The New Zealand Reserve Bank said today that the Official Cash Rate (OCR) remains at 1.75 percent. They expect to keep the OCR at this level through 2019 and 2020. The direction of the next OCR move could be up or down.

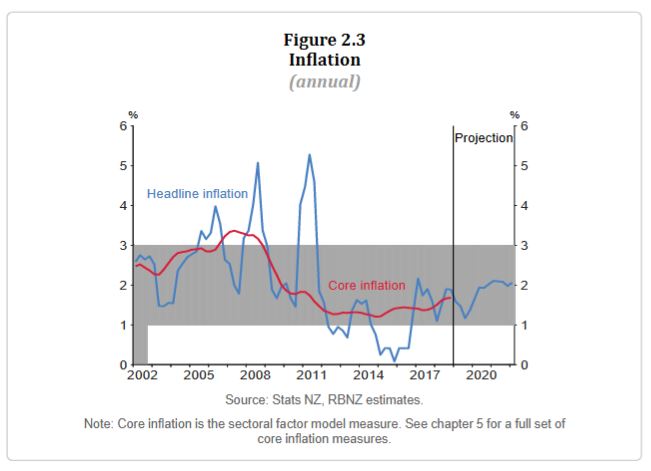

Employment is near its maximum sustainable level. However, core consumer price inflation remains below our 2 percent target mid-point, necessitating continued supportive monetary policy.

Trading-partner growth is expected to further moderate in 2019 and global commodity prices have already softened, reducing the tailwind that New Zealand economic activity has benefited from. The risk of a sharper downturn in trading-partner growth has also heightened over recent months.

Despite the weaker global impetus, they expect low interest rates and government spending to support a pick-up in New Zealand’s GDP growth over 2019. Low interest rates, and continued employment growth, should support household spending and business investment. Government spending on infrastructure and housing also supports domestic demand.

As capacity pressures build, consumer price inflation is expected to rise to around the mid-point of our target range at 2 percent.

There are upside and downside risks to this outlook. A more pronounced global downturn could weigh on domestic demand, but inflation could rise faster if firms pass on cost increases to prices to a greater extent.

They will keep the OCR at an expansionary level for a considerable period to contribute to maximising sustainable employment, and maintaining low and stable inflation.