On 6 November 2013, the Government announced that it would proceed with certain reforms to the Offshore Banking Unit (OBU) regime.These reforms address a number of integrity concerns with the existing regime while ensuring the OBU regime targets mobile financial sector activity. They are now seeking input on proposed changes. Consultation closes for submissions on Wednesday, 8 April 2015

By way of background, an OBU is a notional division or business unit of an Australian entity that conducts OBU activities. To be considered as an OBU, an entity must be declared by the Treasurer as an OBU. An OBU receives concessional tax treatment in respect of eligible OB activities, provided additional criteria are met. One kind of eligible OB activity is a trading activity. Amongst other things, trading activity includes trading with an offshore person in shares, securities and units of an offshore entity, as well as options or rights in respect of these shares, securities and units. As a result, trading in the shares, securities or units (or the associated options or rights) of an offshore subsidiary may constitute an eligible OB activity. This has the effect of allowing the conversion of ineligible non-OB activities to eligible OB activities. That is, the offshore subsidiary may undertake ineligible activities and the OBU may claim the same economic benefit as assessable OB income by trading in the shares it owns in the subsidiary.

Potential activities which could be included:

- Unfunded lending activities (Unfunded lending is where an OBU makes funds available to an offshore person but the funds are not drawn down, or are yet to be drawn down. Income in the form of fees for making the credit available is mobile income and will be treated accordingly as assessable OB income.)

- Syndicated lending activities (A syndicated lending arrangement involves a number of financial institutions lending to a borrower. Syndicated arrangements are common in large capital raisings. In addition to committing to lend their own capital, an OBU may be involved in arranging contributions from a syndicate of other lenders. The OBU may also be involved in underwriting some of the credit risk. The OBU will earn a fee for these services.)

- Guarantee activities and connections with Australia

- Trading in commodities

- Securities lending and repurchase agreements

- Non-deliverable forward foreign currency contracts

- Portfolio investment asset percentages

- Advice on disposal of investments

- Leasing activities

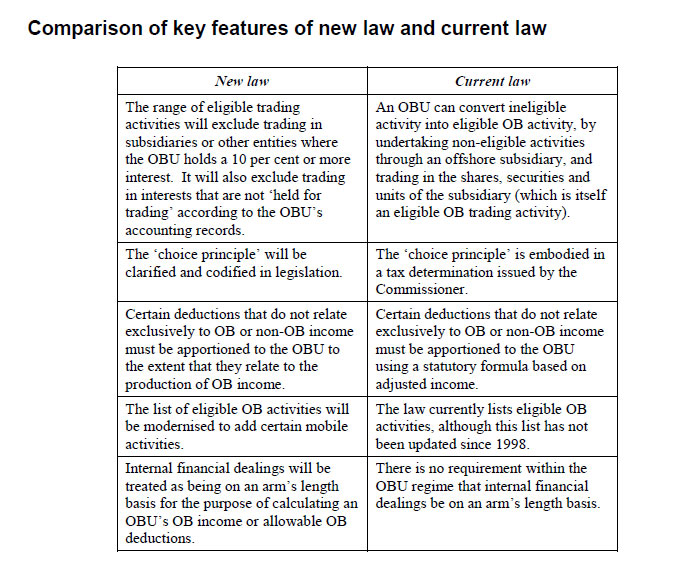

The proposed amendments in the draft Bill are:

- limit the availability of the OBU concession in certain circumstances where it could otherwise be used to convert ineligible activity into eligible activity by trading in a subsidiary;

- codify the ‘choice principle’ to remove uncertainty for taxpayers;

- introduce a new method of allocating certain expenses between the operations of a taxpayer’s domestic banking unit and the OBU;

- modernise the list of eligible activities; and

- treat internal financial dealings (for example, between an Australian bank and its offshore branch) as if they were on an arm’s length basis.

The proposals are likely to lead to greater transparency and clarity, and will offer less wriggle room for financial engineering. Though the changes are mainly technical in nature there could be some implications for banks in Australia.

The proposals are likely to lead to greater transparency and clarity, and will offer less wriggle room for financial engineering. Though the changes are mainly technical in nature there could be some implications for banks in Australia.