The RBA released their quarterly Statement On Monetary Policy today. Expect rate cuts, and QE later as the AUD is allowed to slide, as a decade of wrong policy is now coming home to roost. Plus they are tracking the labour market as a key determinate of policy using the wobbly ABS series data, looking past weaker inflation, and hoping for wages growth.

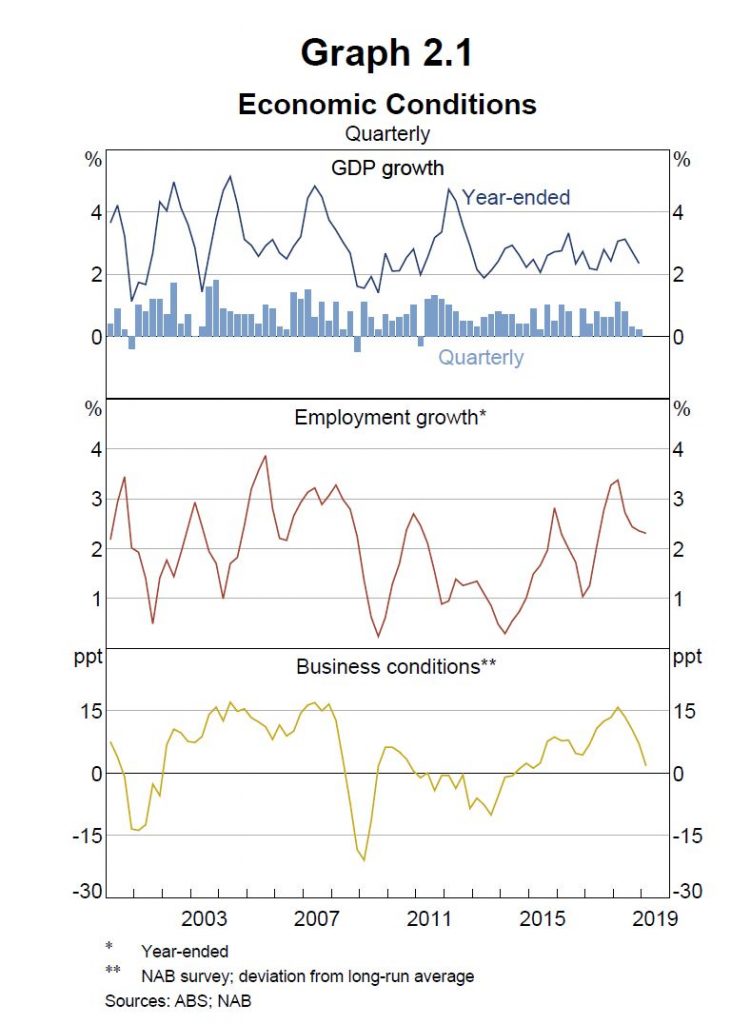

Growth in the Australian economy has slowed and inflation remains low. Subdued growth in household income and the adjustment in the housing market are affecting consumer spending and residential construction. Despite this, the labour market is performing reasonably well, with the unemployment rate steady at around 5 per cent. Underlying inflation has been lower than expected, at 1½ per cent over the year to the March quarter, with pricing pressures subdued across much of the economy.

GDP growth is expected to be around 2¾ per cent over both 2019 and 2020. This is lower than previously forecast, reflecting the revised outlook for household consumption spending and dwelling activity. Stronger growth in exports and, further out, work on new mining investment projects are expected to support growth. Forecasts for inflation have also been revised lower. Trimmed mean inflation is expected to be around 1¾ per cent over 2019 and then increase gradually to 2 per cent in 2020 and a touch above 2 per cent by early

In the near term, CPI inflation is expected to run a little above the rate for trimmed mean inflation, driven by the recent increase in petrol prices.

The Australian dollar is currently around the low end of the narrow range it has been in for some years. Sovereign bond rates in Australia have continued to decline relative to those in the major economies. This has tended to counteract the upward pressure on the exchange rate that would otherwise have come from rising prices for Australia’s key commodity exports.

Conditions in the established housing market remain soft. Housing prices have continued to decline in the largest cities, although the pace of decline has eased a bit recently. Some other indicators, including auction clearance rates, have improved a little since the end of last year, but generally point to continued soft conditions. Prices have also been declining in many other cities and regional areas.

Despite strong employment growth and some recovery in growth of average hourly earnings, growth in household income was very low over Non-labour sources of income have been subdued and are likely to remain so for a while, given the effects of the drought on farm incomes and of soft housing market conditions on the earnings of many other unincorporated businesses. Strong growth in tax payments has also subtracted from disposable income growth over recent years.

Weak growth in household income poses a key risk to the outlook for household consumption, especially in the context of falling housing prices and the need for many households to service high levels of debt. Some recovery in income growth is likely, because employment growth is expected to remain solid, wages are expected to increase and the tax offset for low and middle-income taxpayers is set to come into effect in the second half of this year.

At its recent meeting, the Board focused on the implications of the low inflation outcomes for the economic outlook. It concluded that the ongoing subdued rate of inflation suggests that a lower rate of unemployment is achievable while also having inflation consistent with the target. Given this assessment, the Board will be paying close attention to developments in the labour market at its upcoming meetings.