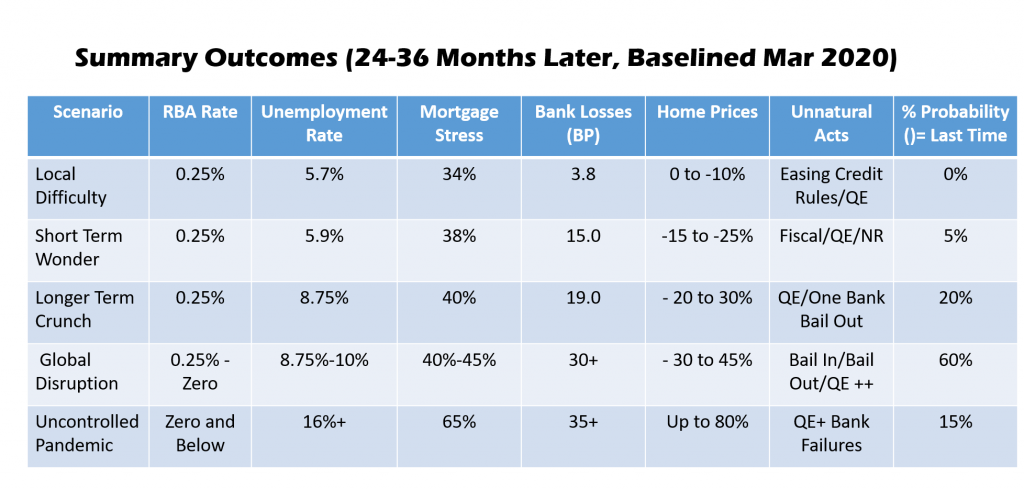

The latest results from the DFA household surveys examining property sentiment, reveals how much things have changed in the past month, from a pre-COVID to a COVID world.

These results are from our rolling 52,000 survey database, and we are able to track sentiment across our various household segments, and across owner occupier and investor cohorts. And I should note that although we run the analysis down to a post code level, the shifts are pretty uniform across the country.

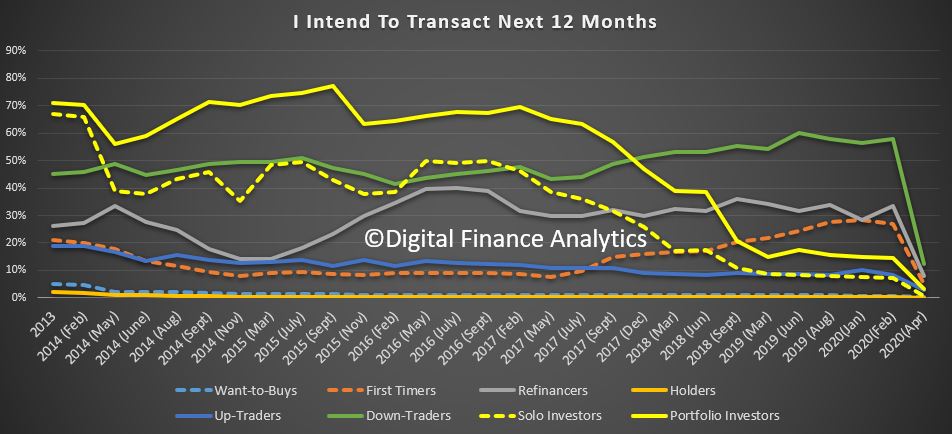

First, we see that the intention to transact has dropped, across all property segments, and there are significant shifts among those seeking to trade downwards in order to to release equity, as fears of equity reduction rise. That said, some here are still seeking to exit now, fearing greater falls later. We covered this in our recent forced sales analysis. Property investors are also stepping back – no real surprise given the fall in rents, and the rises in listings we are seeing. First time buyers are also backing off. Thus sales volume will drop, significantly.

