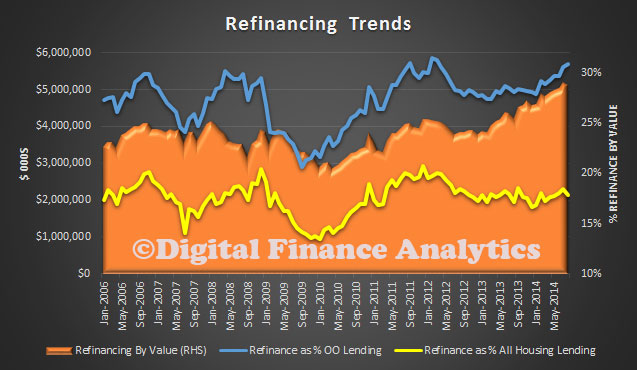

We have been looking in detail at recent trends in housing refinance, by using a combination of the recently released ABS data and results from the DFA surveys. There is an interesting story to tell here. So today we explore the refinancing landscape. First the ABS data shows us that refinancing value has been increasing to a record $5.9bn in July 2014, and represents more than 30% of all owner occupied lending, and about 17% of all housing lending.

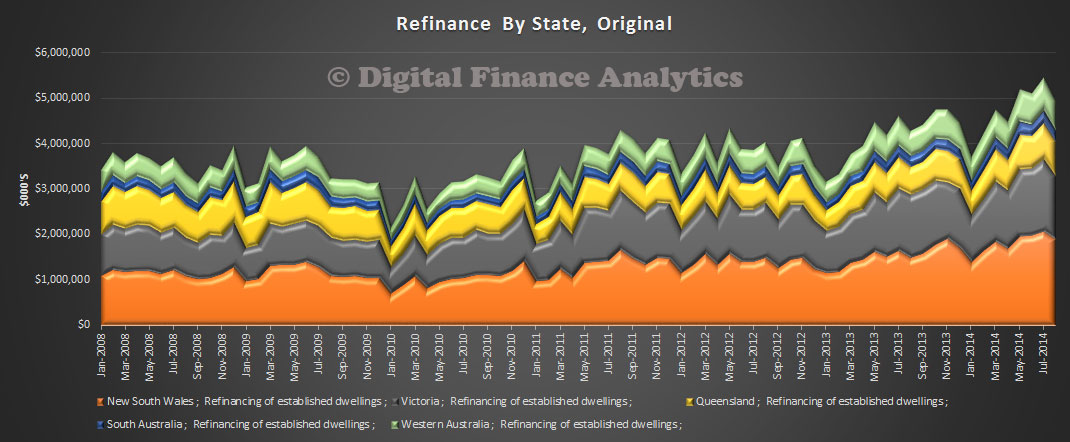

We also see that the state distribution is centered on NSW and VIC.

We also see that the state distribution is centered on NSW and VIC.

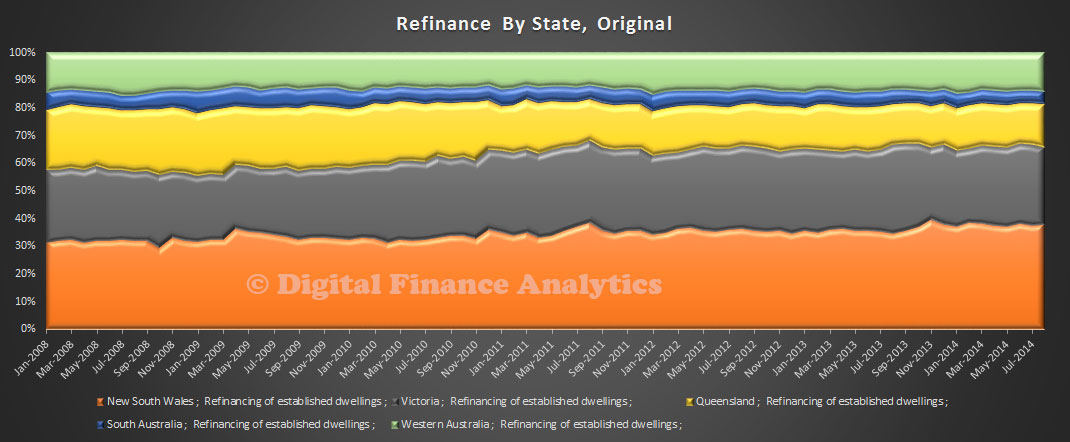

However, looking in percentage terms, there is only a small rise in NSW, and a fall in QLD.

However, looking in percentage terms, there is only a small rise in NSW, and a fall in QLD.

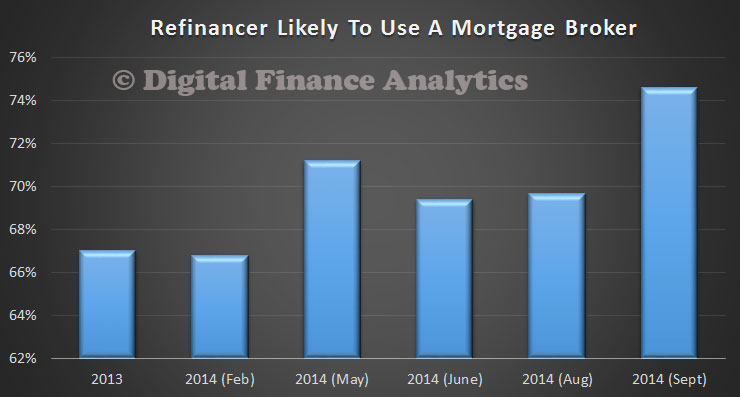

Turning to our surveys, about 17.5% of refinacing are to fixed loans, the rest variable, either principal and interest or interest only. A considerable proportion of refinance deals are via brokers, with a record 74% in September.

