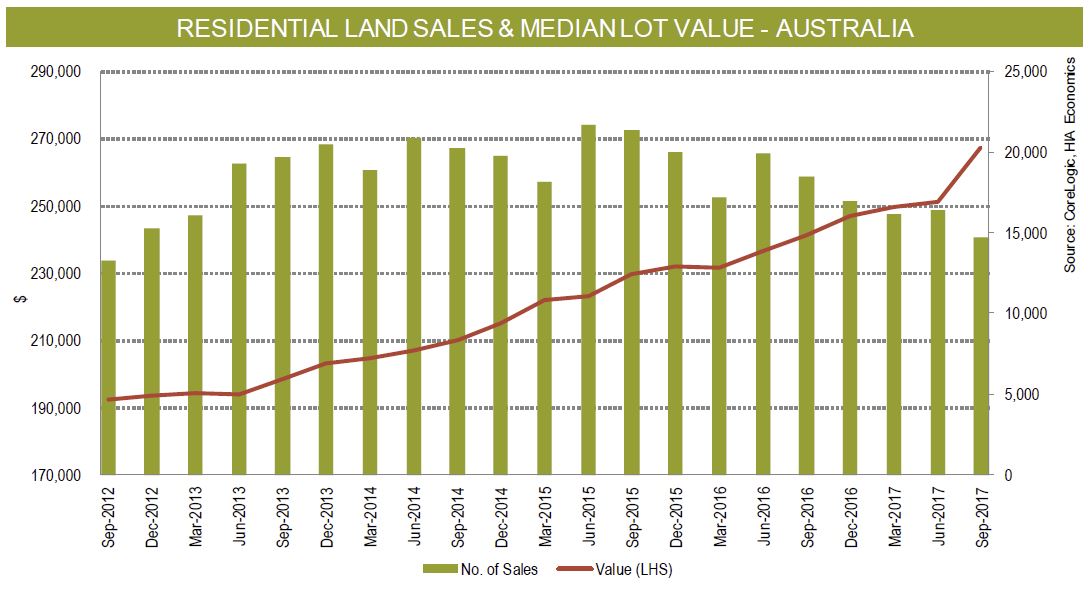

The latest HIA-CoreLogic Residential Land Report shows that the median vacant residential land lot price rose nationally by 6.5 per cent during the September 2017 quarter to reach $267,368.

“Yet again, the price of residential land in Sydney and Melbourne has touched fresh all-time highs.

“Transactions on the land market continue to drop, indicating that supply is simply not matching demand sufficiently.

“The high cost of new residential land is at the heart of Australia’s housing affordability crisis.

“The housing industry’s ability to ramp up the supply of new dwellings as demand dictates is hampered by the inconsistency of the land supply pipeline. The time it takes for land to be made available to builders is unnecessarily long,” concluded HIA Senior Economist Shane Garrett.

According to Eliza Owen, CoreLogic’s Commercial Research Analyst, “The 6.5 per cent acceleration in vacant residential land prices suggests strong demand, even in the context of our largest residential markets passing peak growth rates for the current cycle. The CoreLogic Hedonic Home value index is showing a 1 per cent quarterly decline in capital city dwellings in the three months to January, led by the Sydney market which saw a 2.5 per cent decline.

“Despite the softening in capital growth, land prices were driven higher by long term confidence in some Australian metropolitan markets. Indeed, developers may act counter-cyclically to secure vacant land on the fringe of metropolitan areas before the next upswing. This is reflected in Melbourne, which saw over one in five of the 14,704 vacant land transactions in the year to September.

“In Victoria, CoreLogic development data indicates that 48.6 per cent of residential subdivisions in 2017 commenced on the fringes of Melbourne, such as in Hume, Whittlesea and Wyndham. This further demonstrates the high levels of demand for housing that is connected to the facilities and employment opportunities of major cities,” concluded Eliza Owen.