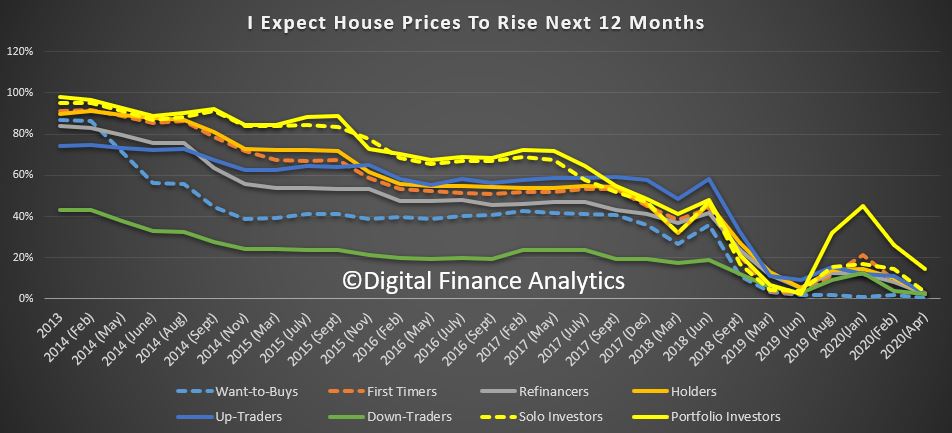

Property price expectations are shifting down, with a massive drop in those expecting any rise in the next 12 months (we may need to change the question to falls in the months ahead!). Portfolio investors remain a little more bullish, but it is all relative.

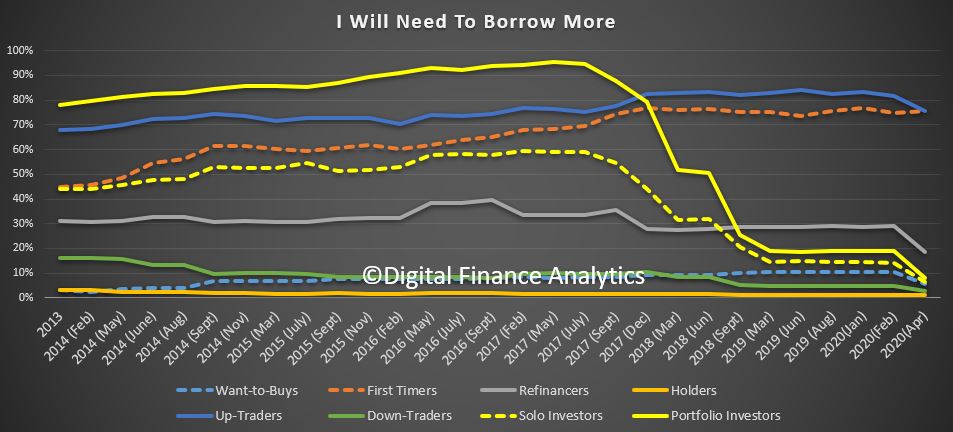

Demand for credit for property purchase also fell, though those seeking to refinance to gain rate discounts are still evident. In two segments, those seeking to trade up, and first time buyers, will still need to borrow more – if they were to transact. As above though the number borrowing is low for now.

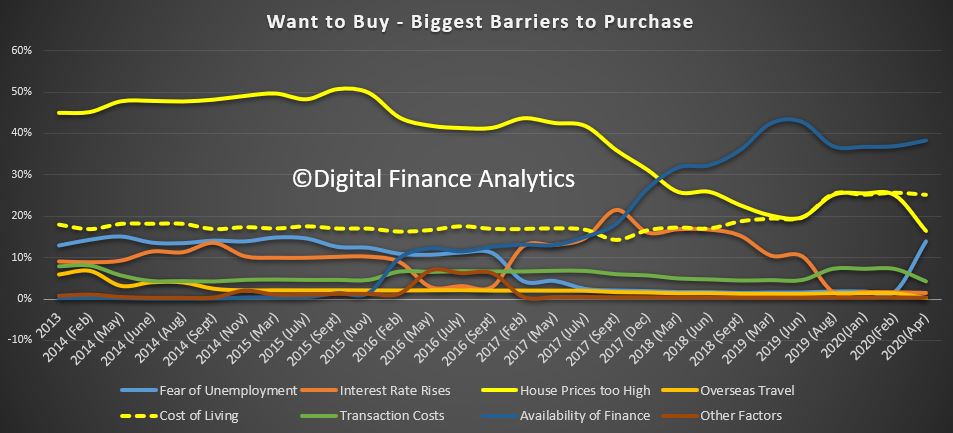

Across the segments, those wanting to buy saw a significant acceleration of concerns about the fear of unemployment – no surprise there.

