In the latest RBA Bulletin there is an article on the Committed Liquidity Facility, which is a facility designed to support some of our major banks. Under the CLF, the Reserve Bank will provide an ADI with liquidity via repurchase agreements (repos), for a fee. Since the CLF was introduced in 2015, the number of ADIs that have applied to APRA to have a facility has risen from 13 to 15.

Under the Basel liquidity standard, the liquidity coverage ratio (LCR) requires authorised deposit-taking institutions (ADIs) to have enough high-quality liquid assets (HQLA) to cover their net cash outflows in a 30-day liquidity stress scenario. Jurisdictions with a clear shortage of domestic currency HQLA can use alternative approaches to enable financial institutions to satisfy the LCR – hence the CLF in Australia.

The RBA says the CLF has been in operation for five years and continues to be required given the still relatively low level of government debt in Australia. However, because the volume of HQLA securities has increased over recent years and they appear to have become more available for trading in secondary and repo markets, the Reserve Bank has assessed that the CLF ADIs should be able to raise their holdings to 30 per cent of the stock of HQLA securities. This increase will occur at a pace of 1 percentage point each year, commencing with an increase to 26 per cent in 2020. Taking into account how the CLF ADIs have responded to the framework between 2015 and 2019, the Reserve Bank has also concluded that the CLF fee should be increased from 15 basis points to 20 basis points by 2021; this is to proceed in two steps, with the fee rising to 17 basis points on 1 January 2020 and to 20 basis point on 1 January 2021.

These pricing changes will have only a minor impact on the CLF Banks in terms of their net interest margins, at a time when many other factors are in play, such as reductions in the RBA’s cash rate, competition for mortgages and the yield curve driving pricing in the 2-5 years portion of banks treasury portfolios.

But there are two bigger questions to ask and answer. First, given the size of Government debt now, and the flow of bonds available, why do we still need this facility at all?

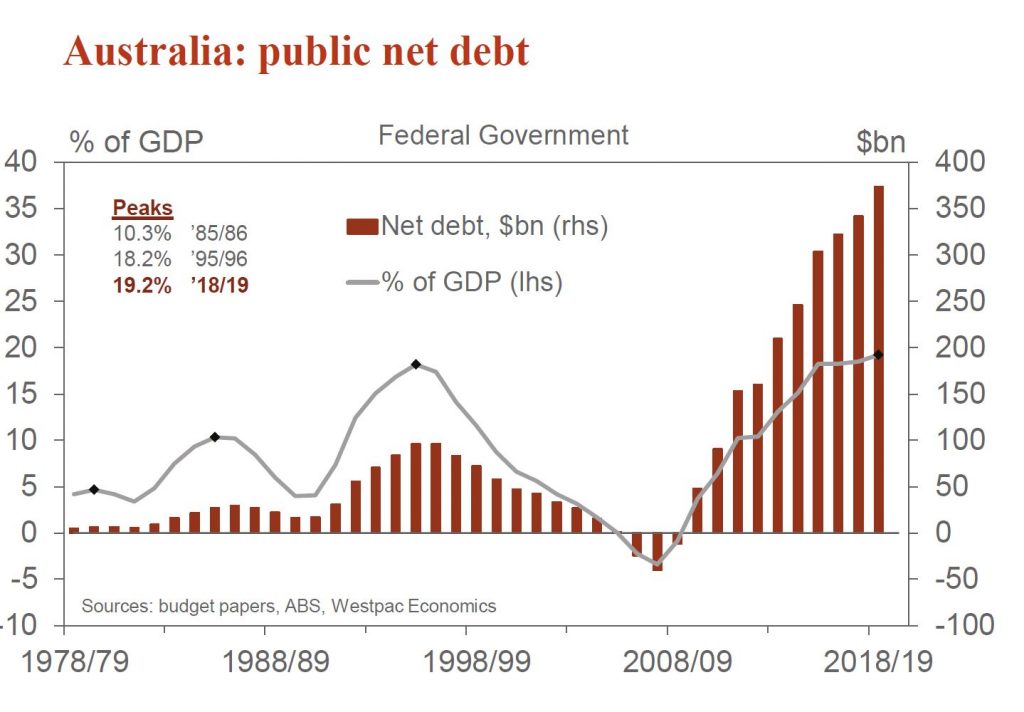

Net general government debt at June 2019 is $374bn (19.2% of GDP), some $12.5bn higher than forecast in the April 2019 Budget

The answer to that, and the second point is the CLF is essentially a back-door QE measure. If international liquidity became an issue, or if rate decreases triggered a capital flight, the CLF allows the RBA to step in and fund the banks’ funding shortfall from a loss of international investors, at rates below the banks’ international funding rates. Thus, high cost international funding by the banks can easily be replaced by cheap RBA funding through a form of QE or money printing subsidising bank profits and banker bonuses – for a short period.

