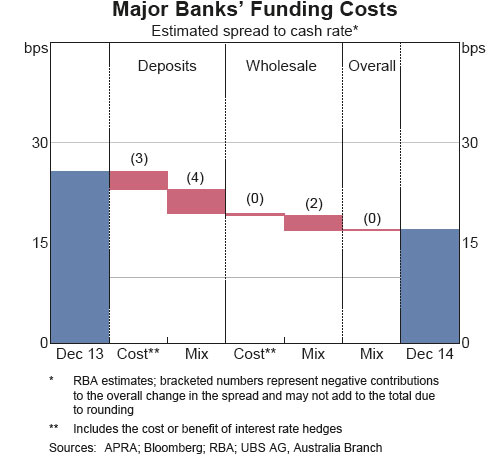

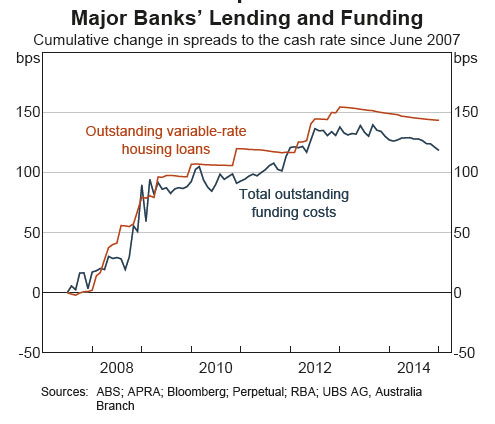

In the latest RBA Bulletin for the March quarter, there is an interesting article on bank funding “Developments in Banks’ Funding Costs and Lending Rates”. It demonstrates mix of forces in play, including competitive dynamics, relative product pricing, and the impact of the global financial system on the banks. The main finding is that the spread between the major banks’ outstanding funding costs and the cash rate narrowed a little over 2014. This was due to slightly lower costs of deposits combined with a more favourable mix of deposit funding. The contribution of wholesale funding to the narrowing was marginal as more favourable conditions in long-term debt markets were mostly offset by a rise in the cost of short-term debt. Lending rates declined a little more than funding costs, reflecting competitive pressures.

The spread of banks’ funding costs to the cash rate is estimated to have narrowed by about 9 basis points in 2014. With the cash rate unchanged over the past year, the slight narrowing in the spread was entirely due to changes in the absolute cost and mix of funding liabilities. In particular, the narrowing was driven by a lower cost of deposit funding and changes in the composition of deposits. Changes in the costs and composition of wholesale funding (i.e. bonds and bills) contributed only marginally to the fall in funding costs. Nonetheless, funding costs relative to the cash rate remain significantly higher than they were before the global financial crisis in 2008.

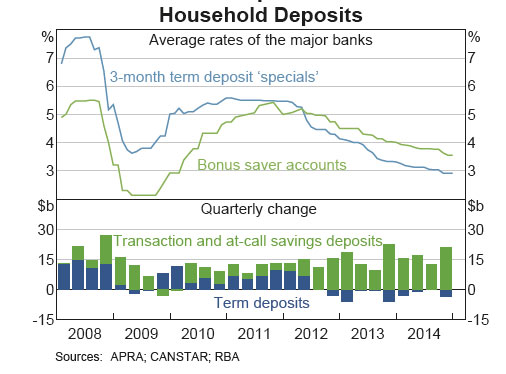

Interest rates offered on some types of deposits declined over the year. The cost of outstanding term deposits is estimated to have fallen by about 40 basis points as deposits issued at higher rates matured and were replaced by new deposits at lower rates. Similarly, the major banks’ advertised ‘specials’ on new term deposits fell by about 40 basis points over the past year.

Interest rates offered on some types of deposits declined over the year. The cost of outstanding term deposits is estimated to have fallen by about 40 basis points as deposits issued at higher rates matured and were replaced by new deposits at lower rates. Similarly, the major banks’ advertised ‘specials’ on new term deposits fell by about 40 basis points over the past year.

During 2014, the estimated average interest rate on outstanding variable-rate housing loans continued to drift lower relative to the cash rate. The overall outstanding rate declined as new or refinanced loans were written at lower rates than existing and maturing loans. This reflected a sizeable reduction in fixed rates over the year and an increase in the level and availability of discounting below advertised rates. The interest rates on around two-thirds of business

During 2014, the estimated average interest rate on outstanding variable-rate housing loans continued to drift lower relative to the cash rate. The overall outstanding rate declined as new or refinanced loans were written at lower rates than existing and maturing loans. This reflected a sizeable reduction in fixed rates over the year and an increase in the level and availability of discounting below advertised rates. The interest rates on around two-thirds of business

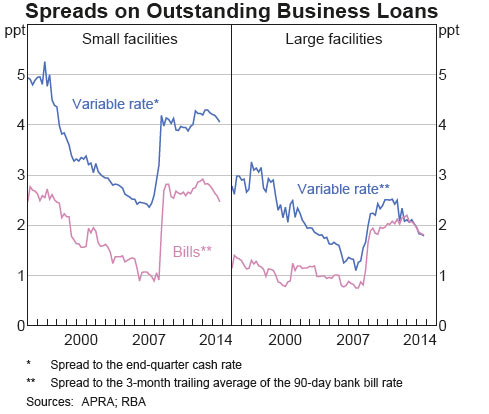

loans are typically set at a margin over the bank bill swap rate rather than the cash rate. While these spreads remain wider, reflecting the reassessment

of risk since the global financial crisis, they have generally trended down over the past two years.  Much of the narrowing of spreads over 2014 was due to average business lending rates declining by over 20 basis points, with outstanding rates for small business decreasing by more than rates for large businesses.

Much of the narrowing of spreads over 2014 was due to average business lending rates declining by over 20 basis points, with outstanding rates for small business decreasing by more than rates for large businesses.