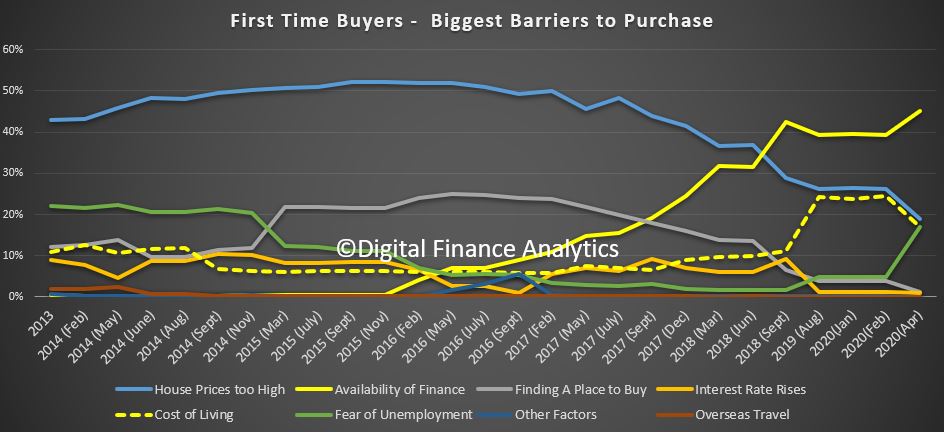

The barriers for first time buyers include the availability of finance (we know some lenders are asking more questions about employment, and income than a month back). Again we see the fear of unemployment lifting consistent with other segments.

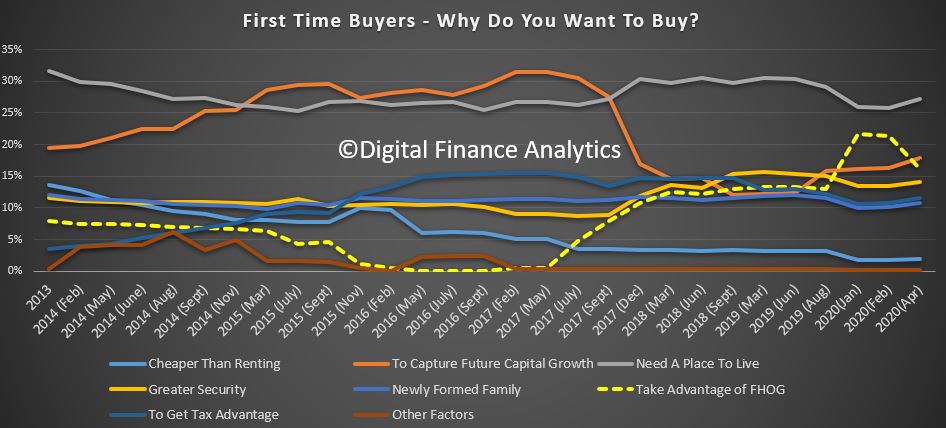

First time buyer motivations show that the attractiveness of the First Owner Grants tailed off, and there was a slight uptick in future capital growth expectations.

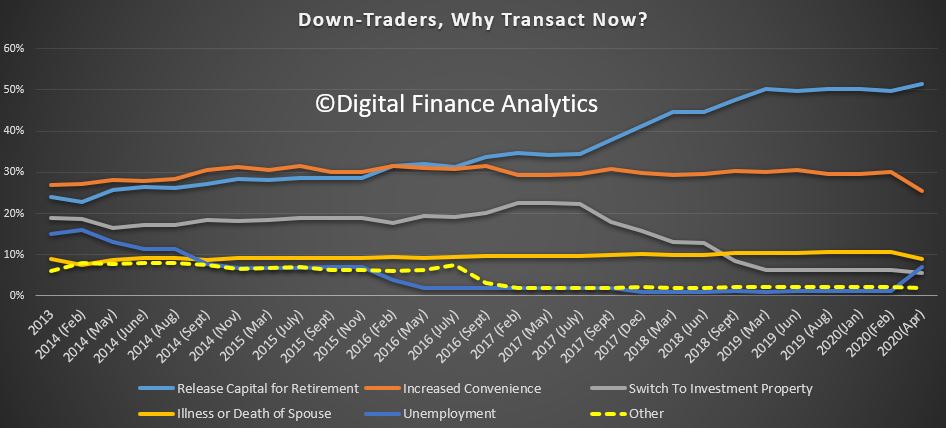

Down traders are driven mainly by a need to release capital for retirement (good luck with that!) and again we see the uptick in unemployment driving the decision to transact.