This also distorts the markets because there are many lenders unable to get the CLF, creating a two-tier banking system with the “blessed” 15 supported by the CLF.

This is what the RBA says:

The Reserve Bank provides the Committed Liquidity Facility (CLF) as part of Australia’s implementation of the Basel III liquidity standard.[1] This framework has been designed to improve the banking system’s resilience to periods of liquidity stress. In particular, the liquidity coverage ratio (LCR) requires authorised deposit-taking institutions (ADIs) to have enough high-quality liquid assets (HQLA) to cover their net cash outflows in a 30-day liquidity stress scenario. Under the Basel liquidity standard, jurisdictions with a clear shortage of domestic currency HQLA can use alternative approaches to enable financial institutions to satisfy the LCR. These include the central bank offering a CLF. This is a commitment by the central bank to provide funds secured by high-quality collateral through the period of liquidity stress. This commitment can then be counted by the ADI towards meeting its LCR requirement given the scarcity of HQLA. The Australian Prudential Regulation Authority (APRA) has implemented the LCR in Australia, incorporating a CLF provided by the Reserve Bank.[2]

The CLF Is Required Due to the Low Level of Government Debt in Australia

The Australian dollar securities that have been assessed by APRA to be HQLA are Australian Government Securities (AGS) and securities issued by the central borrowing authorities of the states and territories (semis). All other forms of HQLA available in Australian dollars are liabilities of the Reserve Bank, namely banknotes and Exchange Settlement Account (ESA) balances. For securities to be considered HQLA, the Basel liquidity standard requires that they have a low risk profile and be traded in an active and sizeable market. AGS and semis satisfy these requirements since they are issued by governments in Australia and are actively traded in financial markets. In contrast, there is relatively little trading in other key types of Australian dollar securities, such as those issued by supranationals and foreign governments (supras), covered bonds, ADI-issued paper and asset-backed securities (Graph 1). Given this, these securities are not classified as HQLA.

The supply of AGS and semis is not sufficient to meet the liquidity needs of the Australian banking system. This reflects the relatively low levels of government debt in Australia (Graph 2). When the CLF was first introduced in 2015, ADIs would have needed to hold around two-thirds of the stock of HQLA securities to be able to cover their LCR requirements. Such a high share of ownership by the ADIs would have reduced the liquidity of these securities, defeating the purpose of them being counted on as HQLA.

Jurisdictions with low government debt have used a range of approaches to address the resulting shortage of domestic currency HQLA. Australia is one of three countries that have put in place a CLF, along with Russia and South Africa. Some other jurisdictions have allowed financial institutions to hold HQLA in foreign currencies to cover their liquidity needs in domestic currency. The main downsides of the latter approach is that it relies on foreign exchange markets to be functioning smoothly in a time of stress and increases the foreign currency exposures in the banking system. Some jurisdictions have classified a broader range of domestic currency securities as HQLA. However, this approach has not been taken in Australia due to the low liquidity of Australian dollar securities other than AGS and semis.

The Conditions for Accessing the CLF

APRA determines which ADIs can establish a CLF with the Reserve Bank. Access is limited to those ADIs domiciled in Australia that are subject to the LCR requirement.[3] Before establishing a CLF, these ADIs must apply to APRA for approval. In these applications, the ADIs have to demonstrate that they are making every reasonable effort to manage their liquidity risk independently rather than relying on the CLF. APRA also sets the size of the CLF, both in aggregate and for each ADI.

The Reserve Bank makes a commitment under the CLF to provide a set amount of liquidity against eligible securities as collateral, subject to the ADI having satisfied several conditions.[4] The ADI is required to pay a CLF fee to the Reserve Bank that is charged on the entire committed amount (not just the amount drawn). To access liquidity through the CLF, an ADI must make a formal request to the Reserve Bank that includes an attestation from its CEO that the institution has positive net worth. The ADI must also have positive net worth in the opinion of the Reserve Bank.

