overall market share of foreign buyers in new and established property markets fell to their lowest levels since 2012, with foreign buyers less prominent in Victoria, NSW and Queensland.

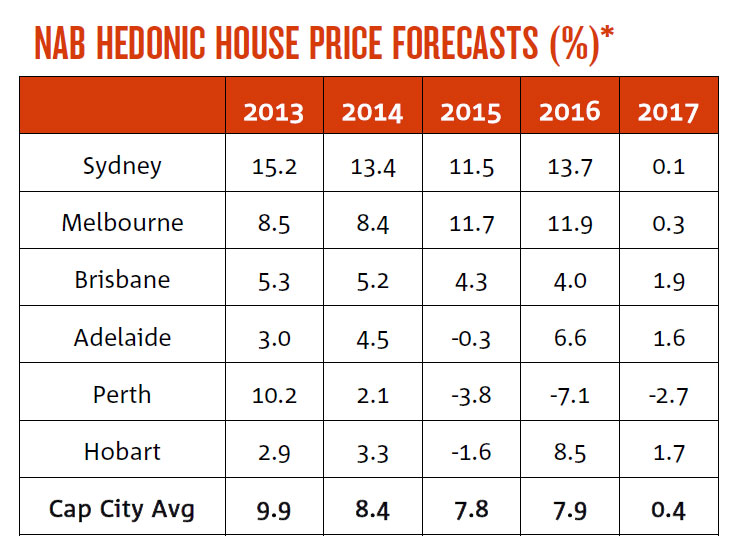

NAB’s forecasts on residential prices

NAB Group Economics has also revised its national house price forecasts for 2016 upwards to 7.9% (from 5.1%). Unit price forecasts were also revised up, to 5.2% for 2016.

“We have revised our price forecasts upwards in response to a sharp rise in the six-month annualised growth in dwelling prices, particularly in Sydney and Melbourne,” Mr Oster said.

“The RBA’s recent interest rate cuts have been a major source of support, while investor credit has also picked up again. On the supply side, there also appears to be a number of factors at play with auction and sales volumes down compared to a year ago.

“As we have said for some time, there is considerable uncertainty over the outlook for dwelling prices. We are expecting a more subdued environment from late-2017 as supply conditions become less favourable.

“However, we continue to hold the view that residential property prices are unlikely to experience a severe price ‘correction’ without a trigger that leaves unemployment or interest rates sharply higher – which we are not anticipating.”

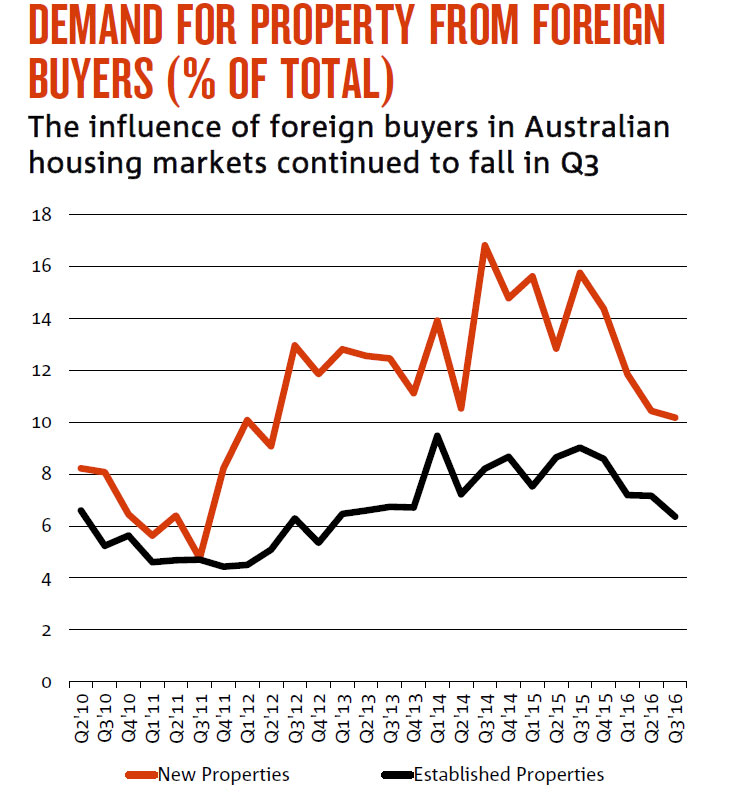

Foreign Buyers

The influence of foreign buyers in Australian property markets continued to lessen according to surveyed property professionals, suggesting that tighter conditions imposed on foreign buyers is still having an impact.

In Q3, foreign buyers accounted for 10.2% of all new property purchases (10.4% in Q2) – the lowest level since mid-2012. In established markets, their share fell to 6.4% (7.2% in Q2) – its lowest level since Q4 2012.

In new property markets, foreign buyers were less prominent in the key states. In VIC, their market share fell to 15% in Q3. This followed a sharp jump in foreign buying activity in Q2 to 21.7% of sales ahead of an increase in the stamp duty surcharge on foreign buyers of Victorian property.

Foreign buyers were also less influential in NSW, where they accounted for just 8% of total demand – the lowest level since Q1 2012.

In QLD, their market share of sales fell to 10.5% (11.2% in Q2). In WA, foreign buyers lifted their market share to 6.6% (3.9% in Q2), which may suggest they are seeing greater value as prices fall.

About 240 property professionals participated in the Q3 survey.