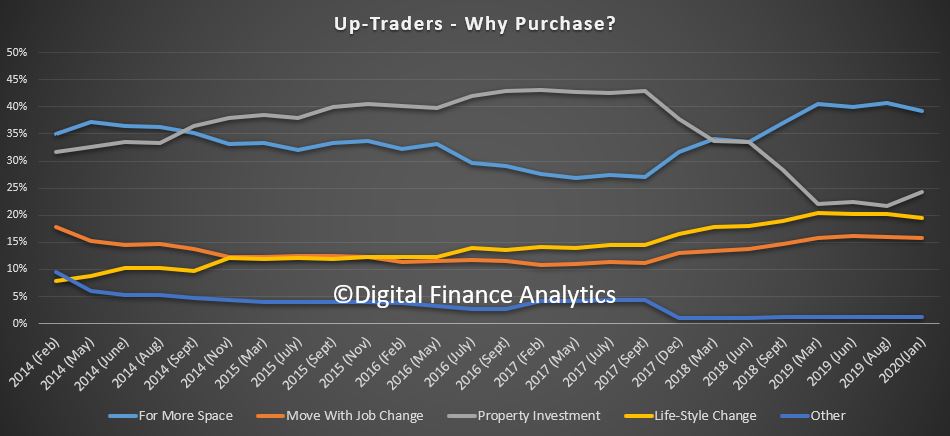

Those seeking to trade up still have the same basic motivations.

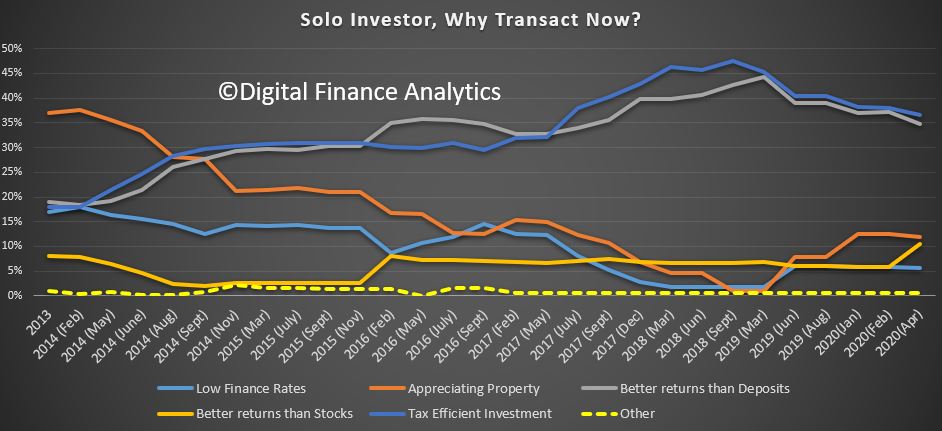

Property Investors are swinging a little towards equity investments, and under 20% are expecting future capital gains for now. Low finance rates, and prospective better returns than deposits remain the stronger themes, though as I have highlighted before, many property investors would be disappointment if they did but calculate the real returns on property. They are overstated, especially if capital values continue to fall.

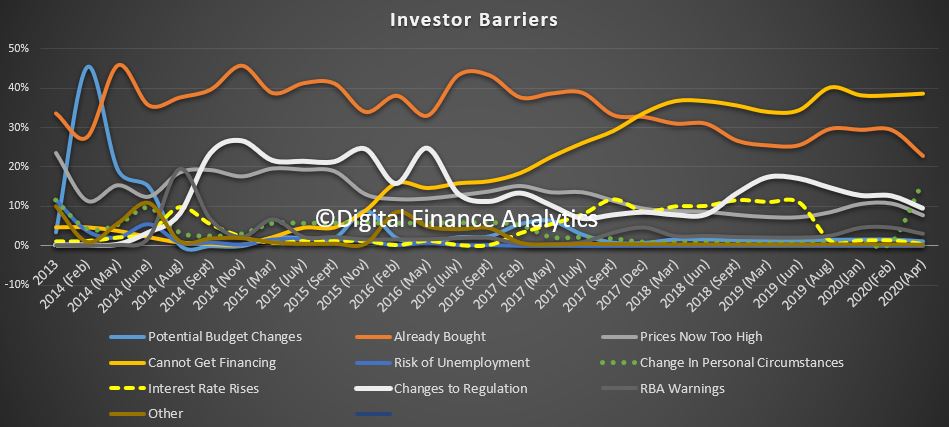

On the other hand, the barriers for investment reveals difficulty in getting financing, and changes in personal circumstances as significant risk factors.

I should caution we may see sentiment swing back in the weeks ahead as things play out, but in summary for now, demand for property is sinking, availability of finance is tightening, and the spectre of unemployment is rising. Property prices are likely to fall, now its a question of how far!