As expected the RBA cut the cash rate to 0.5% “the Board took this decision to support the economy as it responds to the global coronavirus outbreak”.

All the major banks passed on the cut in full (thanks to severe political pressure), though gritted teeth. The profit pressure at the banks just went up a notch, on our modelling, a potential fall of more than 3%, though for some regionals perhaps double that. Players like Suncorp also passed on the cut.

The Government has said there will be a targetted package to assist businesses soon, and before the May budget. The savings deeming rate is now completely out of wack with even the very best deposit rates available, so pensioners, those on Government support and welfare are being hit by the gap. The deeming rate for singles is currently 3.0% for assets over $51,200 and 1.0% for those under that threshold. One way the Government is “balancing” the budget

Overnight the FED cut, in an expected “unexpected” drop of 50 basis points. This was the first time the Fed had cut by more than 25 basis points since 2008 and the reduction marks a stark shift for Powell and his colleagues. They had previously projected no change in rates during 2020, remaining on the sidelines during the election year, after lowering their benchmark three times in 2019. They of course rejected any political influence despite Trump’s consistent pressure to drop rates.

Its become very clear that central bankers are worried not only about the economic impact of COVID-19 but also the losses in the stock market.

The Fed said the coronavirus outbreak had disrupted economies in many countries and these measures will weigh on activity for some time. The magnitude and persistence of the impact is uncertain but the risks to their outlook changed enough to justify a move to support the economy. He added that there will be more action by each G7 nation along with the possibility of formal coordination. In other words, more easing is on the way from other central banks including the Fed if the sell-off in stocks deepens and the global slowdown worsens. This was aimed to restore confidence in the market, it did not.

The OECD indicated that economic growth could fall to as low as 1.5% for this year. The Fed’s decision could trigger a wave of easing from other central banks around the world although those in the euro-area and Japan have less scope to follow with rates already in negative territory.

The G7’s issued a statement that was to the point:

We, G7 Finance Ministers and Central Bank Governors, are closely monitoring the spread of the coronavirus disease 2019 (COVID-19) and its impact on markets and economic conditions.

Given the potential impacts of COVID-19 on global growth, we reaffirm our commitment to use all appropriate policy tools to achieve strong, sustainable growth and safeguard against downside risks. Alongside strengthening efforts to expand health services, G7 finance ministers are ready to take actions, including fiscal measures where appropriate, to aid in the response to the virus and support the economy during this phase. G7 central banks will continue to fulfill their mandates, thus supporting price stability and economic growth while maintaining the resilience of the financial system.

We welcome that the International Monetary Fund, the World Bank, and other international financial institutions stand ready to help member countries address the human tragedy and economic challenge posed by COVID-19 through the use of their available instruments to the fullest extent possible.

But the point is, no rate cut, or government stimulus can cure the virus, which continues to spread with person to person transmission on the rise.

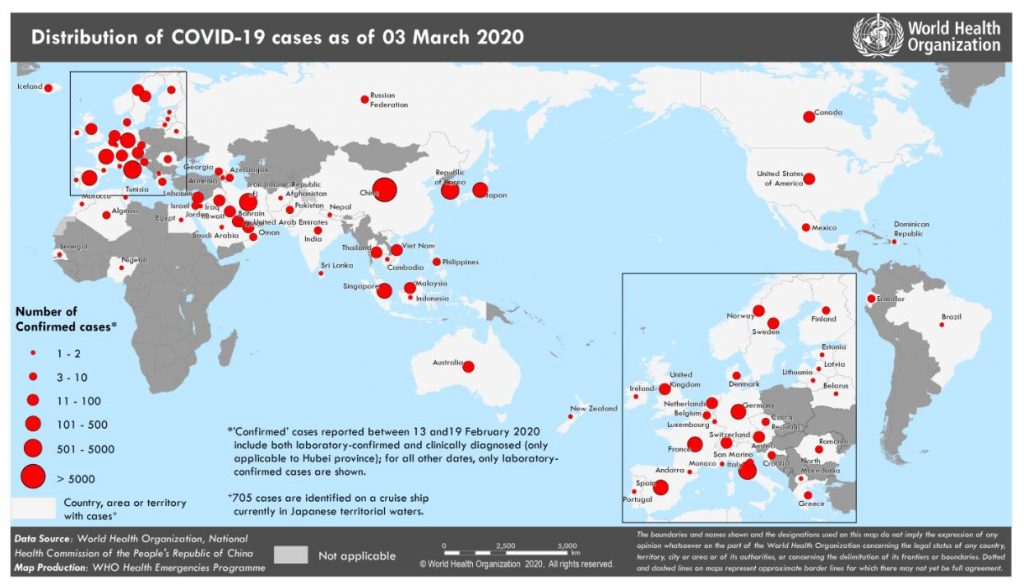

The latest WHO update says eight new Member States (Andorra, Jordan, Latvia, Morocco, Portugal, Saudi Arabia, Senegal, and Tunisia) reported cases of COVID-19 in the past 24 hours. Globally 90,870 cases have been confirmed (1,922 new), with China 80,304 confirmed (130 new) and 2,946 deaths (31 new). Outside of China 10,566 cases are confirmed (1,792 new) in 72 countries (8 new) with 166 deaths (38 new).

The flow on effects in terms of reduced commerce is significant, with more businesses unable to source raw materials or distribute good. Across transport and tourism, and education the impacts are immediate, but other sectors are following. Hence the expectation of slowing growth.

The question becomes, at what point do businesses cease to trade, or pay their employees, and to what extent will households also hunker down (many were already).

The US markets reacted badly to the FED’s move, with the Dow down close to 3%.

The ASX was also down in early trading.

The supply side consequences of the virus, could well flow on the credit markets, and in this case lower interest rates – other than as a confidence signal will not help.

Central bank tools are not going to cure the virus, and lower rates and more QE liquidity might well make the situation worse. Fiscal responses can provide a little more support, perhaps, though Governments seem reluctant to play that card hard.

We are in uncharted territory, and I do not think Central Banks can save us this time.