Following the recent minutes from the Council of Financial Regulators, which is chaired by the RBA, now according to the Australian, the RBA has been lobbying the banks to lend more.

“Reserve Bank governor Philip Lowe is understood to have met with the big bank chiefs in recent weeks to caution them against an overzealous tightening of credit supply in response to lending rules and the Hayne royal commission”.

The RBA is of the view that lenders are turning good business away, and need to take risk on.

Some SME’s are getting caught in the cross fire, and its clear that business is finding it harder to get funding. This was covered in the RBA’s minutes, released yesterday.

Of course the responsible lending obligations have not changed, but now the meaning and obligations are front of mind. Thus banks need to examine income and expenses etc and cannot necessarily rely on HEM or mortgage brokers. So all this is in direct opposition to the RBA’s wishes, and we suspect the risk of legal action, or worse will continue to limit bank lending.

The ASIC Westpac case will be back before the courts in the new year, though as yet is not clear whether HEM will be tested in court, or whether its more about reaching a settlement. And the royal commission recommendations will be out in February

Is the RBA really condoning the bad behaviour and law breaking exposed in the past year?

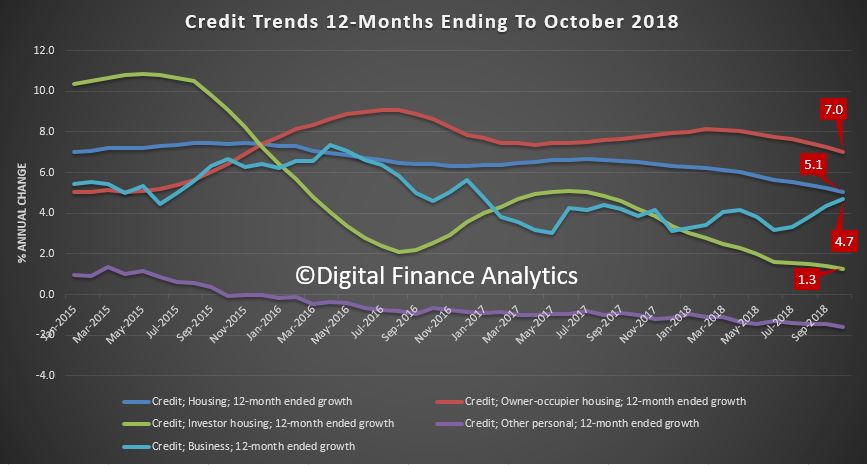

And remember that currently mortgage lending is still running at more than 5% on an annualised basis, according to RBA data.

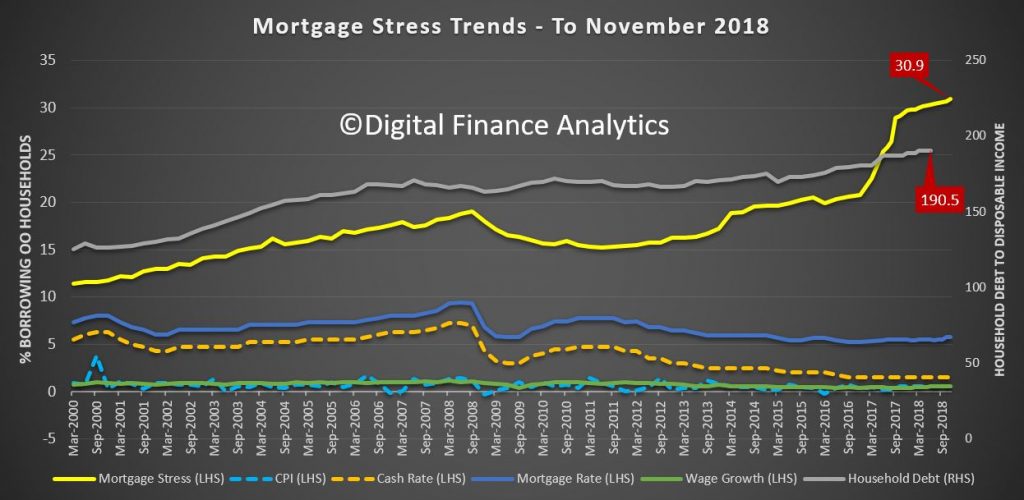

The fundamental problem is the RBA has been responsible for the growth of credit to the point where households in Australia are some of the most leveraged in the world, home prices have exploded and bank balance sheets have inflated. But all this “growth” is illusory. Mortgage stress continues to build and the wealth effect is reversing as home prices slide.

Thus, as we anticipated, we will see a number of “unnatural acts” by the RBA and the Government to try and stop the debt bomb from exploding, by trying to get credit to expand. But this is irresponsible behaviour, in the light of rising global interest rates, high market volatility and building systemic risks.

“….the RBA has been lobbying the banks to lend more.”

I can’t help but feel this is contrary to just published APRA document by a large amount, I mean what is the point of removing interest only loans on mortgages, but it’s OK for ALL other loans? No it is not! This should NEVER be! The RBA is more than happy to drive our nation further and further into UNSUSTAINABLE debt, there is no question about this, the proof is in the pudding, so where is the duty of care to Australians? As per APRA, there is NO DUTY OF CARE by the RBA either! These DONT work for Australian’s, they work for the BIS and US Federal Reserve, they are working for the 1%, they are deliberately selling Australian’s down the drain to enslave and control, ready for the coming collapse and planned reset into a global entity!