Under the CLF, the Reserve Bank will provide an ADI with liquidity via repurchase agreements (repos). In a repo, funds are exchanged for high-quality securities as collateral until the funds are repaid. These securities must meet criteria set by the Reserve Bank. The types of securities that the ADIs can hold for the CLF include self-securitised residential mortgage backed securities (RMBS), ADI-issued securities, supras, and other asset-backed securities. To protect against a decline in the value of these securities should an ADI not meet its obligation to repay, the Reserve Bank requires the value of the securities to exceed the amount of liquidity provided by a certain margin. These margins are set by the Reserve Bank to manage the risks associated with holding these securities.[5] If the CLF is drawn upon, the ADI must also pay interest to the Reserve Bank for the term of the repo at a rate set 25 basis points above the cash rate.

The First Five Years of the CLF

Since the CLF was introduced in 2015, the number of ADIs that have applied to APRA to have a facility has risen from 13 to 15.[6] Each year, APRA sets the total size of the CLF by taking the difference between the Australian dollar liquidity requirements of the ADIs and the amount of HQLA securities that the Reserve Bank assesses can be reasonably held by these ADIs (the CLF ADIs) without unduly affecting market functioning.

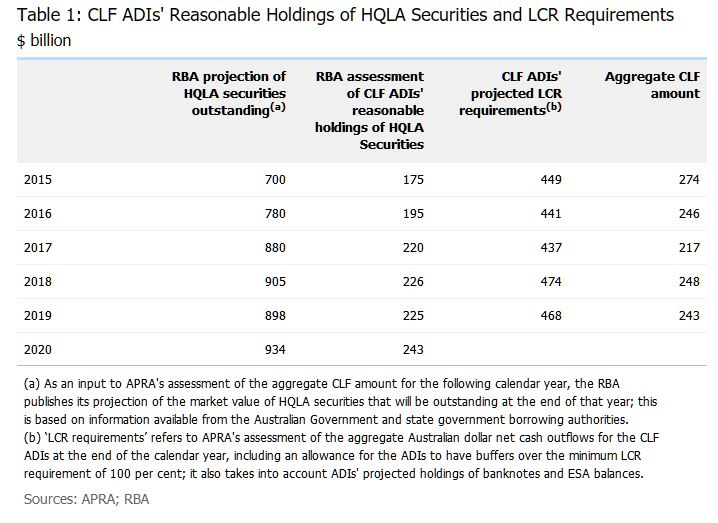

For 2015-19, the Reserve Bank assessed that the CLF ADIs could reasonably hold 25 per cent of the stock of HQLA securities. In determining this, the Reserve Bank took into account the impact of the CLF ADIs’ holdings on the liquidity of HQLA securities in secondary markets, along with the holdings of other market participants. The volume of HQLA securities that the CLF ADIs could reasonably hold increased from $175 billion in 2015 to $225 billion in 2019, reflecting growth in the stock of HQLA securities (Table 1). Over the period, the CLF ADIs held a significantly higher share of the stock of HQLA securities than in the years leading up to the introduction of the LCR (Graph 3). The CLF ADIs have been holding a larger share of the stock of semis compared to AGS.

The CLF ADIs’ projected LCR requirements, which were used in calculating the CLF, increased modestly in aggregate from $449 billion in 2015 to $468 billion in 2019. This increase can be entirely explained by the CLF ADIs seeking to raise their liquidity buffers over time to be well above the minimum LCR requirement of 100. Reflecting this, the aggregate LCR for these ADIs increased from around 120 per cent in 2015 to around 130 per cent in 2019; this was the case for their Australian dollar liquidity requirements as well as for their requirements across all currencies (Graph 4).[7]

The aggregate CLF amount is the CLF ADIs’ projected LCR requirements less the RBA’s assessment of their reasonable holdings of HQLA securities. APRA reduced the aggregate size of the CLF from $274 billion in 2015 to $243 billion in 2019. This reflected that the volume of HQLA securities that the CLF ADIs could reasonably hold increased by more than their projected liquidity requirements over this period.

From 2015 to 2019, the Reserve Bank charged a CLF fee of 15 basis points per annum on the commitment to each ADI. The fee is set so that ADIs face similar financial incentives to meet their liquidity requirements through the CLF or by holding HQLA. The amount of CLF fee paid by the CLF ADIs to the Reserve Bank declined from $413 million in 2015 to $365 million in 2019, which is in line with the reduction in the size of the CLF. Since the CLF was established, no ADI has drawn on the facility in response to a period of financial stress.[8]

Assessing ADIs’ Reasonable Holdings of HQLA Securities

When assessing the volume of HQLA securities that the CLF ADIs can reasonably hold, the Reserve Bank seeks to ensure that these holdings are not so large that they impair market functioning or liquidity. For the period from 2015 to 2019, the Reserve Bank assessed that the CLF ADIs could reasonably hold 25 per cent of HQLA securities without materially reducing their liquidity. This was informed by the fact that a large proportion of HQLA securities were owned by ‘buy and hold’ investors. These investors were price inelastic and generally did not lend these securities back to the market, reducing the free float of HQLA securities. Many of these investors were non-residents (such as sovereign wealth funds), which were holding nearly 60 per cent of the stock of HQLA securities earlier in the decade (Graph 5). So overall, the Reserve Bank concluded that these bond holdings were not contributing significantly to liquidity in the market.