Turning to our surveys, about 17.5% of refinacing are to fixed loans, the rest variable, either principal and interest or interest only. A considerable proportion of refinance deals are via brokers, with a record 74% in September.

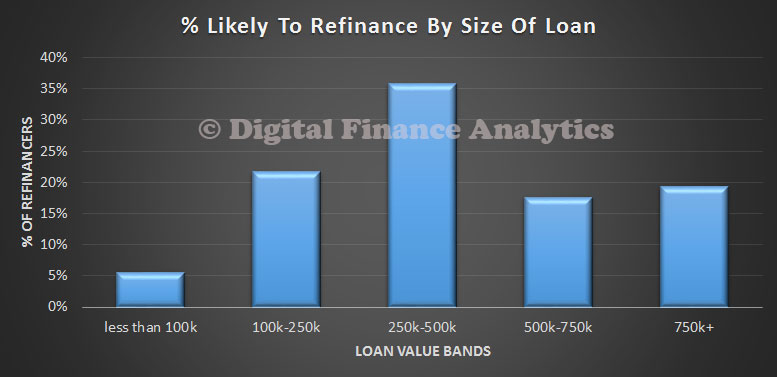

Households with loans between $250k and 500k are likely to refinance, though those with larger loans are more likely to refinance their loan, compared with those with below $100k balances.

Households with loans between $250k and 500k are likely to refinance, though those with larger loans are more likely to refinance their loan, compared with those with below $100k balances.

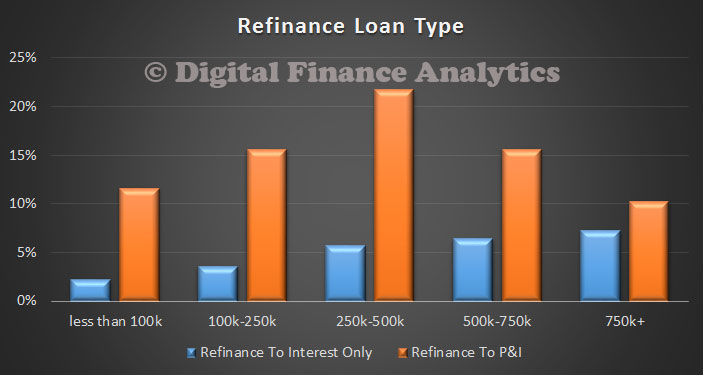

Turning to the loan type, the majority are refinancing to a principal and interest loans (P&I), though we note that those with larger balances are more likely to consider an interest only loan.

Turning to the loan type, the majority are refinancing to a principal and interest loans (P&I), though we note that those with larger balances are more likely to consider an interest only loan.

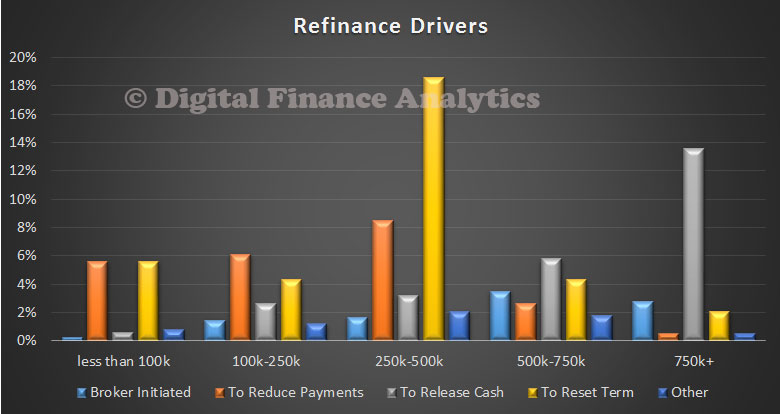

Looking in more detail, we see that brokers are more likely to initiate a conversation with a household on refinancing if the loan is larger. Many are driven by the need to reset the term (this relates to the industry practice of having a nominal 30 year term, with five year reviews, plus fixed term loans maturing). We also see a concern to reduce monthly payments, especially in the loans between 250k and 500k, and to release cash in the case of larger loans, especially above $750k, where we assume the capital appreciation in the property is most significant.

Looking in more detail, we see that brokers are more likely to initiate a conversation with a household on refinancing if the loan is larger. Many are driven by the need to reset the term (this relates to the industry practice of having a nominal 30 year term, with five year reviews, plus fixed term loans maturing). We also see a concern to reduce monthly payments, especially in the loans between 250k and 500k, and to release cash in the case of larger loans, especially above $750k, where we assume the capital appreciation in the property is most significant.

In the survey detail, we found that some were releasing capital to assist in the purchase of an investment property, or to assist others to purchase a property. Refer to the recent post on the Bank of Mum and Dad. Most households who were concerned about rates have already locked into fixed products, though many still preferred the variable rate product. We also found that more than 50% of households considering a refinance were ahead of schedule on their nominal monthly repayments. Those in the range 250k – 500k were least likely to be ahead.

In the survey detail, we found that some were releasing capital to assist in the purchase of an investment property, or to assist others to purchase a property. Refer to the recent post on the Bank of Mum and Dad. Most households who were concerned about rates have already locked into fixed products, though many still preferred the variable rate product. We also found that more than 50% of households considering a refinance were ahead of schedule on their nominal monthly repayments. Those in the range 250k – 500k were least likely to be ahead.

Overall then, refinancing is a significant element in the property owning household sector, and yet there has been little discussion of this facet of the market, compared with first time buyers and investors.