Over recent years, the volume of HQLA securities has risen and they have become more readily available in bond and repo markets (Table 1). The Australian repo market has grown considerably, driven by more HQLA securities being sold under repo. Since 2015, non-residents have emerged as significant lenders of AGS and semis (and borrowers of cash) in the domestic market (Graph 6). Over the same period, repo rates at the Reserve Bank’s open market operations have risen relative to unsecured funding rates (Graph 7). This is consistent with market participants financing a larger volume of HQLA securities on a short-term basis through the repo market. For this assessment, the increased availability of HQLA securities in the market suggests that the CLF ADIs should be able to hold a higher share of these securities without impairing market functioning.

Analysis of transactions in the bond and repo markets using data from 2015–17 suggests that most HQLA securities were being actively traded.[9] Monthly turnover ratios for AGS bond lines were well above zero, and much higher than turnover ratios for other Australian dollar securities such as asset-backed securities, covered bonds, ADI-issued paper and supras (Graph 1). Although semis bond lines were traded less frequently than AGS, relatively few semis had low turnover ratios (Graph 8). As such, some increase in ADIs’ holdings of AGS and semis would appear unlikely to jeopardise liquidity in these markets.

Earlier in the decade, a ‘scarcity premium’ had emerged in the pricing of HQLA securities. Australia’s relatively strong economic performance and AAA sovereign rating have been of considerable appeal to investors with a preference for highly rated securities. Higher yields compared to other AAA-rated sovereigns also contributed to strong demand from foreign investors, particularly for AGS. The scarcity premium was most prominent before 2015, when the yield on 3-year AGS was well below the expected cash rate over the equivalent horizon (as measured by overnight indexed swaps (OIS); Graph 9). However, the scarcity premium has dissipated alongside an increase in the stock of AGS on issue. This suggests that there is scope for the CLF ADIs to hold more HQLA securities without impairing market functioning.

Given these developments, the Reserve Bank has assessed that the CLF ADIs should be able to increase their holdings to 30 per cent of the stock of HQLA securities.[10] To ensure a smooth transition and thereby minimise the effect on market functioning, the increase in the CLF ADIs’ reasonable holdings of HQLA securities will occur at a pace of 1 percentage point per year until 2024, commencing with an increase to 26 per cent in 2020.

The CLF Fee

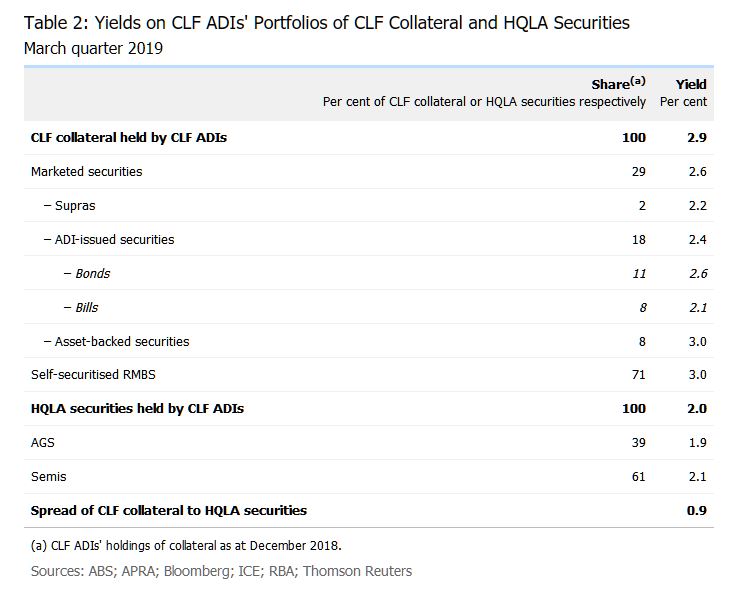

The Reserve Bank sets the level of the CLF fee such that ADIs face similar financial incentives when holding additional HQLA securities or applying for a higher CLF in order to satisfy their liquidity requirements. A useful starting point to assess the appropriate CLF fee is to compare the yields on the CLF collateral and the HQLA securities held by the relevant ADIs.[11] The Reserve Bank estimated that the weighted average yield differential between the CLF collateral and the HQLA securities was around 90 basis points in the March quarter 2019 (Table 2). This includes the compensation required by ADIs to account for the higher credit risk associated with holding CLF collateral rather than HQLA securities, which would be a sizeable share of the spread. However, it is only the additional liquidity risk associated with holding CLF collateral that should be reflected in the CLF fee. In practice, adjusting the spread between CLF collateral and HQLA securities to remove the credit risk component is not straightforward.

When the Reserve Bank set the CLF fee earlier this decade, it looked at repo rates on some CLF-eligible securities to gauge how much a one-month liquidity premium might be worth. Before late 2013, it was possible to separately identify repo rates on government securities (AGS and semis) and private securities (such as ADI-issued securities) in the Reserve Bank’s market operations. Based on these data, it was estimated that the one-month liquidity premium for private securities was less than 10 basis points in normal circumstances. However, given that part of the purpose of the liquidity reforms was to recognise that the market had under-priced liquidity in the past, it was judged to have been appropriate to set the fee at 15 basis points.

It has since become more difficult to gauge a liquidity premium by using repo rates. In particular, in late 2013 the Reserve Bank ceased to charge different repo rates for government and private securities. Instead, the Bank revised its margin schedule to manage the credit risk on different types of collateral accepted under repo. Moreover, most of the collateral now being purchased by the Reserve Bank under repo is HQLA securities. This suggests that repo rates mostly reflect the price for converting HQLA securities into ESA balances, rather than CLF collateral into HQLA.

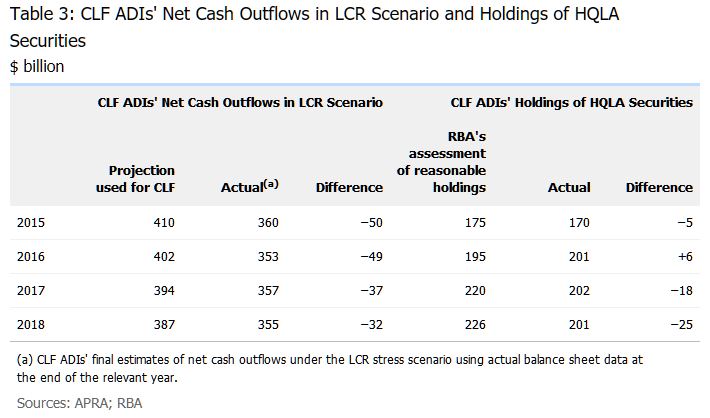

At the same time, it is now possible to take into account how the CLF ADIs have responded to the existing framework when setting the future CLF fee. Since the CLF was introduced, the CLF ADIs (in aggregate) have consistently overestimated their liquidity requirements (Table 3). This has resulted in the CLF ADIs being granted larger CLF amounts, which they have mainly used to hold larger buffers above the minimum required LCR of 100 (Graph 4).[12] In recent years, the CLF ADIs have also been holding fewer HQLA securities than the Reserve Bank had judged could be reasonably held without impairing the market for HQLA securities. Taken together, these two observations suggest that the CLF fee should be set at a higher level in future.

However, there is uncertainty about the exact level of the fee that would make ADIs indifferent between holding more HQLA or applying for a larger CLF. If the CLF fee is set too high, this could trigger a disruptive shift away from using the facility and distort the markets that use HQLA. This has potential implications for the implementation of monetary policy, since the market that underpins the cash rate involves the trading of ESA balances, which are also HQLA.[13] The remuneration on ESA balances is purposefully set at a rate of 25 basis points below the cash rate target in order to encourage ADIs to recycle their surplus ESA balances rather than holding them. There are scenarios where holding ESA balances could be a cheaper way to satisfy the LCR than holding HQLA securities. For instance, earlier in the decade, the yield on AGS was at or below the expected return from holding ESA balances (Graph 9). In this context, the CLF fee should be set such that ADIs would not have an incentive to meet their LCR requirements by holding excessive ESA balances.

As a result of these considerations, the RBA has concluded that the CLF fee should be increased moderately. This should ensure that ADIs have strong incentives to manage their liquidity risk appropriately, without generating unwarranted distortions in the markets that use HQLA. To ensure a smooth transition by minimising the effect on market functioning, the increase will occur in two steps, with the CLF fee rising to 17 basis points on 1 January 2020 and to 20 basis points on 1 January 2021.[14]